Insights into New Mexico State Investment Council's Private Credit Program

Over $13 billion of Fundraisings from managers including Pemberton, AB CarVal, SeaTown, HSBC AM& Abry Partners.

👋 Hey, Nick here. A special welcome to the new subscribers at ING. This is the 77th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕Reads of the week

Credit investments aren't worth the risk right now, PIMCO More here

KKR and Blackrock recap Sirva More here

Vista is considering banks and private credit for $1bn Jaggaer financing More here

Ares leads private credit drive in Italy More here

Asset-Based Finance is Private Credit’s Key Diversifier, AB CarVal. More here

Insights into New Mexico State Investment Council Private Credit Program

Earlier in the year, I provided a few insights into CalPERS Private Debt program (Here if you missed it).

This week’s newsletter focuses on The New Mexico State Investment Council, or The SIC. SIC manages the investments for New Mexico’s four permanent pension funds.

SIC is also one of the fastest growing Sovereign Wealth Funds.

SIC has so much money pouring in from tax and royalty collections on oil and natural gas production in the state that CIO Vince Smith is struggling to put the money to work. (Source)

Assets under management at SIC have grown from $13 billion in 2010 to $56 billion in 2024. Whilst the current size makes it about 10% the size of CalPERs, AUM is forecast to hit $100 billion in the next 10 years.

What does SIC think about Private Credit?

SIC restructured its Fixed Income program in 2023, creating a Private Credit Program.

This review set a target private credit allocation of 15% vs. the 7.4% allocation in 2023.

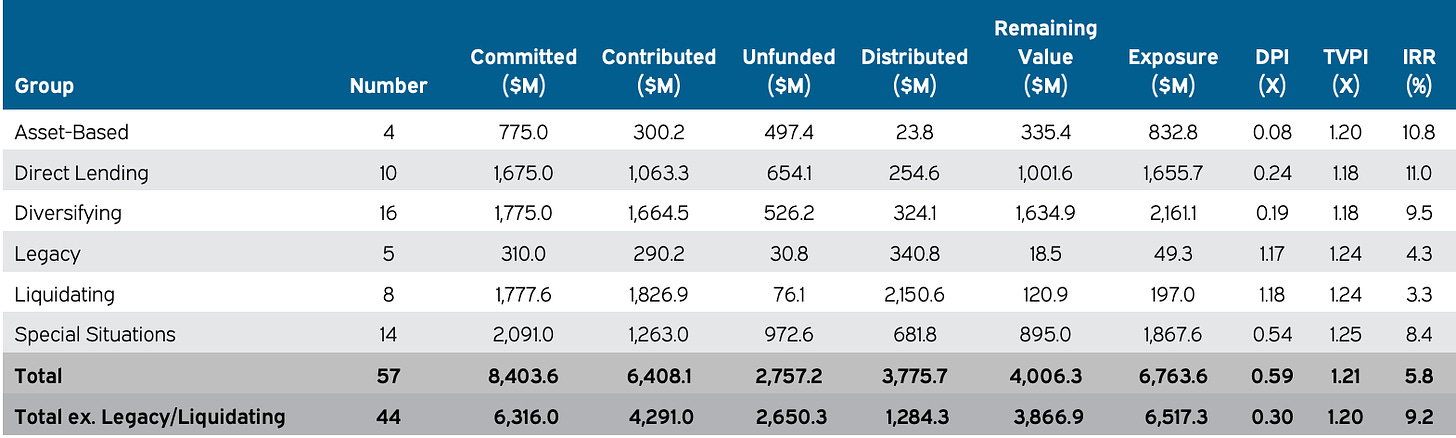

The program has committed $8.4 billion to 57 funds to date. These currently have a NAV of $4 billion. The program has TVPI of 1.2x and core IRR of 9.2%, since inception.

Performance by Strategy

SIC focuses on four strategy types: Direct Lending, Asset-backed lending, Special Situations and Diversifying.

The strategies have returned IRRs of 8-11% and TVPIs around 1.2x. Direct lending strategies have been the top performers with 11% IRR.

HPS’s Specialty Loan V, 2019, has been the top direct lending performer with a 15.1% IRR. (Caution: this is off a 0.3x DPI)

Talking about DPI. Most of SIC’s fund investments have been 2019 onwards. Therefore the average DPI is only 0.3x. Pimco’s Distressed II, 2013 fund is the outlier with a 1.4x DPI.

