Extending Credit: The Evolving Role of Banks in Private Credit

Fundraisings from Bain Capital, Silver Point Capital, Gramercy, Pantheon and Ninety One

👋 Hey, Nick here. A special welcome to the new subscribers at Evvolve & Partners, HPS Partner, and Jarden Group. This is the 89th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Oaktrees Earnings Transcript: “In the fourth quarter, the median EBITDA for our portfolio of companies was $140 million and the median leverage was 5.2 times.” Link

How is private credit weathering its first big rate hiking cycle? FT Alphaville Link

The Rise of Rated Feeders Link

Bank lending to Non-depository financial institutions has increased 300% since 2015. Banks’ Commercial lending has increased only 50% over the same period. Link

PitchBook LCD Global Private Credit Survey Link

👫 Partnerships of the week

“Our LPs are consolidating their relationships and looking to deploy more money with fewer GPs... What becomes important in this context is not only the track record and credibility of the manager but also their ability to deploy large quantities of capital.” Bashak-Julianna Demir, Global Head of Client Relations and European Head of Marketing, ICG Link

Brookfield invests $1 billion in 17Capital’s NAV private credit funds. Link

Blackstone backs Brigade with $300 million for its new private credit strategy and to expand its CLO platform Link

🏦 Extending Credit: The Evolving Role of Banks in Private Credit

Oliver Wyman consistently publishes great private credit thought pieces. You may have previously seen one here. This week’s report is a collaboration between Oliver Wyman & Morgan Stanley.

Below are my favorite extracts but I recommend you read the full report here

Wholesale banks have spent the years since the Global Financial Crisis reshaping their business models to build resilience and generate sustainable returns.

Banks are increasingly shifting toward “originate-to-distribute” models to increase balance sheet velocity and retain a share of the economics through origination fees — this model sacrifices interest income, but delivers higher overall returns, preserves the client relationship, and creates dynamic distribution networks that banks can leverage to manage risk

