The Credit Crunch #49

The Rise of Middle Market Software Lending. Fundraising from Blackstone, Fiera and Carlyle

Welcome to the 49th Credit Crunch.

As a reminder, check out my previous articles here, subscribe here and please share this.

I’ve become obsessed with lending to software businesses. This is my attempt to put a framework around this opportunity.

💻 Why Invest in Middle Market Software Lending

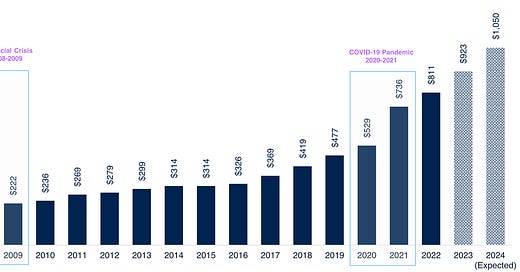

Worldwide software spending has increased 4x since 2008.

Estimated Worldwide Software Spending Since 2008 (Link)

This growth has created an opportunity for lenders.

In particular, Vista Credit and Blue Owl.

Who are these lenders?

Vista Credit

Vista Equity Partners is a software-focused private equity manager founded in 2000. The Firm has grown significantly since inception, and today has more than $101 billion in AUM.

Vista Credit Partners is the Firm’s credit platform. It has raised $11 billion across prior vehicles. It is currently raising its fourth core fund.

Vista Credit lends to enterprise software, data, and technology-enabled businesses in North America. VCP IV will primarily invest in senior secured, first lien credit facilities. The fund has flexibility to invest in unitranche and subordinated loans.

The fund will invest ~50-70% of the portfolio in non-sponsored businesses. These deals will have a ~13-15% coupon plus ~3- 5% of incremental returns through warrants. They typically include multiple covenants and board observation rights. The fund will invest the remaining ~30-50% in sponsored credit transactions.

Blue Owl

Blue Owl is a listed alternative investment manager and was founded in 2009. The Firm has also grown significantly since inception, and today has more than $165 billion in AUM.

Blue Owl has three technology focussed credit platforms. These have raised $18.9 billion across prior vehicles.

Blue Owl makes credit investments in software businesses in North America. Blue Owl primarily invests in senior secured and first lien. The fund has the flexibility to invest in Second lien, Preferred equity, and Common equity.

Blue Owl invests ~80-90% of the portfolio in large established, sponsored companies. These deals will have high single-digit returns. The remaining ~10-20% is invested in Pre-IPO and late-stage VC-backed companies. These deals have incremental returns through equity or warrants. They can have high single-digit to low-teens returns. Both types of financings have covenants.

Why do they focus on software?

Blue Owl and Vista Credit have almost identical investment theses. These are six of my favourite:

Mission critical solutions: Most companies rely on software. This makes many software companies mission-critical to modern businesses. These businesses need this software no matter the economic climate.

Highly recurring revenue: Enterprise software contracts are typically between two and four years. This gives lenders strong visibility into predictable revenue streams.

Strong unit economics: Software companies have gross profit margins between ~70 to 90%. This creates substantial operating leverage.

Highly capital efficient: Cloud computing has lowered software companies’ Capex. This as well as low working capital requirement results in high free cash flow.

Strong customer retention: Enterprise contracts involve high degrees of complexity, lengthy installations, and staff training. This creates meaningful switching costs

