The Credit Crunch #48

Rethinking PIK. Fundraising from Blue Owl, PineBridge Investments, Ares and Blackstone

Welcome to the 48th Credit Crunch.

As a reminder, check out my previous articles here, subscribe here and please share this.

It’s time to talk about PIK.

🕵️ Is PIK as bad as everyone says?

I had an argument with my managing partner today.

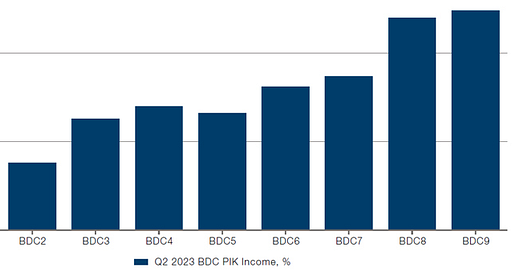

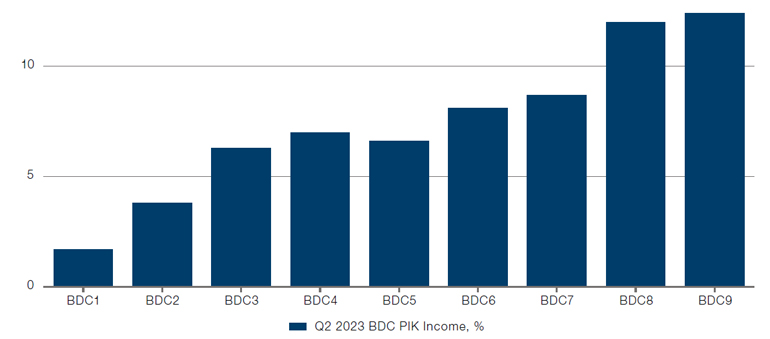

Much like the FT, he believes that charging PIK over cash interest is a slippery slope. He grimaced when I showed him this graph.

I think this argument is more nuanced for three reasons.

1) PIK improves portfolio companies’ free cash flow and interest coverage ratios

Part of the problem is the way BDCs report their quarterly results.

BDCs report their PIK every quarter. This means that newspapers write about PIK every quarter. Bloomberg talks about PIK every quarter. And, competitors gloat about PIK every quarter.

While PIK takes centre stage, worsening interest coverage discreetly evades detection.

