Four reasons why Blackrock acquired HPS

Fundraisings from Triton Partners, H.I.G. Bayside, Investec AIM, Navis Capital and more

👋 Hey, Nick here. A special welcome to the new subscribers at UVA Credit and Restructuring. This is the 91st edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Most Public Pension & Sovereign Wealth funds want to increase their private credit allocation in the next 12 months. OMFIF’s Global Public Funds 2024 report is out. Insights from 28 global public pension and sovereign funds with more than $6.5 trillion of AUM. Link

Helicopter Financing 101 with Thora Capital and Bong Choi Link

Blackstone’s Michael Zawadzki talks about the Long and Growing Runway for Private Credit Link

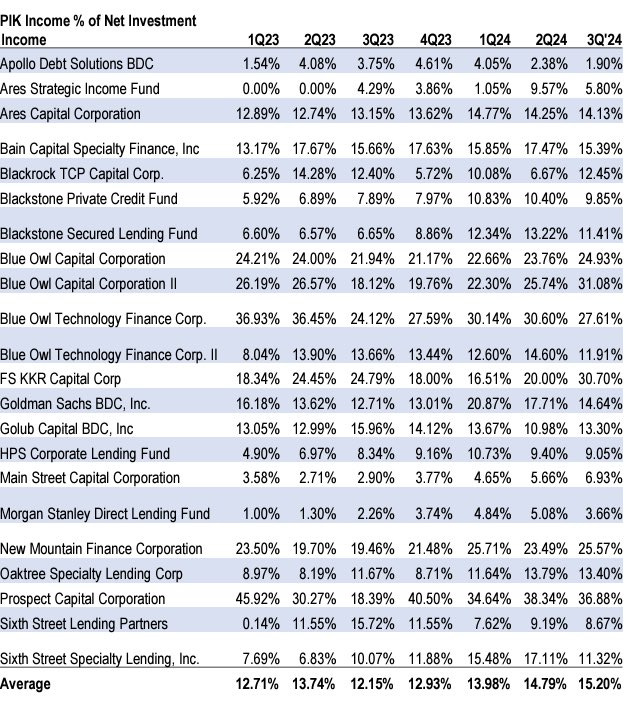

Q3 2024 BDC PIK update

Talking about BDCs, S&P lowered its rating on Prospect Capital’s BDC. See Prospect’s PIK above. Link

Private Credit ETFs are here. BondBloxx and Virtus launched ETFs that invest in private credit CLOs (See Fundraising section for further details). State Street and Apollo are also expected to launch ETFs Link

👫 Partnerships of the week

Brookfield acquired $925 million of CRE Loans from Valley National Bank Link

Mubadala is buying a 42 percent stake in Silver Rock Financial. Link

Allianz and Amundi have paused discussions about combining their asset management businesses into a European investment giant that would manage nearly $3 trillion Link

Four reasons why Blackrock acquired HPS 🏋️♀️

“The trend is your friend. Or, in Larry Fink’s case, your primary acquisition tickbox.” Chris Hughes - Bloomberg