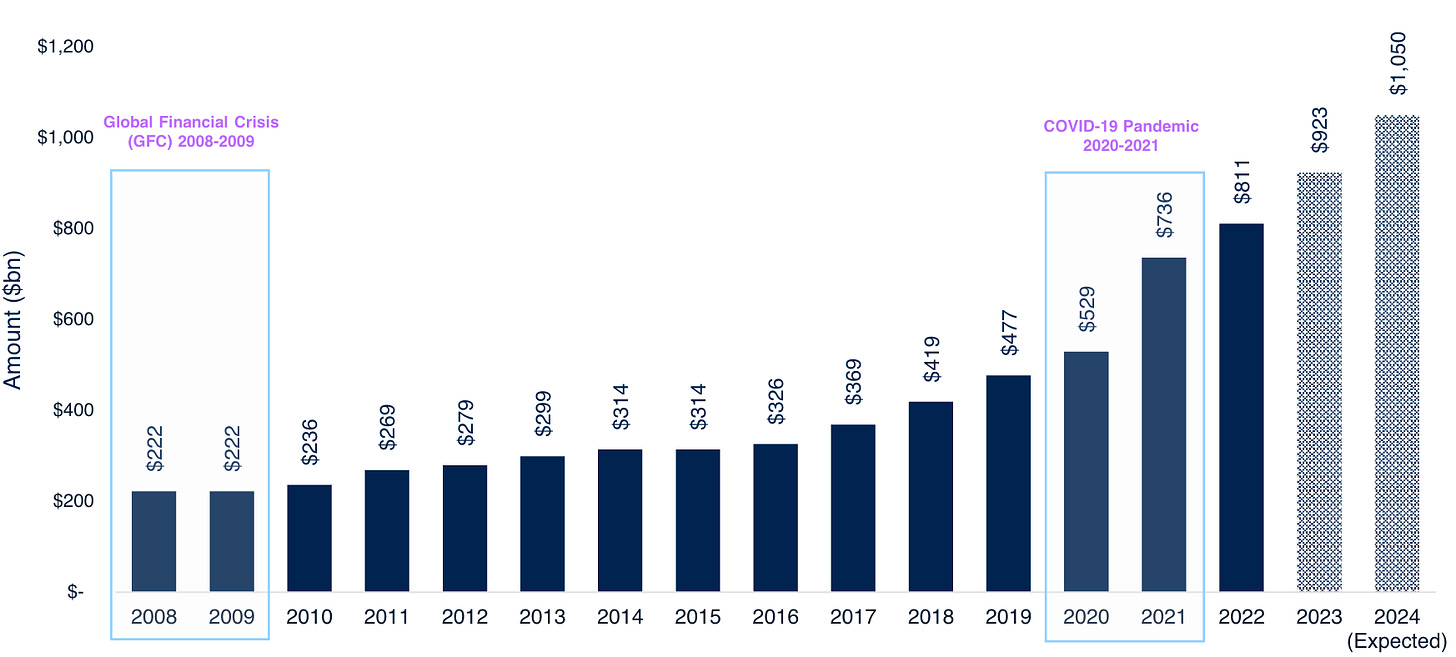

Software has one of the lowest default rates out of any industry over the last 20 years

What types of businesses do they lend to?

Vista Credit and Blue Owl focus on predominantly large, profitable software businesses. Don’t mistake their investment focus with venture debt lenders like WTI, Hercules, and Kreos.

Vista Credit prefers to invest in companies that have at least $500 million in enterprise value and revenues of $100- 500 million.

“These are big, scaled, proven businesses and business models”

David Flannery - Senior Managing Director and President of Vista Credit Partners

Blue Owl invests in even larger businesses. Nearly 90% of its loans have a weighted average revenue of $1.2 billion and a weighted average EBITDA of $324 million.

Notable financing commitments in 2023 included:

Thoma Bravo’s $8.0 billion take-private of Coupa

Haveli Investments’ $875 million acquisition of Certinia

Vista-owned Finastra’s refinancing of its existing syndicated

capital structure. This $5.3 billion debt refinancing was the largest private credit deal in the history of the market.

