Refinancing and Amendments Take Center Stage in 2024’s Private Credit Market

Fundraising from MA Financial, CVI and Channel Capital

👋 Hey, Nick here. A special welcome to the new subscribers at Silver Spike Capital and Shinhan Asset Management. This is the 76th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕Reads of the week

KKR: Four Reasons We Focus on Larger Companies Link

A bankruptcy fight is playing out between HPS and the parent company of Redbox. When it filed for bankruptcy in June, HPS was owed more than $500 million. Link

The EIF favours specialist funds as it chases ‘policy alpha’ Link

Private Credit Managers Are Helping Banks Keep Risky Clients Link

Lenders have agreed to take ownership of Pluralsight. The restructuring eliminates ~$1.2 billion of debt, which is being converted into equity. The lenders will own around 85% of the company, with the remaining equity going to the company’s management, Link

Bruce Richards: “The highest yielding BDCs today are the worst performing representing a bug, not a feature. BDCs investments belong within a diversified public equity portfolio, not as a component of private credit allocation.” Link

📊Charts of the Week

Configure Partners published its Q224 Credit Market Update.

I regularly share this update is because it offers an unbiased and honest perspective into private credit - something that's often discussed behind closed doors but rarely addressed openly.

Here are four key insights that stood out to me, but you should also read the full report here. I’d highly recommend it.

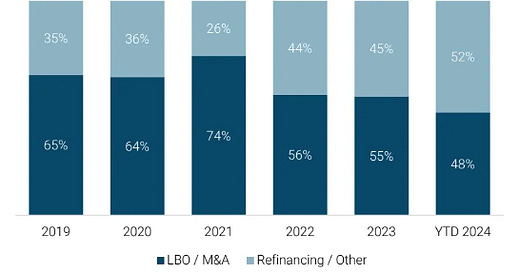

Refinancing activity is the predominant use of of proceeds in 2024

The percentage of deals which are raised for LBOs has fallen to 48% compared to a peak of 74% in 2021.

In contrast to the bullish M&A sentiment earlier in the year, the H2 M&A outlook appears more opaque. Fewer market participants anticipate a resurgence in activity over the next six months.

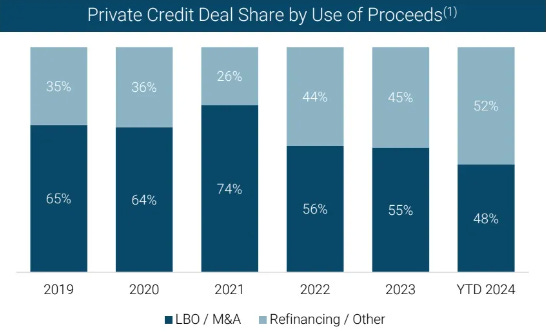

LBOs are more competitive and spreads reflect this

Configure’s data shows that refinancings are ~100 bps more expensive, with lenders competing more fiercely for new acquisition deals where fresh equity comes into the capital stack.

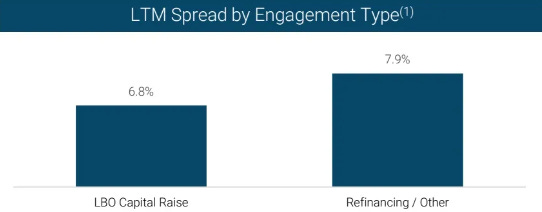

Leverage Multiples are below 2022 highs

Since peaking at 5.0x in 2022, the average funded leverage multiple has fallen 1.0x - 1.5x.

LBOs are able to achieve 0.25x - 0.5x more leverage although this has begun to compress, partially driven by the lack of new acquisition opportunities.

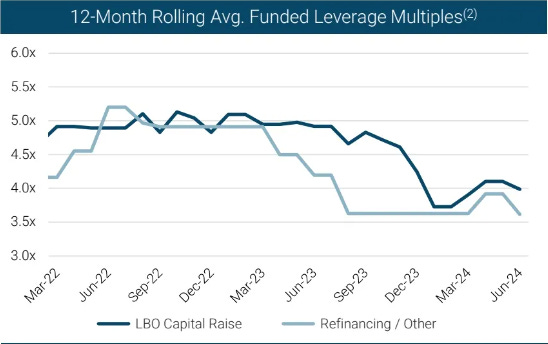

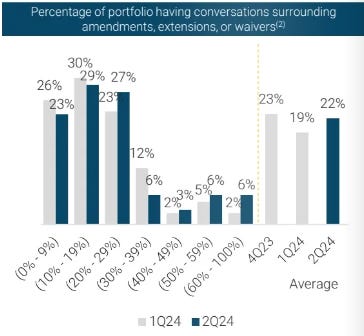

Most Lenders have 20-30% of their portfolio in amendment discussions

The most common amendments include a 12 month repayment extension, additional fees, increased pricing and at least one or two covenants.

Read the Configure Partner’s report here.

💰Fundraising News

MA Financial, an Australia-based alternative manager launched a ~$700 million Real Estate Credit fund, in partnership with Warburg Pincus. The fund will provide institutional investors access to Australia’s real estate credit market. More here

CVI, a Poland-based investment manager, is raising funds for its $280 million Private Debt Fund II. The Fund will lend to small and medium-sized companies in Poland and other Central and Eastern European countries. The European Bank for Reconstruction and Development has committed €40 million for the fund. More here

Channel Capital, an Australia-based investment manager, launched its West Street European Private Credit Fund (AUD) for Australian wholesale investors. The fund is an open-end Australian unit trust that invests Goldman Sachs Asset Management’s European Private Credit strategy. This strategy focuses on senior secured debt for mid-to-large European companies. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.