The Credit Crunch #43

Key insights into How Apollo is doubling down on Private Credit. Weekly fundraising news from Breakwall Capital and Ares.

Welcome back to the 43rd edition of The Credit Crunch.

As a reminder, check out my previous articles here, subscribe here and please share this.

Apollo is the main focus for this week. You may have seen their platform deep dive in November. If you haven’t, then don’t fear. This is (hopefully) a summary of how Apollo is thinking about Private Credit in 20241.

If you’re disinterested in Apollo then ignore this. Scroll down to learn more about Energy specialist lending and another Ares real estate fund.

📊 Apollo: Private Credit is an attractive opportunity But there are caveats

Apollo is excited about Private Credit.

“There is an ongoing generational shift in credit markets”.

They believe that now is the time to take action.

Apollo plans to grow its annual debt origination to $150 billion a year. For context, this is three times more than in 2020.

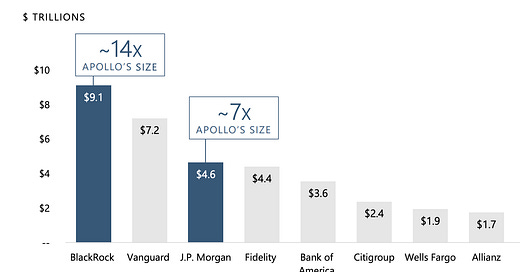

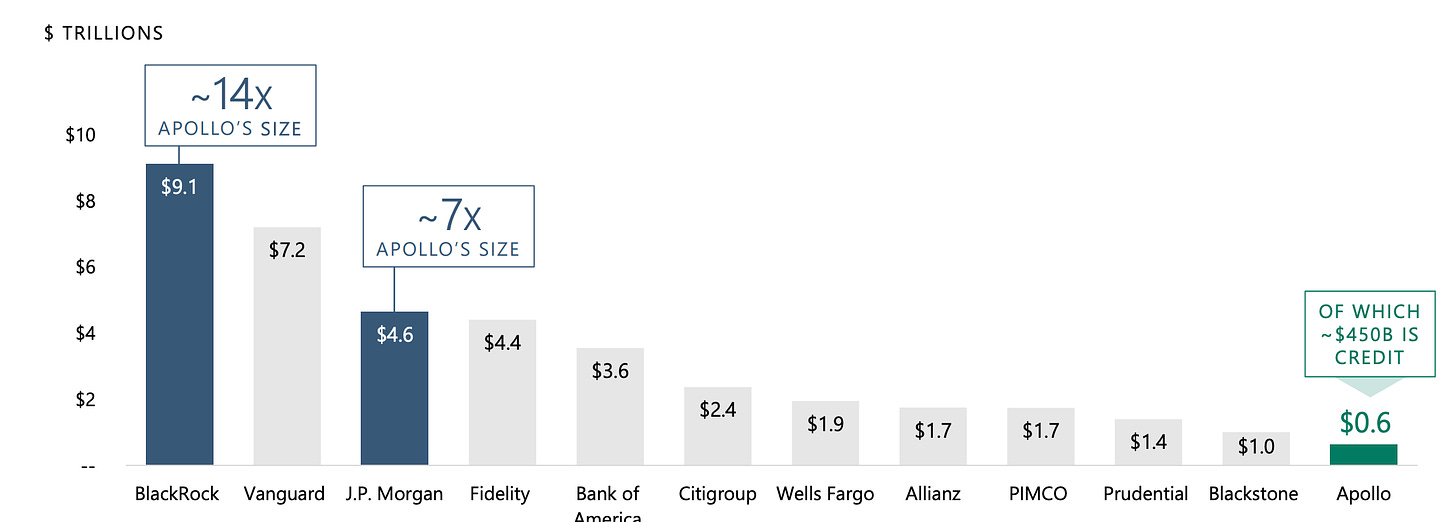

Apollo’s Private Credit AUM will increase from ~$450 billion to ~$750 billion over the next three years. This is still small compared with other managers in the global credit ecosystem.

So why is Apollo so excited?

