The Credit Crunch #41

Blackstone: What it takes to be a skilled manager, Weekly fundraisings from Pathlight Capital, Cliffwater and TDC.

Welcome back to the 41st edition of The Credit Crunch. I’ve changed the format slightly this week so please let me know if you prefer it.

As a reminder, check out my previous articles here, subscribe here and please share this.

📕 Essential Reads

Whilst this article technically came out over a month ago, I’ve read it multiple times over the last few days. I think it’s one of the best pieces of advice for any private credit fund manager going into 2024.

Special thanks, Jonathan Bock.

Blackstone: Private Credit & The Art of Being Prepared (Link to full article)

TLDR:

With slower bank lending, demand for partners in private credit is high. Private credit provided 65% of loans for the leveraged buyout (LBO) market in 2021 and 86% for the market as of year to date 2023.

Of course, not all private credit is created equal.

But because there will be winners and losers, skilled managers have an opportunity to stand out.

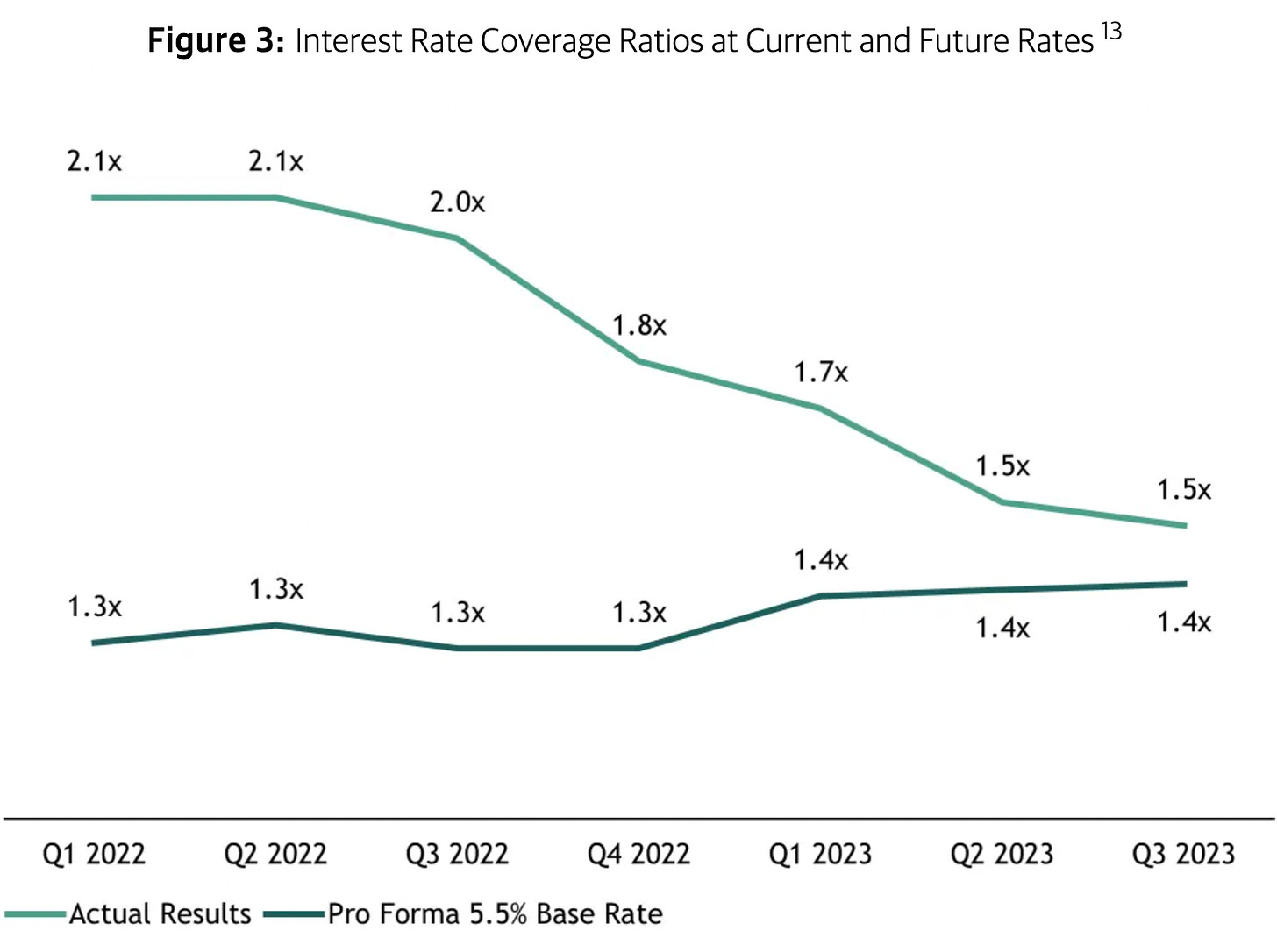

Today, the private credit market operates at a current average interest coverage ratio (ICR) of 1.5x, although 17% of companies operate at an ICR below 1.0x when assuming current base rates. If we assume forward rates of 5.5%, the average ICR of the market is 1.4x, while 20% of companies have an ICR below 1.0x.1

As pressure on borrowers increases in 2024, Blackstone believes there will be meaningful dispersion among managers.

So.. What does it take to be a skilled manager in a “Higher for longer” environment?

Jonathan Bock, Co-CEO of Blackstone’s Business Development Companies, has four pieces of advice.

Focus on first-lien seniority - First-lien security has a 2-3x higher recovery rate than second-lien and unsecured loans.

Invest in less cyclical sectors - Less cyclical sectors have half the default rate and are growing operating profit by twice as much.

Invest in larger companies - Companies with >$100 million EBITDA are growing EBITDA 9x more than companies with <$50 million EBITDA. These companies are 6x less likely to default on their covenants.

Maintain a low-leverage profile.

💰Fundraising news

Pathlight Capital, a Boston-based investment manager, closed its third Flagship fund with $860 million in commitments. The fund provides asset-based loans to North American businesses. Loans can be secured on a first or second-lien basis against both tangible and intangible assets. More here

Cliffwater, a Los Angeles-based alternative investment manager, raised $760 million for its Corporate Lending Fund. The diversified interval fund invests in North American middle-market loans. It does this using a multi-lender model and invests in companies via its 16 investment partners. The fund had exposure to more than 3,400 companies, as of November 2023. These companies had an average EBITDA of $98 million and an average LTV of 41%. The fund had an annualized return of 8.96%, since its inception. More here and here

TDC, a UK-based private credit manager, closed its ~$90 million Impact Fund. The fund was launched to support the recovery of small businesses and employment in the North of England. In particular, small businesses that were profitable before the pandemic. The fund lends between £1 million and £7 million per company and is sector agnostic. TDC is primarily a UK mid-market lender. The Impact Fund sits alongside TDC’s three main funds, which can make larger investments of up to £40m. More here

I.e 20% of companies can’t cover their debt from their current operating cashflows….