The Credit Crunch #50

Insights into CalPERS Private Debt Program. Fundraising from Goldman Sachs, Pátria Investments, and Churchill

Welcome to the 50th Credit Crunch.

As a reminder, read my previous articles here. Subscribe here to get this delivered to your inbox. Please share this.

As promised at the start of the year, I’m providing you with more insights in 2024.

While I can't guarantee CalPERS will invest in your fund, reading this might be helpful.

📚 Insights into CalPERS Private Debt Program

Who is CalPERS?

CalPERS, or the California Public Employees' Retirement System, is the largest public pension fund in the United States. The fund manages the pensions of more than two million California public employees, retirees, and their families. (Link)

CalPERS had $452 billion of Assets under Management, as of September 2023. To put this in context, CalPERS’ AUM is slightly less than the GDP of Singapore.

What does CalPERS think about Private Credit?

TLDR: Not much..

Private credit is a recent addition to CalPERS’ portfolio. The Board only approved Private Debt as an asset class in November 2021. Before this CalPERS made private credit investments under its Opportunistic Strategies program.

The private debt program has a portfolio of 31 investments and has invested $9.5 billion to date (link). This represents only 2% of CalPERS' Total AUM.

Putting this in context, CalPERS has invested more in ten private equity funds than the entire Private Debt program (Link).

Why has CalPERS invested so little in Private Credit?

Being a conservative and prestigious pension fund CalPERS cares a lot about risk. The board said “risk” 162 times in its November 2023 Investment Committee meeting. “Return” was only mentioned 105 times.

These are the three risks that CalPERS seems most concerned about (Link).

Shorter performance history.

CalPERS has ten investment beliefs. These beliefs guide investment decisions that often need balancing multiple, interrelated decision factors. They also provide context for CalPERS' actions.

Investment Belief VII: CalPERS will take risk only where we have a strong belief we will be rewarded for it (Link)

Private credit has grown post-2010 banking regulations. Given this short timeframe, it’s difficult to see how CalPERS could have developed “strong belief” any sooner. It’s also important to remember private credit’s AUM is 8 - 10x smaller than the private equity market.

A lot of money chasing private debt may cause a loosening of underwriting and spread compression

CalPERS highlighted this concern in early 2023, right at the start of the “golden moment for private credit”.

Howard Marks clarified this point in his Easy Money memo:

Low rates make people more willing to lend for risky propositions. Providers of capital vie to be the one who gets the deal. To compete for deals, the “winner” must be willing to accept low returns from possibly questionable projects and reduced safety, including weaker documentation. For this reason, it’s often said that “the worst of loans are made at the best of times.” (Link)

Manager performance in a downturn.

Over 90% of direct lending funds raised in the last 20 years were launched after the Global Financial Crisis.

Few managers have invested and managed portfolios through challenging periods, when interest rates and default rates rise, and owners become unwilling or unable to support their companies with incremental capital.

How have they invested?

CalPERS has committed $23.5 billion to 31 funds (Link). The fund vintages of these investments are 2020 or later.

CalPERS typically invests between $500 million and $2 billion per fund. These funds are predominantly Global or US-focused. Calpers has committed most of its Capital to Direct Lending. It has the flexibility to invest further in Specialty Lending, Real Estate, Asset-backed, and other Structured products (see below).

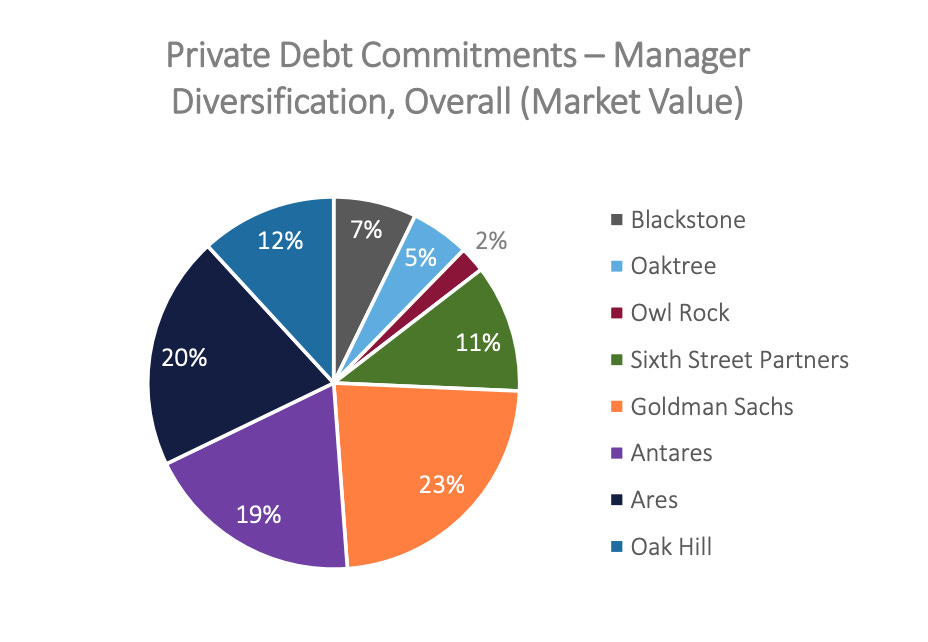

CalPERS has been conservative in its manager selection and has only committed to eight managers to date. These managers have significant scale, multiple strategies, and long track records. The smallest manager, Oak Hill, has $63 billion of Assets Under Management (Link).

