Private Credit and Banks Team Up

Fundraising from Monroe Capital, HSBC AM, Amplify Growth and SC Lowy

👋 Hey, Nick here. A special welcome to the new subscribers at JP Morgan, Wells Fargo, and Citizens Financial Group. This is the 81st edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Belron launches the largest dividend recap transaction of all time. The world’s biggest windscreen repair company is in talks with lenders to raise €8.1 billion. It plans to use the cash to pay a €4.4bn dividend to its investors which include Clayton, Dubilier & Rice, Hellman & Friedman, BlackRock, and GIC. The dividend will nearly double Belron’s overall debt from €5bn to €9bn. Its Debt to EBITDA Ratio will jump to ~5.8 at the end of the year from 3.3 in 2023, according to S&P. Link

KKR: An Alternative Perspective: Past, Present, and Future. The current Alternatives market is less than 11% of global GDP and only 2.4% of global financial assets. In a higher for longer environment, asset classes like Asset-Based Finance that are linked mainly to nominal GDP growth can serve as a buffer to inflation or tightening financial conditions. Private Credit has outperformed public loans since 2005, delivering returns on an annualized basis of 9.5%, compared to 4.8% for Leveraged Loans and 6.4% for High Yield Bonds. Link

Top Takeaways from Oaktree’s Quarterly Letters – September 2024. The rapid monetary policy tightening cycle has created a clear distinction among borrowers. While the majority still have strong fundamentals, a subset has burned through their liquidity buffers, creating a large universe for opportunistic investors. Link

Pitchbook released its Global Private Debt Report for H124. Fundraising is on par with 2023, making it five straight years of $200 billion-plus raised globally. Wealth fundraising has accelerated nearly 40% YoY. Emerging firms have accounted for just 3.5% of fundraising vs 14.8% in 2021. Read the full report here

Blackstone is partnering with Italian insurance company Generali to offer private credit opportunities to individual investors in France. Link

🏦 Private Credit and Banks Team Up

Banks and private credit managers are adjusting their strategies to remain competitive. Matt Levine points out:

Banks are looking for ways to maintain their fee streams without tying up their own balance sheets as they grapple with regulation and capital requirements.

Private credit managers, meanwhile, are under pressure to find new avenues to source investments after raising record amounts of cash.

This week has been a clear demonstration of this:

Apollo announced a $25 billion private credit and direct lending program with Citi. The program will initially focus on North America, potentially expanding to additional geographies. The program will include participation from Mubadala and Athene. More here

Apollo also announced a strategic partnership with BNP Paribas. BNP will commit at least $5 billion to Apollo’s investment-grade and asset-backed credit strategies. The partnership will also include Atlas, the warehouse finance and securitized products business owned by Apollo. More here

BlackRock announced it will invest up to $1 billion alongside Santander. The partnership focuses on project finance, energy finance, and infrastructure. The agreement follows an agreement to invest $600 million in infrastructure debt earlier in the year. More here

Blackrock’s press release reiterated Matt’s view with Blackrock highlighting that this partnership:

“ will provide long-term, flexible capital on a recurring basis to support the growth of its project finance franchise. At the same time, this agreement will provide further access to attractive, differentiated investment opportunities for our clients.”

Santander commented that this:

“ will allow us to continue to proactively rotate our assets, further strengthening our financial position and allowing us to generate capital for additional profitable growth.”

