The Credit Crunch #39

Morgan Stanley, RRJ Capital, Amundi, Monroe Capital and a Bitcoin Private Credit Fund.

💰Fundraising news

Morgan Stanley Investment Management, a division of Morgan Stanley, raised ~$1.2 billion across two new funds, including the North Haven Expansion Credit II fund. The fund invests in technology, healthcare, consumer, digital media, and other high-growth sectors. It invests in later-stage private companies in North America and Western Europe. These companies typically have established products and services and are looking to grow revenue or expand business operations. Investments typically range from $15 million to $75 million per transaction. More here and here

RRJ Capital, a Singapore-based investment manager, is raising up to $2 billion for its Asian Private Credit fund. The fund will finance companies in Southeast Asia, India, and Australia. It is targeting a return of between 15% to 18%. More here

Amundi, a Paris-based asset manager, launched its ~$800 million Agri-Agro Direct Lending Fund. The fund will finance European companies in agriculture and agri-food sectors that are dedicated to shifting to a more sustainable, low-carbon model. It will target an average yield of 3-month EURIBOR + 7% gross (Currently~11%). More here

Monroe Capital, a Chicago-based asset manager, has reportedly held its first close for its $750 million Opportunistic Private Credit II. The fund will focus on specialty finance, asset-backed financing portfolios, highly structured real estate lending, and secondary loan investments. The fund will target a net IRR of 15 to 17% and TVPI of 1.5x to 1.6x. Fees for the fund will be 1.5% on invested capital, 18% carried interest with an 8% hurdle rate. Management fees for the first close investors will be 1% on invested capital and 12.5% carried interest. More here

ADM Capital, a Hong Kong-based credit specialist, launched its $200 million Asia Climate-Smart Landscape Fund. The impact fund will lend senior secured loans to Indonesian SMEs in sustainable agriculture, agroforestry, and aquaculture sectors. More here

Meanwhile Advisors, a US investment manager, launched its $100 million Bitcoin Private Credit fund. The fund will lend to businesses that have legitimate business and cash flows in Bitcoin. It will charge fees and make payments in Bitcoin, therefore mitigating any fluctuations in Bitcoin price. The fund will target a Bitcoin-denominated yield of five percent. More here and here