Private Credit & Bank Partnerships

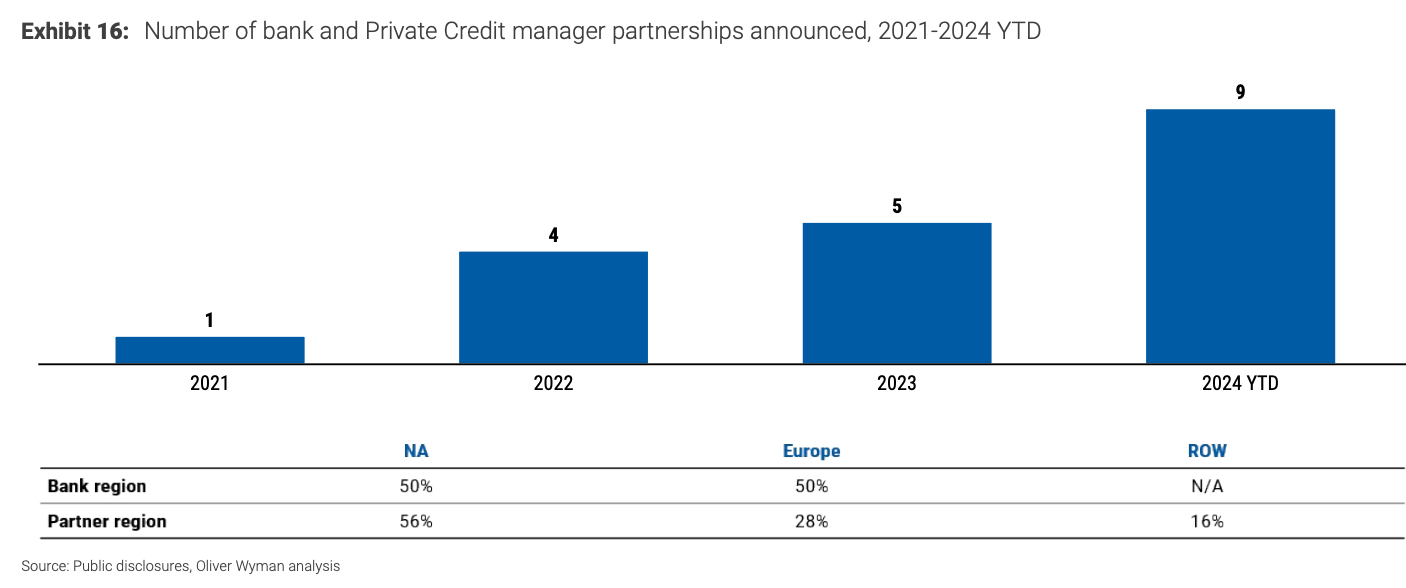

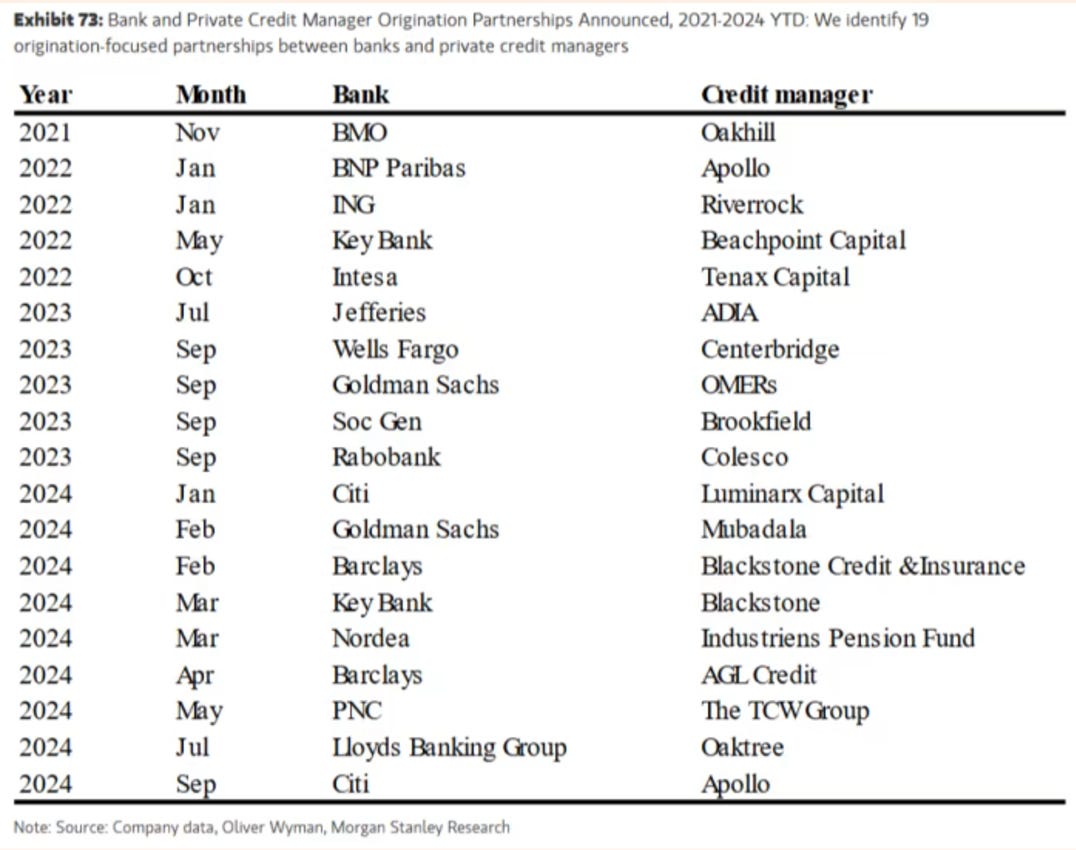

As Private Credit managers increase their assets under management (AuM) and diversify beyond direct lending, building new routes for origination becomes increasingly important to (1) provide sufficient opportunities to deploy capital and (2) originate opportunities aligned with new strategies (e.g., asset-based finance). Partnering with banks to access their origination networks is one way to achieve this objective.

