How Apollo is Applying Pickleball's Playbook to Build a $1 Trillion Credit Empire

Fundraising from Monarch Alternative Capital, Coller Capital, Ninety One and BNP Paribas

👋 Hey, Nick here. A special welcome to the new subscribers at ASC Advisors, AGF Investments and Citi. This is the 82nd edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Mizuho and Golub Capital announced a strategic partnership. As part of the agreement, Mizuho purchased a passive, non-voting minority stake in Golub’s management companies. Mizuho will also be the exclusive distributor of Golub’s investment products to retail and high-net-worth investors in Japan. Mizuho is the 17th largest bank in the world as measured by total assets of ~$2 trillion. Link

Apollo Buys Most of Deutsche Bank SRT Linked to $3 Billion of leveraged finance debt. Apollo took over 50% of the SRT transaction. Junior bonds of $420 million were priced at 10.5% over SOFR. A mezzanine portion of $120 million was priced at a spread of 3.75%. Link

Open AI closes a new $4 billion credit facility with JPMorgan, Citi, Goldman Sachs, Morgan Stanley, Wells Fargo and SMBC. More here

JP Morgan agreed to partner with Cliffwater, FS Investments, and Shenkman Capital Management. Link

Janus Henderson Completes Victory Park Capital Acquisition Link

Matt Levine: Private Credit Wants Everyone’s Money Link

🎾 How Apollo is Learning from Pickleball

Apollo hosted its Investor Day last week. There were two standout presentations that I highly recommend watching. 1) Marc Rowan’s Strategy Update 2) The Credit Update. The Credit Update was a masterclass in storytelling. Massive credit goes to Apollo’s IR and Marketing Team. Below is a summary of the credit update. You can watch the full presentations here

23 million people played tennis last year. How many people do you think played pickleball?

36 million. Thirty-six million people played pickleball last year.

How did this happen so quickly?

It didn’t take much, just a few changes—more adaptability in the sport, a little faster, and pickleball also addressed a few retirement issues.

Pickleball made the sport accessible, which was exactly what the market needed.

Four years ago, Apollo led a transaction for AB InBev. It was a $6.4 billion transaction for an S&P 500 company.

At the time, no one thought of Apollo as an investment-grade lender, let alone a large retirement service business. Many were cynical that Apollo could do this again.

But the reality of this transaction was that you saw all of the great things about Apollo. You saw its adaptability, you saw its speed and you saw Apollo meet with an investment-grade corporate and design something that fit AB Inbev’s needs.

This deal led to nearly $100 billion in private investment-grade deals over the last four years. These include transactions with Intel (Link), Air France KLM (Link), and AT&T (Link). While the bulk of the volume has been with Intel, it demonstrates how Apollo has grown its IG business.

Apollo developed a solution that was exactly what the market needed.

How have they done this?

They have many platforms.

Traditional managers have at least 5 origination platforms.

Apollo has 16 platforms.

This allows them to approach clients like Air France with options across several products.

They’ve built a large, diverse business.