📊Chart of the week

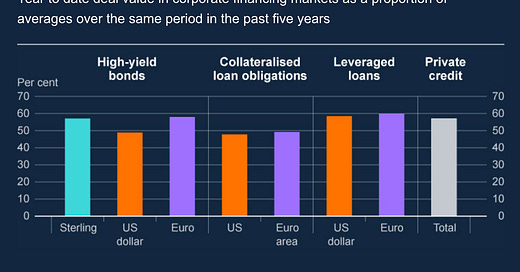

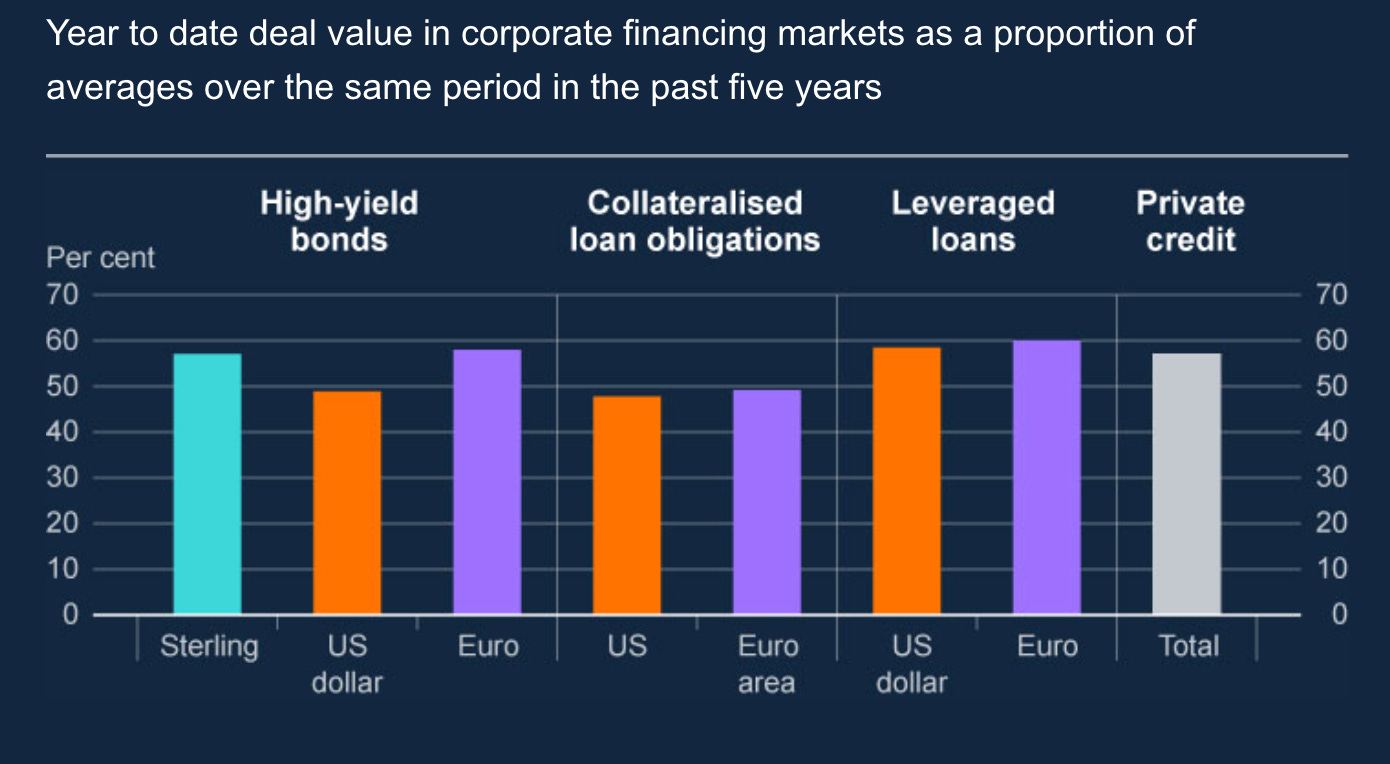

Bank of England - Global debt issuance in 2023 has been weak (Link)

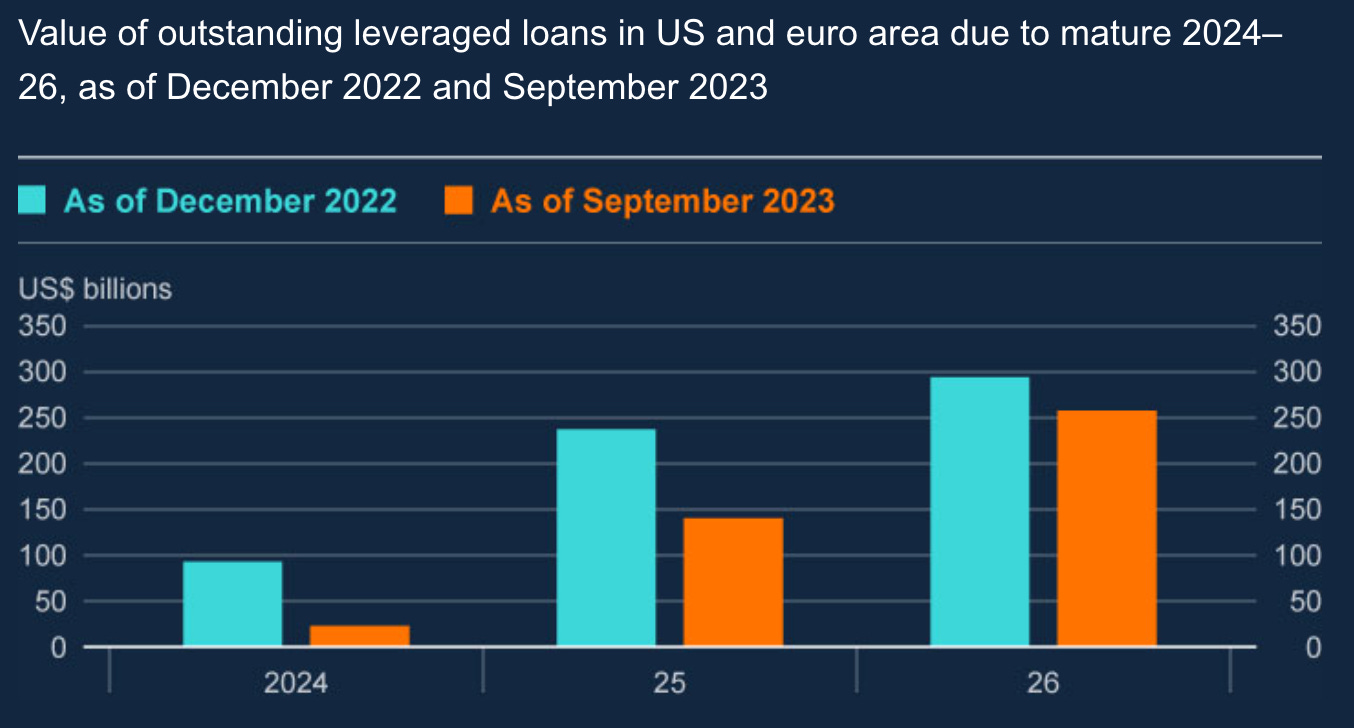

Bank of England - ‘Amend and Extend’ agreements are delaying the need to refinance leveraged loans in the primary market. (Link and Link)

📕 Essential Reads

KKR - 2024: A Credit Vintage to Remember? (Link)

TLDR:

The conditions are ripe among the most attractive new vintages.

Lenders should continue to benefit from relatively scarce capital conditions to reach high-quality borrowers on attractive terms.

Asset buyers are likely to engage in more transactions as valuations come down, and the transactions are likely to be less reliant on leverage.

However, there is also fear in the market. This largely concerns existing portfolios, and we believe it is in some ways legitimate (See six fears).

We expect further deterioration in corporate fundamentals as businesses continue to adjust to a higher-for-longer interest rate and inflation environment. However, we do not foresee a collapse or a sweep of defaults.

We think there will be a strong bifurcation and increasing dispersion between lenders who balanced risk in the good times by lending to high-quality, larger companies with resilient business models and capital structures and those who did the opposite.

As conviction on the future path of interest rates builds and inflation wanes, duration is starting to become more interesting again.

We are starting to shift our allocation toward high-yield bonds, an asset class that has derisked in important ways over the last decade.