Navigating the Blurry Lines Between Public and Private Credit.

Fundraising from HPS, Antares, Pemberton, Arcmont, Sagard and Sona

👋 Hey, Nick here. A special welcome to all the new subscribers at PGIM. As a reminder, Golub is the leading subscriber of The Credit Crunch 🥳 Share this with your colleagues to knock Golub off the top spot.

If you’re new, this is the 67th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

HPS raises $21 billion for its flagship fund Link

KKR joins the S&P 500 Link

Marathon Asset Management: PE Firms Smart to Exploit Weak Debt Covenants Link

Lazard is looking to buy private credit managers Link

⛵️Navigating the Blurry Lines Between Public and Private Credit.

There is a structural shift in Private Credit.

If you look at a traditional investors 60:40 portfolio, 60% equity, 40% liquid fixed income

Over the last 30 years or so, when you look at the 40%, that stayed almost all liquid.

And yet there’s an opportunity to take on some illiquidity to earn a higher return.

Just as we’ve seen on the equity side.

Jon Gray - Blackstone (Link)

Equity markets have long had two distinct segments. First, a very liquid public market, where transaction costs are low. Second, a well-developed private market that can fund businesses of all shapes and sizes, from start-ups to giant companies such as Uber, which went public at a valuation of more than $70bn.

Barclays recently clarified this point (Link)

The Evolution of Private Credit

Today’s credit landscape looks very different than it did a decade ago. One of the key changes has been the rise of lending outside traditional banking. Notably, the private credit market, which has expanded to become an asset class worth ~$1.5 trillion.

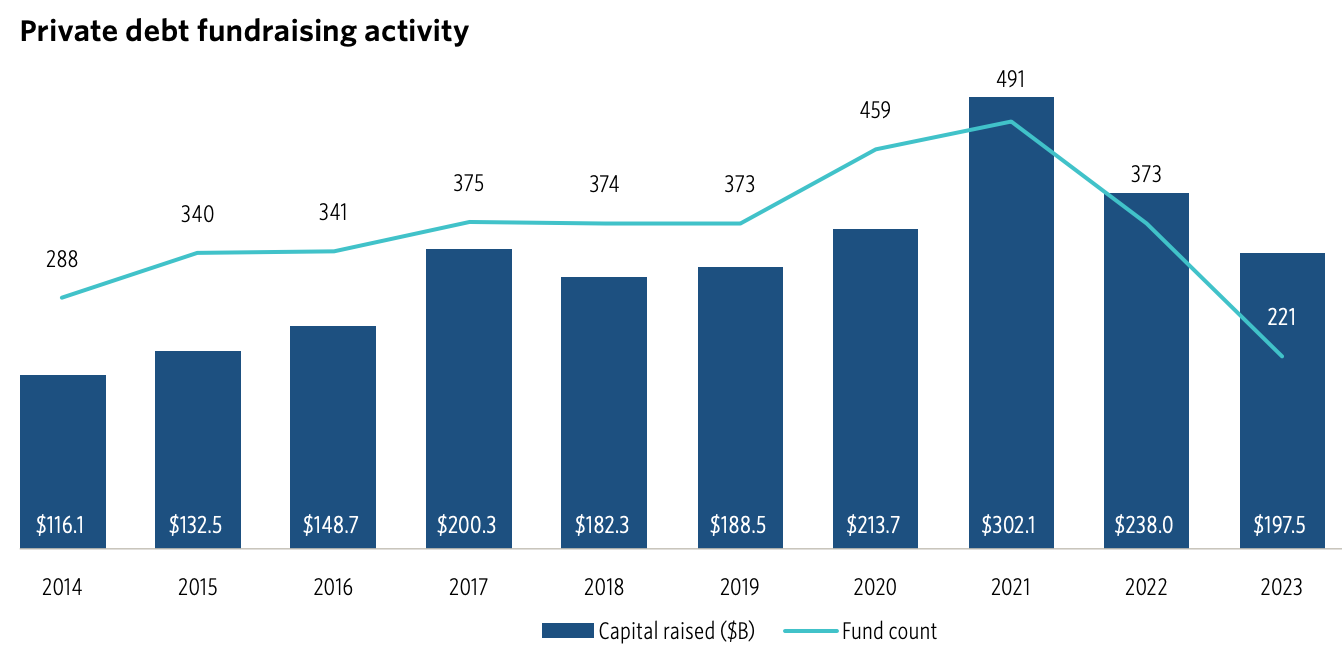

Alternative investment managers have capitalized on this trend. Particularly following the Covid pandemic, where private credit strategies raised 3 times more in 2021 than in 2014. (Also See HPS’ Massive fund in the fundraising section).

This structural change has attracted more investors to private credit.

This is a great opportunity for the CalPERS balance sheet. We need to have investments that are scalable so that we can move the needle.