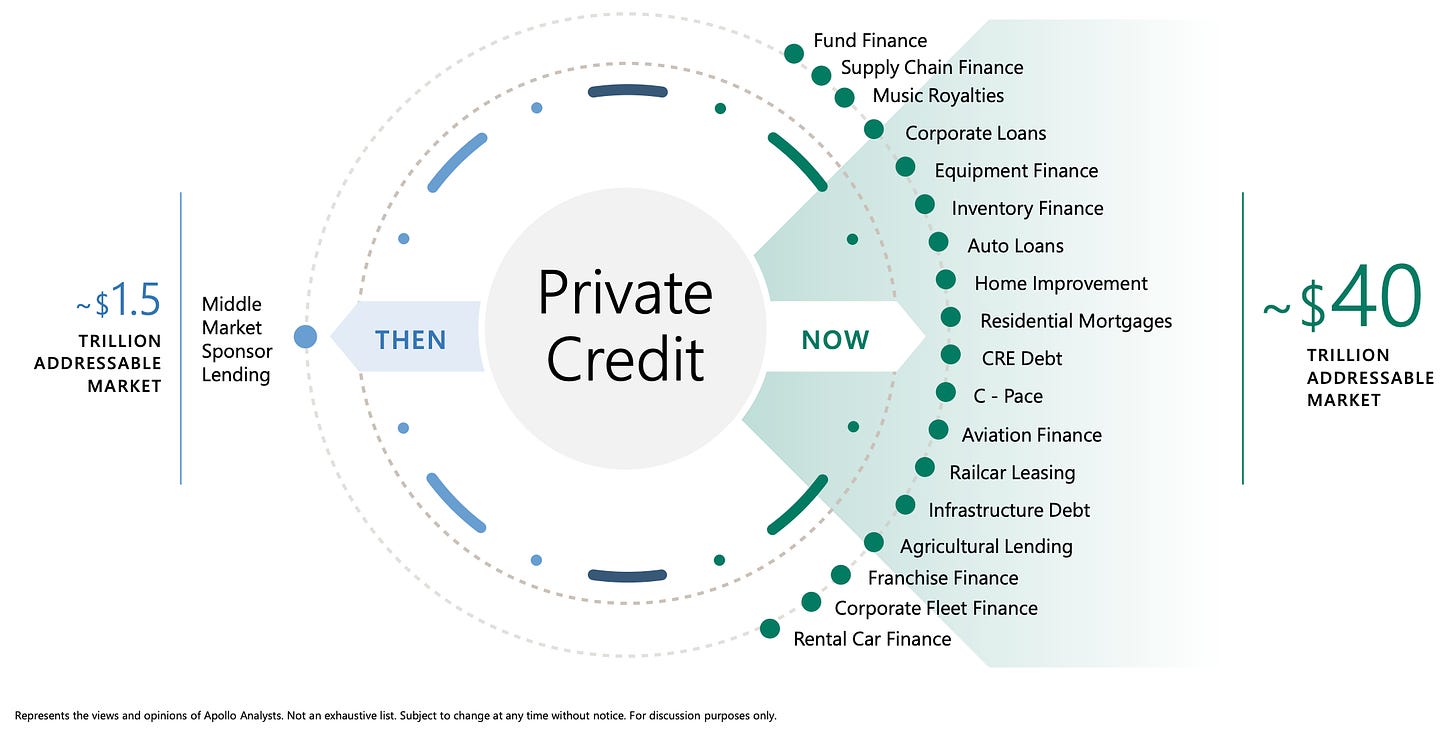

Apollo thinks that Private Credit is much larger than people think. People typically think Private Credit = Leverage lending, a ~$1.2 - $1.6 trillion market (here, here and here)

Apollo believes that Private Credit is a much larger market than this.