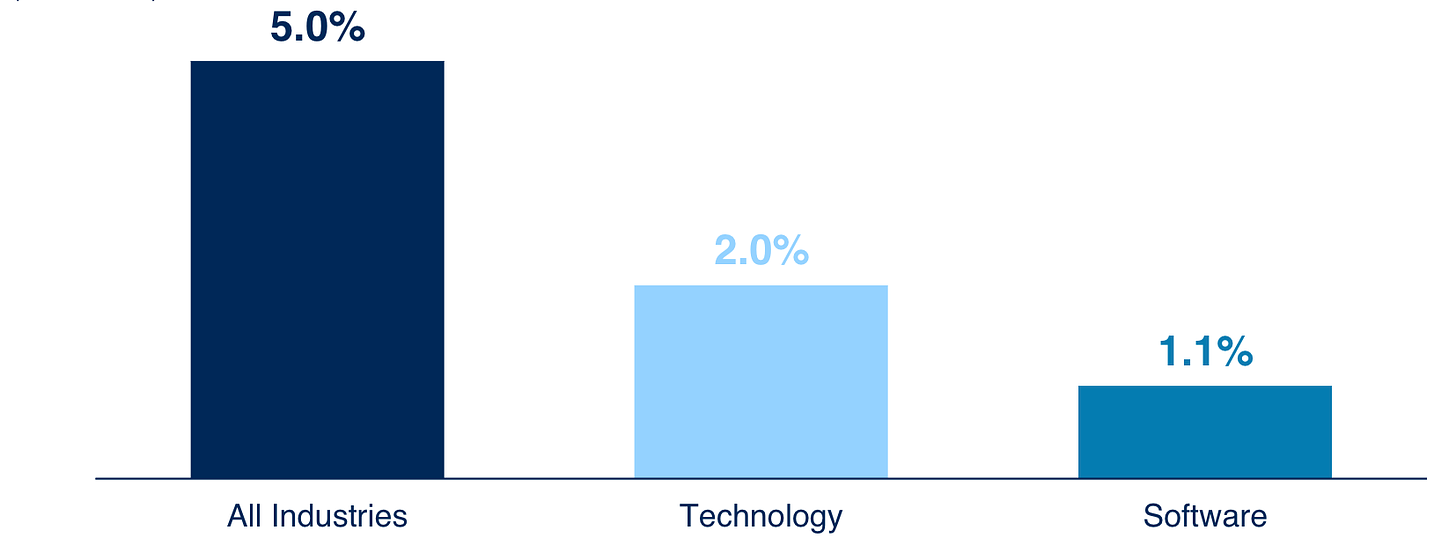

Why do they focus on Seniority and Loan to Value?

Both lenders are vocal about seniority and leverage

Vista Credit

“We rarely find founders taking as much leverage as their company could actually support, and we love that about our business,”

Vista Credit Loan commitments typically start at about $100 million and scale up from there.

“If you think about a $100 million credit investment versus half a billion dollars of enterprise value, those are lower-leverage, lower-risk, lower loan-to-value investments”.