It is impossible for CalPERS to, collect a whole bunch of $50 million investments We need something which is like maybe $500 million.

So for us, the market morphing is very, very interesting

Jean Hsu: Calpers Link

The Morphing of Credit Markets

It has become a popular narrative that this private credit’s growth comes at the expense of liquid credit. The reality is that the relationship is much more cooperative than zero-sum1.

Sponsors continue to dual-track transactions and the choice between public and private markets often hinges on many factors.

Public markets offer cost-effective, straightforward options, but private lenders provide tailored solutions, especially beneficial for strategies involving mergers, acquisitions, and strategic purchases.

If public markets can give sponsors the best execution and the public market is open, sponsors will go for the public market. Even the Middle Market will migrate.

During the Covid pandemic, the value of private lending became apparent. If companies need extensions or modifications, they're talking to a thousand people in a public market transaction. How can they achieve that? Private lenders are their only choice.

Managers need to adapt, or risk being left behind

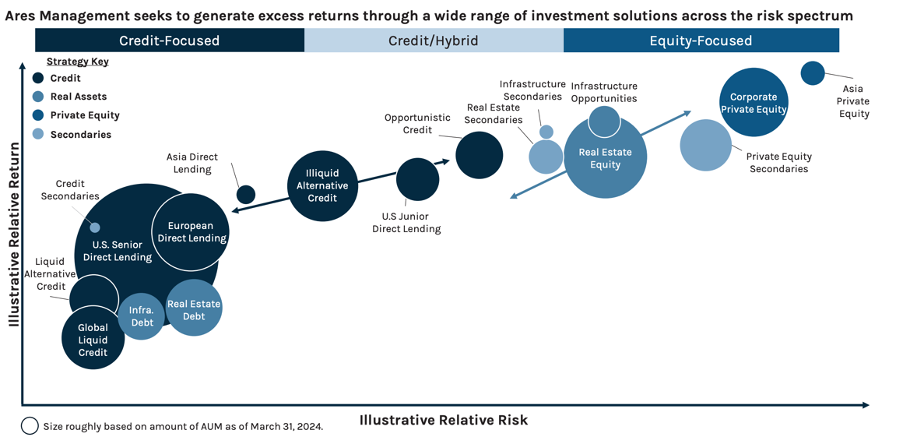

Large managers like Blackstone, Ares, and KKR are adapting.

KKR recently noted:

We saw several strong incumbent KKR relationships transition from syndicated solutions to private financing and vice versa, as they opted to do business with those, they ‘like and trust’ (Link)

Ares also highlighted. Ares Credit Platform does not exist in a vacuum. Ares has large strategies across the risk and return spectrum. (Link)

