💰Fundraising news

Eurazeo, a Paris-based asset manager, closed its ~$2.5 billion Direct Lending Fund VI. The fund primarily lends senior debt to leading European mid-market companies. The fund typically invests in companies with valuations between €30 million and €300 million and can lend between €5 million to €100 million per company. Fund VI has invested in over 50 companies. These companies operate in sectors such as business services, healthcare, specialized financial services, and technology. Eurazeo aims to be the "leading funder of SMEs in Europe”. More here and here

Star Mountain Capital, a New York-based credit investment manager, closed its $1.2 billion Value-Added Direct Lending Fund IV. The fund primarily provides senior secured loans with potential equity upside to North American lower middle-market businesses. It invests in established businesses with at least $15 million in annual revenues and under $50 million in EBITDA. Star Mountain typically lends between $15 million and $150 million per company. Fund IV will invest in a diversified pool of over 50 companies. More here and here

DigitalBridge Group, a listed New York-based asset manager, announced the close of its $1.1 billion digital infrastructure credit fund. The fund focuses on lending to companies across the digital infrastructure sector. It has made 11 investments to date, across Data Centers, Fiber, Satellite Broadband, and Cloud Infrastructure. DigitalBridge can lend between $20 million and $300 million per company. More here and here

Ruya Partners, an Abu Dhabi-based private credit firm, secured a first close of $125 million for its first fund. The fund will lend to Middle East and North Africa-based SMEs, concentrating on mid-market companies, including late-stage venture capital-backed businesses. The fund has a $250 million target, which is expected to be achieved by the first quarter of 2024. More here

Blue Earth Capital, a Switzerland-based impact investment manager, closed its $108.5 million BlueEarth Credit Strategies II. The fund invests across impact sectors and has a strong geographical coverage across three continents (Africa, Asia, and the Americas). The fund invests in industries including financial inclusion, agribusiness, affordable housing, energy access, and healthcare. BlueEarth Credit Strategies II has already achieved three successful exits and realized IRRs above 12%. More here and here

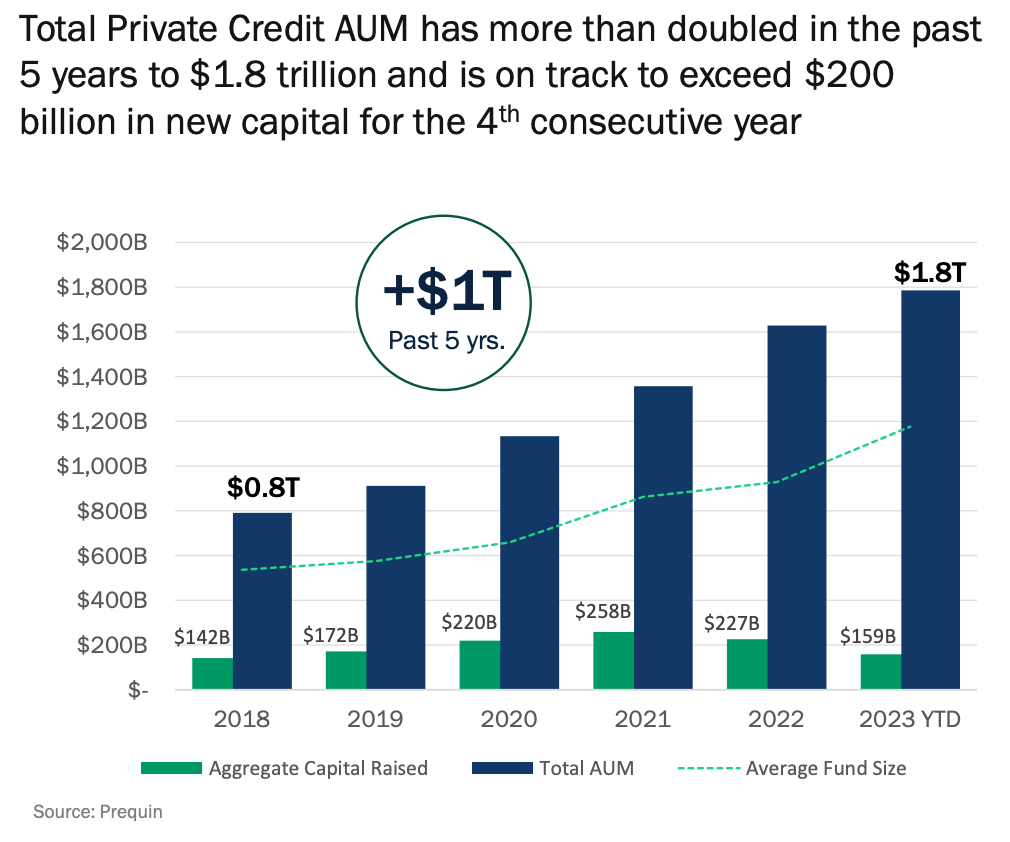

📊Chart of the week

DigitalBridge - Private Credit AUM has more than doubled in the last 5 years (Link)

📕 Essential Reads

PIMCO - This is the environment we’ve been waiting for. (Link)

TLDR:

The fallout from the most rapid rise in interest rates in four decades may be creating the best environment for private credit investors since the global financial crisis.

We expect the current interest rate environment to put pressure on much of the existing stock of credit

Fundamental weakness is becoming apparent in areas of corporate credit, where highly leveraged borrowers are straining to meet floating-rate interest payments or looming debt maturities.

We believe the stress will worsen and spread as fiscal policy turns contractionary and the economy softens, which can create opportunities for private credit investors.

As demand for capital outpaces supply, investors stand to benefit from the combination of liquidity-driven opportunities in private credit, as well as more complex transactions that solve capital structure challenges

Patience is key, because many of these opportunities will arise over the coming months and years as asset owners face uncertain monetary policy, potential slowing growth, and elevated geopolitical tensions.

We anticipate a growing number of [Direct lending] managers may be compelled to sell underperforming credits at a significant discount as they seek to upgrade credit quality, maintain a target yield distribution to investors, and avoid lengthy and time-consuming restructuring processes.

The unprecedented pace of interest rate hikes and resulting volatility are providing abundant potential opportunities in the liquid public markets now, and private opportunities are beginning to materialize in market areas where underwriting became lax.

The next few years will be great vintages, we believe, across the private opportunity set for a wide range of investor objectives.

With demand for capital outstripping supply, investors won’t need to take large risks, in our view, to generate compelling returns.