The Role of Insurance in Private Credit’s Growth

An outsized driver of Private Credit’s recent growth has been demand from life insurer and reinsurer accounts in the US and Bermuda. In the US, life insurers hold ~$5.5 trillion of assets, of which approximately 75% are investment grade credit products. Historically, these accounts invested predominantly in public investment grade corporate and government bonds and publicly traded asset-backed securities. As major alternative asset managers have acquired insurance balance sheets, these investment portfolios have shifted toward a more diversified, higher yielding portfolio — including CLOs, commercial mortgages, and limited alternatives allocations.

This trend has more room to run and Asset-Based Finance (ABF) has become the new frontier for insurance balance sheets, allowing Private Credit managers to originate a broader set of assets and place them with insurers through structuring and credit enhancement that make these assets suitable for investment.

We estimate the addressable market in US specialty finance alone is ~$5.5 trillion AuM

Managers with permanent capital insurance vehicles have been particularly active in this space, as they leverage their low cost of capital to match asset-liability durations. For example, ~35% of Apollo’s total credit AuM is now dedicated to ABF strategies, almost double that of three years ago at ~$197 billion. Banks will continue to play a key role in origination, warehouse financing, structuring, and servicing of ABF lending given their entrenched customer relationships — but Credit managers will hold an increasing proportion of these loans, either originating directly or in partnership with banks.

