European Direct Lender Rankings

Fundraisings from LCM Partners, Morgan Stanley, WhiteHawk and Altriarch.

👋 Hey, Nick here. A special welcome to the new subscribers at PGIM, Callaway Capital Management and With Intelligence. This is the 85th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

They don’t tell you this in the IC memo. 🤦♂️ UK-based Trade Union is protesting against Pemberton over its management of ready meal maker, Oscar Mayer. Pemberton found itself running the ready-meal company after staff shortages fueled by Brexit and a spike in inflation forced the business to restructure its debts. Unite accuses Oscar Mayer of trying to fire and rehire its employees, as well as plans to remove some paid breaks, reduce other breaks and deprive staff of any extra pay and days off for working holidays. More here

How Scott Kapnick built HPS into a $10 billion ‘whale’. Link

Having built Barings’ $36 billion Direct Lending Unit, Corinthia’s team aims to do it again. In half the time. Link

Ares enters Joint Venture with CAL Autmotive to Invest up to $1.5 Billion in New Vehicle Leases. Link

Abu Dhabi’s Private Credit Heist. Link and here

Florida State Board of Administration is selling $4 billion of private credit stakes. The pension fund is offloading opportunistic credit to focus on ‘boring credit’. Link

Sixth Street agrees to invest $500 million in Merchant. Link

🐮 Chobani’s Dividend Recap. Link

🎧 Why Banks and Private Credit are teaming up Link

Wendel to acquire a 75% stake in Monroe Capital for $1.13 billon deal. Link

Private Credit firms are competing to provide $5 billion to fund a buyout of Bausch + Lomb. The debt deal could become one of the largest private credit deals. Link

📊 European Direct Lender Rankings

Reorg published its European Direct Lender Rankings. You can read the full update here.