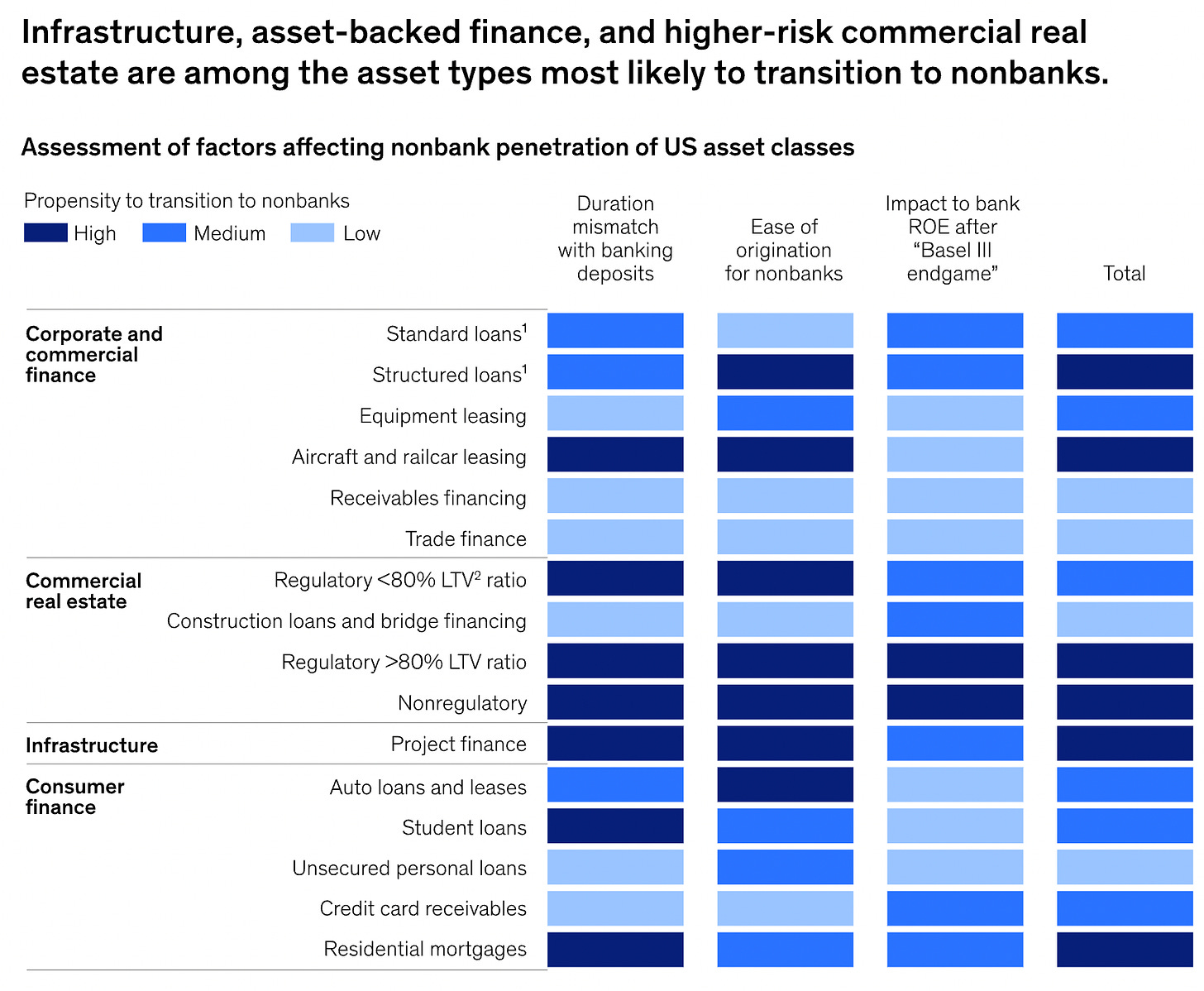

Mckinsey believes that four asset classes will increasingly shift to non-bank lenders.