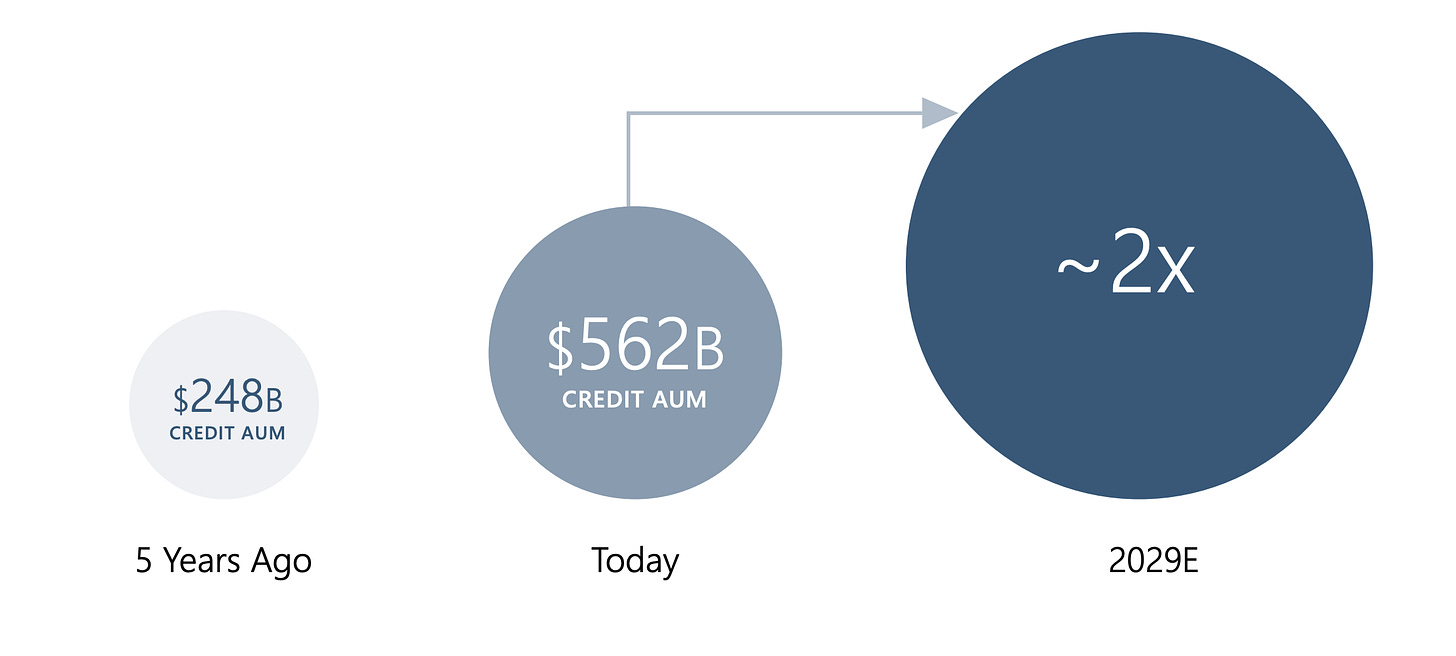

With $562 billion of AUM and a team of 4,000 originators, Apollo has built an extensive business. This allows them to reach a broad spectrum of sponsors and borrowers.

Apollo leads in debt origination, having deployed $151 billion over the past twelve months. They also are a top five participant in the secondary market. These leading businesses allow Apollo to move between either markets at any time. This is becoming increasingly important (More here).

