How Blue Owl became a $200 billion manager in less than 10 years

Fundraising from Eurazeo, Permira Credit, Shorooq Partners and Principal Asset Management.

👋 Hey, Nick here. If you’re new, this is the 63rd edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

How Blue Owl became a $200 billion manager in less than 10 years. Link

Oaktree takes over Inter Milan after its €275 million PIK loan fails to get refinanced. Deloitte claimed Inter Milan was the 14th most valuable football club in 2024. Link

JP Morgan is looking to acquire private credit firms. Link

Matt Levine explains why this is a great idea. Link

HPS caps its latest Corporate Lending fund at $10 billion. Link

📊 Charts of the Week

Thanks to Boring Business for sharing this. This week’s charts are from William Blair’s quarterly survey on Leverage Finance (Link).

TLDR: Loan volumes have hit their highest since 2021, leverage multiples are increasing and pricing is coming under pressure.

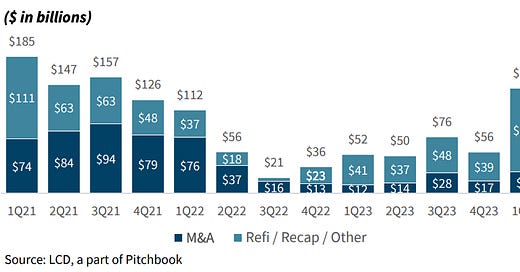

Institutional Loan Volumes

Institutional loan volume surged in Q1. The total volume reached the highest amount recorded in 10 quarters, with refinancing volume leading the way.

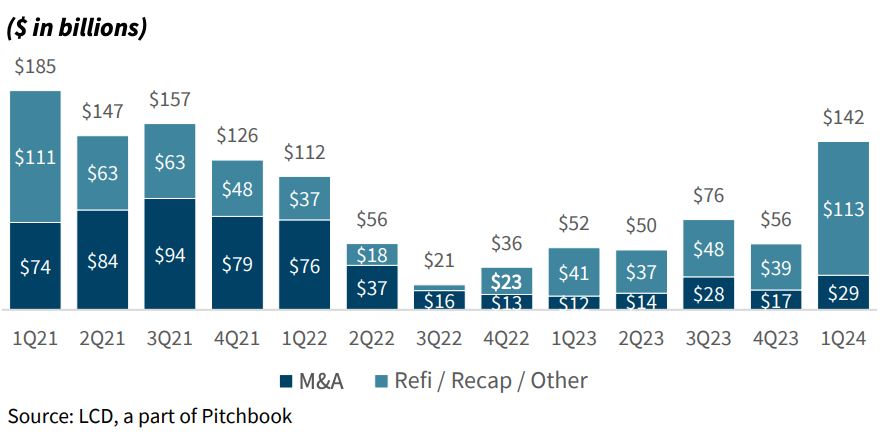

Leverage Loan Multiples

Total leverage in Q1 reached its highest level since Q3 2022.

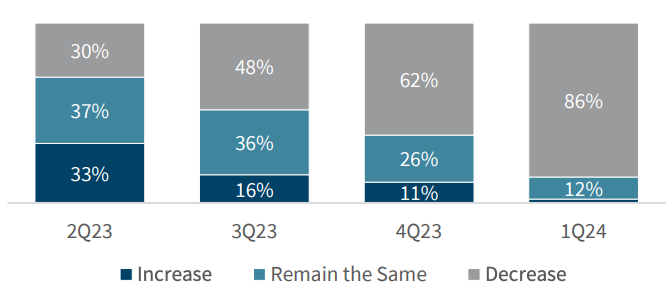

Pricing

86% of respondents said pricing had decreased QoQ

💰Fundraising news

Eurazeo, a Paris-based asset manager, announced the launch of a ~$4.3 billion Direct Lending Fund VII. The fund lends senior debt to leading European mid-market companies. The fund invests in companies with valuations between €30 million and €300 million and can lend between €10 million to €50 million per transaction. These companies operate in non-cyclical sectors such as business services, healthcare, specialized financial services, and technology. Eurazeo aims to be the "leading funder of SMEs in Europe”. More here and here

Permira Credit, a London-based credit manager, is raising up to $815 million for its first Strategic Opportunities fund. The fund lends to mid-market private companies in Northern and Western Europe. It will invest between ~€30 million to €100 million per transaction in 15 to 20 companies. It expects companies to have an enterprise value of up to €500 million. The fund will target a net IRR of 15%+. This is expected to comprise of 70% contractual elements and 30% equity components. Further details can be found in the Minnesota Board of Investment materials.

Shorooq Partners, an Abu Dhabi-based Venture Capital firm, launched its $100 million Venture Debt fund II. It will invest in Series A+ companies. These companies operate in sectors such as software, manufacturing, and fintech. The fund will have an average ticket size of $10 million. It is the second MENA focussed Venture Debt fund with Ruya Partners also announcing a first close in December. More here

Principal Asset Management, an Iowa-based asset manager, launched a private infrastructure debt strategy. Principal will target thematic investments in globalization, decarbonization, and electrification. More here