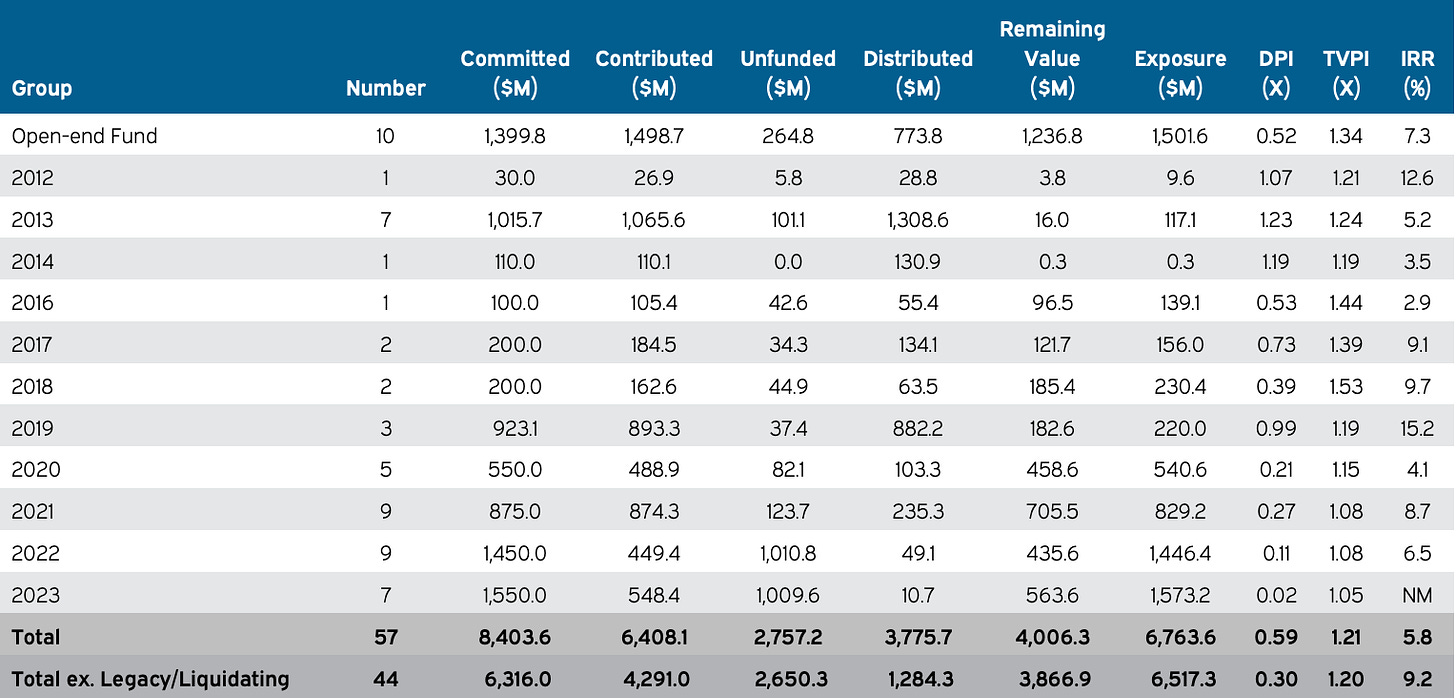

Performance by Vintage

SIC’s private credit investing has ramped up since 2020 with the fund increasing its commitments to $1.5 billion per year.

SIC targets $1.5 billion in annual commitments for 2023, 2024, 2025 and is projected to hit the 15% policy target by 2029.

The SIC’s 2019 investments have been clear outperformers with IRRs of 15.2% and nearly 1x DPI.