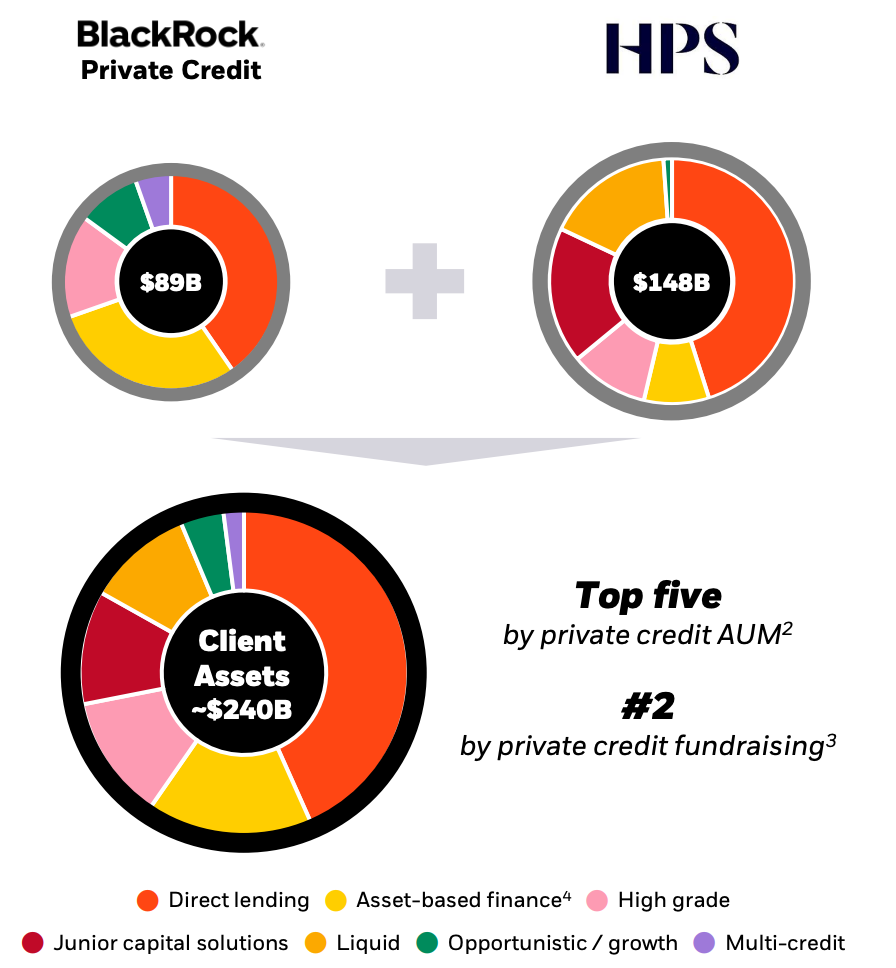

Blackrock confirmed it’s acquisition of HPS last week. As Chris Hughes points out, this acquisition ticks all 2024 private credit buzzwords. Here are the four reasons why this acquisition makes sense.

1) Private credit consolidation.

Prior to the acquisition Blackrock had $89 billion of private credit AUM which makes it ~12th largest private credit manager. Post the acquisition Blackrock will have $240 billion of private credit AUM making it a top five by private credit manager.

This will allow Blackrock to:

Consolidate ~$130 billion in direct lending and junior capital and extends Blackrock’s reach to upper middle-market, non-sponsor, more complex financings.

Deepen engagement with BlackRock’s existing insurance clients, which currently represent $700B+ in AUM,

Enhances Blackrock’s distribution opportunity across the fast-growing wealth segment. HPS currently only has a $20 billion retail private credit platform.

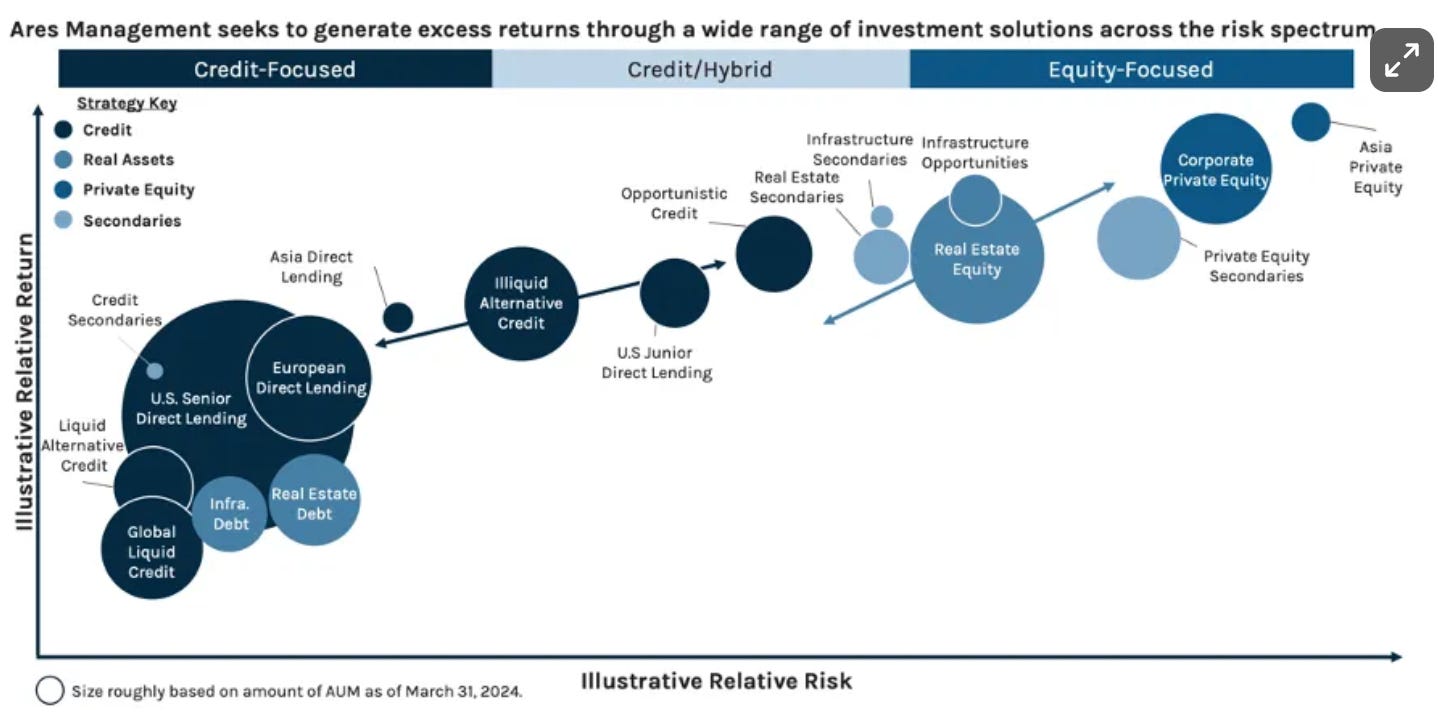

2) Navigating the Blurry Lines Between Public and Private Credit.

