Oaktree Calls Out Sponsors

Fundraising from Warburg Pincus, Park Square, Infranity and Bregal Sagemount.

👋 Hey, Nick here. A special welcome to the new subscribers at Lenora Capital and Citco. This is the 78th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📣 Quote of the week - Oaktree calls out Advent and Silver Lake over collapsed Thrasio

“We believed that Advent and Silver Lake, experienced PE firms with whom we have partnered numerous times, would be steady hands at the helm and able to professionalise the business…..

“This proved to be incorrect”

“We didn’t have appropriate controls in place and instead relied on our alignment with the sponsors”

“This was clearly an error”

“We expected more judicious and cautious deployment of capital for growth”

“Our trust was misplaced”

Read the FT Report Here

📕 Reads of the week

Bain Capital lends $1.8 billion to 43 companies in H124 Link

Ares acquires lower-middle market lender Riverside Credit Solutions Link

HPS is exploring a $10bn IPO Link

Clearlake is buying MV Credit from Natixis. Clearlake Credit’s AUM will increase to over $28 billion post acquisition. Link

Asian insurers shift to private credit amidst new risk-based capital rules Link

Three US Pension funds that are increasing private credit allocations in 2025 Link

SEC Charges Sound Point Capital Management for Compliance Failures in Handling of Nonpublic Information Link (Dentons analysis here)

📊 Charts of the Week - European MidCapMonitor

Houlihan Lokey published its MidCapMonitor for Q2. This is one of the most comprehensive reports on European Mid-market Lending.

Here are four key insights that stood out to me, but you should also read the full report here.

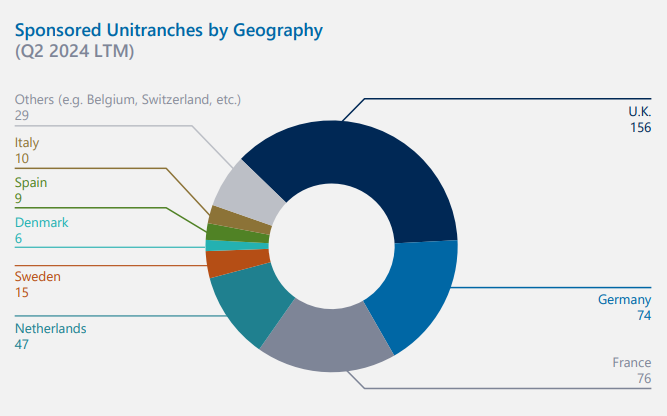

U.K., Germany and France and Benelux lead the growth in deals

These markets remained strong unitranche geographies, accounting for over 80% of deals and showing substantial collective growth.

The U.K. remains the most active market followed by France and Germany.

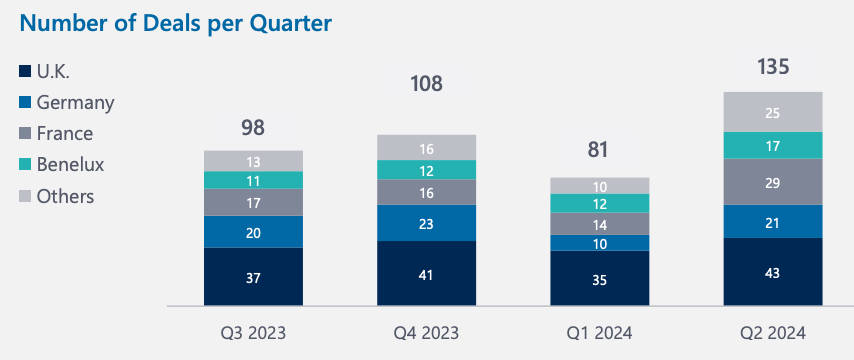

European Unitranche Deals Bounce Back After Q1 Dip

Financing activity picked up, with 135 transactions closing in Q2. This was 67% above Q1 (81 deals).

The U.K., Germany, France, completed deals increased by 23%, 110% and 107%.