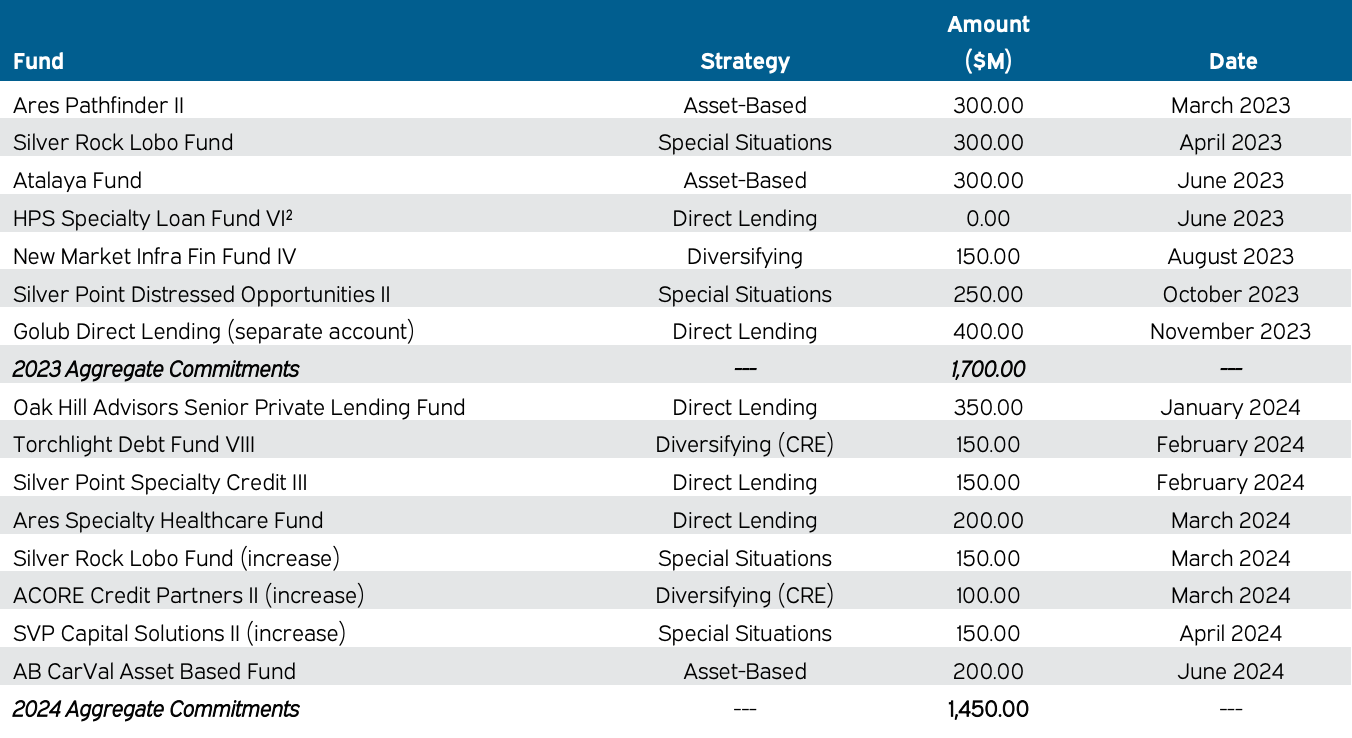

Recent Commitment Activity

Unlike CalPERs, SIC has been actively investing in private credit, committing to 24 funds in the last three years alone.

SIC commits between $100 million to $300 million per fund. It has committed as much as $400 million, Golub’s 2023 fund.

What Strategies are SIC most likely to invest in?

SIC’s managers typically have at least $10 billion of AUM, the smallest being Silver Rock ($7 billion AUM).

SIC is most likely to ramp up its investments in Asset-Based lending. The current allocation of 8% is significantly below the 25% Target.

While SIC may potentially invest in new Direct Lending and Special Situations Strategies, it is more likely that it increases its existing manager allocations, as it did earlier this year.

💰Fundraising News

Pemberton, a London-based asset manager, plans to raise ~$3.3 billion for its Strategic Credit Fund IV. The fund focuses on senior and subordinated loans to sponsored mid-market companies in Western Europe. The fund expects to have 35-50 investments and is targeting net returns of 13-15%. Pemberton’s Strategic Credit Funds I, II and III have produced internal rates of return of 10.2%, 12.6% and 14.9%, respectively, as of March 31, net of fees and not including leverage. More here and here

HSBC Asset Management launched its European Senior Direct Lending strategy, an extension of its existing UK Direct Lending strategy. The new strategy, which brings total commitments across the HSBC Direct Lending platform to $2.4bn, focuses on senior secured loans to private equity-backed, mid-market companies in Europe, particularly those with EBITDA between €10m and €35m. More here

SeaTown, a Singapore-based investment manager, announced a final close of ~$1.3 billion for its second private credit fund. The fund will finance companies across Asia Pacific, targeting a net return in the mid-teens. SeaTown is wholly-owned subsidiary of Temasek’s asset management group Seviora Holdings. More here

Abry Partners, a Boston-based private equity firm, announced the closing of a $1.6 billion continuation vehicle, Abry Advanced Securities Fund III. The transaction is reportedly the largest credit continuation vehicle ever created. It will provide full liquidity to Abry’s existing investors and will provide new and continuing investors the opportunity to seed Abry Partners’ new private credit strategy. ASF III comprises of a portfolio of first lien broadly syndicated loans to more than 210 middle market US companies. More here

The transaction was led by Coller Capital. In 2021, Coller Capital launched its first dedicated credit fund – Coller Credit Secondaries – Opportunities Fund I – which was the largest fund dedicated to private secondaries credit of its time. More here

CCS Partners, a credit manager focused on structured and private asset-based deals launched with $4 billion in commitments. The firm, will invest in securities and loans, including risk transfer trades. More here

Content Partners, a PE firm specialized in acquiring entertainment IP, launched its private credit strategy. The platform will lend to independent studios; owners of entertainment IP rights to film, music and television content; as well as key service providers such as talent agencies. Its investments can span the whole capital stack, from first-lien debt to preferred equity investments. It will also focus on middle-market deals, with its sweet spot transactions between $25 million and $50 million. Content Partners is backed by Carlyle. More here

HSBC Asset Management launched its $240 million Global Transition Infrastructure Debt strategy. The strategy will finance assets that support the transition to a sustainable economy, including investments in clean power, energy efficiency, and clean industry projects. It focuses on investing in senior and second lien debt, targeting mid-market borrowers across investment-grade countries in Europe, North America, and the Asia-Pacific region. More here

AB Carval, a Minneapolis-based investment manager, is currently raising for its evergreen ABF strategy. The strategy is expected to focus on three primary specialty finance segments: consumer, residential, and commercial. Underlying loans are expected to have a weighted average life of 2.5 years and be highly diversified. The Fund is expected to be globally diversified with approximately 50% of assets focused in Europe. CarVal ABF is targeting net returns of 10-13%. Since 2010, the CarVal Specialty Finance Opportunity track record reflects $10.7 billion of equity deployed across more than 350 deals in the U.S. and Europe resulting in a gross IRR of 18.1% and net IRR of 14.6%. More here (2024.06.25 SIC Meeting Materials)

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.