Insurers are Funding the Infrastructure of the Future

Fundraising from Allianz GI, Medalist Partners, Sienna Investments, Neo, Avendus, King Street Capita and Raymond James.

👋 Hey, Nick here. A special welcome to the new subscribers from Blackstone, Sound Point, and Alpine Capital Research. It’s great to have you. Reach out and say hi. This is the 96th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Why BlackRock Spent $30 billion on Private Markets Acquisitions in 2024. Link

Howard Marks’ Memo On Bubble Watch. Link

Antares, Blue Owl, and KKR Prepare to Take Over Alacrity from BlackRock. Lenders will convert half of their loan into equity while providing $175 million of new debt. Alacrity’s capital structure will include a ~$450 million term loan and $250 million of preferred equity. Link

Golub Middle Market Report: Revenue and Earnings Growth Continues in Q4 24. Link

Alliance Bernstein: The Journey from Niche Asset to Core Allocation looks Set to Continue. Link

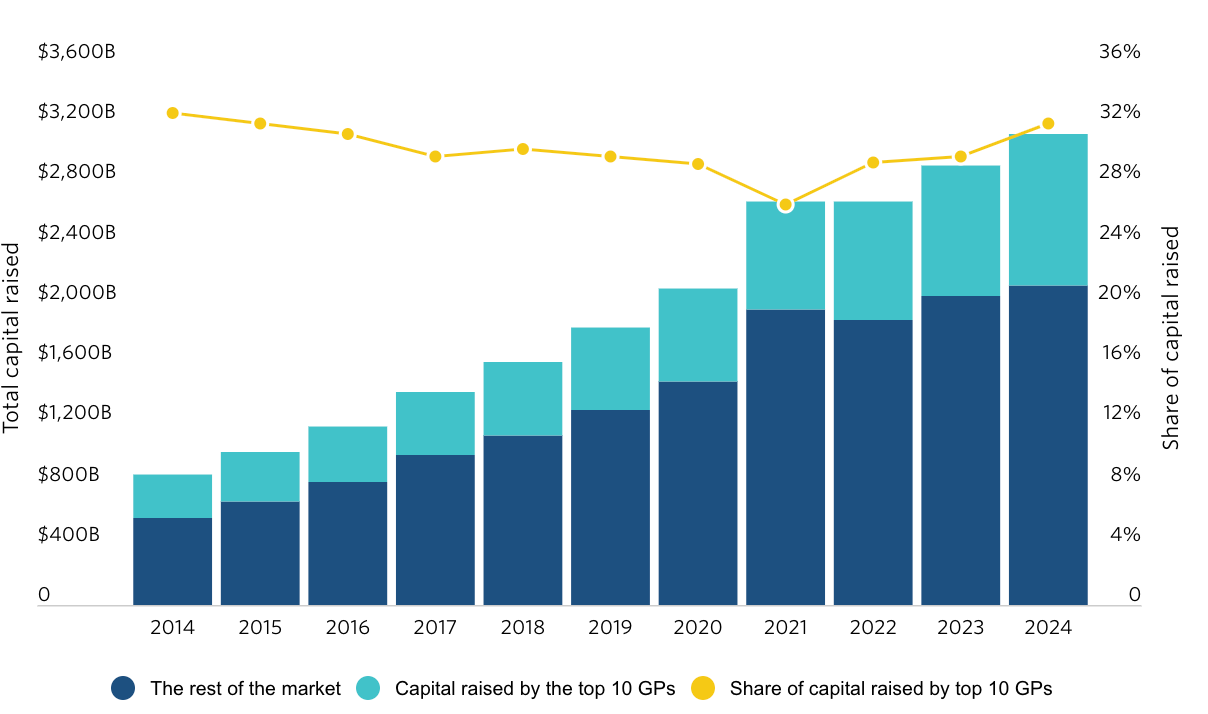

How 10 Private Credit Firms Manage a Third of the Industry’s Capital. Link

👫 Insurance is Transforming Private Credit

Insurance partnerships will be a key focus for 2025 (See last week). You should also read Huw van Steenis’ latest FT column if you don’t believe me (Link). Huw is significantly more qualified to talk about this.

