👋 Hey, Nick here. A special welcome to the new subscribers at Blue Owl, Genesis Ventures, and Deal Catalyst. It’s great to have you. Reach out and say hi. This is the 95th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Beers, Dumplings, and Billion-Dollar Deals: NYT’s Sensational Take on Blue Owl’s Founding Story Link

Man Group: Why size matters in an increasingly bifurcated direct lending market. Link

Carlyle secures the private debt mandate of Chikyoren, Japan’s ~$240bn Pension Fund Association for Local Government Officials. Link

Mubadala Tops 2024 Sovereign Wealth Fund Rankings with $29.2bn of investment in 2024. Mubadala invested $17.5bn in 2023. Link

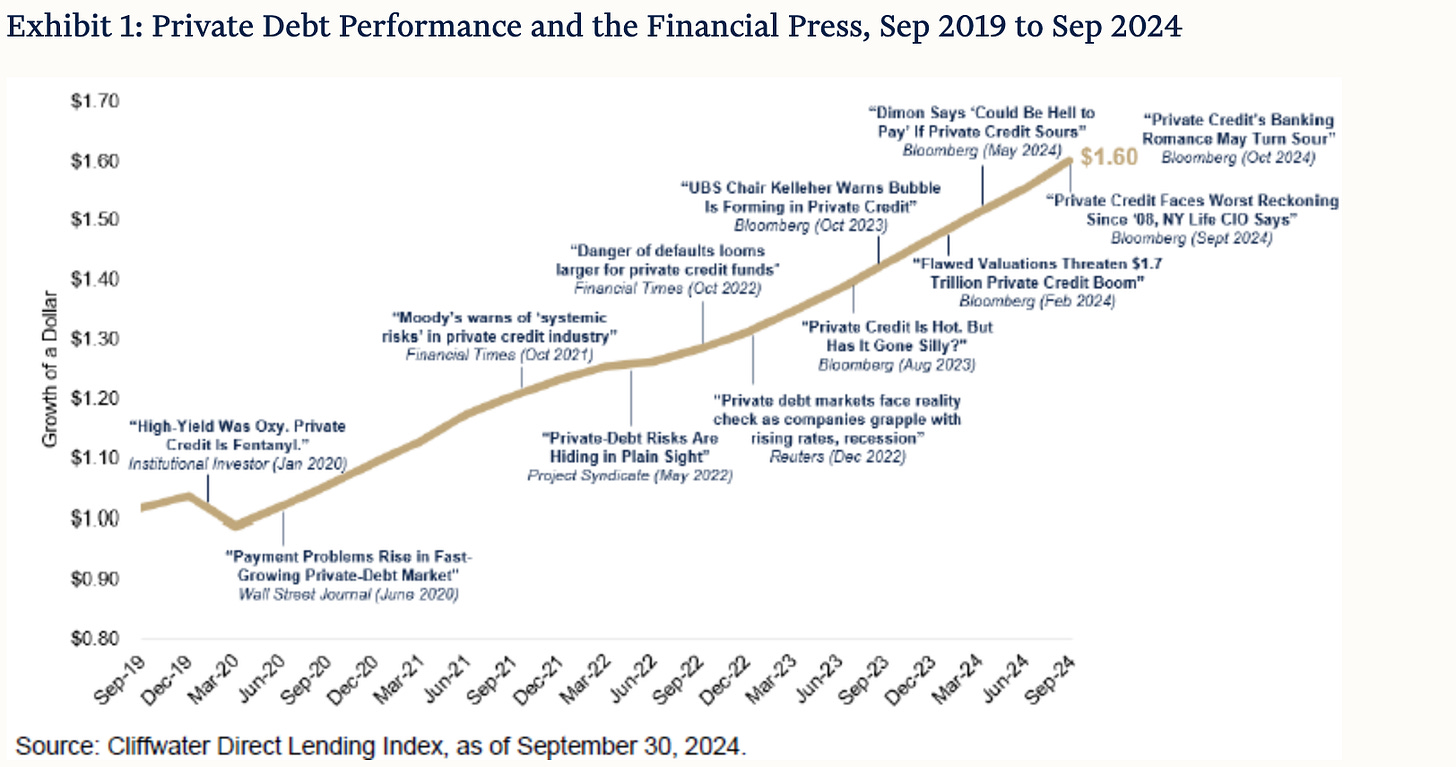

Cliffwater Challenges the Media Narratives on Private Credit Link

📊 Confronting Private Credit’s Brutal Facts in 2025

I spent most of my weekend reading Private Credit Outlooks for 2025. After reading 30+ outlooks, I can summarize the consensus in 4 bullet points:

We will see a resurgence in deal and exit activity.

