Q3 Credit Market Update

Fundraisings from Francisco Partners, ORIX Advisers, Aviva Investors and Forum Investment Group

👋 Hey, Nick here. A special welcome to the new subscribers at Jarden Group, Goldberg Kohn and Capital Market Club. This is the 90th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

BlackRock is closing in on $12bn deal to buy HPS Link and Link

Pantheon acquired a $460 million secondary in Vista Credit Opportunities Fund II. Link

Blackstone acquired a $1 billion portfolio of infrastructure loans from Spanish Bank, Santander. The portfolio comprises of loans that finance assets located largely in Western Europe and the US across the digital infrastructure, renewable energy and transportation sectors. Link

Veritas Capital is looking to reduce its Medallia loan. The loan pays interest at 6.5 percentage points over SOFR. Four of those points are PIK Link

NAV loans experienced a 30% compound annual growth between 2019 and 2023. Some LPs believe that their GPs aren’t providing enough information about NAV facilities. Link

Quote of the week 🗯️

Growth in the European private credit market has accelerated by 29% over the past three years..

Why is this a concern? Certainly, growth of the market alone is not the main worry…

43% of the market belongs to the eight largest providers..

[Some] players have grown to such a scale and have reached such a level of interconnectedness that they now exhibit systemic characteristics.

Keynote speech by Elizabeth McCaul, Member of the Supervisory Board of the ECB Link

📊Charts of the Week

Configure Partners published its Q324 Credit Market Update.

I regularly share this update because it offers an unbiased and honest perspective into private credit - Configure Partners highlight many topics that are often discussed behind closed doors but rarely addressed openly.

Here are three key insights that stood out to me, but you should also read the full report here.

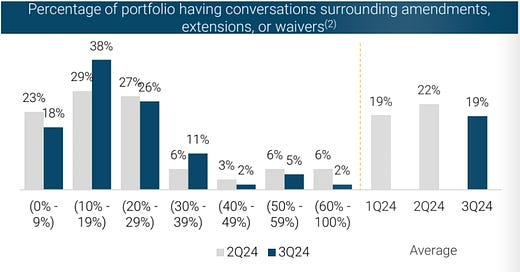

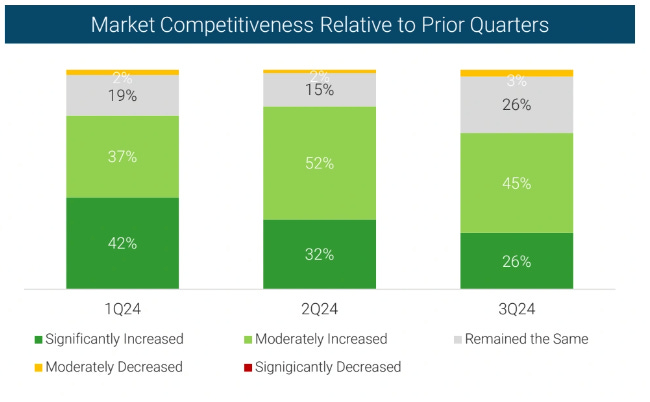

Most Lenders have 20-30% of their portfolio in amendment discussions

The most common amendments include a 12 month repayment extension, additional reporting, increased fees and pricing and at least one or two covenants.