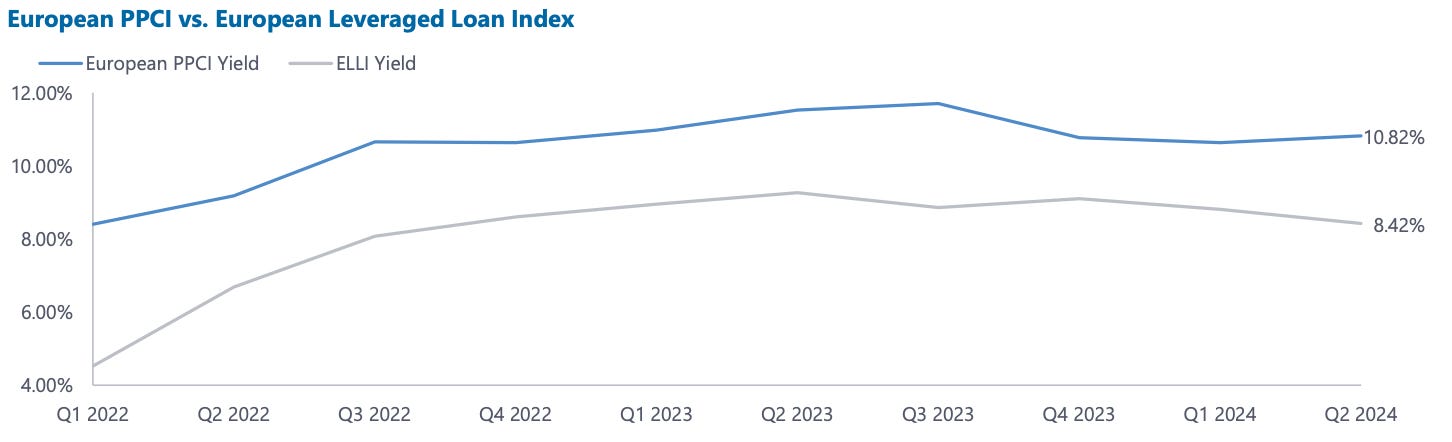

European Yields Increase but Remain Lower than US

Houlihan Lokey’s European Private Performing Credit Index shows an all-in yield of 10.8% as of Q2, slightly higher than Q1.

Whilst yields for European private credit are currently 240bps higher than the Leveraged Loan Index, they remain 74bps lower than the PPCI, which predominantly comprises U.S. private credit market borrowers.

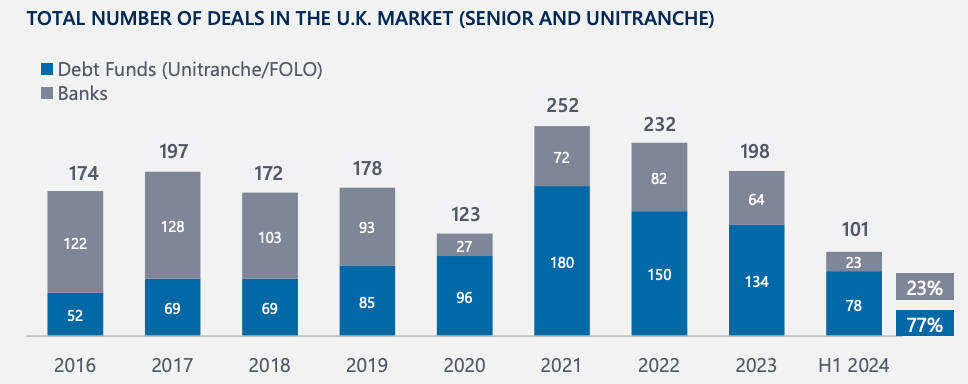

European Private Credit Returns to Growth

Private credit’s growth in the UK continues its growth trend, excluding the 2021 outlier.

The number of private credit deals in H1 were nearly as much as the total deals in 2019. This trend is consistent for most of Europe.

The levels of new LBO financings are in line with levels seen in 2022.

Read Houlihan Lokey’s full report here.

💰Fundraising News

Warburg Pincus, the the oldest private equity firm in the US, closed its $4 billion Capital Solutions Founders Fund. The fund pursues thesis-based investing opportunities in curated structured transactions. It will target a wide opportunities by working with domain experts across Warburg Pincus' core sectors, geographies, and stages. More here

Park Square Capital, a London-based private debt investor, closed its $3.8 billion European Loan Partners II Fund. The fund is a joint venture between Park Square and SMBC. It lends senior secured and unitranche loans to sponsored European mid-market businesses. Park Square and SMBC have made more than 50 joint transactions since the first fund launched in 2017. More here

Infranity, a Paris-based asset manager, launched its $1.8 billion Enhanced Return Debt strategy. The fund invests in sub-investment grade senior debt in the infrastructure sector. It will have a 50% allocation to climate solutions, with a focus on renewable energy, low carbon energy transition projects and essential digital and social infrastructure. In line with Infranity’s operating model capital deployment has been taking place at pace with Five seed assets already being executed. More here

BNP Paribas, a Paris-based asset manager, closed its $821 million European SME Debt Fund III. The fund lends secured bullet loans to small and medium-sized companies in continental Europe. The fund aims to invest in a portfolio of 70 mid-caps and SMEs. More here

Bregal Sagemount, a New York-based manager, closed its $800 million Credit Solutions funds. The funds lend to growth businesses with high recurring revenue in five key sectors. They typically lend between $15-100 million per transaction and can invest in both senior secured and subordinated debt. The funds are complementary extensions to Sagemount’s equity funds. More here and here

Allianz Global Investors, raised $620 million at the first close of its Impact Private Credit Strategy. The fund lends to businesses addressing societal challenges, these include: climate change, planetary boundaries and inclusive capitalism. It targets European small to mid-market corporates. The fund is an Article 9 fund. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.