The sweet spot has been and remains —> Middle Markets.

Fundraisings from Legal and General, AGL Credit Management / Barclays and Kennedy Lewis

👋 Hey, Nick here. If you’re new, this is the 56th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

Alliance Bernstein: The Bright Side of Higher Rates. Persistent stress among banks should broaden the opportunity for private lenders. Investors must pick their spots carefully. High rates will be a burden for some borrowers and may pose risks for lenders. Lenders can pick strong borrowers with superior collateral and negotiate deals with high return potential and strong downside protection. With ample equity cushions to absorb losses, there’s no need for credit investors to lose sleep trying to time the market. (Link)

PIMCO: Navigating the Descent. There is an important distinction between existing assets and new investment opportunities. Existing stock faces real challenges from higher interest rates and a slowing economy. Existing stock has a substantial distance remaining to mark to more realistic, market-based price levels. Especially in areas with fundamental weakness. (Link)

KKR: April 2024 Market Review. With interest rates likely to remain elevated for the foreseeable future, it is still a good time to be a credit investor. Credit has become a much larger asset class. Instead of worrying about the perfect timing for deploying into a “golden age for private credit”, we think it is time to think more about a golden age for credit allocations. That means taking advantage of the growing number of options available for getting deployed and building diversified portfolios (Link)

💬 Quote of the Week

Bruce Richards - CEO Marathon Asset Management (Quote)

Not too Big, Not too Small: Fitch Ratings just released a new report (last week) entitled “Fitch expects a challenging environment for private credit in 2024.” In other words, be wary of a bad vintage, underwritten on assumptions that didn’t meet the base case. This Fitch report focused on Upper Middle Market loans, whereby Direct Lenders aggressively chased larger companies to deploy capital, raising larger and larger funds/BDCs. In earlier years, there were 3-5 deals per year greater than $1B par amount, however, in the past 3 years there were 80+ private debt transactions greater >$1Bln.

Today, many of these larger transactions are struggling under higher financing costs according to Fitch. The Fitch study was taken from available data reported by BDCs of large alternative asset managers, showing:

5.6% Default Rates for large Middle Market Loans (up from 1.4%), making this the highest default rate since Fitch began recording this data in 2007.

In contrast, Fitch tracks data for 300 Middle Markets reporting a default rate of 3.7%, considerably less compared to its larger cohort.

Fitch reports that 25% of private credit loans are now Cov-lite.

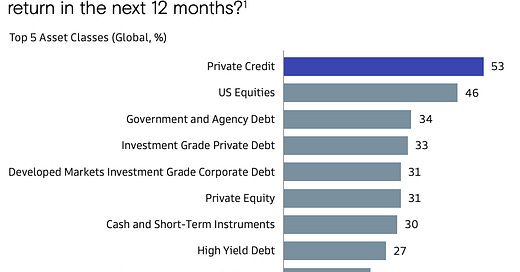

So, let’s see what S&P Global Ratings has to say about this. According to S&P Global’s LossStats, Middle Market companies ($50mm EBITDA or less) have 63% recovery rates vs. 58% for Large Corp ($50mm+ EBITDA) as shown in this table below.

When it comes to direct lending the sweet spot has been and remains —> Middle Markets.

Strong sponsors, less leverage and strong covenant protections with attractive spreads. Too small of a company, the degree of difficultly is much higher since financial data is simply harder to obtain and verify, as many of the smaller companies lack a financial sponsor who writes a 50% equity check and are so well equipped to guide the company. The Upper Middle Markets are often dual tracked in the BSL market, where covenants are too loose/absent while tighter spreads and greater debt-to-EBITDA ratios sometimes push the lender to offer PIK options or simply stretch the loan.

My advice is that the greatest value is in true Middle Market loans - I believe it’s a better balance that provides wider spread, stronger covenants, a great selection of companies across industry, and strong PE sponsors. Investors can capture a higher spread for MM loans v. Large MM loans. Contrary to the narrative espoused by many, MM loans have a lower default rate, a higher recovery rate and often tighter covenants.

