The Credit Crunch #42

Where did all the money go? 4 Key Insights into Top Private Credit Funds of 2023.

Happy New Year!

If you enjoy this post, please share it because I need to show my wife that spending weekends writing a newsletter is cool…

If you’re new to The Credit Crunch then check out my previous articles here and subscribe here.

Background

I started The Credit Crunch in March 2023, right at the start of the “golden moment for private credit”.

I started The Credit Crunch because I wanted to understand why Jonathan Gray was so excited.

In particular, I wanted to understand:

What type of private credit funds were raising money?

How much money were they raising?

What was unique about these funds?

Every week for the last 41 weeks, I’ve analyzed the fundraising announcements of between 4 to 6 private credit funds. In total, I’ve written about 183 private credit funds. These funds raised more than $285 billion in 2023.

Whilst I’ve enjoyed learning and writing about these funds, my friends don’t understand why you read this newsletter.

So..

In a bid to provide you more insights in 2024.

This is my Christmas gift.

I give you 4 key insights into Top Private Credit Funds of 2023.

If you like this post, subscribe because there will be more insights next week.

Where do Private Credit Funds raise money?

That’s right, US private credit funds took all the money in 2023, with 92 funds raising $178 billion. (Canada supported the continent and their 6 funds raised $13 billion).

Total fundraising in the US was five times any other country. The next closest country was the UK, where 31 private credit funds raised $35 billion.

On top of having the most funds, the US also took the prize for the biggest funds. On average, US private credit funds were two times larger than any other country.

Which strategies raise the most money?

Middle-market funds were by far the largest winner in 2023, with 68 funds raising $134 billion.

Middle-market fund sizes ranged from $120 million to a colossal $17 billion (Great work HPS). HPS’s fund significantly skewed the average fund size. A median fund size of $1 billion is more representative.

Distressed and “Opportunity” funds were also notable recipients of capital in 2023. Oaktree’s Opportunities Fund XII was the clear outlier in this category raising $18 billion. This fund also took the crown for the largest private credit fund of 2023.

What fund sizes raised the most money?

The majority of capital went to the Whale funds (Funds with over $1 billion of AUM). These 78 funds raised more than $255 billion in 2023.

The remaining funds accounted for only 10% of the total capital raised. These funds had an average fund size of $374 million.

The distribution of Private credit fund sizes followed an exponential trend. The largest 20 funds are true outliers. This makes it hard to get any meaningful insights unless you ignore these funds.

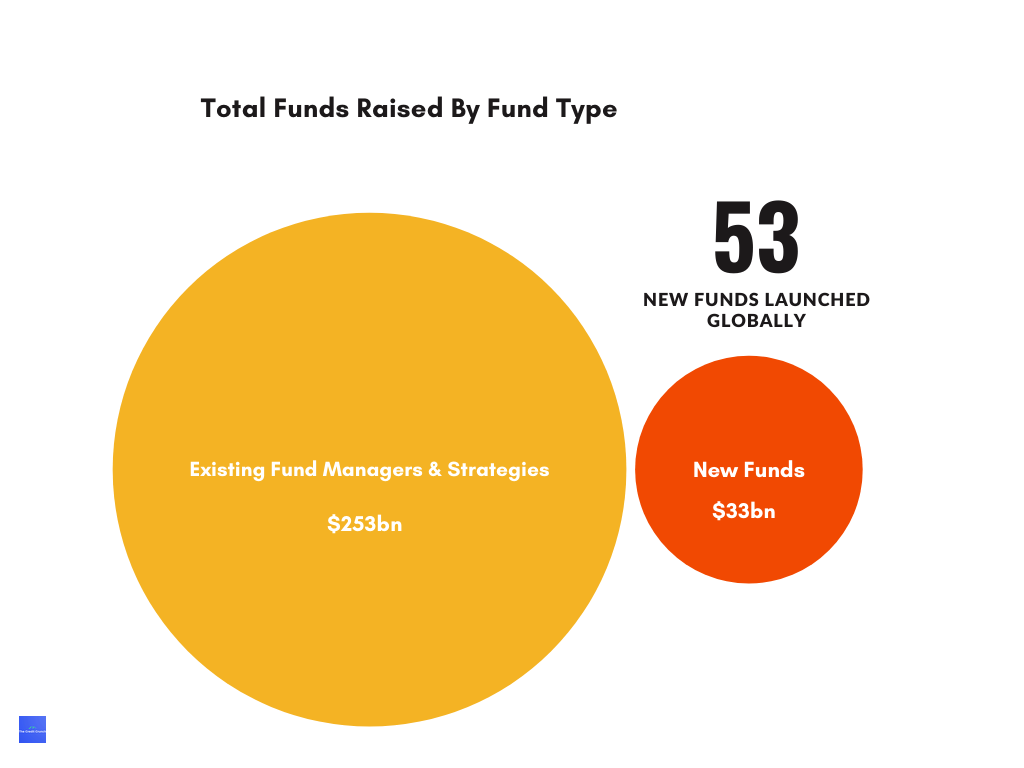

Can new funds and strategies raise money in this environment?

Most of the private credit capital went to Existing Fund Managers. More specifically managers who have more than $50 billion of AUM.

I should caveat that “New” includes new strategies launched by existing asset managers

If you exclude existing asset managers, less than 1% of all capital went to new credit managers. These funds had an average size of $120 million.

What does this mean for 2024?

If you want to maximize your chances of raising money in 2024, here are 3 pieces of advice:

Be an established North American private credit fund

Focus on middle-market

Target a fund size of more than $1 billion.

If by any chance you’re Howard Marks or believe in Second-Level thinking, ignore this advice.

For everyone else, subscribe because there will be more insights next week.

Nick

DISCLAIMER

This analysis is based on data from the 183 fundraises I covered last year. I’ve tried my hardest to capture every fundraise and wasted many evening hours scrolling through Google News.

I do understand that this data is not a complete list and unfortunately, I’m not privileged enough to own a Preqin account. (If anyone at Preqin wants to give me a free account then I’d love you forever.)

Despite this, I believe the data is directionally accurate and provides some unique insights.