💰Fundraising news

Avenue Capital, a New York-based investment manager, is raising up to $800m for an environmental impact fund. The fund will lend to middle-market companies in sustainability sectors such as food, water, waste, and clean energy. The fund will lend between $20 million and $75 million per transaction. It will be Avenue’s second environmental impact private credit fund following a $500m strategy launched in 2020. The fund will reportedly target a mid-teens annual return. More here

Greenbridge Capital, a Latin America private lending platform, launched a $200 million fund. The first fund will focus exclusively on the Chilean factoring market and is funded by Bladex. The fund will maintain a revolving portfolio of short-term invoices from high-credit-rated companies. Greenbridge Capital has plans to expand to other countries in the region such as Colombia, Peru and Mexico. Greenbridge Capital is a joint venture between Toesca Asset Management and TC Latin America Partners. More here

True North, an Indian investment manager, announced it raised $120 million for its private credit fund. The fund lends to middle-market businesses in India. It will lend up to ~$24 million per transaction and can lend up to 50% of enterprise value. True North expects returns of between 15%-18%. More here and here

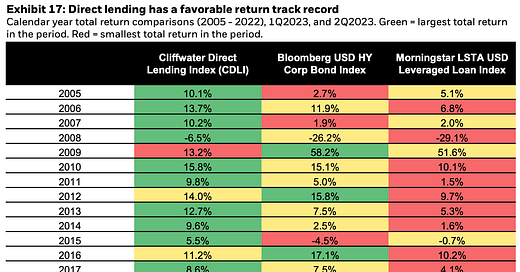

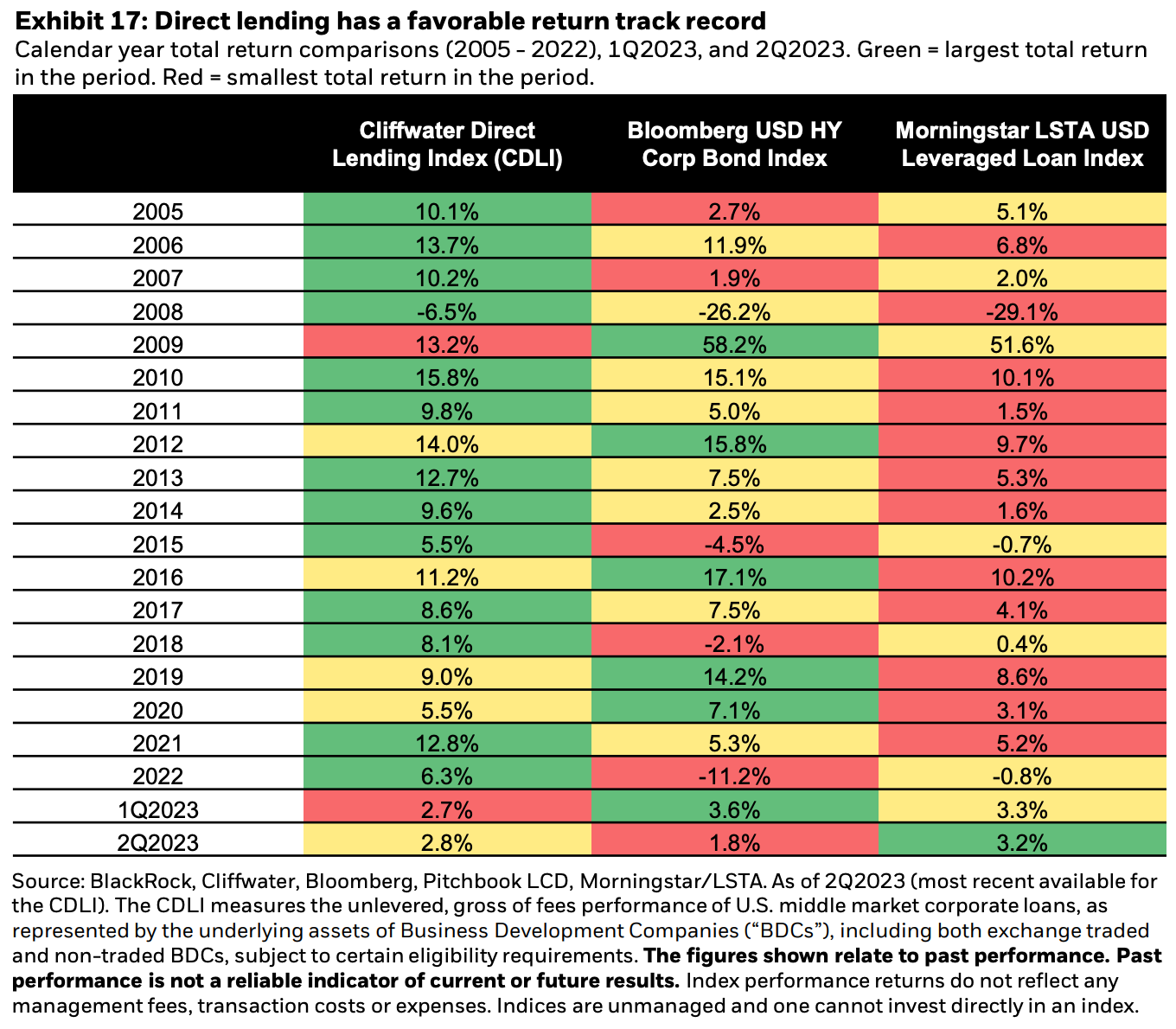

📊Chart of the week

Blackrock - Direct Lending’s favorable track record (Link)

📕 Essential Reads

Blackrock - Unpacking Private Credit’s Growth Drivers (Link)

TLDR:

Key growth drivers include:

Borrower preferences for customized funding solutions, certainty of execution, and the flexibility inherent in a long-term borrower/lender relationship (i.e., the “demand” for private debt)

Investor desires for diversification, with opportunities to introduce structural protections, depending on the strategy (i.e., the “supply” of capital used in private debt lending)

Structural shifts in the public markets, which are now serving larger borrowers, leaving public debt market deal sizes prohibitively large for most middle market companies, and

A continued contraction in bank credit availability, which we expect should allow for a further expansion of private debt’s “addressable market” of borrowers