The Enduring Appeal of Lower Middle Market Direct Lending

Fundraising from ICG, Madison Realty, Sound Point Capital and Genesis Alternative Ventures

👋 Hey, Nick here. A special welcome to the new subscribers at Prosek Partners, Barings and Corre Partners. This is the 79th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Blue Owl Q2 Pulse Check: The current environment in direct lending continues to be one of the best. Link

Oaktree Apologises to Advent and Silver Lake. Link

Private Credit in India Link

Apollo and State Street join forces on public-private credit fund Link

AXA expands its mid-market direct lending platform and completes its acquisition of CAPZA, a European Private Debt Firm. Link

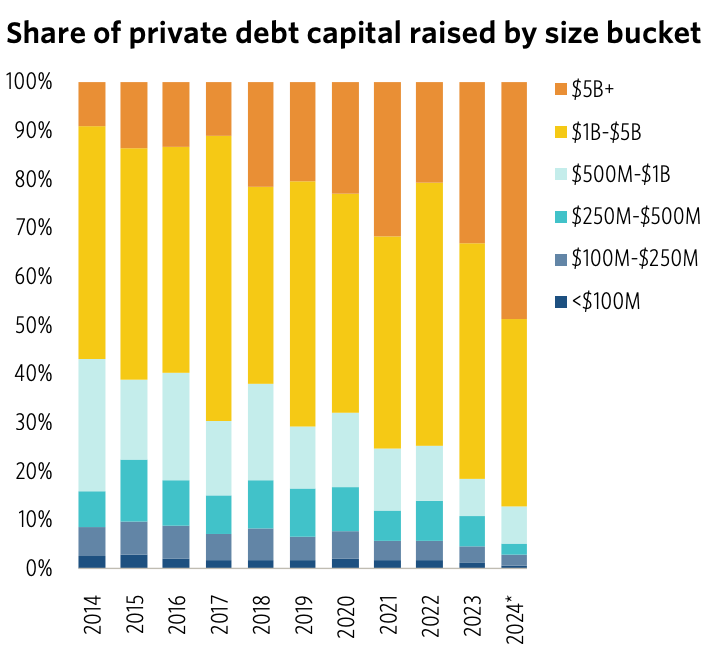

📊 Chart of the Week -Fund Sizes

The biggest managers keep getting bigger. ICG’s latest fund (see below) is a prime example, but Pitchbook have the real evidence.

In 2014, less than half of the funds raised more than $1 billion.

In 2024, nearly 90% of the fundraises are over $1 billion.

Read the Q2 Global Private Market Fundraising Report Here

The Enduring Appeal of Lower Middle Market

One of my hopes for The Credit Crunch is to provide you with an encyclopedia of fundraising material.

I’m always looking for new material so please share yours with me.

The middle market is one of the most covered debates and I enjoy it writing about it. This week’s insights are brought to you from Pinebridge, you can read their full report here

You can also read some of other managers’ insights below:

Lower Middle Market - Muzinich, Investec, BDC Analysis

Core Middle Market- Marathon Asset Management, Bain Capital, Ares

Upper Middle Market - Apollo, Ares, KKR

Why Lower Middle Market is Compelling

Pinebridge believes there are three reasons why the lower middle market is particularly compelling:

