The Credit Crunch #40

Oaktree, BNP Paribas, Vistara Growth, CIBC Asset Management and insights from Coller Capital

💰Fundraising news

Oaktree Capital Management, a global asset manager, closed its $3 billion Special Situations Fund III. The strategy invests in private credit and equity. It has a flexible mandate and invests in middle-market companies facing stress or temporary dislocation. Oaktree expects the fund to yield private-equity-like returns with credit-like risk. The fund surpassed its $2.5 billion target and is almost 30% larger than its predecessor. More here

BNP Paribas, a Paris-based asset manager, launched its ~$820 million Climate Impact Infrastructure Debt fund. The fund will finance energy transition projects in continental Europe. These projects will concentrate on renewable energy, clean mobility, the circular economy, and emerging sectors like batteries, hydrogen, and carbon capture. The fund has made three investments, including financing a low-carbon energy producer, a heating platform, and a portfolio of onshore wind farms. More here

Vistara Growth, a Vancouver-based growth capital lender, announced a first close of $150 million for its Vistara Technology Growth Fund V. Vistara lends to mid and later-stage enterprise software companies across North America. It targets companies with between $10 million and $100 million in annual recurring revenue and will invest in both sponsored and non-sponsored companies. Vistara’s track record across four funds includes 34 investments, 15 exits, and zero losses, producing a mid-teens Net Annualized IRR to date. Vistara is targeting a $400 million final close and expects the fund to invest in 18-24 companies at $10-$30 million per investment. More here and here

CIBC Asset Management, a division of CIBC, launched the CIBC Ares Strategic Income Fund. The Fund will provide Canadian accredited investors with access to the $2.5 billion Ares Strategic Income Fund. The fund lends senior secured loans to middle-market US companies. The fund currently has 211 companies in its portfolio. These companies have a median EBITDA of $64 million and have an average LTV of 34%. More here, here, and here

📊Chart of the week

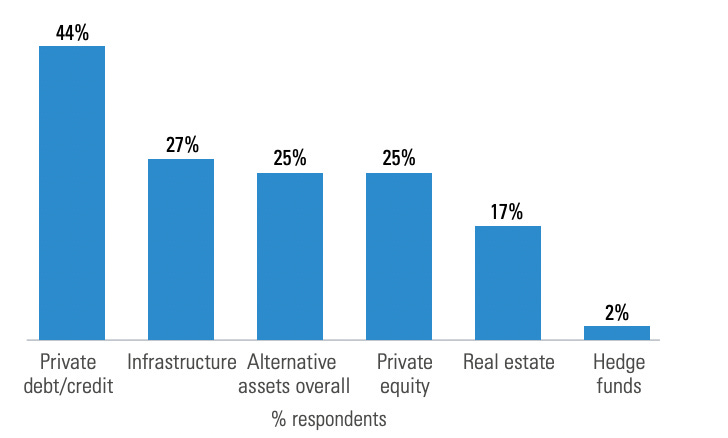

Coller Capital: Where will LPs increase investment in 2024? (Link)

Coller Capital researched the plans and opinions of 110 investors in private equity funds. These investors, based in North America, Europe, and the Asia-Pacific region (including the Middle East), comprise a representative sample of the LP population worldwide. In total, the investors surveyed oversee an aggregate minimum of $2.2 trillion in assets under management.

Key insights:

44% of LPs anticipate target allocations to private credit to increase over the next 12 months, the greatest increase of any strategy.

Private credit remains an attractive opportunity given:

Anticipation of higher for longer interest rates,

Continued expectations for reduced bank lending

Unfavorable macroeconomic dynamics