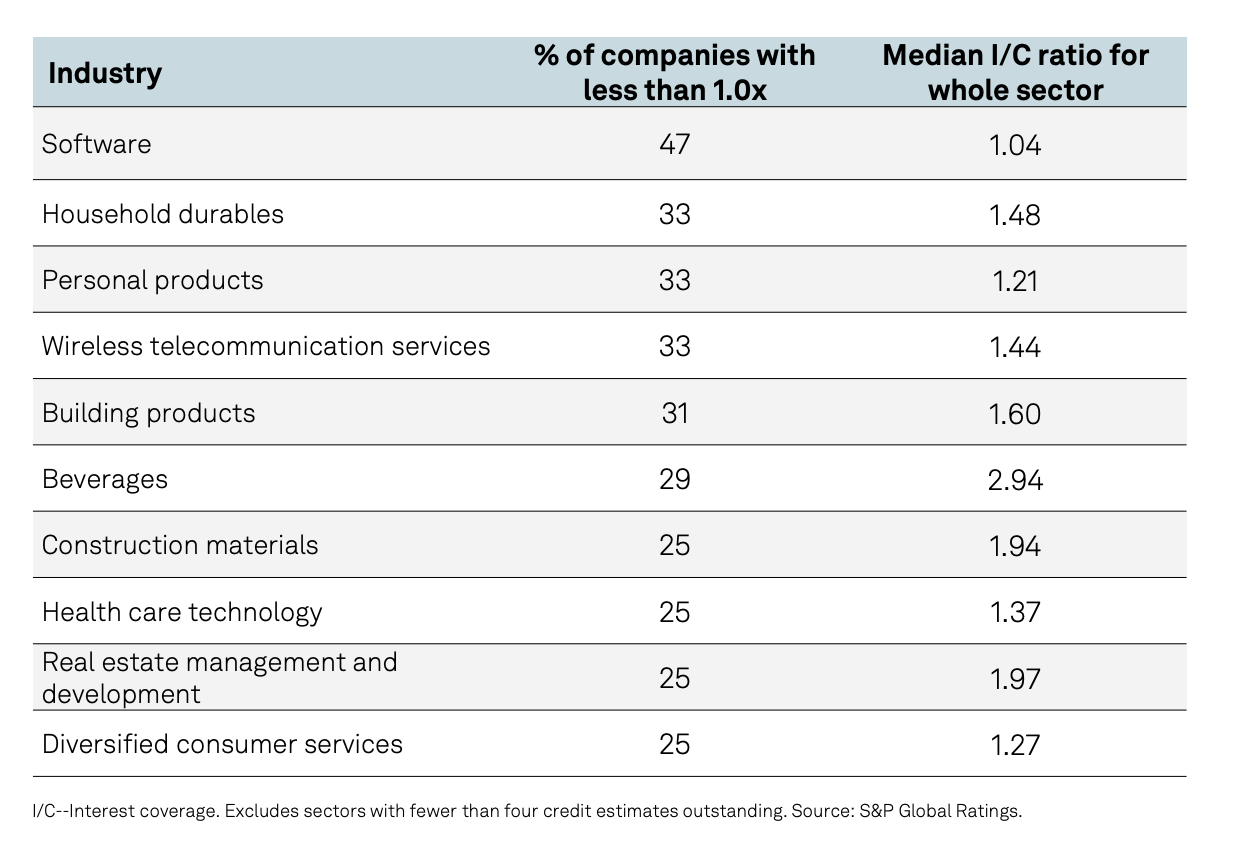

S&P recently published the Top 10 sectors with less than 1.0 interest coverage ratios. Almost half of the companies in the software sector have an interest coverage ratio of less than 1.0x.

Swapping cash interest for PIK gives companies breathing room to build up reserves or reinvest. This might also be an opportunity to tighten your covenants.

2) PIK delays loan losses

One of my managing partner’s arguments against PIK is that LPs know this is covering up potential losses.

Whilst I agree this might be true, I think this belief is largely anecdotal.

TCW recently highlighted that:

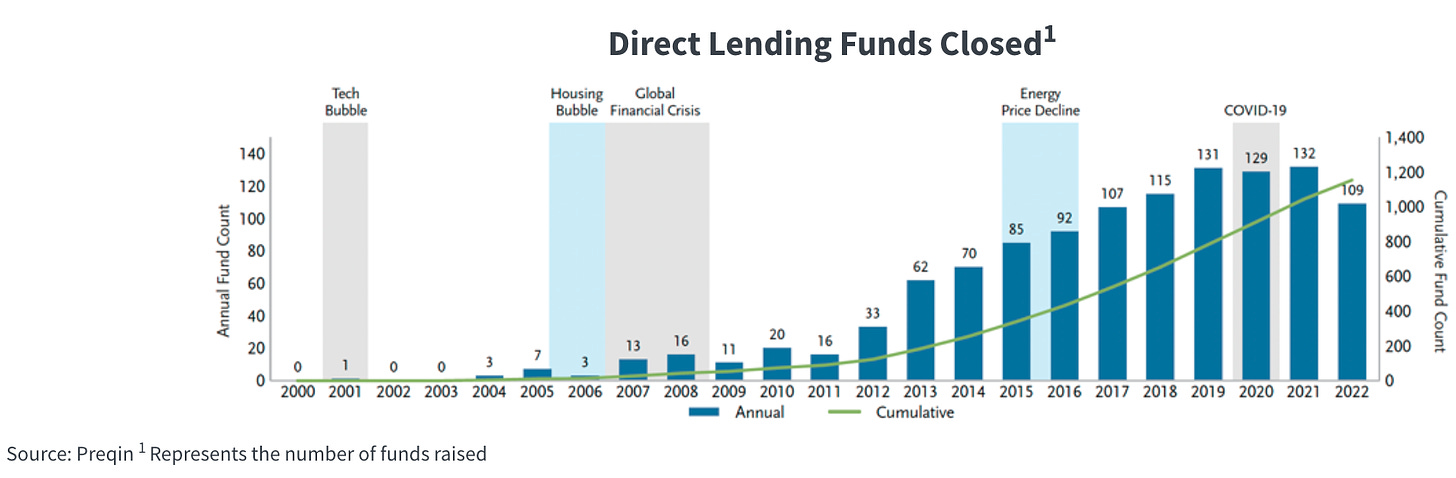

Approximately 95% of the direct lending funds raised since 2000 were established following the Global Financial Crisis. Few have invested and managed portfolios through challenging economic periods, when interest rates and default rates rise, and owners become unwilling or unable to support their companies with incremental capital. (Link)

These funds are now faced with two options:

A) Keep the cash interest. Increasing the chance of bankruptcy and potential near-term losses. Tell investors that your competitors’ loss ratios are artificially lower due to their PIK loans.

B) Swap cash interest for PIK. Reduce the interest burden and near-term bankruptcy potential. Tell investors the problem is temporary.

This problem reminds me of the Asian Diseases Study:

Imagine the U.S is preparing for the outbreak of an unusual disease, which is expected to kill 600 people. Two alternative programs to combat the disease have been proposed.

If Progam C is adopted, 400 people will die

If Program D is adopted, there is a 1/3 probability that nobody will die and a 2/3 probability that 600 people die.

An overwhelming majority chose Program D. With program C framed as a guaranteed loss, the subjects elected to risk killing everyone over the certainty of killing 400 people with certainty.

Michael Lewis Undoing Project

3) PIK helps sponsors

This is my weakest argument but it’s worth highlighting:

Lowering cash interest reduces the potential need for sponsors to inject capital. With private equity fund launches at a decade-low, your sponsors might thank you (Link).

Whilst this might not guarantee future deal flow, forcing a sale or investment won’t make you any friends.

Similar to private credit (Link), the largest private equity funds account for a disproportionate amount of capital (Link). With capital concentrated on a reduced number of sponsors, it pays to have friends.

💰Fundraising news

Blue Owl, a New York-based asset manager, is raising $2.5 billion for its GP Strategic Capital platform. The platform is a joint venture with Lunate, an investment manager backed by Abu Dhabi sovereign wealth fund ADQ. It will acquire minority stakes in private market investment managers with AUM of less than $10 billion. It will target GPs with a clear sector specialization, differentiated approach, and an established foundation of a durable, stable platform with identifiable key drivers of franchise value. More here

PineBridge Investments, a New York-based asset manager, closed its $1.7 billion PineBridge Private Credit III. The fund lends senior secured loans to sponsored US-based lower-middle-market companies. It will target companies in the business services, consumer, healthcare, and specialty manufacturing sectors. Loans are typically provided to companies with EBITDA between $7.5 million to $30 million. PineBridge’s private credit team has committed $4.5 billion to 79 portfolio companies to date. More here