The battle is already playing out in 2025 with three managers announcing partnerships last week:

Sixth Street announced a partnership with Northwestern Mutual. Sixth Street will manage $13 billion of Northwestern Mutual’s $320 billion portfolio. Investments will span Sixth Street’s multi-strategy private capital approach, including asset-based finance and opportunistic investments in real estate and infrastructure debt and equity. Northwestern Mutual will also acquire a minority equity interest in Sixth Street. Link

Golub closed its $200 million investment into Nassau Financial Group, a provider of fixed annuities. Link

Ares raised ~$2.3 billion of equity for Aspida, a life insurance and annuity company based in Durham, N.C. Aspida has ~$19 billion in assets. These are managed by Ares Insurance Solutions who has helped build a portfolio of investments that is over 90% investment grade. More here

Huw highlights that:

There is a profound shift in the funding model of private credit…

Private credit assets funded by insurers at the top seven listed private market players now account for 43 per cent of credit assets held by these companies, up from 32 per cent at the end of 2021…

Put another way, more than half of inflows in 2024 came from insurers.

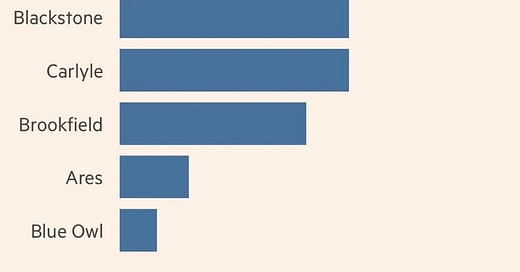

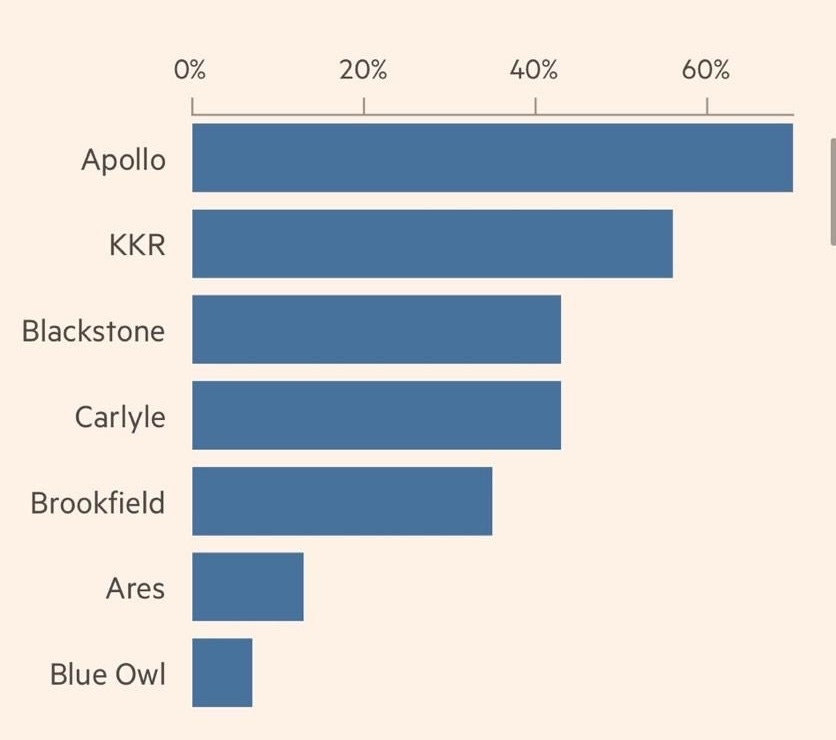

Estimated share of credit assets funded by insurers

This capital is transforming the type of projects private credit can back with insurers prioritizing high-quality long-dated 7 to 9 per cent returns. You may remember Ares talked about this last summer. This aligns with infrastructure financing’s needs. More specifically data centers and the energy required to power these data centers.

Blackstone estimates that the US will see over $1 trillion invested in data centers over the next five years, with an additional $1 trillion invested internationally (Link)

Data centers are one of Blackstone’s highest-conviction investment themes. Read below to find out why.