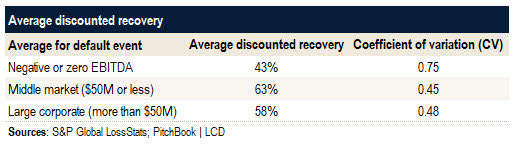

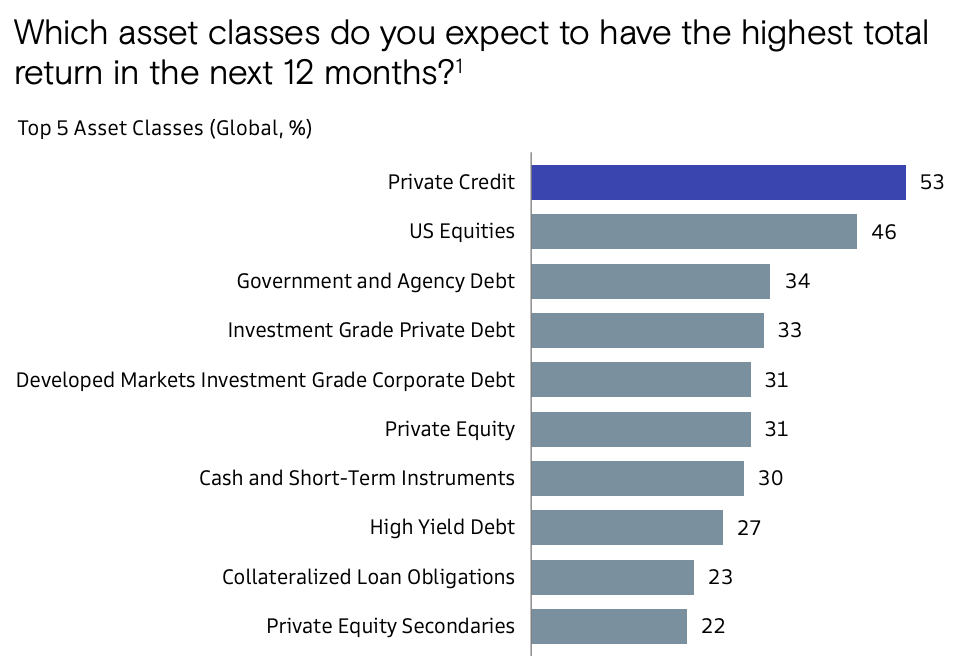

📊 Insurers have high hopes for Private Credit

GSAM’s Global Insurance Survey incorporates the views of 359 Chief Investment Officers (CIOs) and Chief Financial Officers (CFOs) representing over $13 trillion in balance sheet assets combined, approximately half of the balance sheet assets for the global insurance sector. (Link)

💰Fundraising news

Legal & General Investment Management, a London-based asset manager launched a new Short-Term Alternative Finance Fund. The fund will invest in a portfolio of sub-1-year private credit assets. Types of investments could include capital call facilities, supply chain finance, trade receivables, and asset-backed financing. The first fund has deployed over £2 billion, since its launch in 2021. The funds will target assets with an average investment grade rating. More here

AGL Credit Management, a New York-based credit manager, launched AGL Private Credit. The strategy is an exclusive partnership with Barclays, the British investment bank. The fund will lend senior secured loans to large corporate borrowers. AGL will operate as an independent manager, with complete control over origination, asset selection, and portfolio management. Barclays will provide AGL exclusive access to deal flow. The platform has reportedly received a $1 billion anchor commitment from a wholly-owned subsidiary of the Abu Dhabi Investment Authority. More here, here and here

Kennedy Lewis Investment Management, a New York-based credit manager, received a passive, minority investment from Petershill at Goldman Sachs Asset Management. The firm manages private funds, a business development company, and collateralized loan obligations. It lends to middle-market companies in the US and Western Europe. More here and here