The Credit Crunch #45

Bain Capital on Why you should invest in Core Middle Market. Fundraisings from KSL Capital Partners, Bain Capital, Allianz, Capza and Palmer Square Capital.

Welcome back to the 45th Credit Crunch.

Thanks to everyone who liked my last post. I’ll be sending you my fund size analysis in the next few days. If you’re new and want to receive this analysis then subscribe and like this post.

Last week was the busiest week in over a month, with ~$4 billion of fundraising announcements.

My favourite being KSL Capital Partners closing its Credit Opportunities Fund. I covered KSL in September 2023 when they closed their second Tactical Opportunities fund (Link). KSL have a unique strategy whereby they focus exclusively on the Travel and Leisure sectors. My favourite credit investment being the Wildwood Snowmass Ski resort (Link). I’m keen to do a deep dive on KSL. If you know someone who works there I would be extremely grateful for an introduction!

📊 Chart of the Week

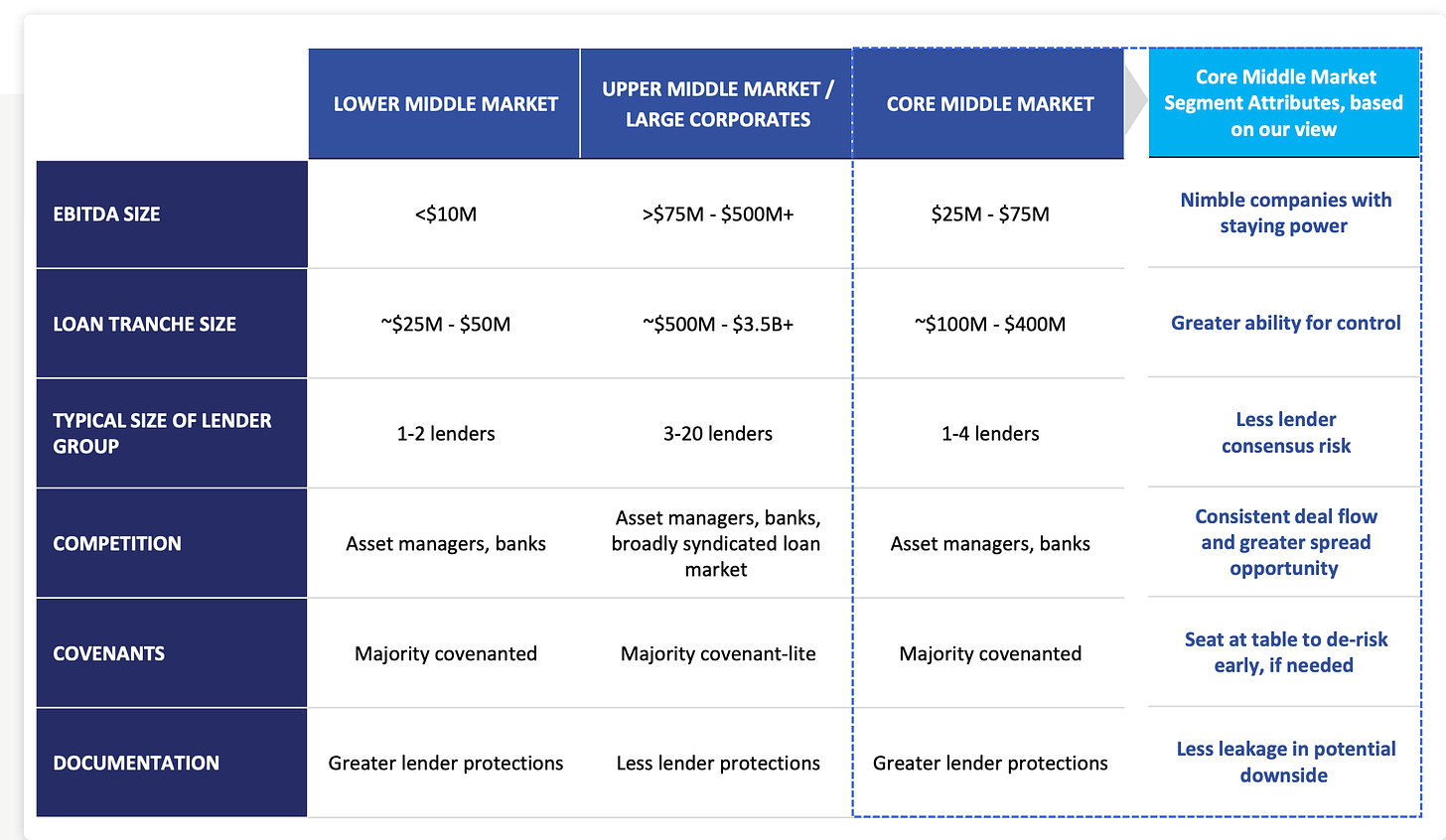

Bain Capital - Why you should invest in Core Middle Market

I’ve been relentless in sharing insights about Upper Middle Market Funds over the last few months. These funds typically forecast that Lower & Core Middle Market are going to be the real losers over the next few years.

It's therefore great to see a counterargument to this viewpoint. This argument is backed up by the fact that Bain Capital announced its latest $1.25 billion Middle Market Fund. (See the Investor overview here )

I’m going to work on a longer piece on the Lower Middle Market over the next few weeks. Please share all data and insights with me.

💰Fundraising news

KSL Capital Partners, a Colorado-based investment manager, announced a final close of ~$1.3 billion for its Credit Opportunities Fund IV. The fund invests in US-based travel and leisure businesses. Its primary focus is high barrier to entry urban and resort destinations. The firm’s current portfolio includes Cameron House, a seventeenth-century castle resort in Scotland and Camelback Resort in Pennsylvania. More here

Bain Capital, a Boston-based investment manager, closed its $1.25 billion Middle Market Credit 2022 fund. The flagship strategy invests across the capital structure, including senior, subordinated, second-lien, and preferred equity. The fund targets “core” middle-market companies with EBITDA between $25 million to $75 million. It can lend to companies in North America, Europe, and Asia. The fund has invested in five companies and expects to invest in ~50 companies. More here and here

Allianz Global Investors, a global investment manager, launched its ~$820 million European Private Credit III. The fund lends senior loans to medium-sized companies in Continental Europe. It will target companies with stable balance sheets in all sectors except finance and real estate. The fund is an Article 8 fund. Portfolio companies will have a contractual commitment to achieve sustainability objectives. The cost of debt will also be indexed to whether or not these objectives are met. More here

Capza, a Paris-based investment manager, announced a first close of ~$330 million for its Artemid Senior Loan IV. The fund lends senior secured loans to European lower middle-market companies. Artemid invests between €5 million to €50 million in companies with EBITDA between €8 million to €100 million. Its loans are structured as bullet repayments with maturity dates between 5 to 8 years. The Artemid Senior Loan funds have lent over ~$1.3 billion to 70 companies since 2014. More here

Palmer Square Capital, a Missouri-based investment manager, raised $90 million for its BDC. The BDC invests in large, broadly-syndicated loans to US-based large caps. It has total assets of ~$1.1 billion, invested across 40 industries. These companies have a weighted average EBITDA of $448 million, weighted average interest coverage of 2.3x and weighted average leverage of 5.3x. More here and here