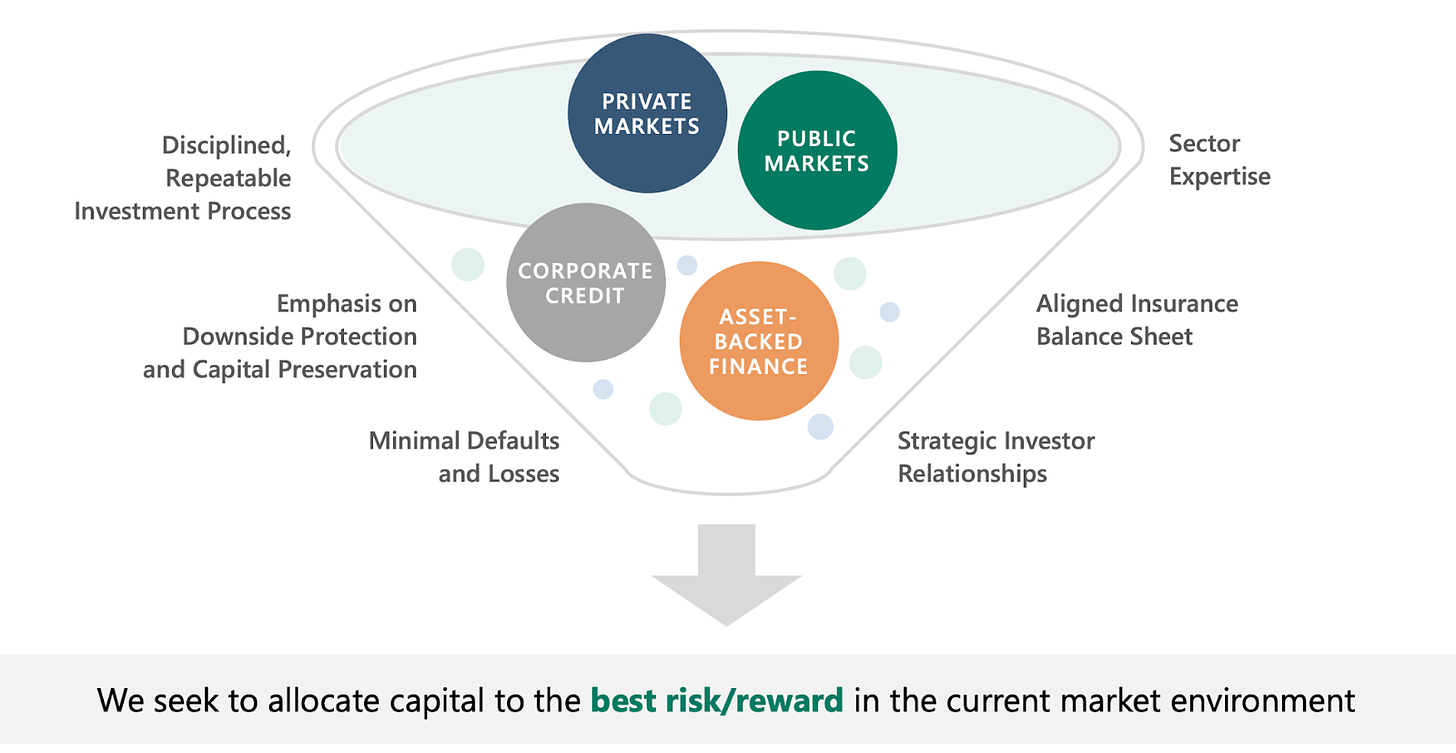

They allocate capital to the best risk/reward in the current market.

Apollo believes that traditional managers can’t think like them. Traditional managers are very narrow and very siloed. They have a private business or a public business. They have an asset-backed business or a corporate business.

Apollo sees itself as a credit allocation business.

It's not about private and public. It's not about corporate or asset-backed.

It's about what is going to be the best risk-adjusted return.

Apollo has used this playbook to double AUM.

They also believe that they will do this again.

And Just like pickleball, Apollo believes they are exactly what the market needs.

💰Fundraising News

Monarch Alternative Capital, a New York-based manager, closed its $4.7 billion Capital Partners VI fund. The opportunistic fund has a global mandate and invests across opportunistic credit and real estate. This includes corporate loans and bonds, capital solution investments, real estate lending, and structured credit. The fund has already invested $3.5 billion. More here

Coller Capital, a UK-based private market secondaries manager, launched its $250 million Private Credit Secondaries Fund. The fund is targeted towards high-net-worth investors outside the US. More here and here

Ninety One, a UK-based asset manager, closed its ~$160 million European Credit Opportunities Fund. The fund lends to non-sponsored borrowers in European mid-markets. Recent facilities include a founder-owned German renewable energy company, a privately-held UK waste recycling business, and a family-owned Swiss consumer products business. More here

BNP Paribas Asset Management announced a first close of ~$100 million for its second European Special Opportunities Debt Fund. The opportunistic fund of funds focuses on private debt funds holding stressed and non-core mid-market loans. It will invest in 6 to 8 private debt funds and target a Net IRR of 12-15%. The fund has a target size of EUR 300 million. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.