There will be a revival in IPOs.

Data Centers, AI, and energy generation (particularly nuclear) are massive opportunities.

Yields are expected to remain well above historical levels.

Sounds like 2025 is going to be great for you all. Time to buy that Rolex. Go into debt if you have to…

Fortunately, I know that you are all smart readers and if I published this alone you’d be disappointed in me. I’d be disappointed in me. And to be fair you deserve more.

The Stockdale Paradox & Brutal Facts

I’m a fan of Jim Collins. If you haven’t read any of his books I’d highly recommend starting with Beyond Entrepreneurship 2.0.

Jim describes how great leaders and great companies embrace the Stockdale paradox. This concept is named after Admiral Jim Stockdale, the highest-ranking officer in the Hanoi Hilton prisoner-of-war camp during the Vietnam War. Tortured over twenty times during his eight-year imprisonment, Stockdale lived out the war without any prisoner’s rights, no set release date, and no certainty as to whether he would even survive to see his family again.

Embracing the Stockdale Paradox can be summarized below:

You must retain unwavering faith that you can and will prevail in the end, regardless of the difficulties, and at the same time you must confront the most brutal facts of your current reality, whatever they might be.

You must believe you can survive the camp and will live to see your loved ones again, and at the same time you must stoically accept that you will not be out by this Christmas or the next Christmas or even the next Christmas after that.

Never fall into the leadership trap of creating false hopes soon to be destroyed by events. Yet equally, never capitulate to despair and lose faith that you will prevail in the end….

You need the Stockdale Paradox to lead a company from good to great.

You need the Stockdale Paradox to navigate turbulence and disruption.

You need the Stockdale Paradox to reverse decline and engineer a return to success…

Great leaders confront the brutal facts before they set a vision and strategy, and they create a climate where the truth is heard. Failure to confront the brutal facts is a precursor to catastrophic decline, always.

I know you are all great leaders. It’s time we confront six brutal facts before deciding how great 2025 will be.

These are my top 6 brutal facts, comment below if I’ve missed any.

