👋 Hey, Nick here. A special welcome to the new subscribers at Hollyport, Phoenix Merchant, and ASC Advisors. This is the 84th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

🛌 Private Credit's Wet Dream

Everything seems fantastic when your eyes are closed; it's only when you wake up that you realize you have to clean up the mess.

I work for a European private credit fund that lends to technology-focused businesses. Whilst our fund is smaller than most of the managers I typically write about, we have invested alongside managers like Apollo.

I’ve spent most of last week on calls with frustrated borrowers and their sponsors. After a meeting that felt more like an angry Karen video than a conversation, I sat back and reflected. This isn’t the “Golden Moment” Jon Gray promised.

If you read my newsletter a few months ago, you would have seen a summary of what leading managers talked about on their earnings calls. Here are a few of my favorites:

“The demand for direct lending is extremely strong.”

“The default rate across our 2,000+ portfolio was less than 40 basis points.”

What I’m currently dealing with feels very different from these quotes. My experience feels more like what Configure Partners outlined in its latest survey:

“20% of lenders’ portfolios are in amendment discussions”

“Refinancing activity is the predominant use of proceeds”

“LBOs are more competitive and spreads reflect this”

Why is my reality so different? Sometimes I question whether this is what KKR predicted. Long-time readers may remember this:

“There will be increasing dispersion between lenders who balanced risk in the good times and those who did the opposite.”

If you are having similar concerns, I wouldn’t panic. I know that you and your manager are good investors. But you may know someone who is working for one of these “risky” managers. Their careers may be in serious danger.

Much like a teenager’s exaggeration of their sexual exploits, there is a possibility that the largest managers aren’t sharing the complete truth. Here are a few reasons why I’m not 100% convinced everything is as golden as some managers are saying.

Many of these leading managers were involved in the deals below:

Blue Owl-Led Private Debt Group Takes Ownership of Pluralsight (Link)

Amazon Aggregator Thrasio Files For Bankruptcy (Link)

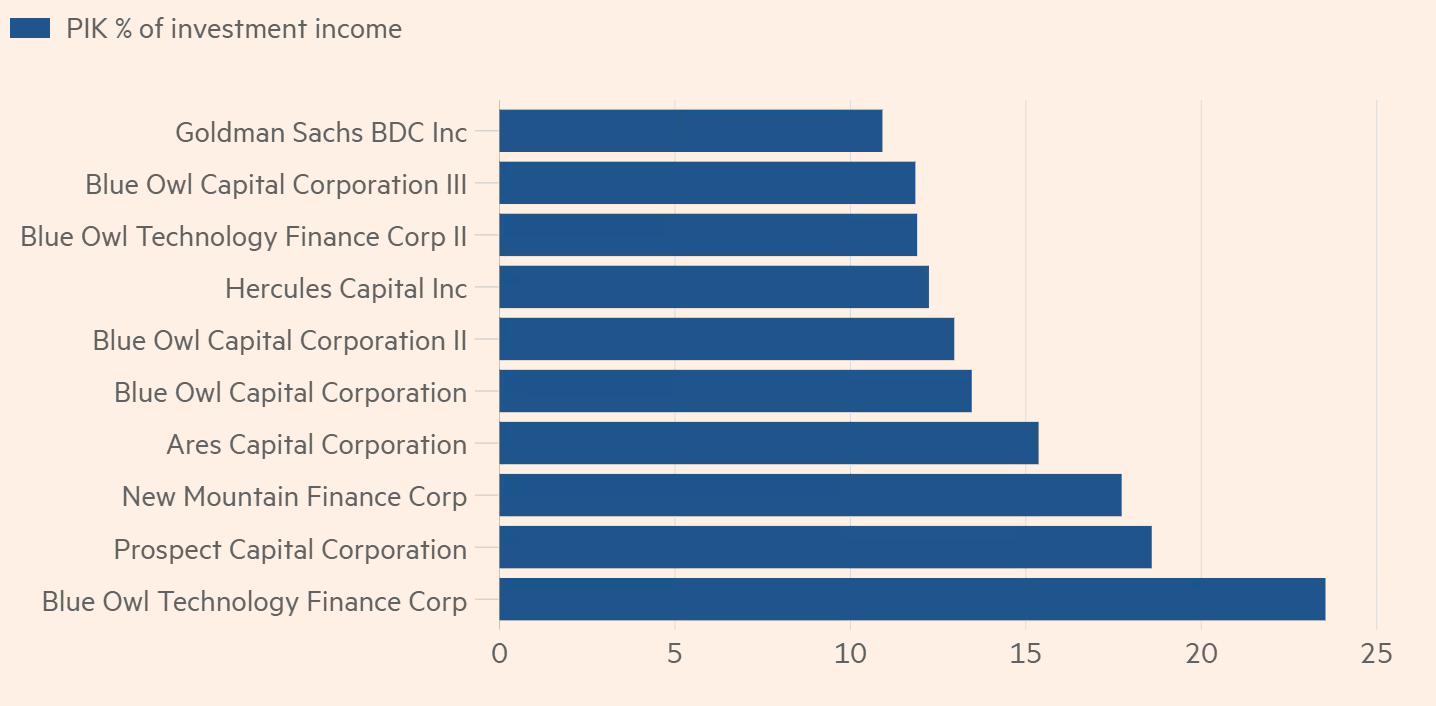

BDC Lenders are putting off handling their inevitable mess and borrowers paying debt with PIK is at elevated levels.

Some managers are beginning to acknowledge that there may be some clean-up work.

Oaktree recently wrote:

“Higher interest rates for an elongated period could present challenges for companies that carry high levels of debt. Although the pace of inflation has slowed, it remains an issue for companies and consumers alike. If market conditions become more constrained, these companies may find it challenging to obtain essential capital.”

Private credit, as we know it, is nearing its 16th Birthday. What we are experiencing is a natural part of our industry maturing. Some people might feel embarrassed, especially if they haven’t experienced this before. Others might be confused. If you're feeling anxious, talking to a more experienced manager might help.

The current environment isn’t as good as many lenders would like their LPs to believe. But it definitely isn’t as bad as the FT makes out. There are increasing allocations to private credit, rates are likely to be higher for longer and, M&A will come back. We can take pleasure from these facts.

But we should all recognize that some mess will be part of the journey.

And that is perfectly normal.

📕 Reads of the week

Fed’s Kashkari Says Private Credit May Lessen Systemic Risk. Video link

Blackstone’s Credit Is Now Its Top Business with >$350 billion of assets. Link

Ares acquires a ~$500 million portfolio of private credit Limited Partner stakes. Link

BlackRock’s 2024 Global Insurance Report: 30% of Insurers plan to increase allocations to private debt. Link

BlackRock planning to expand direct lending in India. Link

Pimco “There needs to be compensation well north of 200 basis points in going from public credit into private credit, and we don’t see that in the current market” Link and Podcast Link

The Untapped Potential of Private Debt for Africa’s Mid-Sized Businesses. Link

💰Fundraising News

BNP Paribas Asset Management launched its first evergreen private credit fund under ELTIF 2.0. The fund allows professional and retail clients to invest in European private credit with quarterly liquidity. It will invest in European Corporate, Infrastructure, and Commercial Real Estate credit. More here

MA Financial, an Australia-based alternative manager, raised ~$330 million for its Real Estate Credit fund, in partnership with Warburg Pincus. The fund aims to provide financing to address Australia’s nationwide housing shortage. MA Financial believes this is an estimated US$37 billion funding gap. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.