How has Private Credit performed?

Private credit is up 10.7% YoY, as of September 2023. This was the second best-performing asset class for CalPERS (Link).

Most funds have vintage years of 2020/2021 and are early in their investing cycles. As a result, only 12 of the 31 funds have an investment multiple of more than 1.1x.

The median Net IRR of its investments is 10.1%. The median investment multiple is 1.08x.

The best-performing fund in its portfolio was the Antares Credit Opportunities Series 4. This fund has a net IRR of 21.9% and an investment multiple of 1.17x (Link)

CalPERS’ largest cash investment is $1 billion to West Street Strategic Solutions Fund I. It has committed $2 billion to this fund. The fund has a net IRR of 7.4% and an investment multiple of 1.14x (Link)

Who can raise money from CalPERS?

My View: CalPERS will invest in fund sizes greater than $3 billion from managers with at least $30 billion of AUM.

Rationale Below:

CalPERS’ existing managers have a median Assets Under Management of $130 billion. It’s unlikely CalPERS will invest in a manager with less than $30 billion of AUM, especially considering the smallest manager has $63 billion of AUM.

CalPERS invests between $500 million and $2 billion per fund. It committed $1.25 billion to Ares Senior Direct Lending Fund II which was an $8 billion fund (Link), showing it can commit to more than 15% of the fund.

What Strategies are CalPERS most likely to invest in?

Real Estate - Blackstone is the only manager in CalPERS real estate credit portfolio. This concentration risk could be an opportunity for other managers. Oaktree launched its Real Estate Debt Fund IV in September 2023 (Link). Given its familiarity with Oaktree, this may be a natural investment.

Opportunistic Credit - Wilshire is CalPERS’ investment consultant. They believe the outlook for U.S. Opportunistic Credit was “Highly Favorable”. The most likely candidates for this allocation are Blackstone Capital Opportunities Fund V or Blackstone’s Tactical Opportunities Fund. (Link and Link)

Distressed Credit- Wilshire also believes that U.S. Distressed Credit has “Attractive Historical Risk-Adjusted Returns”. The best candidate for this allocation is Oaktree’s flagship distressed fund, Opportunities Fund XII. CalPERS would be able to make a significant investment as the fund is reportedly raising more than $18 billion. (Link)

Non-Traditional and Asset-Based Lending - Apollo is a notable exclusion from the CalPERS’ portfolio. Apollo’s strategic focus on Asset-Based Lending could provide several opportunities for CalPERS (Link) Brookfield is another notable exclusion from the CalPERS’ portfolio. The ~$900 billion manager is currently raising funds for its $5 billion Infrastructure Debt Fund III. Last but not least, Blue Owl and Vista Credit’s Technology funds could provide attractive Net IRR for this allocation. (Link)

Direct Lending - CalPERS has committed 85% of its Private Debt Program to Direct Lending. Given this concentration, I don’t expect CalPERS to invest in many new Direct Lending strategies in the next few years.

Why am I excited about this?

I’ve become more and more excited throughout writing this article. Why am I excited that private credit isn’t a priority for CalPERS?

Here’s Why:

CalPERS has a long-term Private credit allocation target of 5% (Link). The program has funded less than 50% of this and there is ample opportunity for investment in other funds.

CalPERS had a 10-year total return of 6.3%, as of September 2023 (Link). Many private credit funds will outperform this return in a “higher for longer” environment. Outperformance will make CalPERS ask “is 5% the right allocation target?” Remember the Investment Belief VII.

CalPERS are just getting started. CalPERS private credit program is less than three years old. They’ve focussed on the largest managers with the largest funds and longest track records. I would expect the program to evolve much like the erivate equity. The Private Equity Program even has an Emerging Manager Program…

I hope you enjoyed this. If you work at any of the above-mentioned funds email me. I’d really appreciate your feedback.

💰Fundraising news

Goldman Sachs Asset Management launched a new European private credit strategy. The fund provides individual investors direct access to European private credit markets. It will invest in directly originated, senior secured debt from medium to large-size borrowers. The strategy targets non-cyclical, recession-resilient industries. The fund has raised over $600 million and has invested in 23 companies to date. It is an open-ended, semi-liquid fund offering monthly subscriptions and quarterly redemptions. More here

In case you missed it Blackrock and Carlyle launched similar vehicles this month. (Link) and (Link)

Pátria Investments, a Latin America-focused manager, launched its ~$1 billion Infrastructure Credit Fund. The fund will finance energy transition and social development projects in Brazil. It will lend between ~$10 to $20 million per project, complementing the role of development banks. More here

Churchill, a New York-based asset manager, closed ~$400 million for its third middle market CLO. The CLO is a partnership with Mubadala. It has a four-year reinvestment period and a collateral pool comprised of senior secured loans. The CLO has a four-year reinvestment period and a collateral pool comprised of senior secured loans. Churchill has accumulated ~80% of these loans have been as of the closing date. More here

This announcement reiterates Mubadala’s enthusiasm for co-investing with US private credit managers. Other notable investments include Blue Owl’s Technology fund (Link), Ares European Real Estate (Link), and Ares Secondaries (Link).

If you’re interested in learning more about CLOs, I’d highly recommend reading Guggenheim’s (Link) and Pinebridge’s (Link) reports.