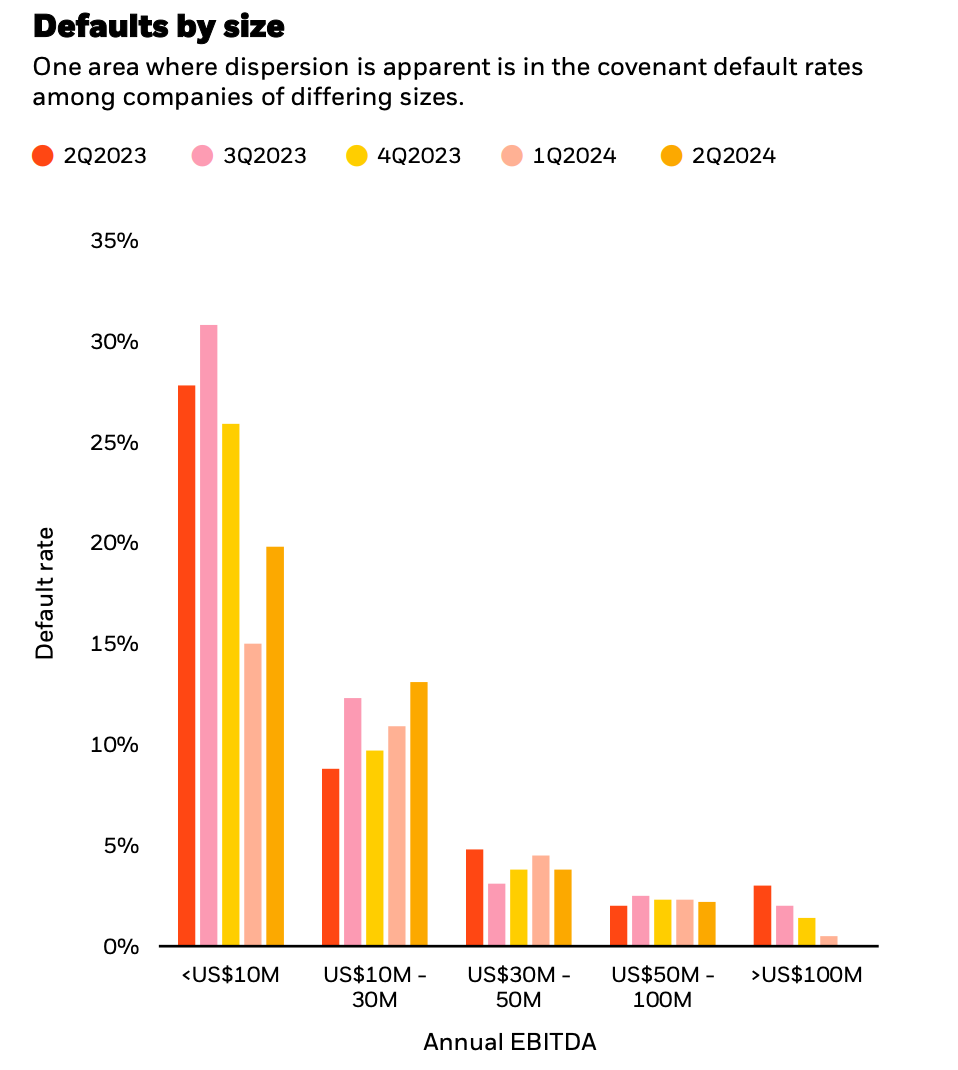

Deepening Dispersion

One of the main themes continuing into 2025 is dispersion, but not widespread market disruption. Resilience is not equal in all parts of the market. Dispersion will persist across managers, strategies, vintages, and geographies.

Dispersion by sector should continue. Each industry faces its own unique set of growth drivers and headwinds, creating different degrees of cyclicality, pricing power, operational agility, and financial flexibility.

Germany is in recession, there are “trading issues” in France and it’s not much better in the UK.

Loan Amendments, PIK, and Defaults

As I’ve highlighted before, most lenders have 20-30% of their portfolio in amendment discussions.

Many managers have addressed these amendments through increased use of PIK. However, as Barings suggests “in private markets, you are often able to kick the can down the road, but it doesn’t work in perpetuity”.

Bank of America forecasts that default rates could rise as high as 4% in 2025, approaching or converging with public credit.

"A lot of 2021 vintage deals, which are creating the overhang in these portfolios, will have to reach some sort of their end game over the next one to two years.”

