The Credit Crunch #52

Does Size Matter in Middle Market. Fundraising from Ares, Manulife & Hamilton Lane

Welcome to the 52nd Credit Crunch. (Congratulations to the select few who have been here from the beginning)

As a reminder, read my previous articles here. Subscribe here to get this delivered to your inbox. Please share this.

Scroll down to the bottom, if you’re here for the fundraising news.

🧐 Does Size Matter?

Should I invest in the Lower or Upper Middle Market?

If you asked me this three years ago, I would have said:

“Upper.”

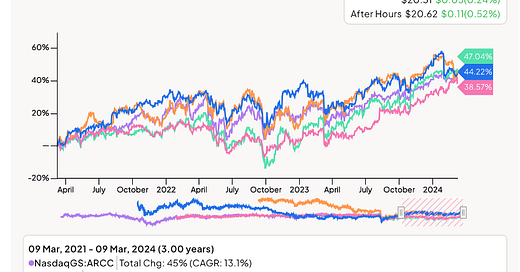

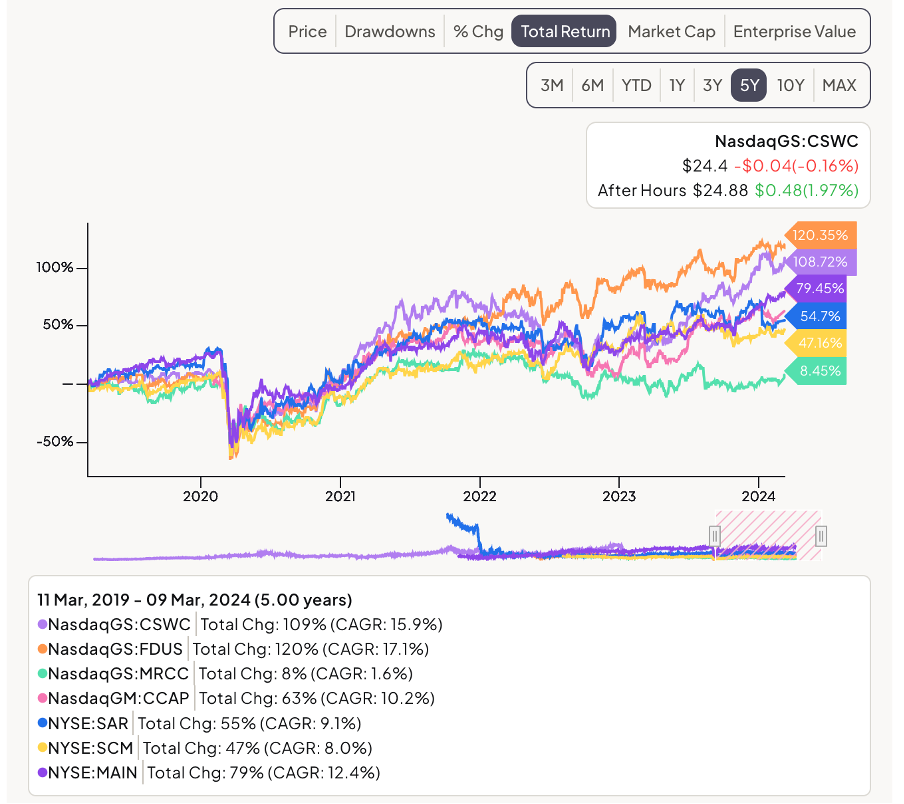

Using BDCs as a benchmark, The Upper Middle Market has been less volatile and outperformed the Lower Middle Market by ~2% per year over the last three years.

Upper Middle Market BDC 3-Year Total Return Performance

Lower Middle Market BDC 3-Year Total Return Performance

I thought about ending the post here and enjoying a free weekend, but Nassim taught me better.

If you asked Apollo this question, they would say:

Upper Middle Market offers an attractive proposition for several reasons:

Large Companies have more established and diversified products and services. Consumers are more likely to use these in good or bad times

They have more pricing power to negotiate with suppliers

They have a higher ability to pass on price increases to customers

(Link)

Whereas Bain would say:

Lower Middle Market lenders have greater spread opportunity, tighter covenants and perform more thorough due diligence (Link).

Unfortunately, both these opinions are anecdotal and subjective.

So Does Size Matter?

This is the first part of a series where I’ll look for evidence to help answer this question.

Part One: Payment-in-Kind (PIK)

If you recall, I had an argument with my Managing Partner about PIK a few weeks ago (Link).

