The Credit Crunch - Daniel Loeb ❤️ Credit

Your weekly summary of Private Credit fundraising, news & insights

💰Fundraising news

Brinley Partners, a New York-based credit manager, is reportedly raising $1 billion for its second private debt fund. The fund primarily lends to sponsored businesses with EBITDA of at least $40 million. Brinley focuses on market-leading businesses with defensible positions and resilient free cash flow. Brinley can lend up to $250 million per transaction, it has a flexible mandate and invests across the capital structure. More here and here

Blackstone, a Global asset manager, is raising $400 million for its Blackstone Private Credit Fund (BCRED). BCRED is the world’s largest Business Development Company with total investments of $48 billion1. The fund predominantly lends senior secured loans to sponsored North American companies. These companies typically have between $215 million of EBITDA. The fund’s portfolio has an average loan-to-value ratio of 43 percent. More here and here

Barings, a Global investment manager, is raising ~$900 million for its Australian private credit fund. Barings currently has about ~$1.7 billion of loans in Australia, primarily in healthcare, education, and software. The fund is targeting a net return of five to six percentage points over the cash rate (Currently ~9-10%). The Reserve Bank of Australia last week lifted to a 12-year high of 4.35%. More here

📊 Charts of the Week

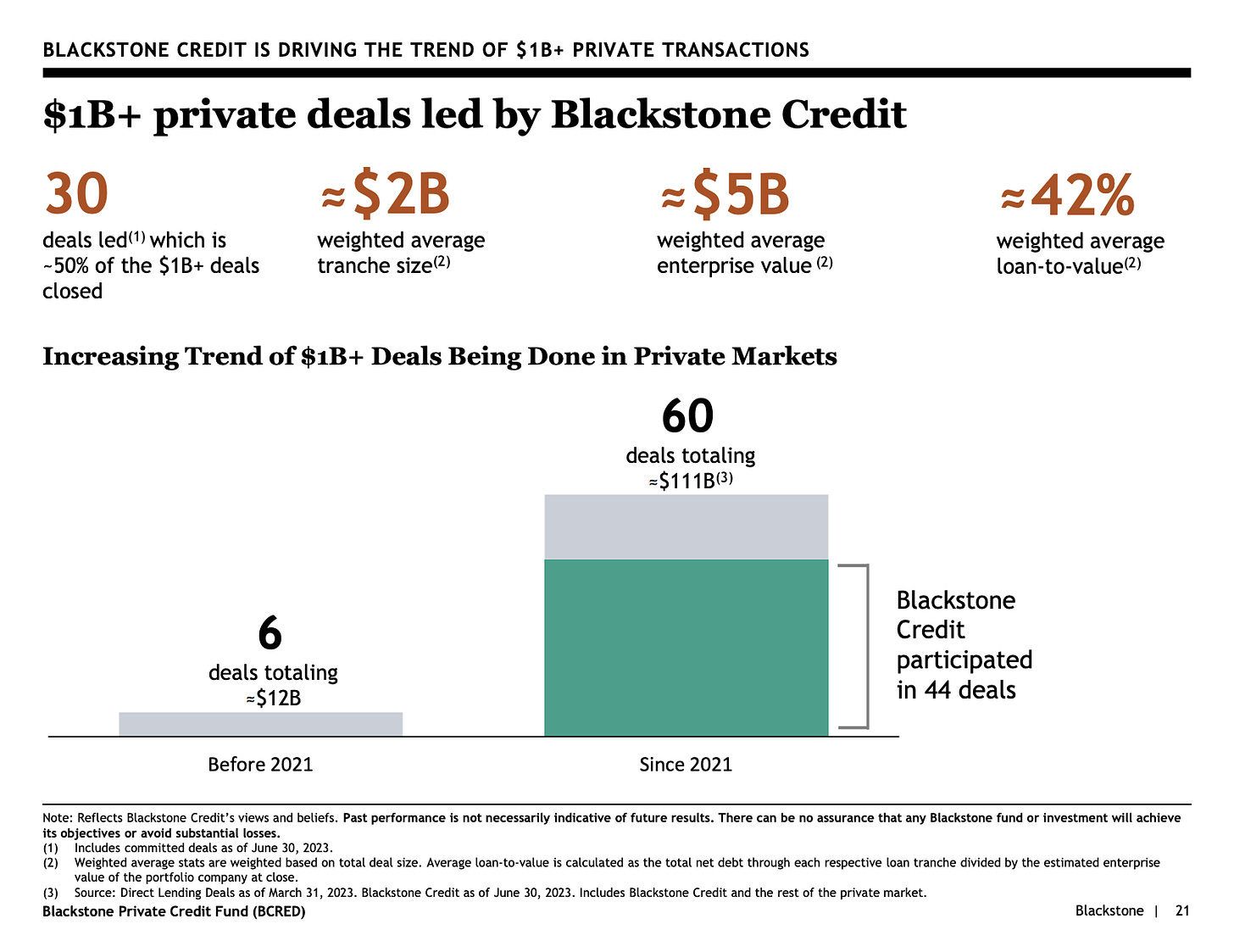

Blackstone - $1B+ private credit deals have taken off 🚀 (Link)

TLDR:

The number of private credit deals >$1bn has grown 10x in the last 2 years.

Loan-to-value ratios highlight that 58% of equity sits behind these loans.

📊 Essential Reads

Third Point - Daniel Loeb thinks that credit is attractive. 😊 (Link)

TLDR:

The current opportunity set in credit is the most attractive overall since 2020. Spreads are not extraordinarily wide, but yields are exceptionally attractive (close to 10% on the JPM Global High Yield Index), and we are seeing wide dispersion between “high quality” and more complex situations.

It is hard to overstate the market’s current obsession with balance sheet strength.

Distinguishing which companies have real leverage problems versus perceived leverage problems involves thorough analysis of asset sale opportunities, capital structures, and cash flow statements,

We are finding many opportunities in improving credits with ‘bulletproof’ securities (by virtue of seniority, security, or both) yielding 10%-13%.

As of September 30, 2023. Based on publicly reported total net assets of both traded and non-traded BDCs.