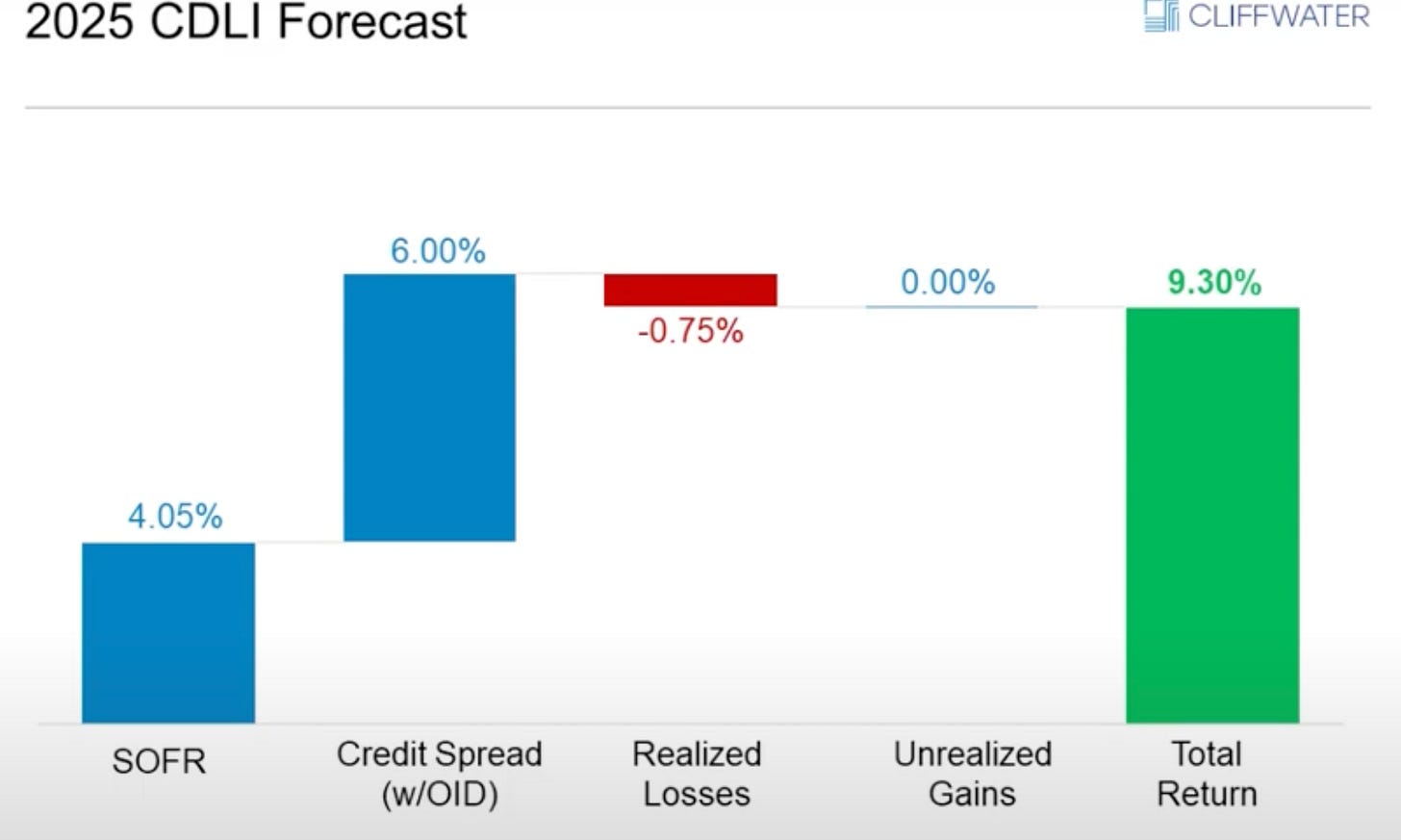

Competition and Margin Compression

The banks are back and heightened competition between banks and private debt funds has resulted in lower spreads and looser covenants.

To beat out the broadly syndicated loan market, private credit has to offer covenants that give borrowers more flexibility, including PIK toggles.

Apollo and Cliffwater forecast all-in yields between 9.3% and 9.5%. Pitchbook forecast credit spreads lower than this.

