What Leading Asset Managers are talking about in Q324

Data Centers, AUM Growth, M&A, Spread Compression and PIK

👋 Hey, Nick here. A special welcome to the new subscribers at First Sentier Investors Centerbridge and CSG Investments. This is the 87th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

This week’s newsletter summarizes what leading asset managers are talking about in Q3 24. If you haven’t had a chance to listen to the latest earnings calls, then this post is for you.

I’ve divided this post into key themes, let me know if I’ve missed any.

Overall Trends

Manager AUM Growth

Platform M&A

Data Centers, AI & Nuclear

Direct Lending Trends

M&A / IPO Markets

Spread Compression

PIK - I’d love to hear from anyone with experience on this development

📚 Quotes of the Quarter

Manager AUM Growth

Rapid AUM growth was a consistent theme across all managers this quarter. Both Apollo and Brookfield reiterated their goals to double AUM over the next five years.

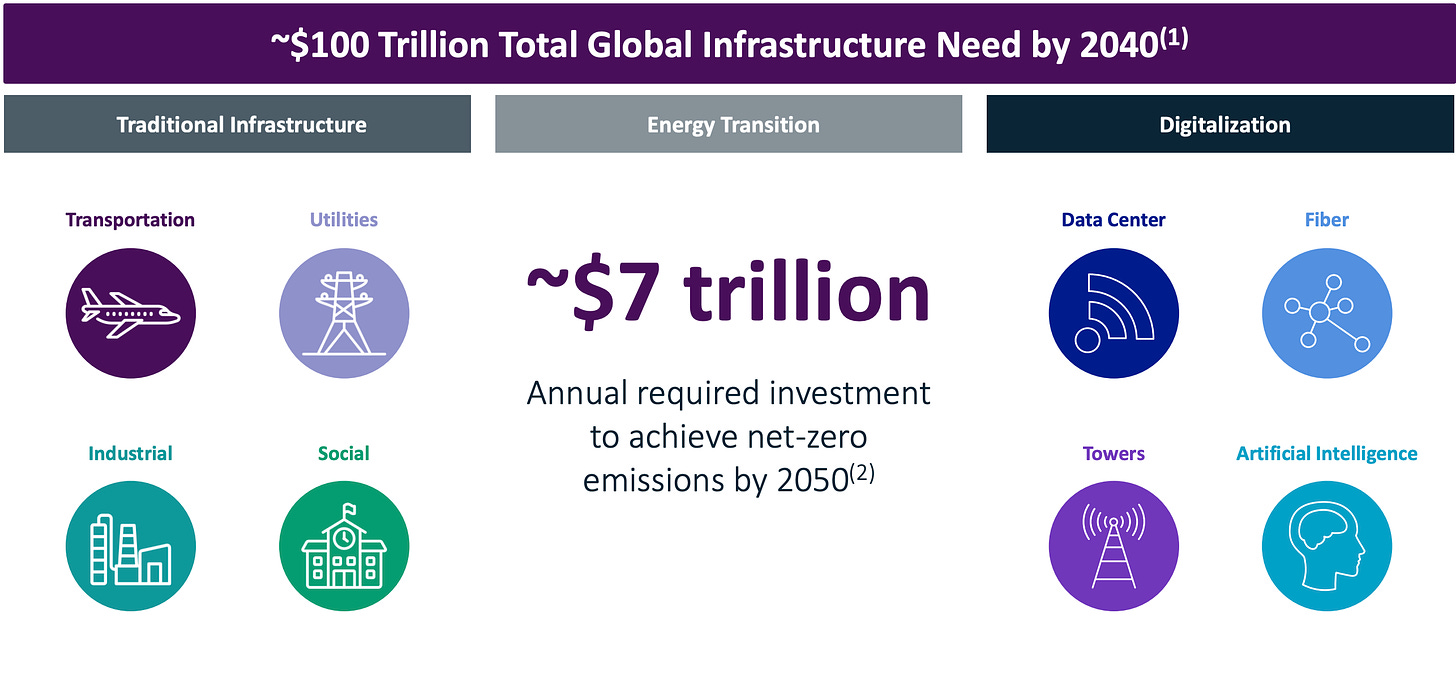

Blackrock: “The growth of private markets is underpinned by the continued rise of infrastructure. It presents a generational investment opportunity. Over the next 15 years, we'll need to invest $75 trillion to repair aging infrastructure to invest in new projects like data centers and decarbonization technology.”

