Why Howard Marks Is Accelerating His Opportunistic Fund's Deployment

Fundraisings from Pantheon, Crescent Capital, AlpInvest, Pemberton and more.

👋 Hey, Nick here. A special welcome to the new subscribers from HSBC, Upper90 and Oaktree. It’s great to have you. Reach out and say hi. This week’s post isn’t flashy. But neither is downside protection. It’s also my 109th post. You can read my previous articles here and subscribe here

📕 Reads of the Week

Last week, I highlighted that 2025 is the year everyone rebranded as “opportunistic.” Few embraced the opportunistic label more fully than Oaktree, which raised a $16 billion fund two months ago. If you’re looking for a deeper understanding of how this trend plays out, Howard Marks’s latest memo is essential reading.

We anticipate a higher incidence of distress and increased demand for bespoke capital solutions, meaning we’re likely to invest our latest opportunistic debt fund faster than otherwise would have been the case.

Howard Marks: Nobody Knows (Yet Again) Link

CVC explores Golub acquisition. Link.

AllianceBernstein: Where Do Private Assets Fit in an Insurer’s Liability Profile? Link

Pitchbook: European private credit dealmaking ties quarterly record, but M&A underwhelms. Link

US Private Credit Monitor. Link

Coller Capital has acquired a $1.6bn senior direct lending portfolio from multiline US insurer American National, marking the largest ever LP-led credit secondaries transaction focused on a senior direct lending portfolio. Link

Finastra refinance effort stalls. Vista has paused its refinancing of nearly $6bn of debt and preferred equity after failing to find any lenders at 4.5 percentage points over.

Barnet Pension Fund ups allocation to private debt. Link

Will the “denominator effect” increase secondary sales? Link

📊Charts of the Week

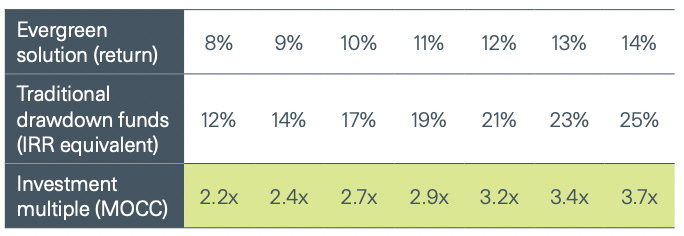

Stepstone: Why choose an evergreen fund?

In the last five years, the number of evergreen funds has nearly doubled. These funds offer investors immediate, full, and constant capital deployment.

Not only is this attractive from a return perspective, but it also simplifies and accelerates the process of reaching target allocations.

Stepstone has highlighted how these funds provide an effective way to maximise the multiple on committed capital (MOCC).

The chart below shows the comparable IRR to achieve the MOCC over 10 years.

See the full analysis here.