🏭 Building the Infrastructure of the Future

As you may have noticed there’s going to be a lot of focus on infrastructure this year. I’d like to stay on top of this so please share your insights with me. As a starting point, Blackstone published a deep dive into data centers last year (Link). Summary below:

Think back to 2006, when cloud computing first emerged.

Facebook hit 100 million users by 2008

Instagram hit 100 million in 2013

Netflix hit 100 million in 2017

ChatGPT hit 100 million users just two months after launching

Data usage has increased by 100 times over the past 15 years with more data created in the past three years than in all of history. As AI continues to gain momentum, this trend will only accelerate.

Global Data Created, Consumed and Stored

(Zettabytes)

Data Intensity: The Rising Demand for Power

It’s not just the amount of data that’s growing—it’s the intensity of the data being processed. A ChatGPT query requires 10 times the power of a Google search and AI-generated images using tools like DALL-E needs 50 times the power of a Google search.

To put that into perspective, creating a basic AI-generated video is the energy equivalent of charging your phone 119 times.

With this explosion of data, there’s an urgent need for physical infrastructure to store, process, and deliver it. The number of US-leased data centers has increased 17 times, in the last 5 years alone.

US New Leasing

Megawatts

This year, 5,000 megawatts of data center capacity will be added in the US. That’s roughly 1% of the US’s total power consumption

This sudden surge is a major shift. The US will have to double its power grid’s capacity over the next 12 years to keep up. If you’re not excited yet, read Blackstone’s full piece to learn more.