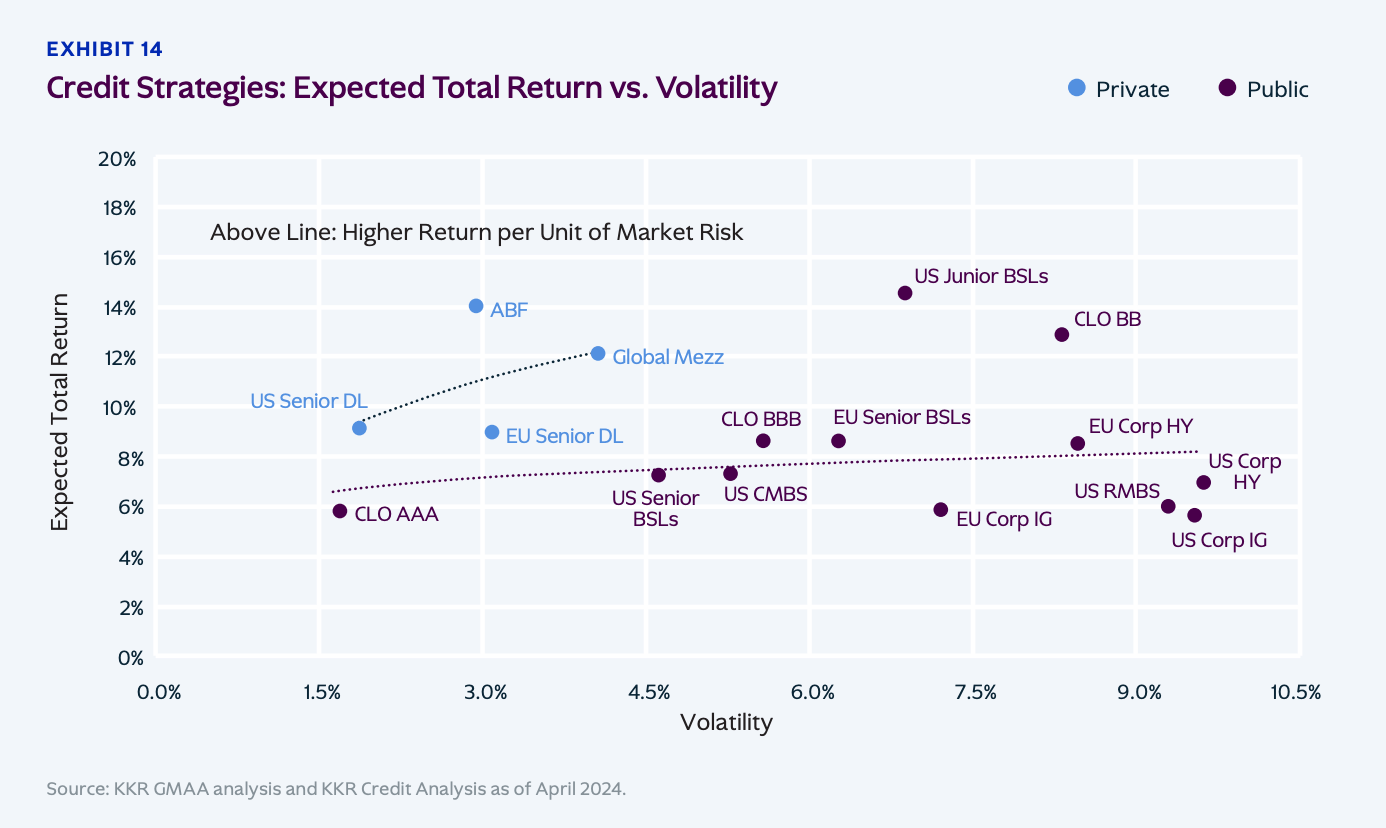

KKR believes the morphing of private and public credit provides large managers with alpha:

A public credit knowledge base and visibility can often create reverse-inquiry ideas which can be great private credit opportunities. The reverse can also be true — near term maturities in private credit portfolios can oscillate into public credit.

This dynamic demonstrates the value of a multi-disciplined platform and the ability to toggle across both markets to capture best relative value for investors while contributing to an origination pipeline.