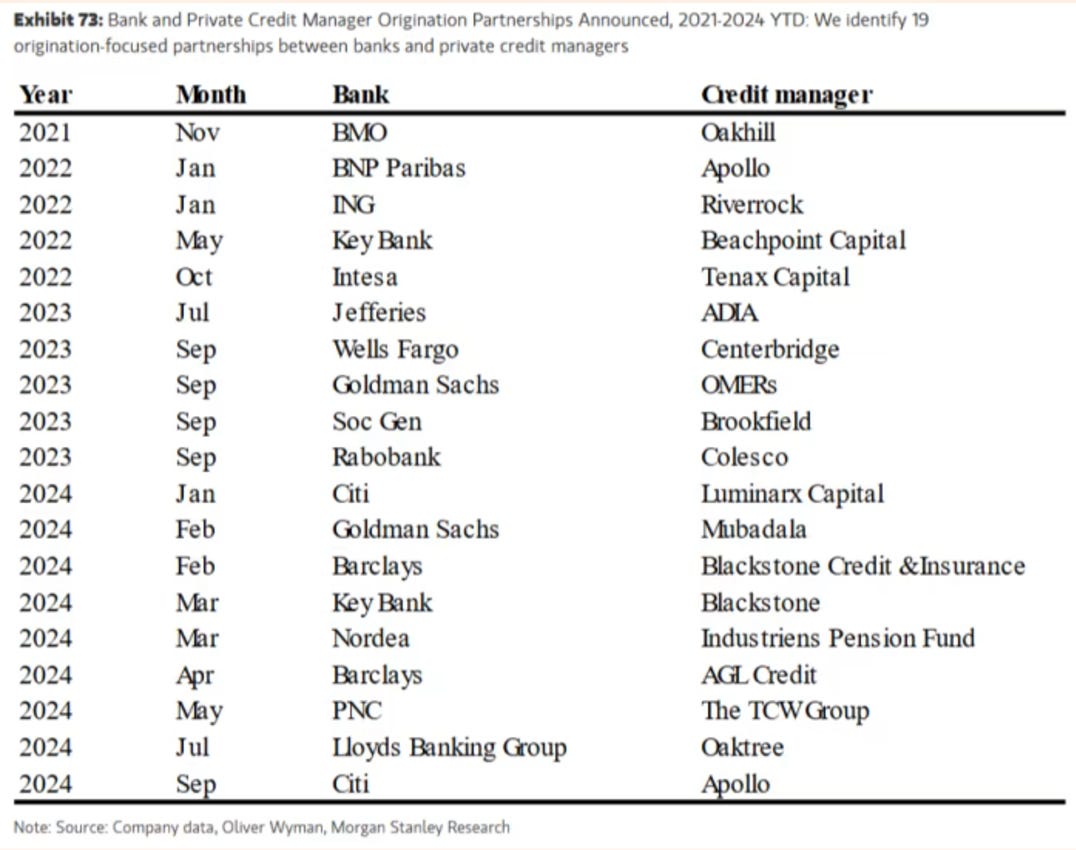

Bank & Insurer Partnerships

Banks & insurers are increasingly working with asset managers. 2024 was a record year for partnerships and this doesn’t show signs of slowing down.

Apollo’s $25 billion partnership with Citi was a highlight but other notable partnerships are highlighted below:

The consensus view is that bank partnerships will expand the breadth of companies accessing private credit and insurance partnerships will deepen pools of capital.

What happens to managers who fail to find partnerships?