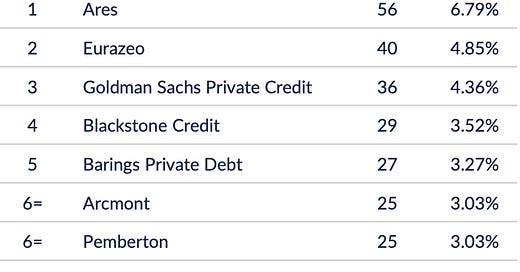

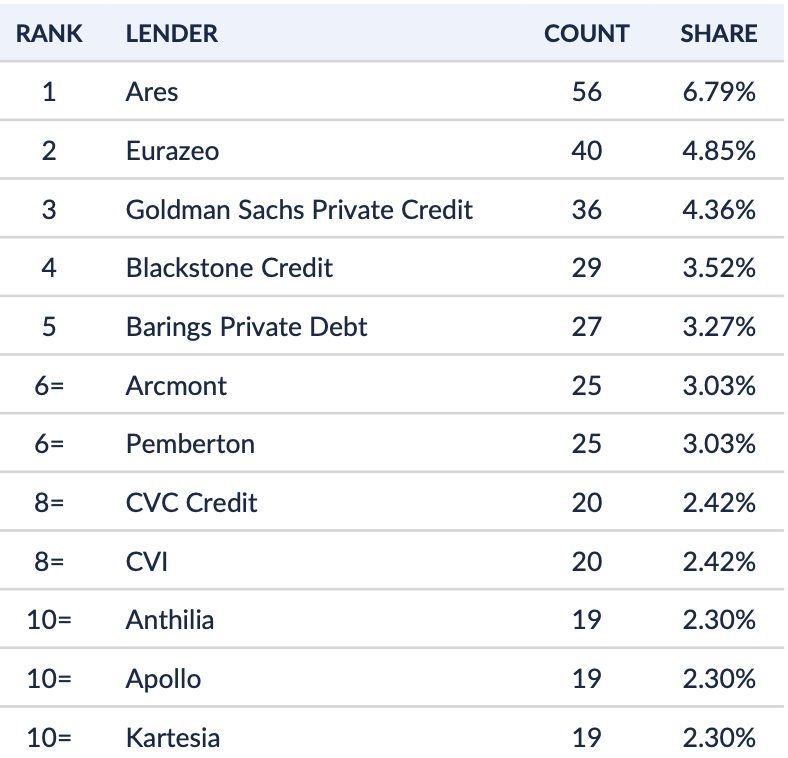

Top 10 Direct Lenders in 9M 24

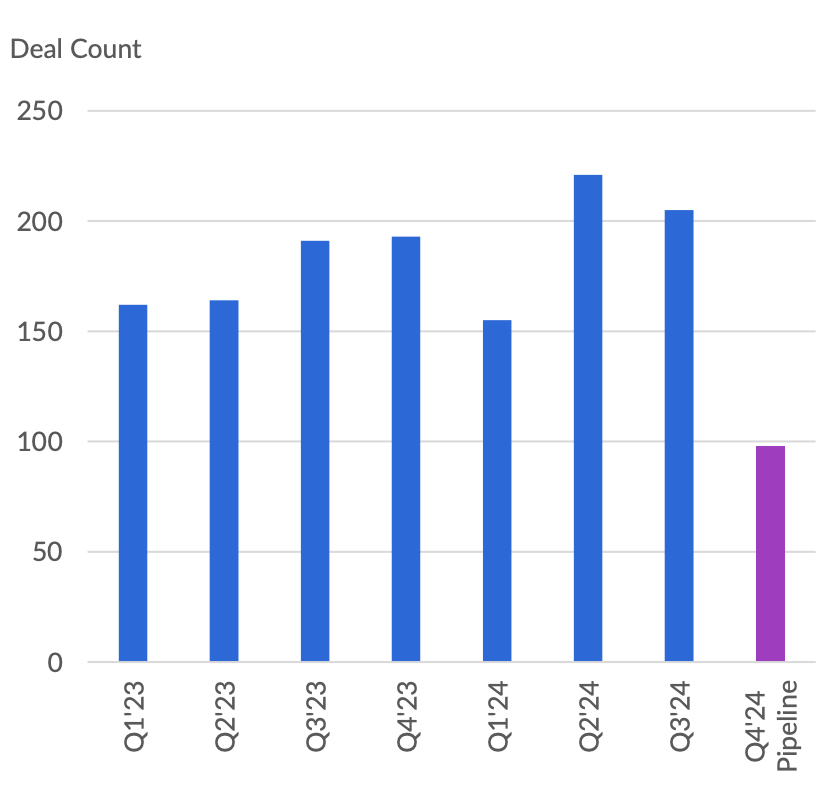

European direct lending activity for the first nine months of 2024 was robust, totaling 581 deals — an 12% increase from the same period in 2023.

Lower mid-market deals continued to dominate the market, accounting for 74.5% of the total activity

The UKI region remained attractive for direct lenders representing 34.3% (199 deals) of the market. France (16.9%, 98 deals) and DACH (13.9%, 81 deals) remained in second and third place, respectively.

Deal Activity

💰Fundraising News

LCM Partners, a London-based alternative asset manager, is raising $6.5 billion for its Credit Opportunities V. The fund will invest in both performing and non-performing loans and targets an IRR of 15%. Brookfield owns 49.9% of LCM.

“It can sometimes feel like we are a garbage people for the banks because we buy assets and structures they either don’t want or don’t need any more

Morgan Stanley Investment Management closed its $2 billion North Haven Tactical Value II. The opportunity fund is more than 50% larger than its predecessor and will leverage Morgan Stanley's network for deal sourcing. It can invest in credit, hybrid, and non-control equity investments. More here

WhiteHawk Capital Partners, an LA asset-based lending manager, closed its $1.1 billion Fund IV. The fund provides non-traditional capital solutions to companies needing liquidity and growth capital. Investment sizes range from $15 - $200+ million for companies with valuations between $25 million - $1+ billion. WhiteHawk can be flexible around collateral and will lend against Tangible and intangible Assets. More here and here

Altriarch Asset Management, a Charleston, South Carolina private credit firm, announced a $70 million commitment from the State of Wisconsin Investment Board.

Altriarch provides asset-based loans to specialty lenders and small businesses. It can lend senior, mezzanine, and participation capital up to $50 million per borrower. More here and here

iCapital, a New York-based alternative investments marketplace, is raising $200 million for a private credit fund. Bain Capital, Audax Group and Charlesbank Capital Partners will help it manage the fund. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.