💰Fundraising news

Kennedy Lewis, a New York-based credit manager, closed its $4.1 billion Capital Partners Master Fund III. The opportunistic strategy primarily invests in non-sponsored borrowers in underserved sectors including life sciences, power, technology, media, and telecommunications. The fund includes exposure to Kennedy Lewis' homebuilder finance strategy. This strategy finances U.S. homebuilders to acquire land and complete horizontal development. More here

Blue Owl, a New York-based asset manager, announced it raised over $1.9 billion new for its technology lending funds in 2023. The strategy lends primarily senior secured loans to US-based private software companies. The fund’s traditional borrowers have an average annual revenue of $991.5 million, EBITDA of $241.5 million, and enterprise values of $5.9 billion. Its average investment per company is $31.5 million. More here

M&G Investments, a London-based investment manager, launched its Corporate Credit Opportunities strategy. The strategy will comprise of two buckets.

A liquid corporate credit bucket (70-85% of the total portfolio). This will predominately focus on floating rate, senior secured syndicated loans.

An Illiquid corporate credit bucket (15-30% of the total portfolio). This will invest in large and mid-market direct lending opportunities as well as junior loans with strong covenants.

The fund is targeting gross yields of Euribor plus five to six per cent over the medium term (9-10%). Prudential’s With Profits Fund has already invested €500m into the strategy. The fund is M&G’s first European Long-Term Investment Fund (ELTIF). More here