His (and the FT’s) wisdom suggests:

Higher amounts of PIK are a sign that portfolio companies cannot afford to pay cash interest. This helps fund managers delay impending credit issues. Check back in a few quarters to see how these companies are performing…

With this wisdom in mind, we should be cautious about funds with higher levels of PIK income. These funds have more companies that cannot afford to pay cash interest. These funds use PIK to keep the fund’s investment income high and or delay credit issues.

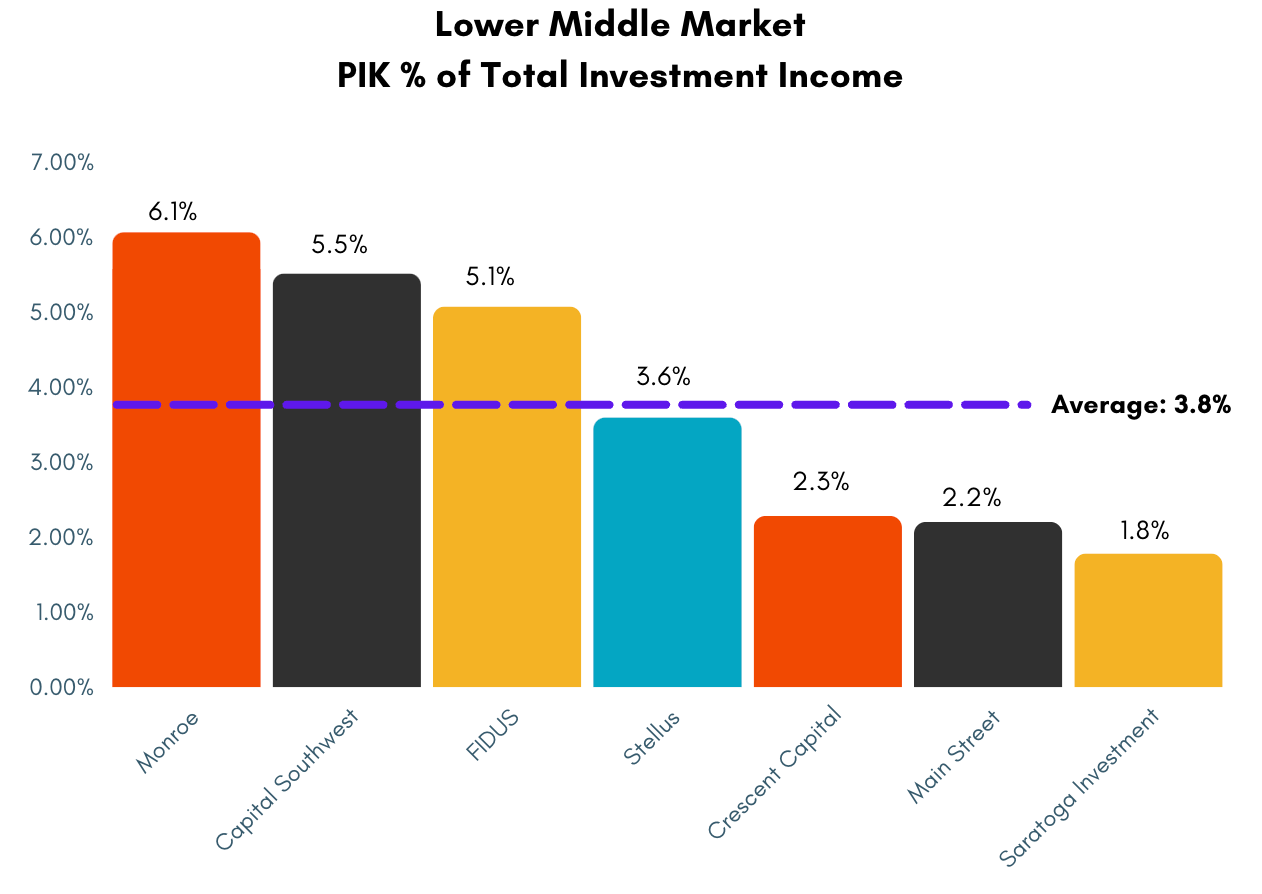

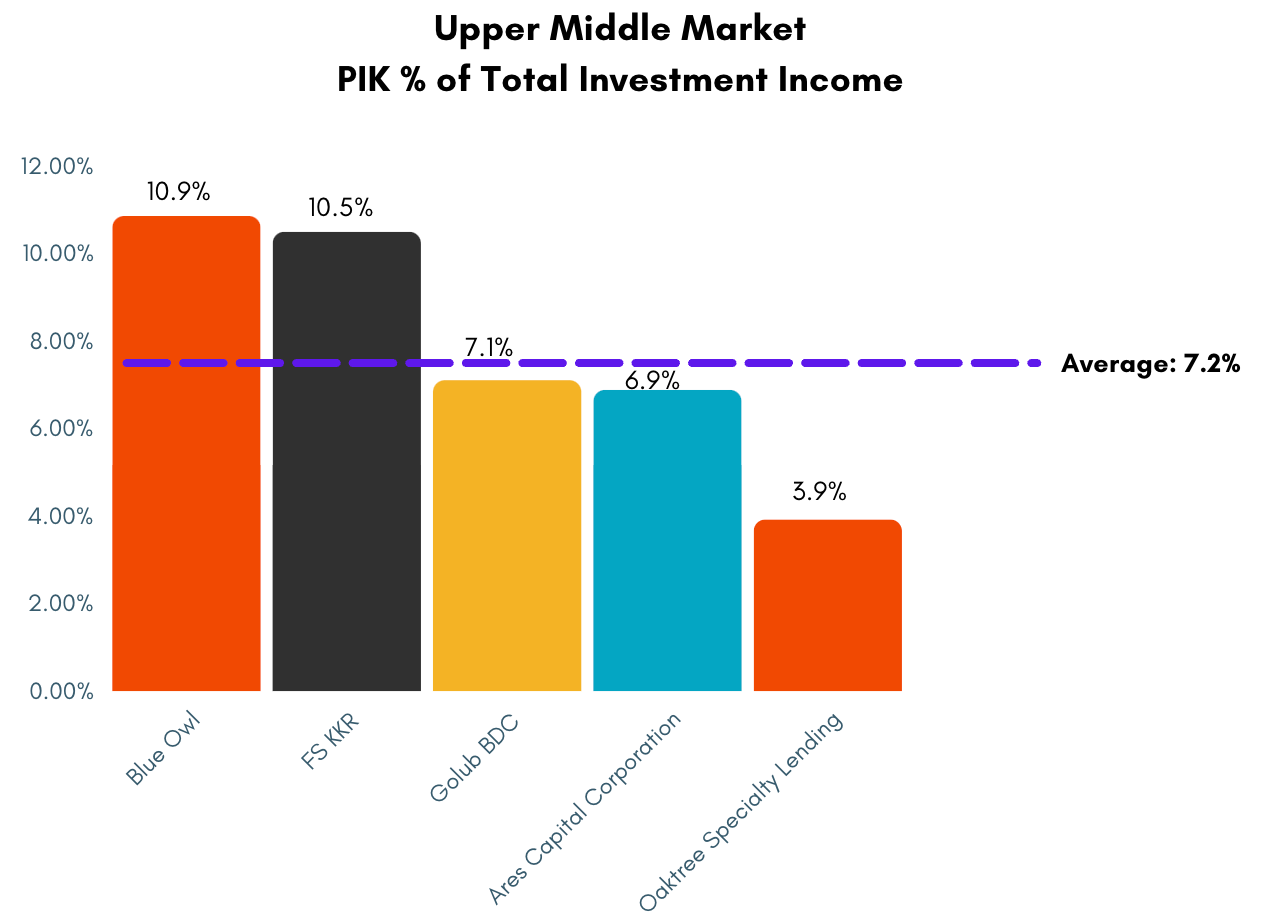

So how do the two markets stack up?

Upper Middle Market investment income has nearly 4 percentage points more of PIK than Lower. This has also increased as much as 200% YoY.

So, whilst Blackstone might say:

Companies with >$100 million EBITDA are growing EBITDA 9x more than companies with <$50 million EBITDA

