Aircraft Leasing presents a rare opportunity: Oaktree

Fundraisings from Blackstone, Apollo, Pimco, 5C Investment Partners & Keppel.

👋 Hey, Nick here. A special welcome to the new subscribers at Pollen Street, Blackrock and AXA IM. This is the 86th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Ares is on course to raise more than $80bn from investors this year. Link

KKR and Capital Group announced a strategic partnership for individuals to invest across public and private debt markets. The funds will invest in direct lending and asset-based finance. They’ll be sold through US financial advisers and structured as interval funds that offer liquidity quarterly. Link and Link

Ares partnered with Investec to extend its subscription line facilities across the mid-market. Link

UK-based Local Government Pension Scheme (LGPS) announced its private market commitments surpassed £6 billion. Link

Restructures

Antares, Blue Owl and KKR are in restructuring talks with Alacrity. The insurance claims manager was acquired by BlackRock less than two years ago and has $1 billion of Senior debt. Alacrity also has a mezzanine loan from Goldman Sachs. Alacrity, which handles insurance claims through a network of adjusters, has struggled over the past few quarters amid fewer weather-related claims. A new capital injection is also being discussed. The talks are ongoing and no terms have been agreed upon, the person added. Link

Carlyle handed over its luxury streetwear retailer End Clothing to lender Apollo. Carlyle acquired a majority stake in the brand back in 2021, which valued the business at £750m. The business has struggled in recent years with EBITDA falling 68% last year to £13m. As part of the agreement, Carlyle and End Clothing’s co-founders have fully exited the business. More here

Pemberton assumed control of Univativ, a German staffing platform. Triton’s acquisition of Univativ was financed by a uni tranche loan from Pemberton in 2017. Link

📊 Aircraft Leasing: Fleeting Supply

Oaktree believes the next chapter in the private credit story is the migration of asset-backed finance toward alternative capital providers.

Aircraft leasing is one area where Oaktree sees an opportunity.

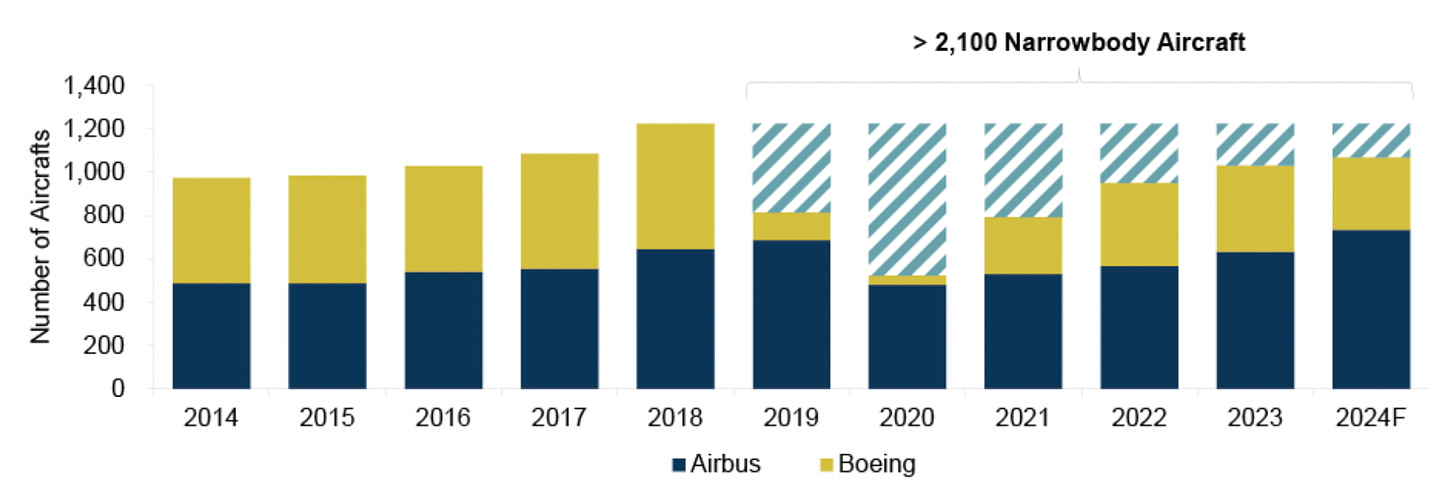

Since 2019, aircraft production has declined, largely due to delays and quality control issues at major manufacturers like Boeing, Airbus, and Pratt & Whitney. This has led to unprecedented order backlogs and higher aircraft lease rates.

Global airline traffic has now surpassed pre-pandemic levels, and aircraft producers have been unable to meet the increased demand. Due to the extremely limited supply of new planes, airlines have no choice but to put aside idealized fleet planning and prioritize leasing and purchasing midlife assets.

The current supply-demand imbalance presents a rare opportunity for appropriately resourced aircraft investors to step in and provide financing to proven aircraft leasing platforms and originators.

2024 Aircraft Deliveries Are Likely to Remain Below 2017 Levels

Read the full report here

💰Fundraising News

Apollo closed its $4.8 billion Origination Partnership Fund II . The fund focusses on sponsor-backed large-cap lending in the United States and Western Europe. It primarily targets companies with over $100 million of EBITDA. More here

Apollo’s Large Cap Direct Lending business has raised $13.3 billion in just over 12 months.

Blackstone announced a final close of $22 billion for its Senior Direct Lending Fund. This includes leverage. Blackstone deployed or committed $40 billion in direct lending through the third quarter, more than double the total for all of 2023. This includes lead roles in some of the largest deals of the year with CoreWeave ($7.5B), Squarespace ($2.7B), Fidelis ($2B), and Davies (£1.5B). More here

Pimco raised $2 billion for its Asset Based Finance Investment fund. The fund will focus on consumer, non-consumer, and residential mortgages. Non-consumer includes aviation finance, equipment finance, data infrastructure and small business loans. More here and here

5C Investment Partners, a New York-based investment manager, announced the launch of its $1.6 billion debut fund. 5C will primarily lend to sponsor-backed, upper-middle market companies with high-quality businesses and durable competitive advantages. Liberty Mutual Investments and the Dell Family Office are anchor investors. More here

ESR Group, a Hong Kong-based manager, raised $325 million for its first South Korean real estate credit fund. The fund will target “New Economy” real estate assets based in South Korea. These include logistics centres, data centres, infrastructure and energy transition. More here.

Keppel, a Singapore-based asset manager, announced a first close of $300 million for its third private credit fund. The fund lends to Asia Pacific-based companies. It invests across a wide range of real asset sectors but focuses on defensive infrastructure-like operating businesses. This includes renewable energy, transportation, telecommunications, logistics and social infrastructure. The fund has a target fund size of $1 billion. More here

Keppel believes it can capitalize on the continued growth of private credit in Asia Pacific, which has quadrupled over the past decade. Despite this Asia Pacific accounts for only 6% of the global private credit market. Given that the Asia Pacific region is expected to contribute over 60% of global GDP growth over the next decade, there are considerable opportunities for its private credit market to expand.

DRC Savills, a UK-based manager announced its new $220 million pan-European whole-loan fund. The fund provides loans to top-tier sponsors for real estate acquisitions and capital expenditure in Europe. DRC is Savills Investment Management’s real estate debt arm. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.