Why private credit managers ❤️ asset-based lending

Fundraising from Kartesia, Pemberton, Guggenheim Investments, StepStone, Tanarra Capital and Principal Asset Management.

👋 Hey, Nick here. If you’re new, this is the 65th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

Eighty percent of insurers plan to increase investments in private credit –Moody’s. Link

Golub is benefitting from this☝️trend. It announced a $200 million minority investment from Nassau Financial. The partnership will give Nassau’s insurance business access to Golub’s middle market strategies. Link

Was KKR right about the Bifurcation of Credit? Another Canadian manager suspends cash distributions. Next Edge is winding down its flagship credit fund. Link

Private Credit Defaults Will Purge ‘Tourist Investors,’ BCI Says. Link

🚜 Why private credit managers ❤️ asset-based lending

Hopefully, you’ve noticed me writing about this topic over the last 6 months. If you missed it, you can read about how Apollo and KKR think about asset-based lending (Here, Here, and Here).

Oliver Wyman has produced a great new report on this and you can read the full report here. Below with a summary.

TDLR:

Managers need to sustain the sector’s extraordinary growth and satisfy the sea change in allocations to credit.

Leveraged lending has become more crowded.

Waves of bank disintermediation

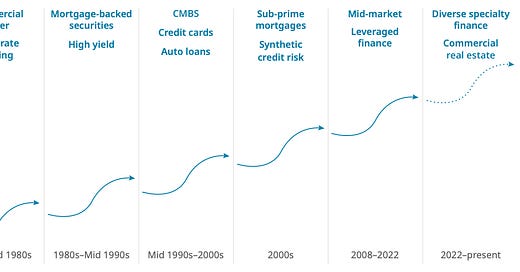

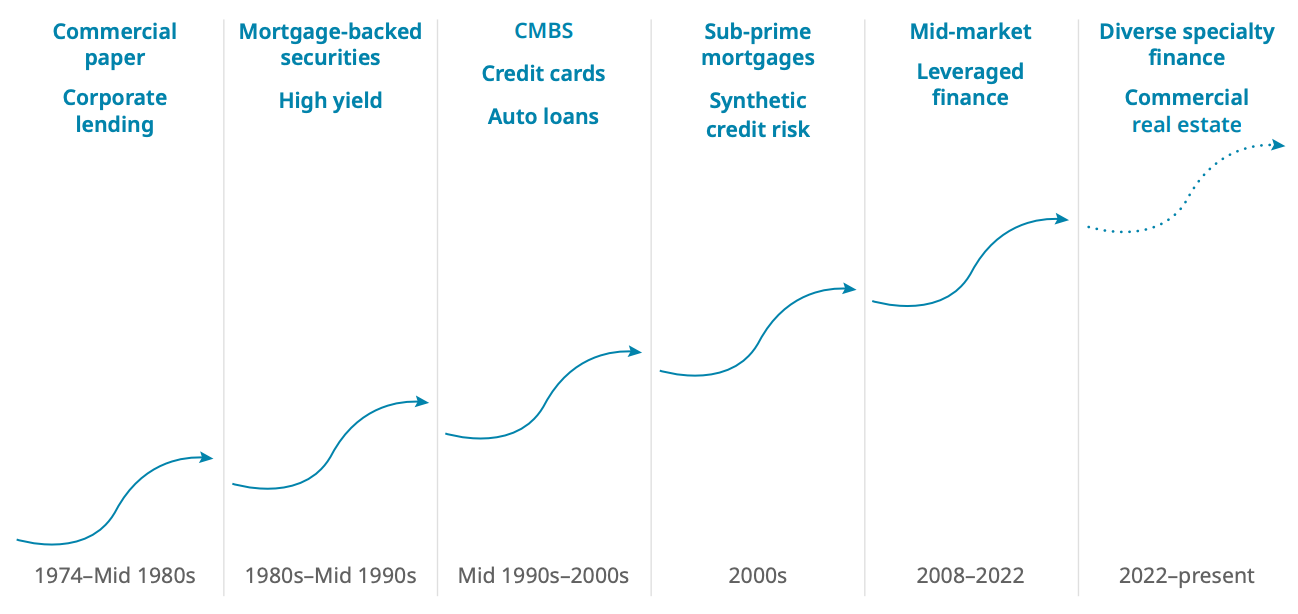

The shift of lending away from banks has a long history. Bank lending as a share of total borrowing has been falling for over 50 years.

Oliver Wyman believes bank disintermediation is typically due to interest rate shocks, regulation, and financial product innovation.

What we are seeing is the re-tranching of the banking system where banks parcel the riskiest slice to private credit (Apollo refers to this as the latest Secular Change).

How big is the opportunity?

Asset-based lending can be defined as Specialty Lending + Real Estate. Below is a breakdown of some of the asset categories.

Oliver Wyman estimates the total outstanding pool of specialty finance assets is ~$5.5 trillion in the United States. Including outstanding mortgages and commercial real estate, this increases to roughly $26 trillion.

Apollo estimates the global market is ~$40 trillion.

Non-bank financing appears more prevalent in specialized hard asset classes, such as those backed by aircraft, transportation assets, and other equipment and software.

The size of the market continues to grow, particularly in new assets such as royalties and renewables.

💰Fundraising news

Kartesia, a London-based asset manager, closed its ~$2 billion Senior Opportunities II fund. The fund lends senior loans to European mid-market companies. It has deployed 60% of its fund in 30 portfolio companies, across 7 countries and 10 industries. The fund is 80% larger than the first fund, which closed at €1 billion in March 2021. More here

Kartesia’s fund is 5th largest European fund raised this year, overtaking Goldman Sachs’s West Street European Fund.

Pemberton, a London-based credit manager, announced a NAV Strategic Financing strategy. The fund is anchored by the Abu Dhabi Investment Authority (ADIA) and is expected to have a first close of at least ~$1 billion. The strategy will provide GPs with capital for increased fund commitments, succession planning, and accretive portfolio investments such as bolt-on acquisitions. More here

ADIA’s other notable investments in the last 12 months include AGL, Centerbridge Partners, Cheyne Capital and Jefferies Credit Partners

Guggenheim Investments, a New York-based asset manager, closed a $1.2 billion levered private credit vehicle. The transaction was led by Apollo S3 and Pantheon. It’s unclear what strategy the fund will focus on. More here and see Guggenheim’s strategies here.

Pantheon also led Goldman Sachs’s West Street European Middle Market Credit Fund (Here)

StepStone, a New York-based investment and advisory firm, launched its Private Credit Income Fund (“CRDEX”). The evergreen interval fund can be purchased daily via ticker CRDEX. It will predominantly invest in senior secured Direct Lending assets but will also invest in asset-backed finance and niche lending strategies. StepStone invests through secondaries as well as co-investing alongside private credit firms. StepStone has over $500 billion of assets under its advisement, including assets for leading public pension funds such as PennSERS, TRS, and previously CalPERS. This is one of the fund’s key differentiators and CRDEX will “cherry-pick” investments from leading private credit firms. More here and check out the investor deck here

Tanarra Capital, an Australia-based asset manager, launched a new ~$700 million private credit fund. The fund will lend to Australian public or private investment-grade companies. It will invest between USD 65 to $100 million per company and expects to have a concentrated fund of 8 to 10 companies. The fund will target high single-digit returns. More here

Principal Asset Management, an Iowa-based asset manager, launched its Private Credit Fund I. The fund will invest in North American lower and core middle-market companies. These companies will have EBITDA between $5 to $50 million. Target facility sizes range between $25 to $300 million. The fund will be managed by the direct lending team of Principal Asset Management. More here and here