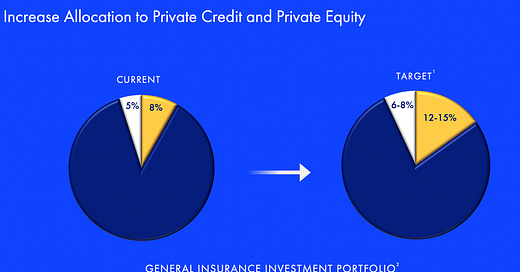

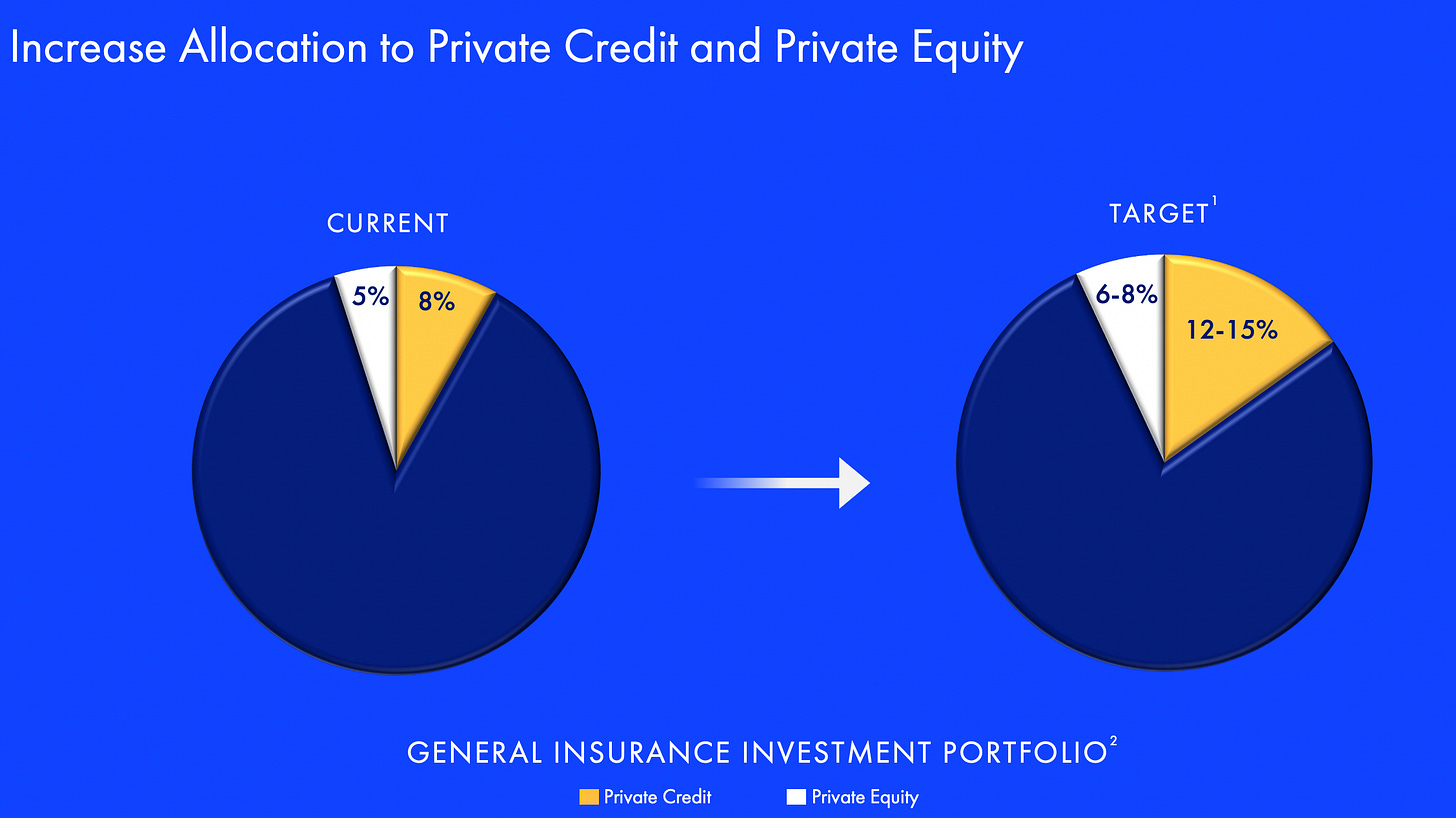

AIG Increases Its Private Credit Allocation

AIG’s PowerPoint still runs on Windows 95, but its investment policy just got a refresh.

This week AIG announced that it aims to allocate between 12% and 15% of its general insurance investment portfolio to private credit, up from 8% as of now.

The $90 billion portfolio will lead to an additional ~$6.3 billion of capital for private credit. More here.