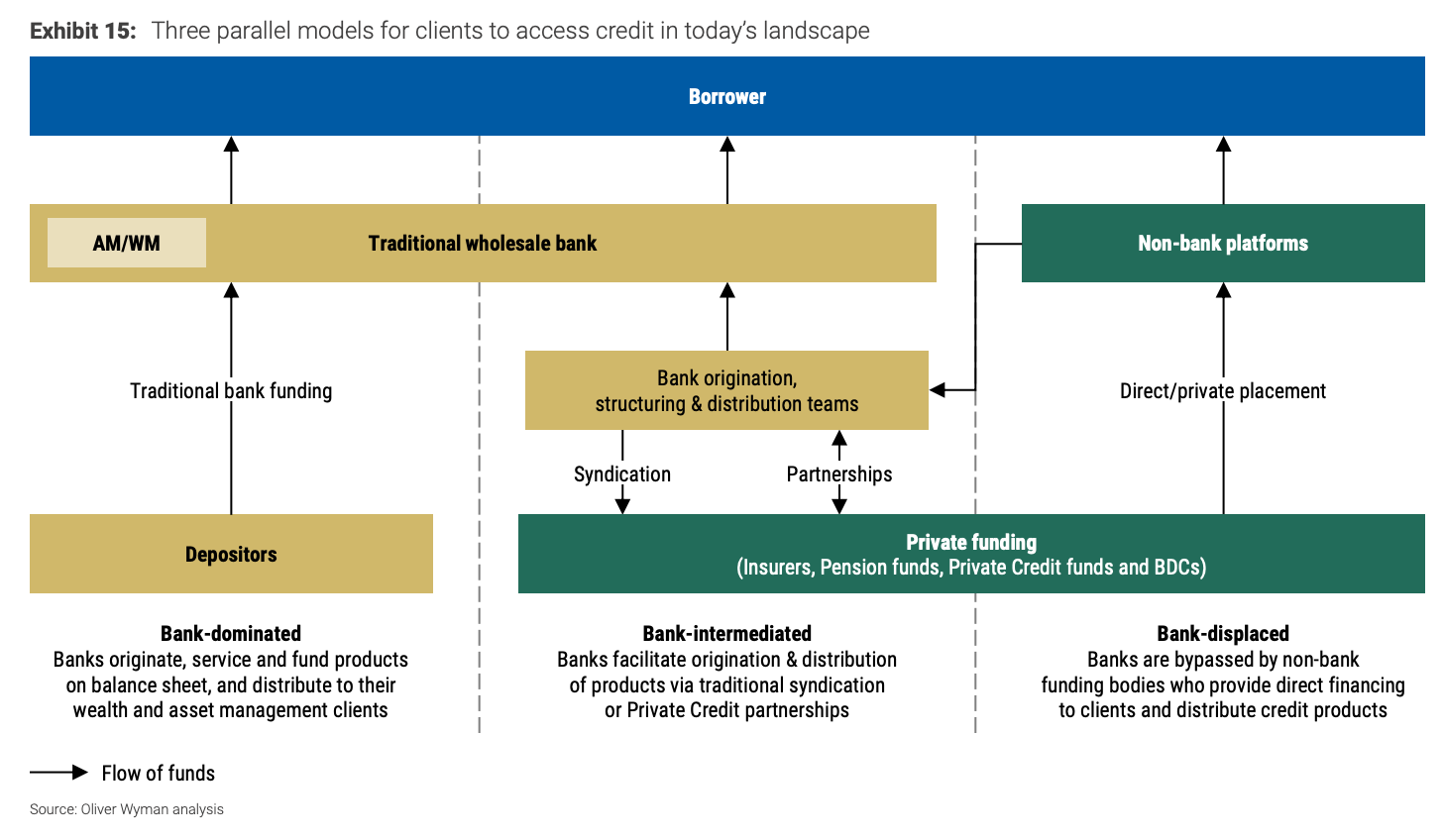

Three models to access credit

True disintermediation of banks remains limited, but this trend has become more common over the past 10-15 years, particularly in the US market.

💰Fundraising News

Bain Capital raised $9 billion for its Global Special Situations Fund II. The strategy pursues opportunities across three primary investment strategies:

Capital Solutions: Investing and partnering with companies to fund growth and M&A, provide liquidity, or optimize a company’s capital structure.

Hard Assets: Supporting asset owners and operators across the capital stack to structure tailored investments and build platforms that address market inefficiencies.

Opportunistic Distressed: Investing in complex and often misunderstood assets in dislocated market environments.

Silver Point Capital, a Connecticut-based manager, closed its $8.5 billion Specialty Credit Fund III. Silver Point's Direct Lending strategy lends to sponsored and non-sponsored middle-market companies in North America. The fund focuses on companies with EBITDA between $25 to $100 million and typically lends $200 to $500 million per transaction. Silver Point oversees $35bn in assets across private and public credit strategies. More here and here

Gramercy, an emerging markets manager based in Connecticut, closed its $760 million Capital Solutions Fund III. The Fund invests in USD loans, mostly primary, across Latin America (~75%) and CEEMEA (~25%), diversified across industries, company types, and sizes. Loans aim to deliver attractive mid-teens returns. They are typically structured as highly covenanted, asset-backed, self-liquidating structures, with strong LTV ratios and cash flow control. To date, Gramercy has deployed approximately $5 billion across over 100 investments. More here

HSBC Asset Management is raising at least $500 million for its Venture Debt strategy. The strategy lends senior secured loans to growth and late-stage VC-backed tech and life science companies. It will leverage HSBC Innovation Banking’s presence in the UK, US and Europe and will target annual returns of 15% to 18%. More here and here

Barings raised $400 million for its first European middle market private credit CLO. The CLO is backed by a portfolio of nearly 50 private credit loans representing eight European countries, in addition to a European broadly syndicated loan bucket. Barings European Private Credit has invested over €13 billion across 153 senior transactions with 64 different sponsors in the last three years. More here

Pantheon launched its Credit Solutions Fund, an evergreen fund providing the US private wealth market access to private credit secondaries. Pantheon believes the fund will benefit from several key strengths of secondary investing, including the potential for attractive discounts, greater diversification, shorter durations, and more immediate distributions compared to private credit alternatives. Pantheon has been investing in private markets secondaries since 1988 and has more than $3 billion in client assets dedicated to private credit secondaries. More here

Ninety One, a UK-based asset manager, announced a first close of $260 million for its third African and emerging market-focused credit opportunities strategy. The Fund invests in USD loans and bonds issued by mid to large-sized corporates across Africa. The ACO Fund 3 aims to provide investors with competitive return outcomes whilst simultaneously advancing economic development through sustainable capital deployment in Africa. The African strategy has invested over $1.2 billion across 82 counterparties in more than 20 countries since its launch. Almost half of these investments have been made in infrastructure and telecoms. More here, here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.

Curious: What do you think about Pagaya and its role in facilitating as a middleman in between the highway of private credit and bank originators? Seems like value-add comes from ability to execute on consumer-centric credit underwriting, but couldn't these private credit shops build in-house capabilities themselves without sacrificing any of the spread?