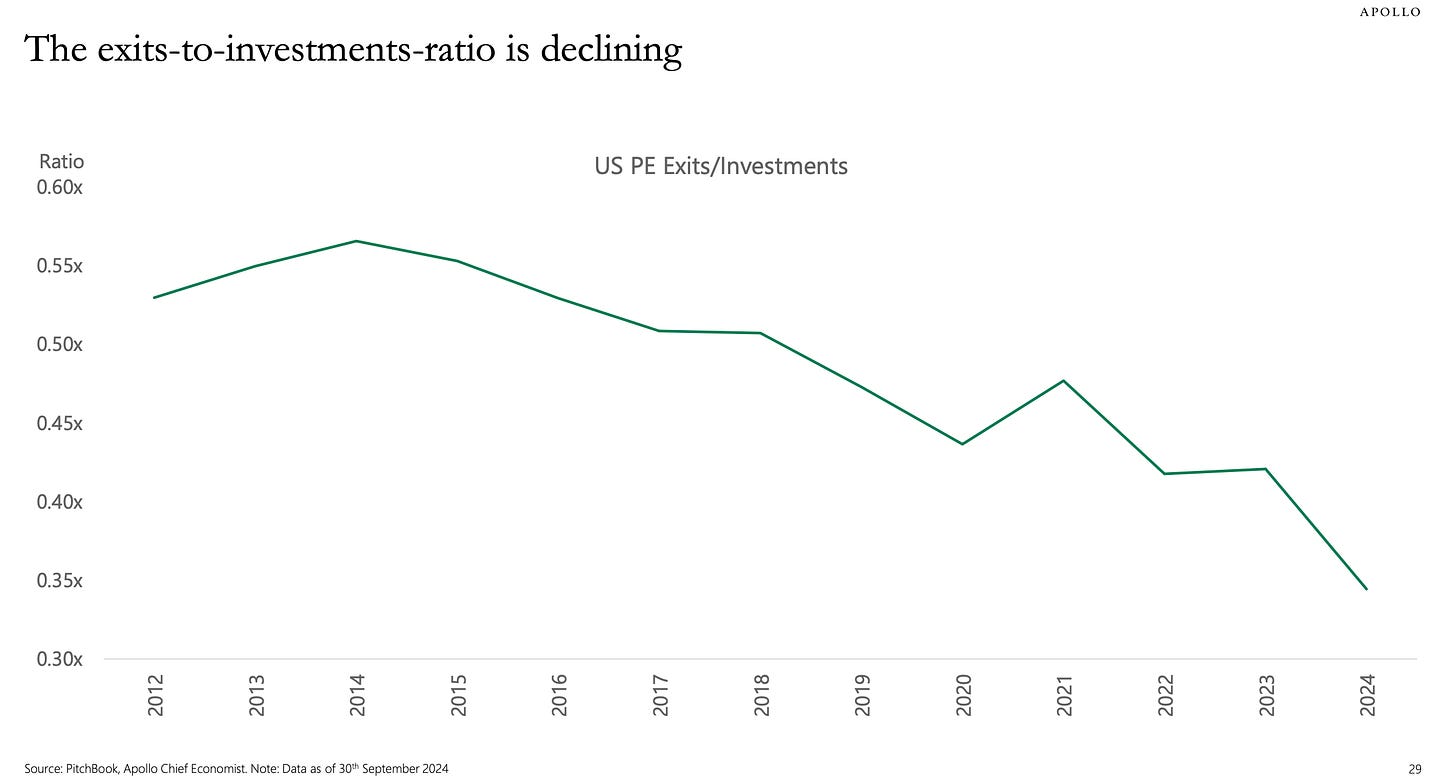

PE Liquidity Demands & Dry Powder 🛫

The backlog for the first quarter, as we sit here in early December, is as high as we’ve seen in a while coming into a new year. More evidence that unrealized exits are starting to come to market,

“These new deals are planes on the runway waiting to take off. And there are planes looking to land that have been circling the airport for a while.”

Randy Schwimmer, vice chairman of Churchill Asset Management.