Blue Owl highlights its focus on meaningful equity cushions

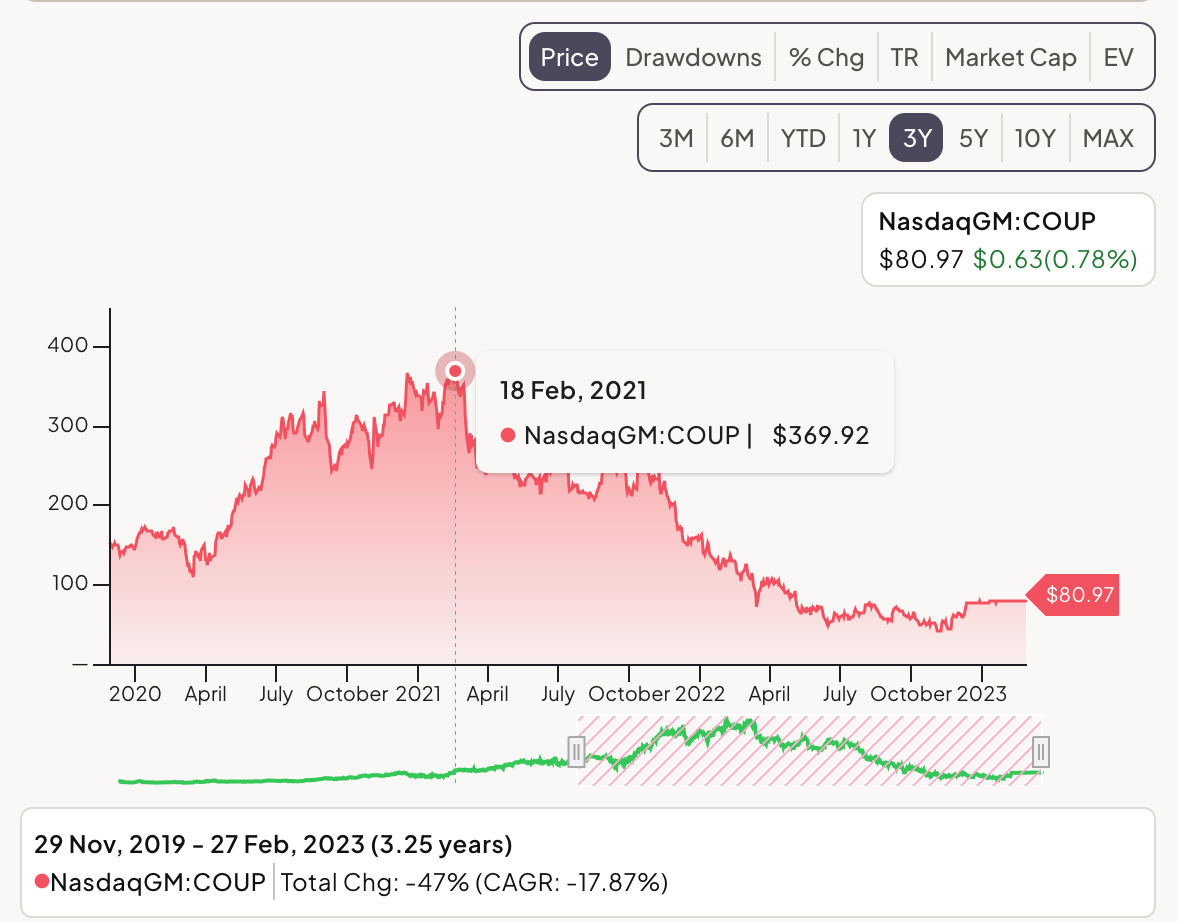

This is particularly important given software’s share price performance over the last two years.

Here’s Coupa….😳

What are their returns?

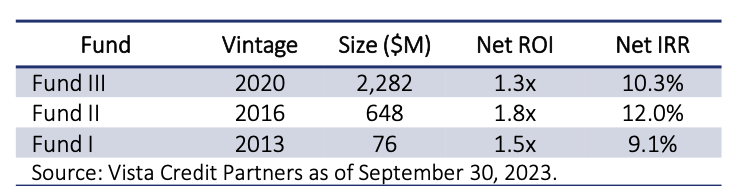

Vista Credit has deployed over $11 billion since its inception (including leverage and recycling). Performance for the strategy has been attractive, generally generating first and second quartile performance relative to peers on a net IRR basis.