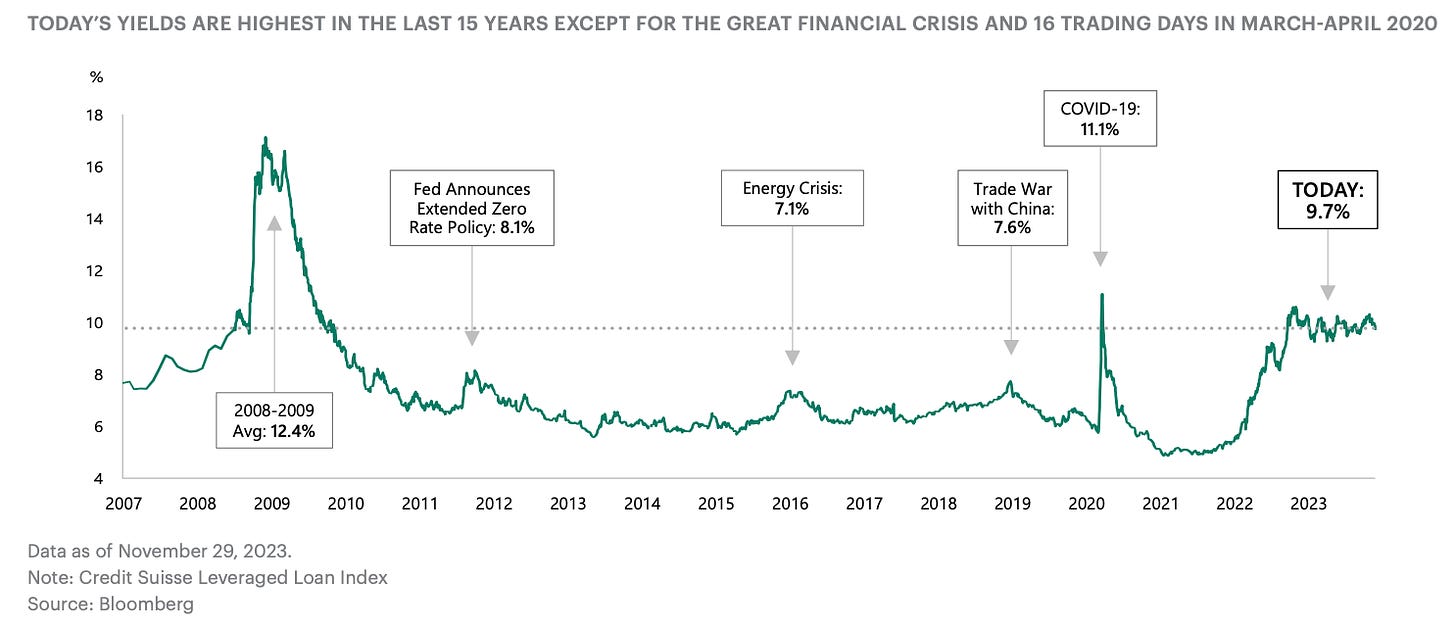

Apollo also believes that Private Credit investors can benefit from historically “higher for longer” yields.

So what is Apollo going to do about it?

It’s important to note that Apollo doesn’t think that all Private Credit is attractive. They are particularly focused on three themes.

Apollo ❤️ large corporations

Large corporations offer an attractive proposition in the current environment for several reasons:

They have more established and diversified products and services. Consumers are more likely to use these in good or bad times

They have more pricing power to negotiate with suppliers

They have a higher ability to pass on price increases to customers

Overall, large firms generally have resilient revenue streams, higher margins, more cash on hand, and use lower leverage.

Apollo ❤️ recurring revenue

Several industries benefit from recurring revenue streams and robust cash-flow profiles. This gives them a more robust credit profile. Below are three of the sectors which Apollo is keen to focus on:

Enterprise software, particularly providers that offer business-critical solutions.

Healthcare technology services. These businesses can also benefit from demographic drivers, such as an aging population. This can further protect cash flows despite a more challenging economic environment.

Business services.

Apollo is primarily Focused on Asset-Backed Finance

Apollo believes that the role of banks has fundamentally changed since the Global Financial Crisis. (unlike every other Private Credit manager..) This has particularly impacted Mid-Market and Large Corporate lending.

Apollo believes that asset-backed finance has outperformed over the last decade. Especially for investment-grade loans. This outperformance is driven by a number of key structural characteristics including, diversified collateral, bankruptcy remoteness, amortization, and covenants.

This makes Asset-Backed finance a natural evolution for Private Credit.

What are the caveats?

Apollo believes there will be winners AND losers.

Higher rates for longer will put borrowers under stress.

It’s critical for lenders to seek structural protections. Apollo has three pieces of advice

Focus on seniority in the capital structure

Stay mindful of loan-to-value

Stay mindful of interest coverage ratios

If you’ve been reading The Credit Crunch regularly this may sound familiar. This advice is remarkably similar to what Blackstone wrote a few weeks ago (Link), KKR wrote in December (Link) and Pimco wrote in November (Link).

💰Fundraising news

Breakwall Capital LP, a New York-based credit manager, launched as an independent and employee-owned asset manager. Breakwall is an energy specialist lender. It lends senior secured loans to middle-market and developing energy companies. It mainly focuses on companies addressing energy reliability, affordability, and environmental sustainability. Breakwall was previously part of Riverstone. The strategy has invested ~$5.3 billion across more than 60 transactions since 2014. More here

Ares, a Los Angeles-based alternative investment manager, is expected to raise up to ~$2 billion for its European Real Estate Debt fund. The raise is a partnership with Mubadala and Abu Dhabi-based real estate developer Aldar. Ares has rapidly grown its European Real Estate business since launching in January 2022. The European Real Estate Debt team has now originated and closed over £1.1 billion of loans. More here and here