💰Fundraising News

🇮🇳 Spotlight on India

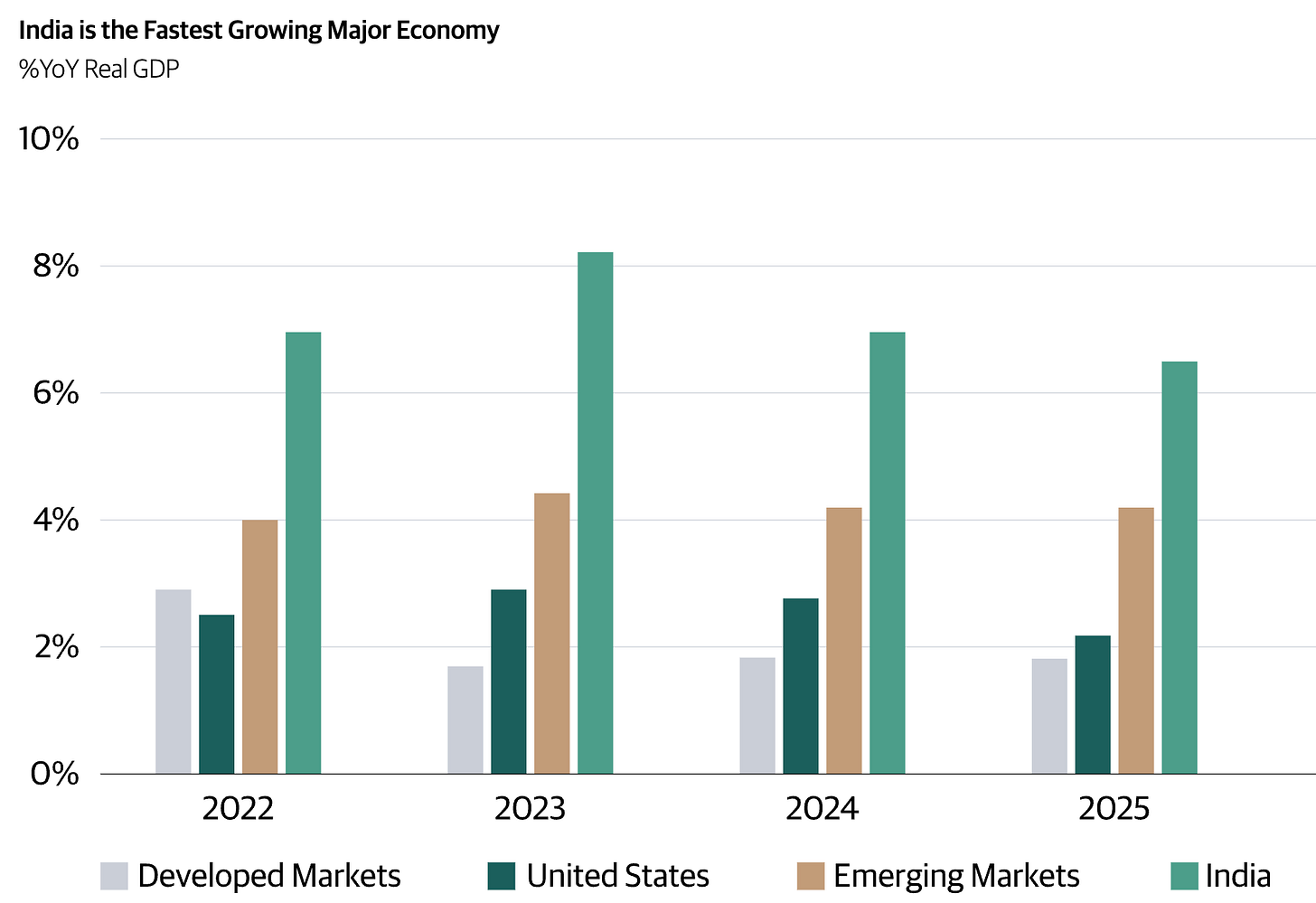

Blackstone believes that India is a “promising geography” for investment opportunities.

Here are five reasons why Blackstone isn’t sleeping on India:

A growing middle-class

A large working-age population

An enormous pool of talented engineers

It’s the fifth-largest economy in the world

It’s the fastest growing major economy with 7% GDP growth

Blackstone is the largest alternatives firm in India having invested over $55 billion since they opened their office there nearly 20 years ago.

Private credit in India is still in its early stages. I recorded less than $2 billion in India-based fundraising last year. But 2025 might be a turning point and there are two standout fundraises from India this week.

Neo Asset Management, an India-based investment manager, is raising ~$700 million for its second private credit fund. The fund will target mid-market companies in India. More here and here

Avendus, an India-based asset manager, launched its $466 million Structured Credit Fund III. The fund will target mature and growth-oriented mid-market companies. It is sector-agnostic, focusing on pharmaceuticals, healthcare, manufacturing, consumer, chemicals, and technology. It aims to build a portfolio of 12-18 transactions with a target gross portfolio IRR of 16%-18%. More here and here

Other Fundraising

Allianz Global Investors closed its $1.5 billion Private Debt Secondaries Fund. The fund was Allianz GI’s first secondary fund and predominantly invests in senior direct lending opportunities, selectively complemented by opportunistic credit positions. It aims to build a portfolio across managers, sectors, and geographies. More here

Medalist Partners, a New York-based investment manager, is raising ~$750 million for Asset-Based Private Credit Fund IV. The fund invests in lending programs secured by hard and financial assets. Medalist focuses on smaller, less crowded parts of the market, with transaction sizes between $5 and $30 million. Collateral for loans includes commercial equipment, autos, receivables, litigation finance, consumer loans, aircraft, and real estate. More here and here

Sienna Investment Managers, a Luxembourg-based asset manager, launched its ~$200 million Biodiversity Private Credit Fund. The fund will invest in three types of companies: those providing biodiversity solutions; those engaged in reducing the negative impact on biodiversity; and those that significantly outperform their sector’s practices in terms of biodiversity preservation. More here and here

King Street Capital, a New York-based alternative asset manager, is launching a new private credit fund with Lumyna. The fund will primarily invest in corporate and asset-based lending. Up to half of the fund could be invested in Europe. Generali Investments, the asset management arm of Italian insurance firm Generali has committed ~$70 million. More here

Raymond James, a Florida-based investment bank, launched RJ Private Credit Income Fund, a US-registered interval fund. It will directly or indirectly invest at least 80 per cent of its assets in private credit assets including direct lending and investing in BDCs. Between 30 and 70 per cent of the fund’s allocations will be made into investment funds. Link

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.