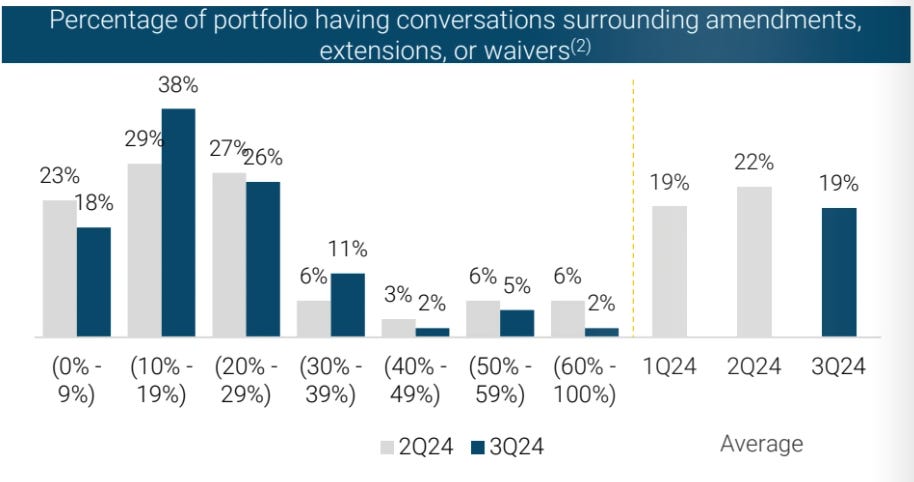

Leverage Multiples are below 2022 highs

Since peaking at 5.0x in 2022, the average funded leverage multiple has fallen 1.0x - 1.5x.

LBOs are able to achieve 0.25x - 0.5x more leverage although this continues to compress, partially driven by the lack of new acquisition opportunities.

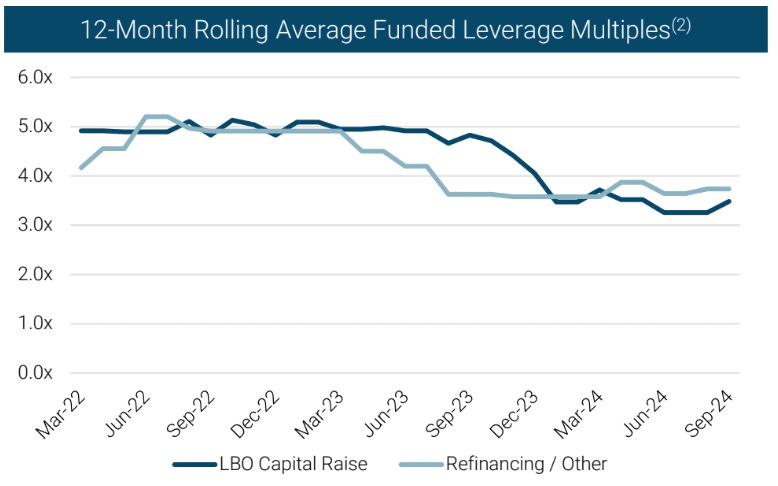

Most Lenders believe that markets are more competitive this quarter

Read the full report here

💰Fundraising News

Francisco Partners, a San Francisco-based manager, raised $300 million from NYSCRF for its FP Credit Partners III. The fund provides a spectrum of capital solutions for technology companies, ranging from traditional credit financings to flexible growth structures designed to meet company objectives with minimal dilution to existing equity. FP Credit Partners II had a final close of $2.2 billion in 2021. More here and here

ORIX Advisers, a New York-based middle market manager, raised $300 million from NYSCRF for its OCU Empire Fund. The fund leds to well-equitized, high-growth, late-stage tech companies underserved by traditional lenders. Orix Growth Capital is typically targeted at companies with run-rate revenues of at least $10 million with good top line growth. The strategy has provided $2.7 billion in funding to 199 companies, since 2001. More here and here

Aviva Investors, a London-based asset manager, launched its $950 million Multi-Sector Private Debt LTAF. The fund will provide pension funds a diversified portfolio across the private debt spectrum and a range of sectors. This includes Real Estate, Infrastructure, Structured Finance and Direct Lending. More here

Aviva Investors is the largest provider of Long Term Asset Funds (LTAFs) for the UK Wealth market. Learn More about LTAFs here

Forum Investment Group, a Denver-based real estate investment manager, launched the TSCG Credit Opportunities. The fund is a partnership with its portfolio company TSCG and is raising up to $50 million from accredited investors. It intends to issue small loans to TSCG tenants seeking finance tenant improvements, leasing and development efforts. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.