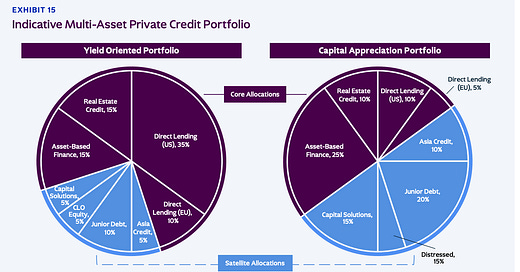

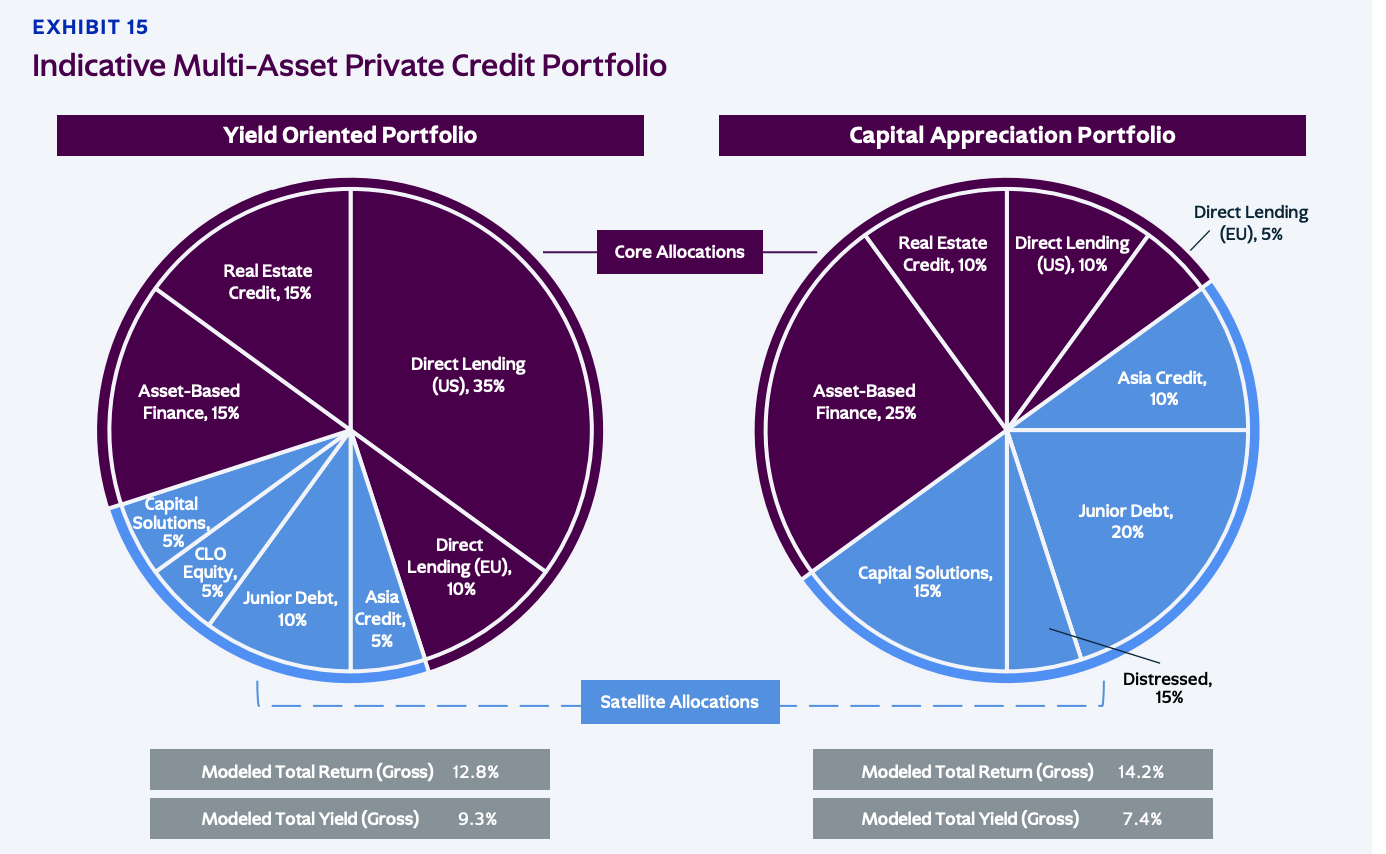

KKR also suggests that value has become less apparent in this market. Investing with a multi-asset portfolio is therefore an efficient approach to managing risk assets during a non-obvious market.

Investing in both public (liquid) and private (illiquid) allocations builds a more resilient portfolio.

This has been particularly true market volatility over the past two years.

KKR is excited about this:

Given our positioning as a scaled and global platform, we are able to see the market from all angles. This is even more exciting when you think about our multi-asset capabilities and affinity to customize solutions in a market environment compounded with supporting technicals for credit.

Investors such as CalPERS are addressing this:

If we don't need that much liquidity, can we allocate more?

We used to have like 20% in non-public assets. Right now, we are migrating into close to 30 to 40%.

Jean Hsu: CalPERS Link

💰Fundraising news

HPS Investment Partners closed its $21.1 billion Specialty Loan Fund VI. The fund is HPS's flagship strategy. It primarily lends to large ($75-350+ million EBITDA), non-sponsored, upper middle market companies in North America, Western Europe, and Australia/New Zealand. It has a primary focus on North America. To date, SLF VI has invested more than $2.5 billion across 29 investments. More here and here

Antares Capital, a Chicago-based private credit manager, is looking to raise ~$6 billion for its third senior loan fund. The fund lends senior secured loans to sponsored companies in the US and Canada. It typically invests between $40 to $60 million in companies with EBITDA of $10 to $100 million. The fund primarily invests in non-cyclical industries, including insurance, non-elective healthcare, software, and business services sectors. Antares are targeting an unlevered return of 8-9 percent and a levered return of 14-15 percent. More here and here

Pemberton, a London-based credit manager, plans to raise ~$4.3 billion for its fourth mid-market debt strategy. The fund lends senior loans to European companies with EBITDA between €15 million and €75 million. More here and here

Pemberton is also raising ~$3 billion for its second Senior loan fund. The fund lends senior secured loans to European mid-market companies, with EBITDA €25 million and €100 million. The strategy targets larger companies, with lower leverage and larger equity cushions than its Mid-Market Debt strategy. It typically invests between €50 million to €250 million per transaction. Given its more conservative nature, the strategy works in partnership with leading commercial banks in each jurisdiction. More here and here

Arcmont, a London-based credit manager, launched its first Long-Term Asset Fund (LTAF). LTAFs are regulated vehicles that allow UK Defined Contribution pension schemes to invest in private credit. Arcmont is the first European Private Debt manager to receive approval. The fund will leverage Arcmont’s Direct Lending strategies and invest in European upper mid-market businesses. More here

Sagard, a Canada-based asset manager, launched an evergreen credit investment fund for Canadian accredited investors. The fund will lend to North American middle-market companies. It will target companies with EBITDA between $10 and $200 million and can lend between $10 and $250 million per transaction. Sagard targets a net return of 9-10% More here and here

Sona Asset Management, a London-based credit manager, closed its $800 million Capital Solutions II fund. Sona’s main fund is a Liquid European Credit strategy. It launched its Capital Solutions strategy in 2020 to create flexible financing. The strategy is not a distressed debt approach, but it will sometimes encounter stress and distress. It targets a net IRR in the mid to high teens. More here, here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.