The Credit Crunch - Limited Edition

Four Insights into Private Credit Fund Sizes

🤓 Benchmarking Private Credit Fund Sizes

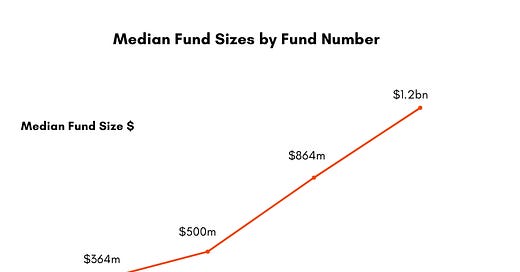

How big should your next private credit fund be?

In 2023, a typical manager raised a first fund of ~$400m

Successful funds typically grew between 30-80% per new generation.

After four funds a successful manager should expect a fund of more than $1 billion.

Note, that this excludes managers with more than $50 billion of AUM. More on them below.

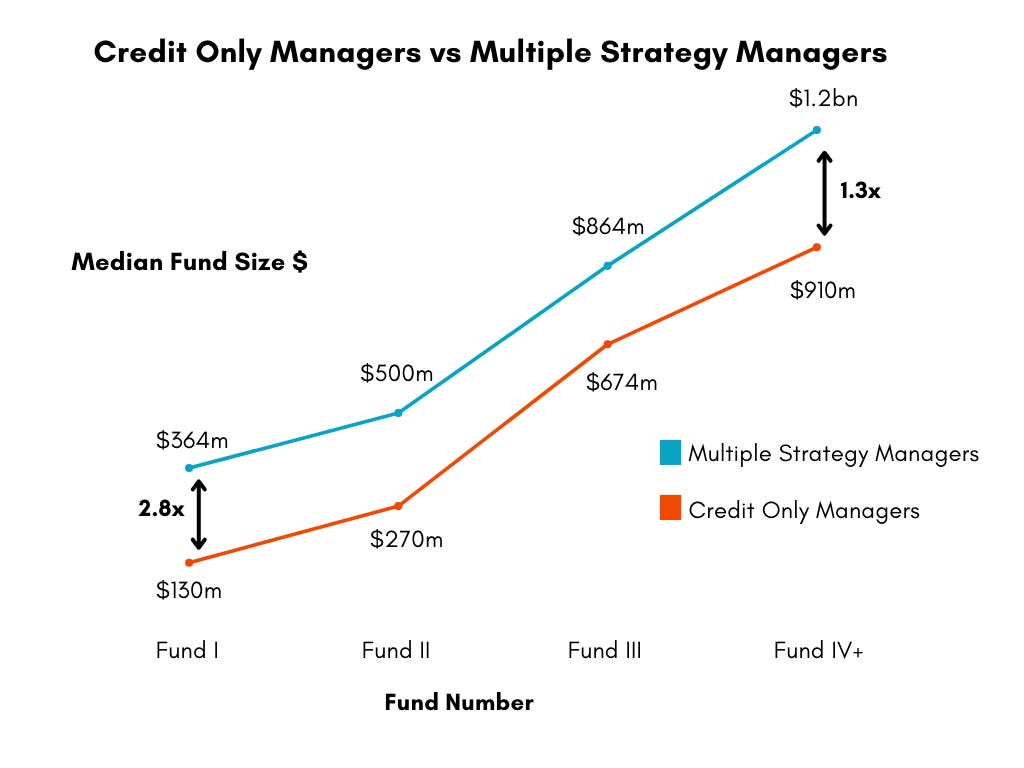

Does it matter who raises the funds?

I write about two types of managers:

Credit-only managers. Examples include Calmwater Capital, Deerpath , Vistara Growth

Asset managers with multiple strategies e.g. Hayfin, Charlesbank, Sixth Street

Filtering the data by these categories, it’s easy to see a difference in fund size.

Credit-only managers typically raise smaller funds. This gap narrows the more funds they raise.

Two potential explanations:

Asset Managers have existing LPs from their other strategies. These LPs provide them an advantage when launching their new credit fund.

Existing Asset Managers have higher operating costs. They require larger new funds to justify launching a credit strategy