I wrote about this a few months ago.

It has become a popular narrative that this private credit’s growth comes at the expense of liquid credit. The reality is that the relationship is much more cooperative than zero-sum.

Sponsors continue to dual-track transactions and the choice between public and private markets often hinges on many factors.

Public markets offer cost-effective, straightforward options, but private lenders provide tailored solutions, especially beneficial for strategies involving mergers, acquisitions, and strategic purchases.

If public markets can give sponsors the best execution and the public market is open, sponsors will go for the public market.

Many of Blackrock’s peers have been keen to highlight how they are adapting to this.

Ares highlighted that its Credit Platform does not exist in a vacuum and the manager. has large strategies across the risk and return spectrum

“[Blackrock are] building portfolios that are seamlessly integrated across public and private for our clients.” Net Interest

3) Bank Partnerships

Citi CEO, Jane Fraser talked about Citi’s partnership with Apollo this week. Citi and other banks are looking for scaled direct lending partners to provide deal certainty.

Blackrock have been clear that they want to be a long-term capital partner for banks. There have been recent examples of this - Santander in October- but these have been far smaller compared to Apollo’s $25 billion partnership.

4) Barbell Strategies

At one extreme, investors flock to passive funds and ETFs for cheap, convenient access to benchmark returns.

At the other, those seeking higher returns allocate to specialist fund managers in private markets, hedge funds, real estate, and other alternatives.

Meanwhile, conventional fund managers in the middle feel pressure to up their game, specialise, or merge for scale.

Huw Van Steenis Vice Chair Oliver Wyman

Of all the coverage and analysis on Blackrock’s acquistion the above quote from Huw Van Steenis is the clearest rationale for the deal. Alternatives are Blackrock’s fee machine. As of last quarter, alternatives made up just 3% of BlackRock’s total assets, but generated 11% of total revenue. The HPS acquisition will further amplify this profitability and alternatives will make up over a quarter of BlackRock’s earnings post acquisition.

And if four reasons weren’t enough, here’s one more to seal the deal.

“The deal is a marriage of a large incumbent player with an entrepreneurial challenger that’s got a hot product itching to find a mainstream audience”

Chris Hughes - Bloomberg

💰Fundraising News

Temasek launched a $7.5 billion private credit platform. The platform will be managed by 15 professionals across offices in New York, London, and Singapore. Link

Triton Partners, a UK-based manager, closed its $1.1 billion Debt Opportunities II fund. The fund lends to European mid-market companies, primarily in Triton’s core sectors of Business Services, Industrial Tech, and Healthcare. It will focus on pull-to-par investments in senior secured non-control debt of fundamentally sound companies facing temporary headwinds, via the secondary market. It also provides primary and asset-backed lending on an opportunistic basis. More here

H.I.G. Bayside Capital, the special situations credit affiliate of H.I.G. Capital, closed its $1 billion Loan Opportunity Fund VII. The Fund lends to special situation credit opportunities in the European middle market. It invests primarily in senior secured European stressed and special situations credit, targeting equity-like returns. H.I.G. Bayside Loan Opportunity Fund V was named “Best Performing Debt Fund Over $1.5B” by Private Equity Wire/Bloomberg in November 2022. More here

BondBloxx launched a private credit ETF. The ETF will provide investors exposure to US middle market companies and will invest at least 80% of its assets in private credit CLOs. Link and Prospectus

Virtus Investment Partners, a Connecticut-based manager, launched its Seix AAA Private Credit CLO ETF. The fund will primarily invest in AAA-rated private credit CLOs and provide active management in a transparent, liquid, and cost-effective ETF. The fund will be managed by Seix Investment Advisors. Link and Fact Sheet

Investec AIM, the UK-based subsidiary of Investec Bank, held the first close of its second Private Debt Fund at $210 million. The fund finances both sponsored and unsponsored businesses primarily in the UK, Ireland, Benelux, and DACH regions. It targets companies with EBITDA between €3m and €50m. Investec’s Direct Lending team has sourced €9.5bn in loans across 330 transactions over the last 14 years. More here

Navis Capital Partners, a Southeast Asian manager, raised $135 million first Asian Credit Fund. The fund will lend to mid-market businesses across Southeast Asia. More here and here

Blue Earth Capital, a Swizerland-based impact investor, announced a first close of $113 million for its evergreen, semi-liquid impact private credit strategy. The fund lends to organizations that promote environmental and social impact, with a special focus on organizations providing access to basic needs and services. It typically lends $20 million per transaction and can invest in emerging and developed markets. More here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.