Apollo: “AUM across our ABF platform exceeds $65 billion. That's up 40% versus last year.”

Ares: “This is not just a sponsor lending business, this is a broad-based private credit business across corporates, real estate, infrastructure, alternative credit, it's global.”

Manager Platform M&A

The second consistent talking point is that capital is increasingly concentrating around the largest managers. This has two potential implications 1) Sub-scale managers will struggle to raise capital going forward, and 2) Merging or being acquired by a larger manager will accelerate growth. Blue Owl illustrated this point most clearly:

Blue Owl: “That's why ICONIQ and Iron Point said, We want to join with the Blue Owl platform in order to be able to build our business further… Consider Oak Street, we had $10 billion of assets [at acquisition], we've now tripled the assets and tripled the revenues in that business. We see a very similar opportunity sets in those two businesses.”

Brookfield explained a very similar reason why Castelake joined their platform.

Data Centers, AI & Nuclear

Data Centers were by far the most discussed asset. Most managers continue to emphasize why they are best positioned to capitalize on this opportunity.

Blackstone: “Blackstone is the largest data center provider in the world with holdings across the U.S., Europe, India and Japan. The Blackstone portfolio consists of $70 billion of data centers and over $100 billion in prospective pipeline development”

KKR: “We currently own four platforms operating across the U.S., Europe and Asia… The total enterprise value of those platforms and their contracted and highly visible pipeline is over $150 billion.”

Brookfield: “Our $30 billion semiconductor fabrication plant we are building with Intel in Arizona, our data center portfolio, which is among the largest in the world, and enough fiber optic cables to circle the globe, all speak to our scale and capabilities that few others have.”

Source: KKR

Direct Lending Trends

M&A / IPO Markets

Managers were relatively cautious about forecasting a rapid improvement in exit markets. This contrasts with this time last year, when most of them were predicting that 2024 would mark the return of the IPO market.

Blackstone: “We had two very slow years in '22 and '23. [In] '24, you've watched the momentum build up. And as I said on TV earlier, as the price of the public market goes up, it's like a magnet pulling private companies into the market. And so, I think you'll begin to see more. I think IPOs in the U.S. [this year] are up something like 30% from IPO to today. That will get investors more motivated to invest in IPOs.”

KKR: “If you look back over the past 12 months, we've had four IPOs of size… And it's just a very small data point, obviously, but all those IPOs are trading well above issued price and, on average, they're trading close to 50% above their issued price. And as one of the probably largest equity issuers in the marketplace that's, while a small data point, I think a helpful one as we think about what the IPO market could look like, through 2025.”

Deployment & Spread Compression

BDCs in particular were vocal on this talking point. In summary:

Benign M&A markets → Subdued Deployment → Spread Compression

Despite this, managers think spreads have plateaued and could widen if the M&A market improves.

ARCC: “Spreads.. have come in at least 100 basis points this year... There are plenty of large cap unitranches getting done with force, but middle market deals or not. So I'd just say that the range is generally 450 to 550 market… When you consider the base rate plus the spread in the fees is still getting you to a pretty attractive gross unlevered return on the asset, in our opinion.

Apollo: “On the traditional credit platforms. We were in the 410 area about a year or so ago, we're in the 375, 380 zip code today.”

FS KKR: “The M&A volumes that everybody has been forecasting, including ourselves have been a little bit slow to return. I think we've been happy with our deployment numbers, but there's a bit of an imbalance in terms of available capital and kind of deal flow.”

PIK

PIK has been an interesting development compared to prior quarters, with managers emphasizing that not all PIK is equal.

Many are choosing to use PIK to make the initial deal more attractive to borrowers. This is very different from most of the media coverage. (Again, I’d appreciate some real world color on this.)

FS KKR: “We structured this new debt with a PIK option, which gives us and management flexibility to address these underperformance issues… but we do have sign-off on all the budgeting since we're on board.”

ARCC: “90% of our PIK income was structured at the time of the investment versus only 10%, which is amendment oriented PIK.”

Blue Owl: “Over 80% of our PIK income was structured at initial underwriting, and more than half of our PIK exposure is in the form of first lien investments. In addition, PIK exposure remains stable year-over-year and quarter-over-quarter in the portfolio. In fact, these PIK names represent some of our best investments.”

Thanks again for reading, let me know if you find these posts useful or how I can improve it for next quarter.

I’d appreciate it if you shared this with your colleagues.

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.