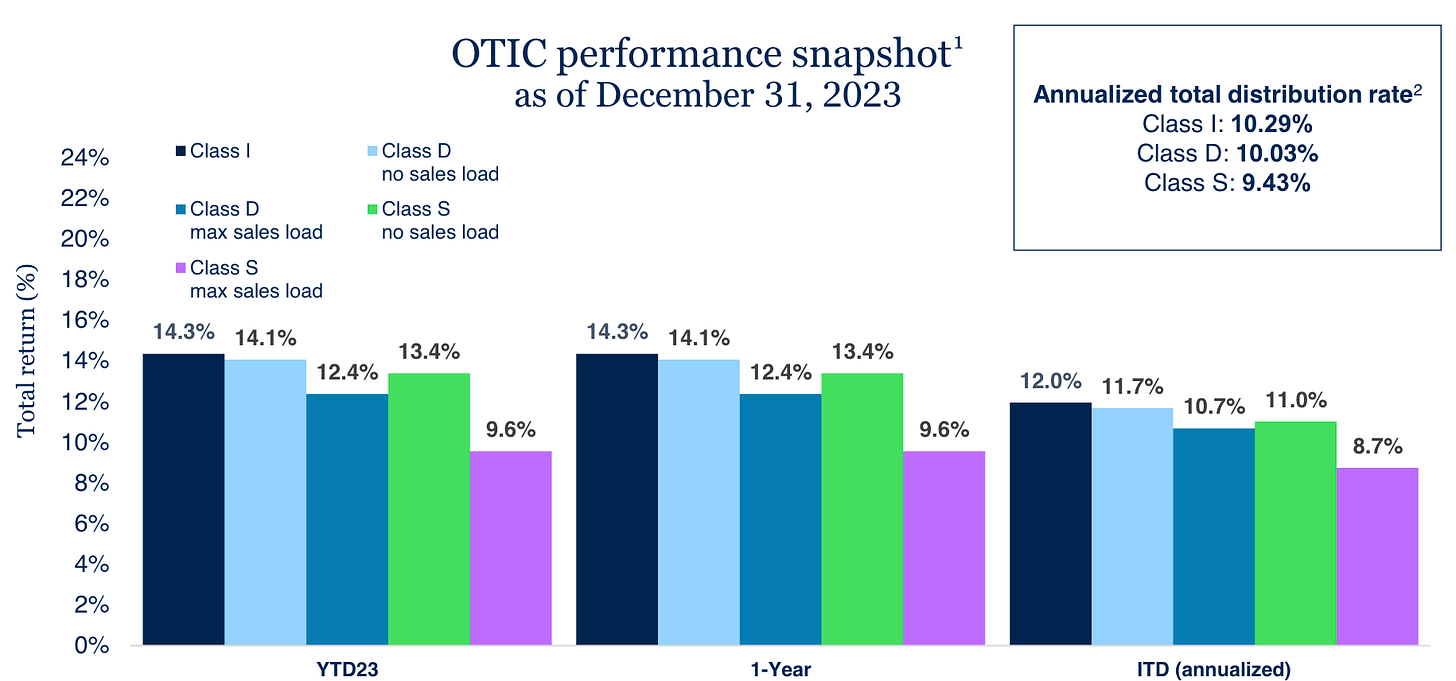

Blue Owl’s Technology Income Corp is a perpetually non-traded business development company. Its $2.9 billion portfolio is diversified across 102 portfolio

companies. Below is a snapshot of its performance as of December 2023:

Sources (Link, Link, Link, Link, Link, Link, Link, Link, Link, Link - Unfortunately the Dallas Retirement Fund’s website has gone down. Message me if you want this pdf)

💰Fundraising news

Blackstone, announced its $10 billion Capital Opportunities Fund V. The opportunistic fund can lend across sector, geography, scale, and structure. Blackstone has openly shared its plan to capitalize on a “Higher for longer” environment (Link). The fund is likely to invest with the three S’s in mind. Sector selection, scale of company, seniority of capital. Fund IV closed in January 2022 at a final size of $8.75 billion. More here, here, and here

Fiera Private Debt, a Canada-based credit manager, announced a first close of $350 million for its seventh flagship fund. The fund lends senior secured loans to middle-market Canadian businesses. Loans are fixed rate and have an average duration between 5 to 10 years. The fund invests between $10 million and $60 million per transaction. Fiera Private Debt has raised and invested over $3.5 billion in capital in mid-market Canadian companies. More here and here

Carlyle, a Global asset manager, launched its European Tactical Private Credit Fund. The evergreen strategy will invest in deals originated by Carlyle’s $188 billion Credit platform. It will provide individuals access to a wide range of its European Private Credit strategies. The fund will primarily invest in senior secured and floating rate debt. It is an open-ended, semi-liquid fund offering monthly subscriptions and quarterly redemptions. More here

In case you missed it Blackrock launched a similar vehicle to French investors last week (Link)