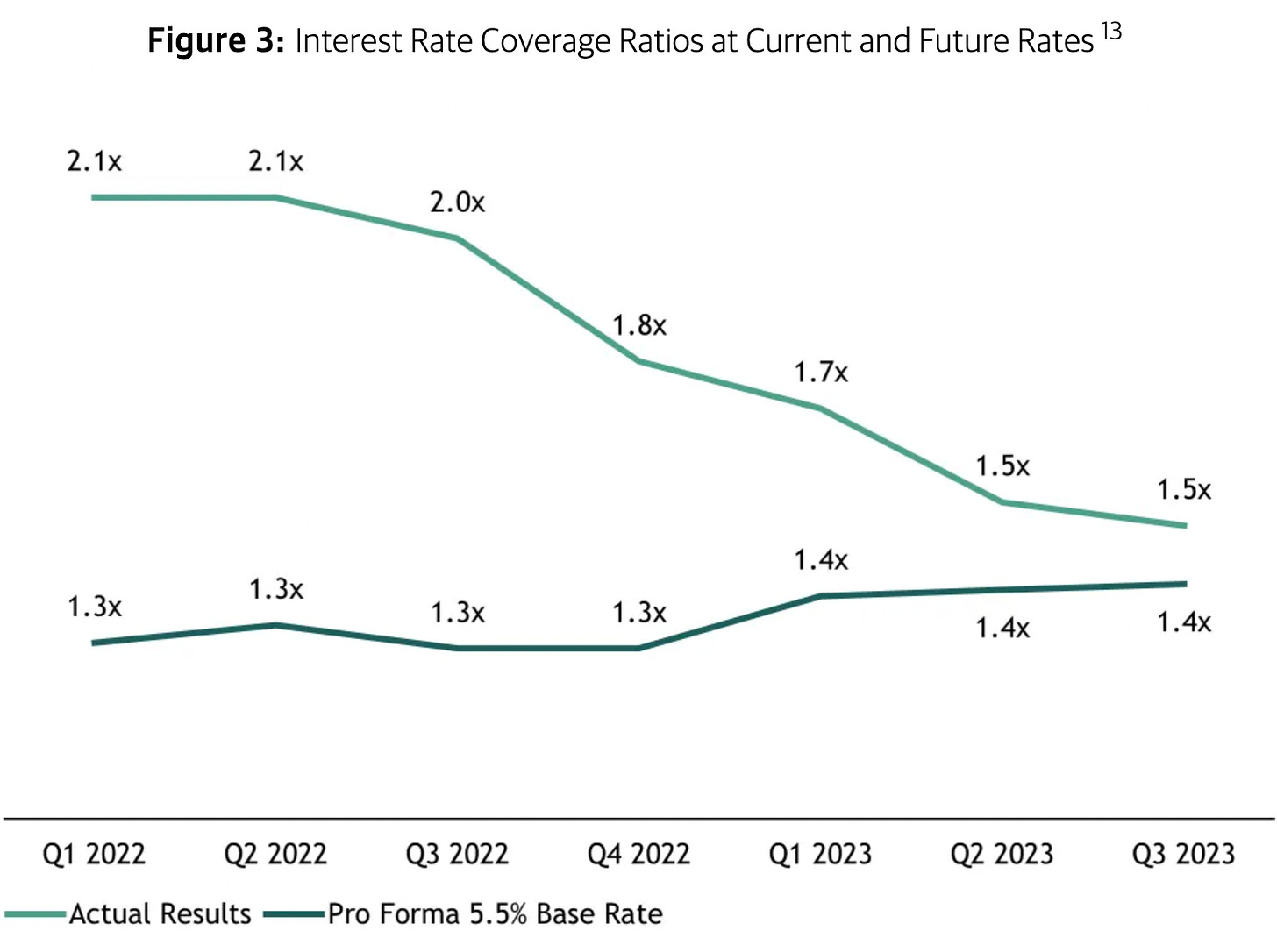

The data suggests that the worsening Interest Coverage Ratio trend is not improving and sponsors are begging for help.

Round 1 goes to the Lower Middle Market.

💰Fundraising news

Ares launched Ansley Park Capital, a ~$3 billion lending and specialty finance company. The strategy provides financing for essential-use, large-ticket equipment. Ansley Park will offer equipment-based loans to an array of industries, including manufacturing, rail, construction, marine, infrastructure, energy, healthcare, and corporate air travel. Loan sizes will start at $5 million and scale to over $100 million. Ares acquired Ansley Park’s management team and platform from BciCapital. More here

Ares isn’t the only asset manager doubling down on asset-based finance. KKR and Apollo also recently highlighted their focus on this opportunity (Link) and (Link).

Manulife, a Boston-based investment manager, closed its $752 million Capital Partners VII fund. The Fund provides junior credit to US middle market companies. Investments include a mix of subordinated debt alongside structured or common equity. This combination provides meaningful participation in growth balanced by contractual cash coupons. The Fund targets companies with more than $20 million of EBITDA in sectors including Business Services, Industrial Manufacturing, Aerospace & Defense, and Building Products. It expects to invest in 20 to 30 companies. The team has deployed $3.3 billion into 126 companies, since its inception. More here

Hamilton Lane closed its $700 million Strategic Opportunities Fund VIII. The fund will invest in attractive opportunities within Hamilton Lane’s existing credit platform. It has flexibility to invest across the capital structure and prioritizes downside protection, shorter-duration, and cash yield. Hamilton Lane raises an Opportunities fund every year and has raised $4.9 billion across the Fund series to date. The funds typically have an investment period of one to two years and a Net IRR between 9 - 11%. More here and here