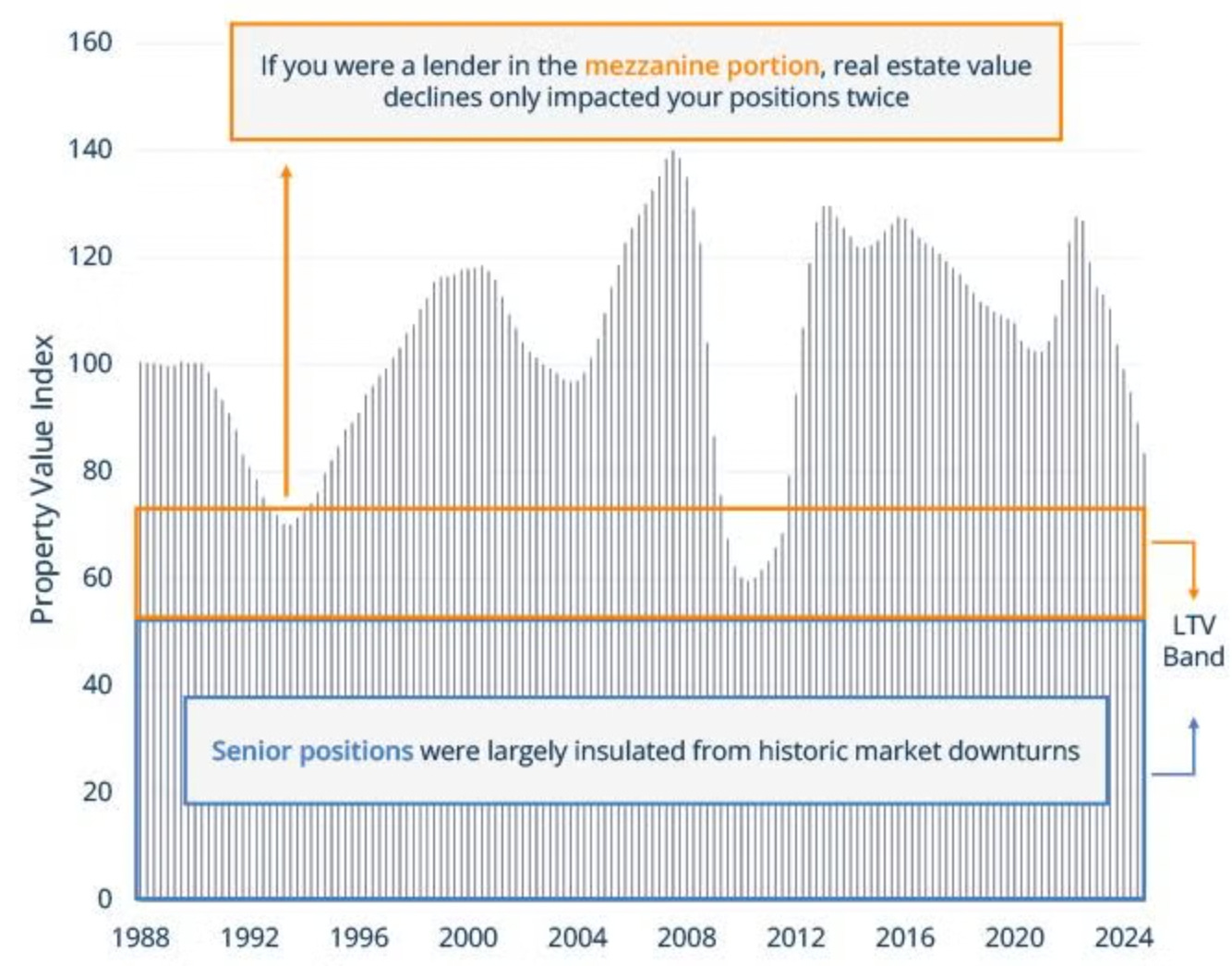

Real Estate Credit Tends to Be Insulated From Declines in Property Values

Brookfield published a whitepaper on fortifying portfolios with private real estate credit. Link

🏦 Partnerships of the Week

Bain Capital acquired a 9.9% stake in Lincoln Financial for $825 million. Lincoln and Bain Capital will also enter a 10-year, non-exclusive investment management relationship, with Bain Capital becoming an investment manager across a variety of asset classes, including private credit, structured assets, mortgage loans, and private equity. More here

Wendel completed the acquisition of Monroe Capital. Link

HSBC is looking to partner with private credit firms. More here

💰Fundraising News

Pantheon closed its $5.2 billion Senior Debt III fund. The secondary fund invests in portfolios of sponsored senior-secured loans. The closing of this fundraise creates one of the largest dedicated pools of credit secondary capital in the industry. More here

Crescent Capital, a Los Angeles-based alternative credit manager, closed its $3.4 billion European Specialty Lending Fund III. The fund lends to sponsored European companies with EBITDA of €5 million to €25 million. It has already committed €800 million across 16 transactions. More here

AlpInvest Partners, a New York private equity investor and subsidiary of Carlyle, raised $3.2 billion for Strategic Portfolio Finance Fund II. The fund lends to private equity funds, GPs, and LPs. It also pursues Credit Secondaries investments. AlpInvest has invested with over 380 private equity managers and committed over $100 billion to date. More here

Pemberton, a London-based manager, is targeting $3 billion for its Strategic Credit Opportunities Fund IV. The fund launched in 2024 and seeks to achieve a 15% IRR. The fund has commitments from entities like the Illinois Municipal Retirement Fund and the New Mexico State Investment Council. More here

Fortress is raising $1.5 billion for its Asset-Based Credit Fund II. The fund will focus on deals such as lender finance transactions and portfolio acquisitions of consumer and commercial receivables. It will target a net return of around 10%-12%. More here

Andros Capital Partner, a Houston-based investment manager, closed its $1 billion Energy Capital III fund. The credit opportunities platform focuses on dislocated assets and distressed situations in the energy sector. It invests in both public and private companies through preferred equity or debt instruments. Andros has a flexible investment mandate that allows the firm to invest in equity or debt securities. More here

CVI, a Poland-based credit investor, raised $205 million for its second private credit fund. The fund lends to SMEs in Poland and across Central and Eastern Europe. CVI has completed over 700 private debt transactions and invested almost €3 billion. More here

ImpactA Global, a women-led emerging markets infrastructure debt investor, raised $200 million for its latest fund. The fund lends to high-impact infrastructure projects in emerging markets, focusing on addressing climate challenges and reducing social inequalities. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.