4 reasons why KKR has never felt better

Fundraisings from Acore Capital, Deerpath, Tor, Pangana and Manulife IM.

👋 Hey, Nick here. If you’re new, this is the 59th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

Howard Marks on how to become a better investor Link

Bank of England is applying more pressure on private markets Link

Proskauer’s private credit index shows that defaults increased in Q1, lower middle market was the worst. Link

💬 Quotes of the Week

Howard Marks - Oaktree (Quote)

“Management fees are the only certainty in the investment world”

Chris Sheldon - KKR (Quote)

“If I go back years and years before KKR and I think about my first job in credit, my first boss said to me, Chris, if you want to stay in credit, you have to be right 99% of the time. It's pretty intimidating as a 23-year old. The reality is, if you think about it, it's right. You invest in credit, your upside is get your money back, you get some coupon along the way and your downside zero. On a loss adjusted basis you need to be right 99% of the time.”

🚀 KKR has never felt better about Credit

KKR held its Investor Day last week. Here are a few of my favorite insights:

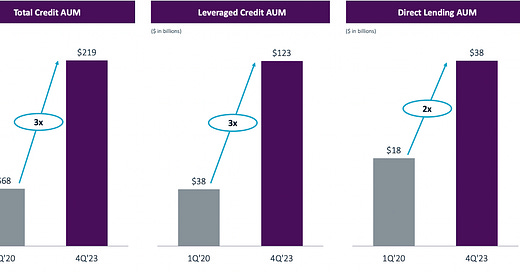

KKR’s Credit AUM is up 3x in less than four years

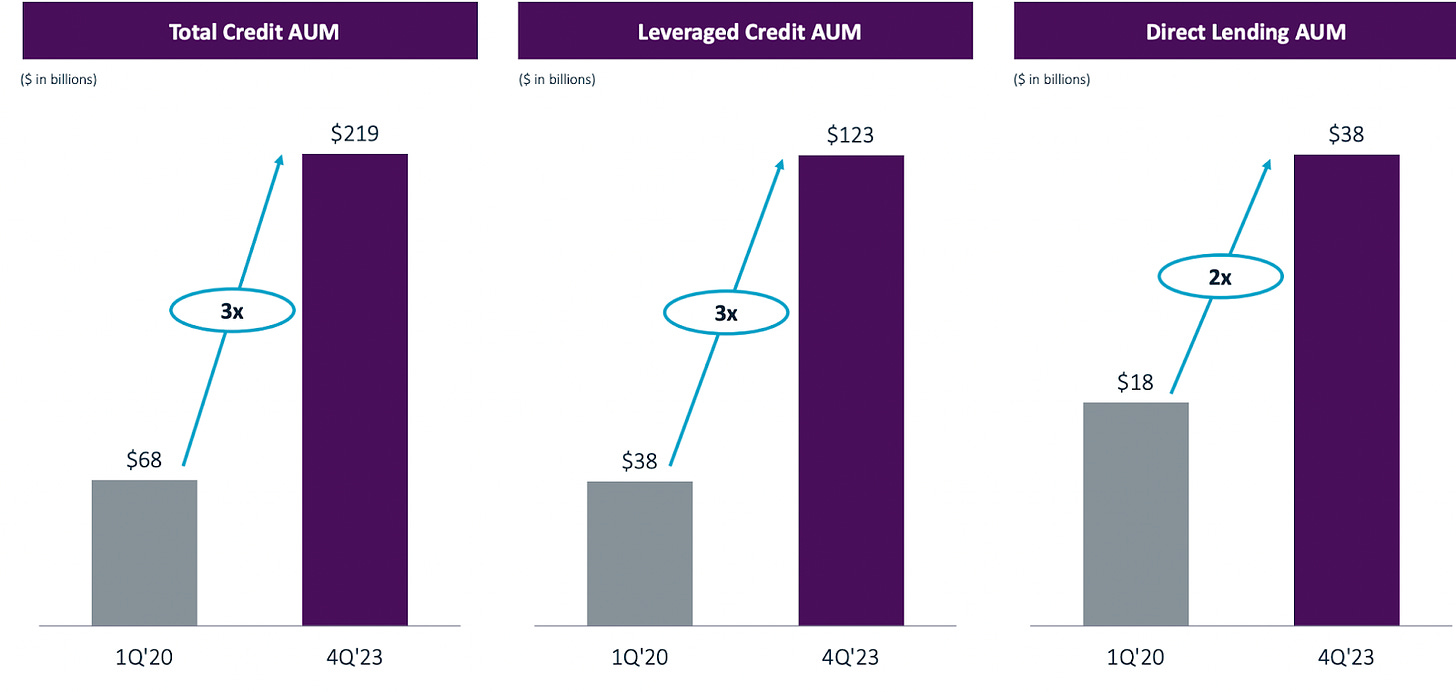

KKR has outperforming credit strategies

KKR believes its success is down to 4 reasons:

They're large, scaled, growing, and have the right products, the right team, and the right younger strategies with the roots in the ground to grow and mature. (See above)

They have the insurance and they have Global Atlantic. These lead to increased distribution, increased insurance operating income and increased performance income for flagship funds. KKR believes this is an economic multiplier, and it's powerful.

They have first-mover advantages. One in asset-based finance. The second in Asian Credit.

And finally, they've made significant investments in distribution. These investments are working. (They’ve grown their distribution team 3.4x in the last 5 years. This has led to a 5.5x increase in prospects)

I’d highly recommend reading the slide deck (Here pages 122- 140) or watching the webcast (Here Credit starts at 1:57:00)

💰Fundraising news

Acore Capital, a California-based real estate credit manager closed its $1.4 billion Credit Partners II. The fund will lend floating rate loans secured against “buildings in transition.” This includes ground-up construction projects, assets being renovated, repositioned, and or rebranded. When the borrower achieves the business plan and stabilizes the asset, they either sell the building or replace the loan with permanent financing. The fund has an $80 million average loan size and a loan-to-cost range of between 55 percent and 75 percent. It has invested ~$375 million in 18 investments. More here

Deerpath Capital Management, a New York-based manager, raised $452 million for its tenth CLO. The CLO is secured by a diversified portfolio of senior secured loans to sponsored middle market companies and has been primarily originated by the Deerpath. Deerpath provides cash-flow-based senior debt financing to lower-middle market companies across North America. Its latest CLO brings the firm’s total CLO AUM to approximately $3.2bn. More here

Tor, a Hong Kong-based alternative credit manager, raised $310 million for its third Asia opportunistic private credit fund. The fund lends senior secured loans to large Asia Pacific companies. It targets deal sizes of $50m-$150m. Tor favors ‘common law’ jurisdictions such as Australia, Singapore, and Hong Kong, with ~75% of the portfolio invested in countries where Tor can depend on enforcement outside the region. Tor has $2.1bn of assets under management. More here and here

Pengana Capital, an Australia-based asset manager, announced its USD ~$160 million Australian listed fund. The retail fund will invest in up to 2,000 individual loans originated by twelve credit placement partners. It will focus on mid-market companies in the US and Europe. The fund will offer a 7 percent yield and monthly distributions. More here

Manulife IM, a Singapore-based investment manager, launched its Private Credit Plus strategy. The fund-of-fund is targeted towards private banks and wealth managers in Singapore. It is a semi-liquid strategy that invests in US middle market senior secured loans as well as asset-based lending. The direct lending investments will be sourced by Manulife’s platform and ABL will be sourced by Marathon Asset Management. Manulife expects the fund to generate a double-digit yield. More here