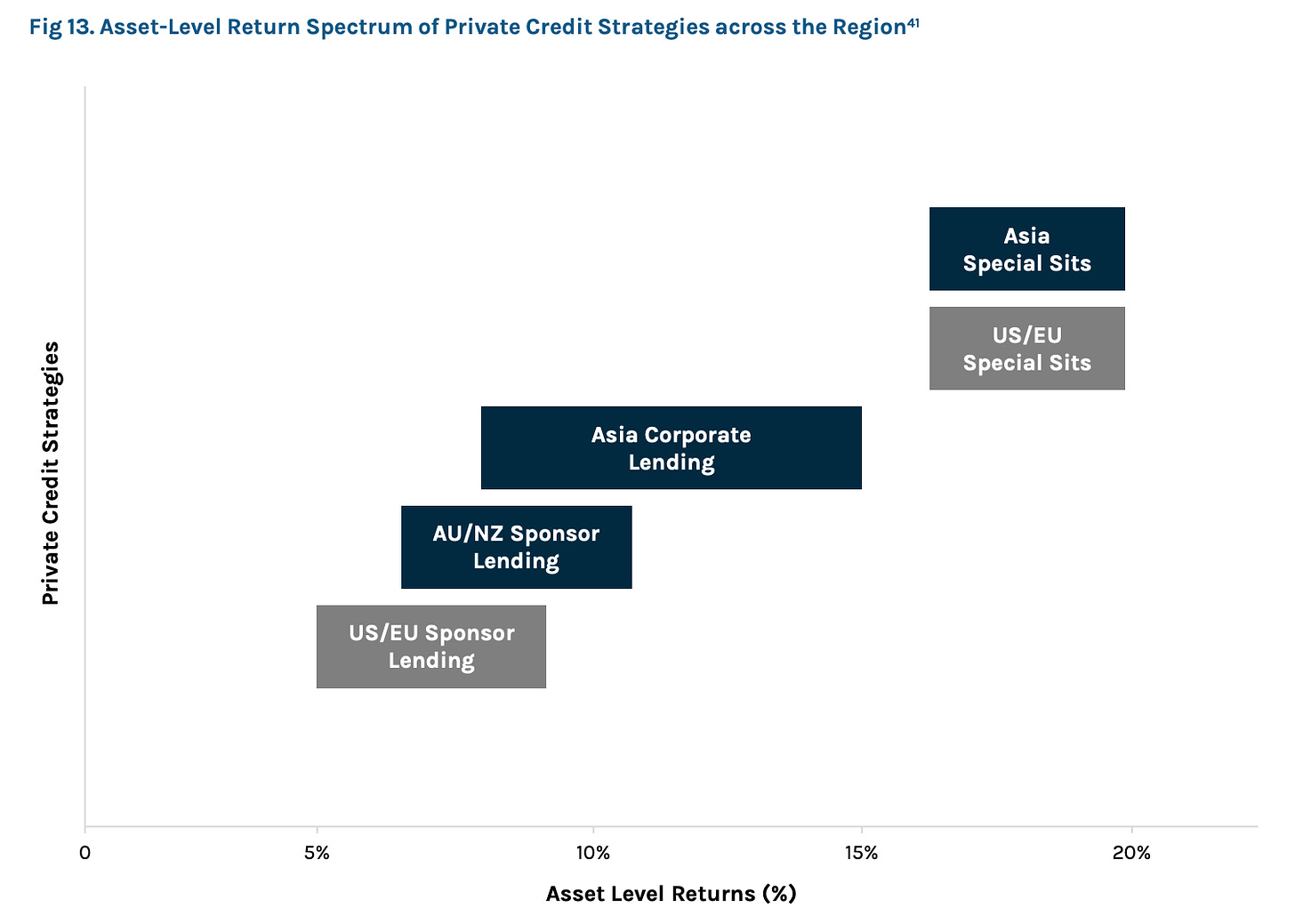

Ares, a Los Angeles-based alternative investment manager, raised $1.7 billion for its Ares Asia Direct Lending fund. The fund lends senior secured loans to sponsored and non-sponsored corporates based in Australia and New Zealand. The team will also invest in asset-backed transactions. Ares believes lending to APAC corporates offers a 2-3% return premium over the U.S. and Europe. More here and here

Blackstone launched its European Private Credit Fund to retail investors in France. The launch is an exclusive partnership with BNP Paribas. The fund allows European retail investors to invest in middle market private credit. Since launching in October 2022, it has achieved annualized net returns of 12.0% (Class I). It currently has a loan portfolio of €500 million. 87% of the portfolio is invested in historically lower default rate sectors such as software, IT services, and healthcare. Portfolio companies have an average loan-to-value of 38% and an average EBITDA of €159 million. More here and here