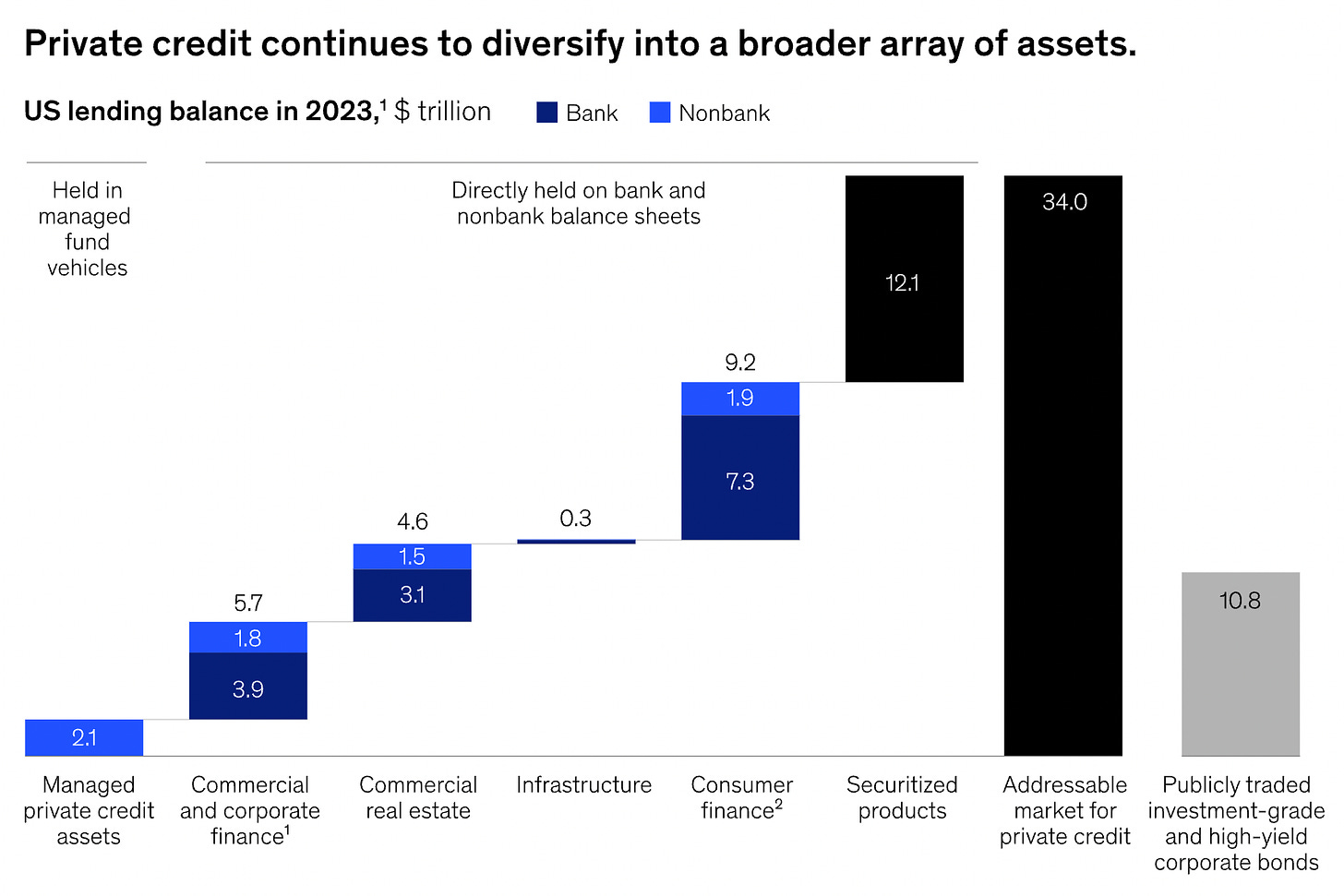

They also highlight that “the size of the addressable market for private credit could be more than $30 trillion in the United States alone.”

💰Fundraising News

Monroe Capital, a Chicago-based credit manager, launched its $1 billion Drive Forward Fund. The fund will finance automotive businesses that align with the White House’s pledge to ensure the future of the automotive industry is made in America by American manufacturers and American workers. Monroe intends to pair private investor capital with leverage, including low-cost government-guaranteed leverage. More here

HSBC Asset Management is raising $1 billion for its first NAV financing fund. The fund will primarily provide senior loans to mid-market European PE funds secured by their underlying portfolios. More here

Amplify Growth, a Dubai-based partnership, announced the launch of its $100 million venture debt fund. The fund lends to technology companies in the Middle East, Africa, and Turkey. It will target businesses in the Series A to Series C stages. The Fund is a partnership between Ajeej Capital and Nuwa Capital. More here

SC Lowy, a Hong Kong-based asset manager, raised additional funds for its South Korea Private Credit Strategy. The fund will provide real estate finance to developers, construction companies, and domestic financial institutions in South Korea. It will primarily target senior secured lending for residential, commercial, and logistic developments in major cities. The commitment was led by a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA). More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.