Historically higher yields

Lower leverage

Stronger lender protection

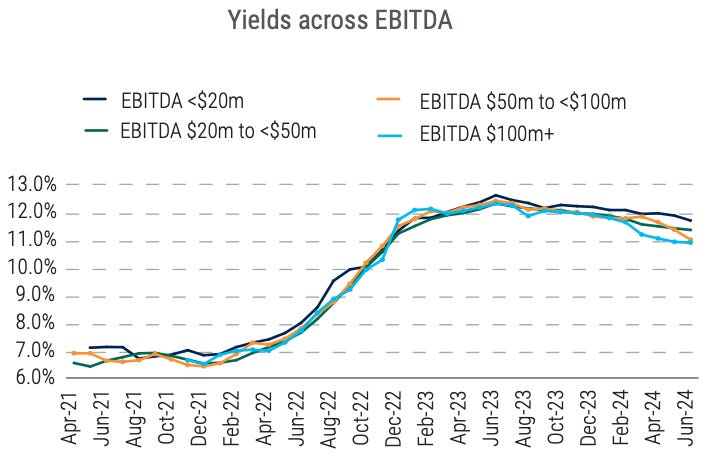

Lower Middle Market Issuers Have Historically Higher Yields

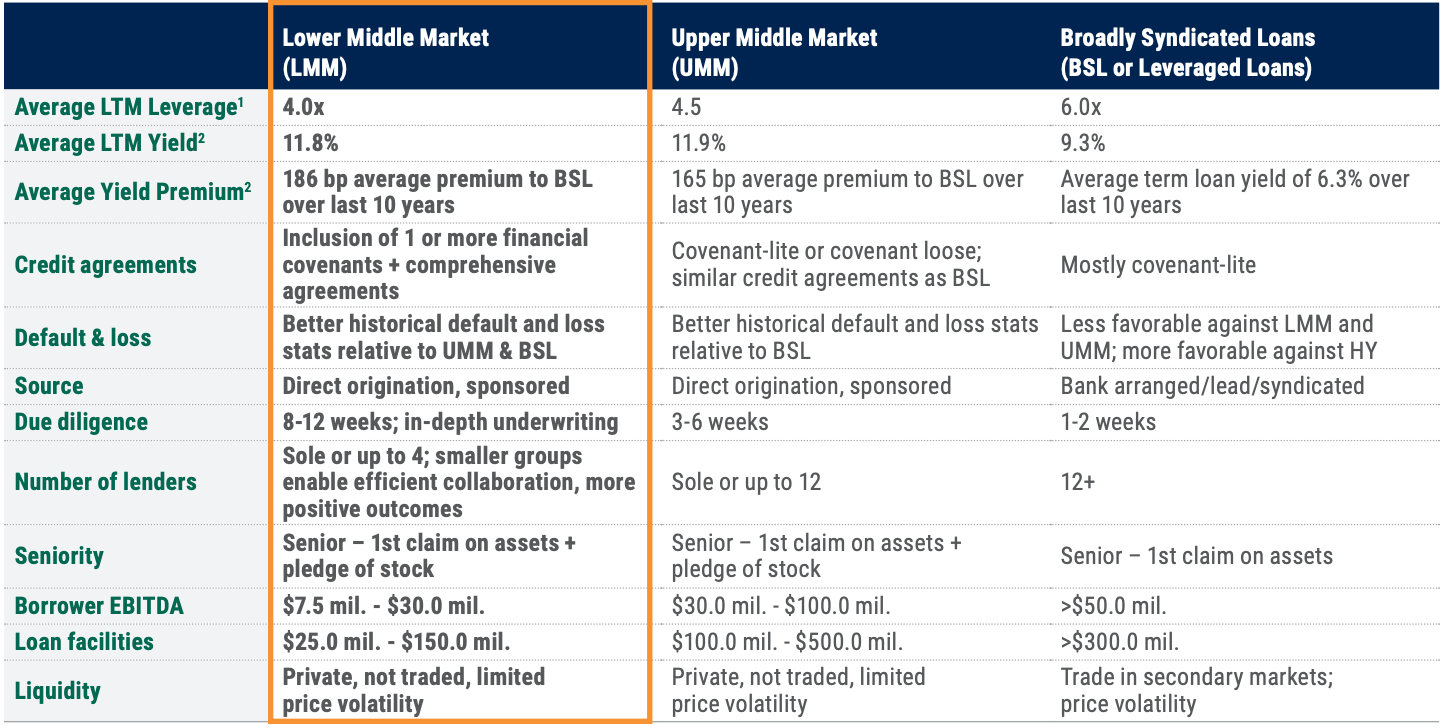

With average yields currently ranging from 11%-12%, the lower middle market offers a historically less competitive environment for lenders and wider spreads observed over time.

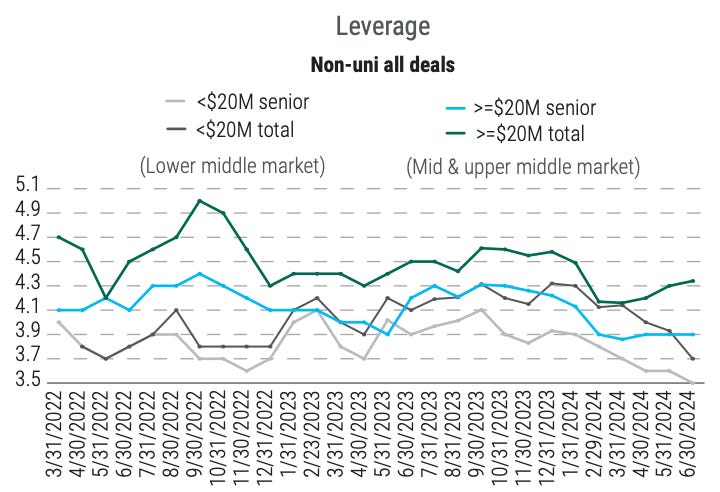

Lower Middle Market Issuers Have Historically Lower Leverage

Looking back over the past decade, LMM deals have averaged 4.0x leverage since 2013, compared with 4.6x for the upper middle market.

Lower Middle Market Issuers Have Stronger Lender Protections

Although the loans are smaller, lenders in the lower middle market tend to do more in-depth and lengthier due diligence, averaging eight to 12 weeks (versus three to six weeks for UMM lenders).

These deals have enhanced safety features, supported by more protective credit agreements and more conservative and simplified debt/equity structures.

The higher the EBITDA level, the more likely lenders are to consider a covenant-lite deal, with nearly half willing to consider deals with no covenants at all. In comparison, just 2% of lenders to the under-$30 million EBITDA market would consider a covenant-lite deal.

PineBridge believes lower middle market lenders typically are also less tolerant of EBITDA adjustments and more conservative when quantifying the impact of synergies.

You can read the full report here here

💰Fundraising News

ICG, a London-based manager, closed its $17 billion Senior Debt Partners V fund, its flagship direct lending strategy. The fund lends first lien, senior secured loans to sponsored mid and upper-mid-market European-based businesses. More here and here

Madison Realty Capital, a New York-based real estate firm, closed its $2 billion Debt Fund VI. Fund VI is the largest U.S.-focused real estate debt fund raised in 2024. It will have the capacity to invest between $6-8 billion of total commitments, including leverage and recycling of capital. The fund will focus on lending to major metropolitan markets in the U.S. It invests in multifamily and residential-related properties with an opportunistic view on hotel, student housing, land, industrial, retail and office. More here

Sound Point Capital Management, a New York-based manager, closed its $1.2 billion U.S. Direct Lending Fund III. The fund focuses on core middle market, sponsor-backed companies. It has already committed more than $650 million across 33 investments. USDL III is nearly double the size of its predecessor fund. More here

Genesis Alternative Ventures, a Singapore-based venture debt lender, closed its $125 million Fund II. The Southeast Asia-focused fund lends to revenue-generating technology companies backed by venture capital funds. These start-ups typically do not qualify for regular bank loans because they lack collateral or have not yet reached profitability. Fund II has already deployed venture more than $20 million to a handful of start-ups. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.