📊 Charts of the Week

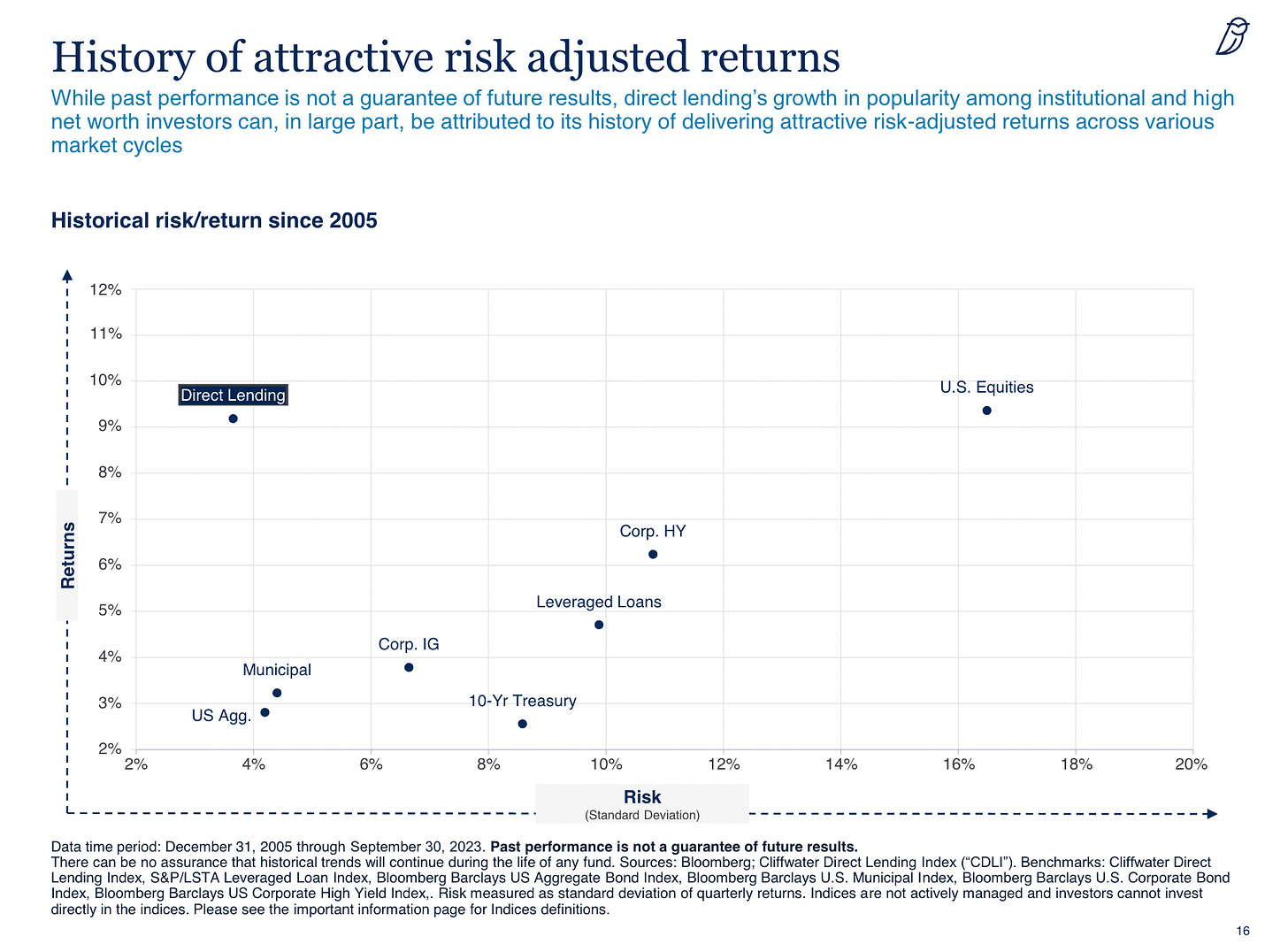

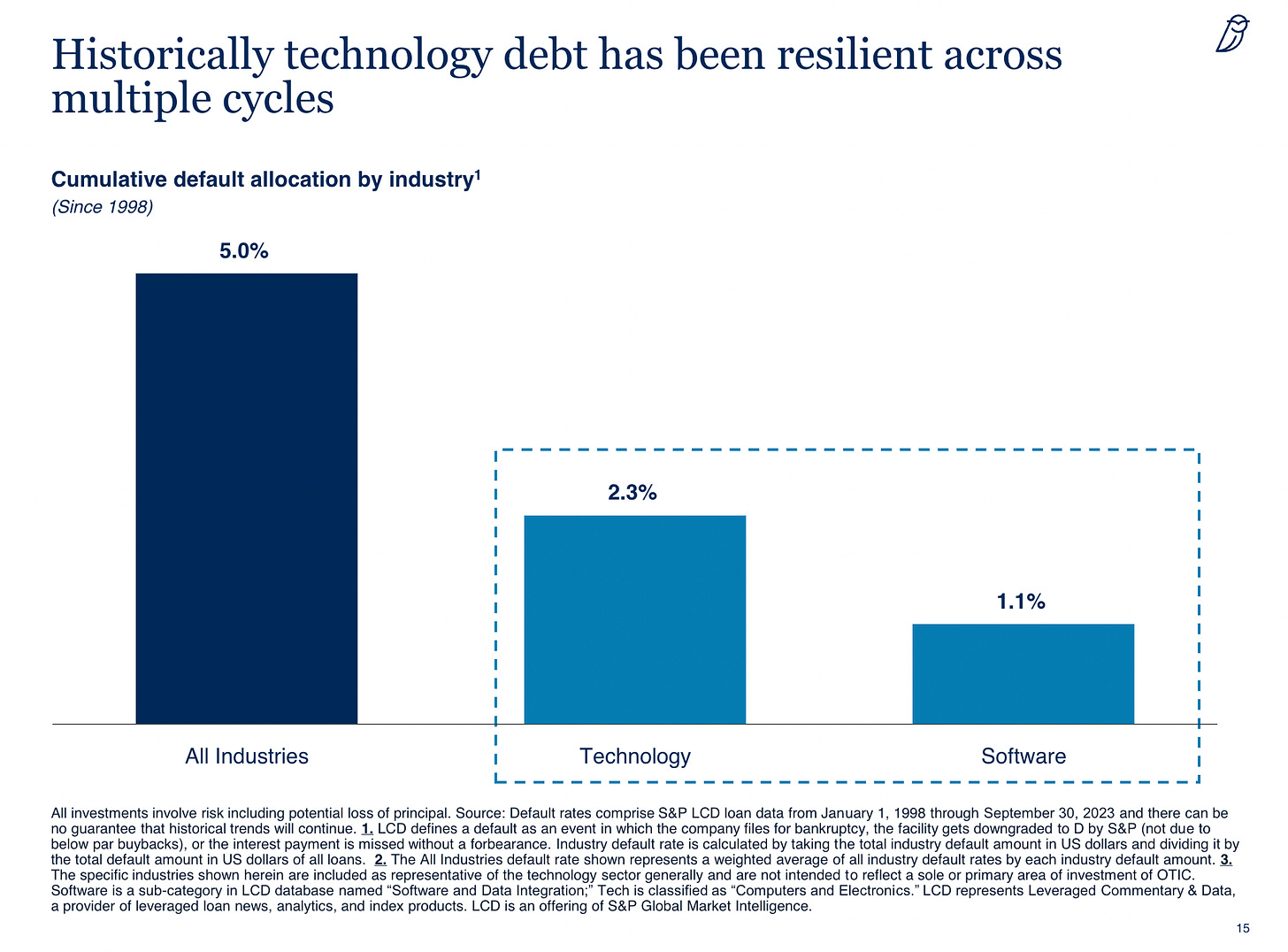

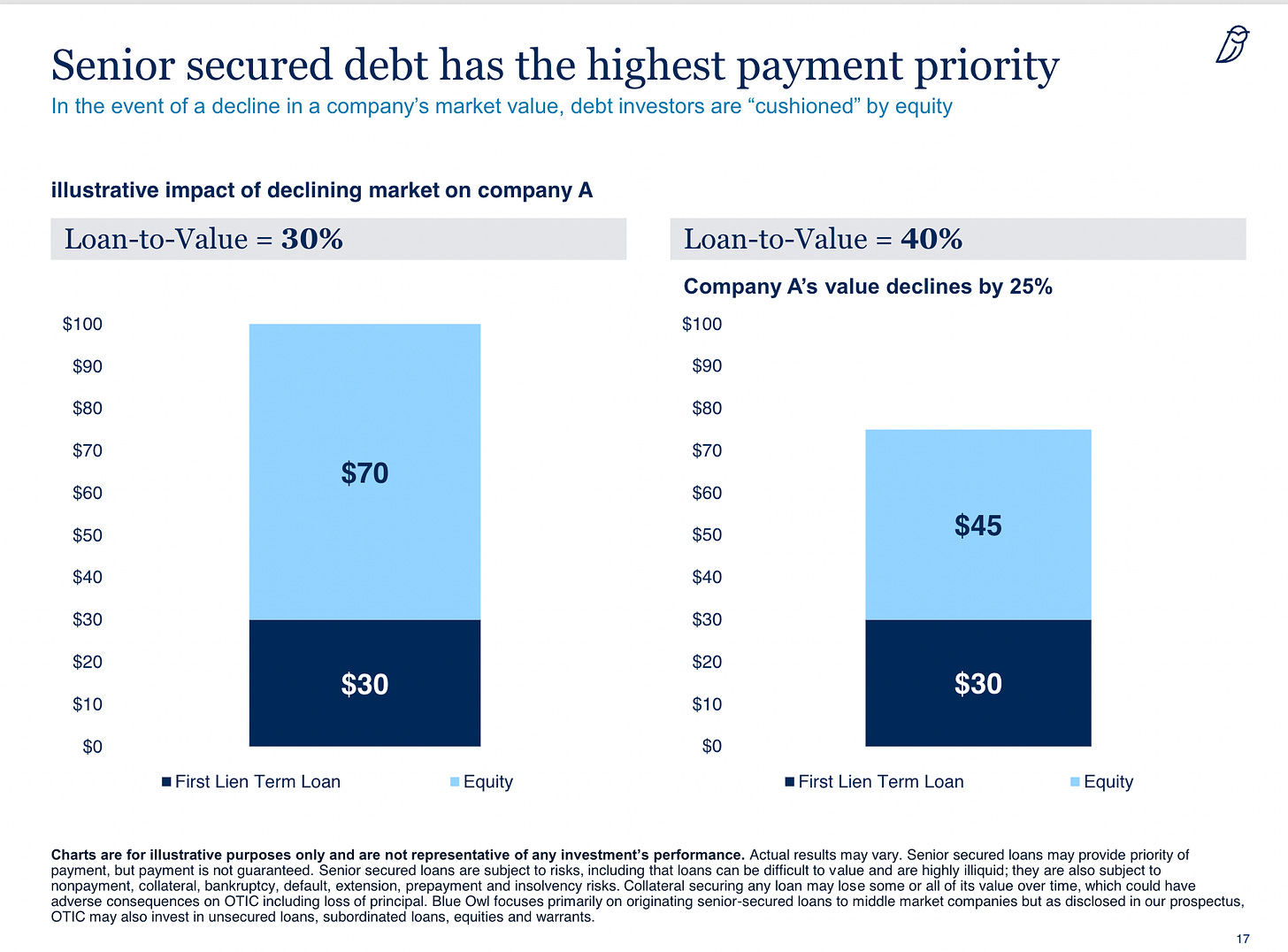

Blue Owl - Why now is a great time to lend to software businesses (Link)

TLDR:

Historic Direct Lending outperforms US Equities

Software Companies have low default rates

Decreases in technology equity valuations ≠ decreases in technology debt valuations