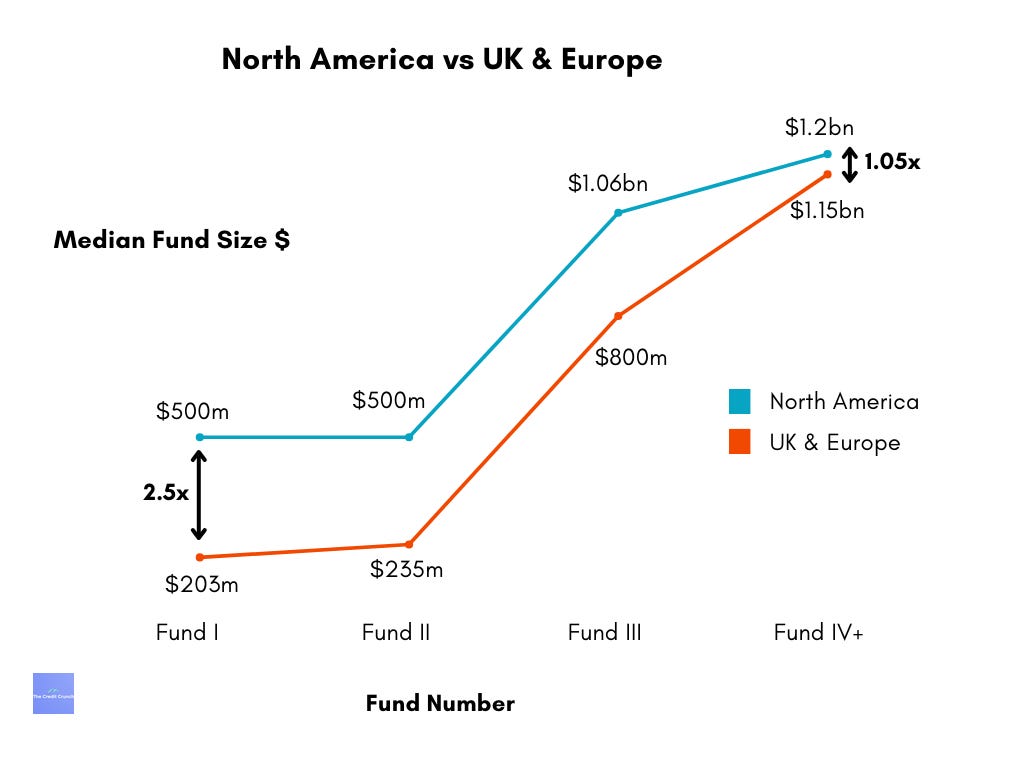

Does Geography impact fund size?

North American funds accounted for over 60% of fundraising last year (Link)

Like their food (Link), North American funds were bigger than European funds. This was particularly noticeable when comparing first and second funds.

Two potential explanations for this difference

US managers have a larger pool of LP capital. This gives them a distinct advantage earlier on. European managers have to develop a compelling track record before raising US capital

North American private credit market is larger. North American funds need to be larger to lend in this market.

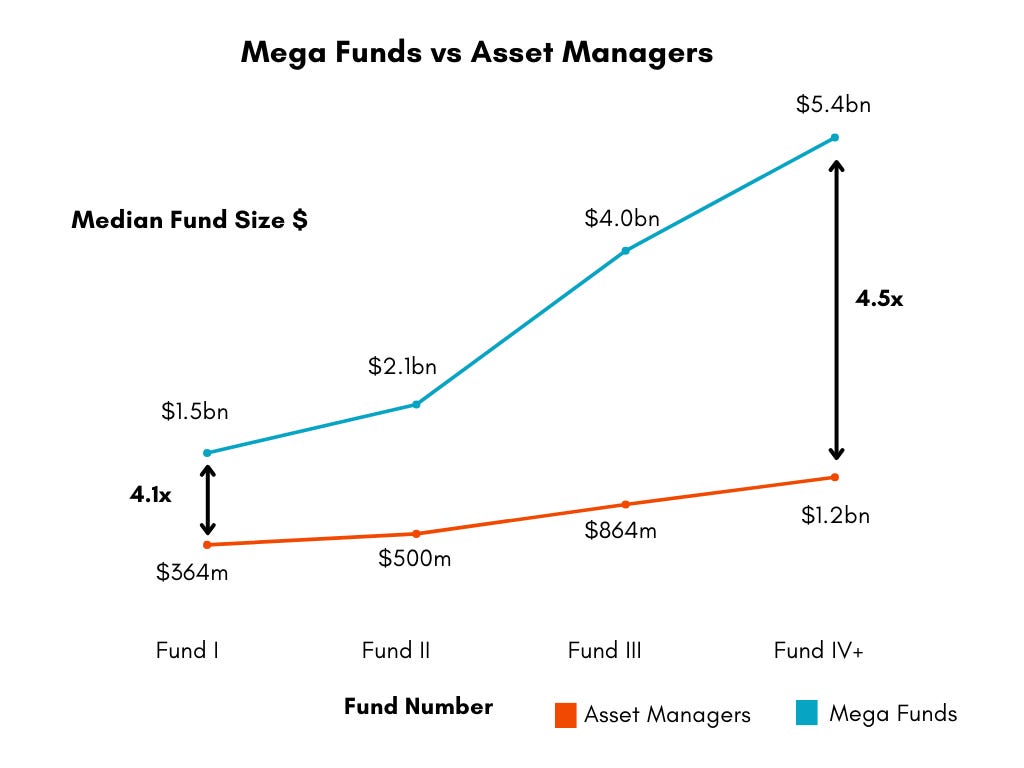

Do mega funds have an advantage?

Managers with over $50 billion of AUM have a distinct advantage. This holds true throughout every generation.

The gap consistently stays between 4-4.5x vs other managers.