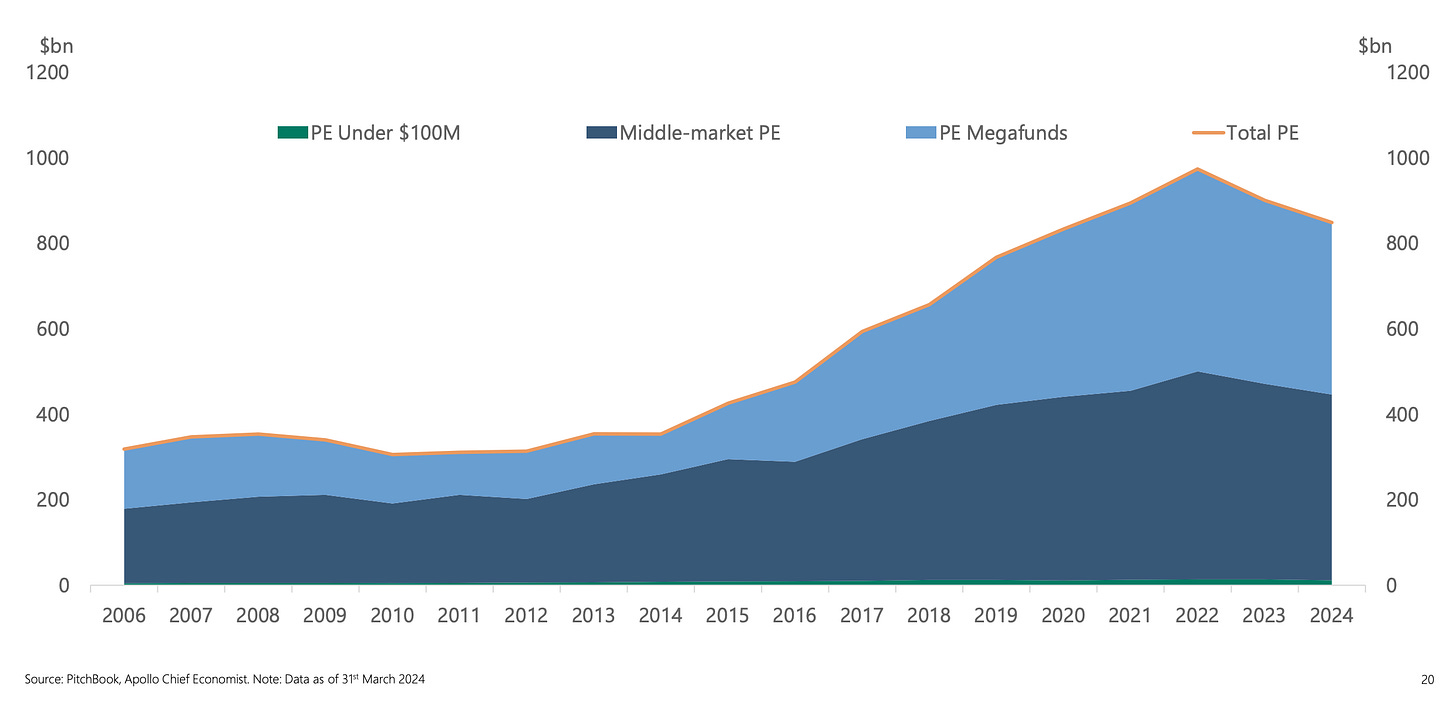

PE Dry Powder is near all-time highs.

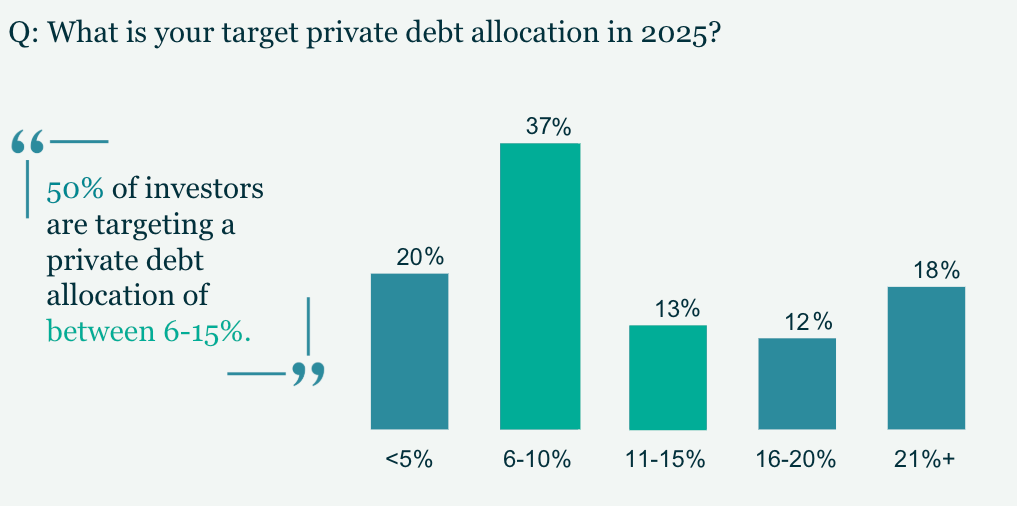

Private Credit Allocations are Likely to Remain Robust

Most investors expect to increase their allocations with half of investors targeting between 6-15%.

But as I highlighted last week, Megafunds and leading managers stand to gain the most from this.

“As a new entrant, the odds are stacked against you right now”

Tyler Gately, Head of North America Private Credit at Barings

Challenges aside, 2025 offers many reasons for optimism. If these brutal facts seem daunting, remember the Stockdale Paradox:

You must retain unwavering faith that you can and will prevail in the end, regardless of the difficulties, and at the same time you must confront the most brutal facts of your current reality, whatever they might be.

Thanks for reading, let me know if you think I’ve missed out on any brutal facts.

💰Fundraising News

Blackstone raised ~$75 million from the New Hampshire Retirement System for its Private Multi-Asset Credit Fund. The interval fund invests in a wide range of credit strategies with a focus on private investments. It will focus on investments in the U.S. but has no minimum or maximum limit on the amount invested outside of the U.S. More here and here

Tacora Capital, a Texas-based Venture Debt fund, raised $268.7 million for its second fund. Unlike traditional venture debt, Tacora focuses primarily on asset-based lending to venture-backed businesses. The fund lends against loans, leases, invoices, purchase orders, receivables, and a little bit of equipment. It typically lends between $10 and $40 million per transaction. Fund I closed at $350 million, raising $250 million from Peter Thiel and the remainder from five other investors that included one large endowment and one large foundation. More here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.

Amazing piece!