Buy the Debt.

The Asset Based Lending Land Grab is on. Fundraising from Ares, BNP Paribas, Forum Investment, Root Capital and more

👋 Hey, Nick here. A special welcome to the new subscribers at Hollyport, Phoenix Merchant, and ASC Advisors. This is the 83rd edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Mark Rubenstein: Incumbents are no longer resisting. JPMorgan, Citi, and BlackRock are all positioning themselves to benefit from the Private Credit trend. A new ecosystem in finance is emerging and so far it hasn’t been stopped. Link

Schroders “The most interesting opportunity is where there’s emotional bias and fear — and that’s in the commercial real estate market”. Bloomberg has more here, Listen to the podcast here

Montana Board of Investments increases its Private Credit allocation to 4%. Link

Private equity’s latest source of leveraged buyout funding is US farmers. Butterfly Equity is acquiring The Duckhorn Portfolio, a North American luxury wine company, financed by the Farm Credit System. Press release and FT article

Moody’s reports higher default rates among PE-backed firms. Link

Buy the Debt.

The race for asset-based & infrastructure Lending AUM is on. Last week saw over $30 billion of acquisitions. Below are my highlights (Let me know if I missed any)

Several managers are considering investing in or buying HPS before a potential IPO. Suitors include BlackRock, Abu Dhabi-based manager Lunate, and CVC Capital Partners. More here

BlackRock completed its acquisition of Global Infrastructure Partners, a leading independent infrastructure manager with over $100 billion in AUM. BlackRock paid $3 billion in cash and ~$11.8 billion in BlackRock’s stock. Here

Blue Owl expanded into the data center space, acquiring IPI for $1 billion. Founded in 2016, IPI has a portfolio of 82 data centers comprising more than 2.2 gigawatts of leased capacity globally. More here and here

Blue Owl has also acquired three other managers this year. Investment manager Kuvare Asset Management, real estate lender Prima Capital Advisors, and credit manager Atalaya Capital Management

Castlelake agreed to buy over €3 Billion of Consumer Loans from Alma, a Buy-Now Pay-Later platform in France. The forward flow agreement will allow Castlelake to buy short-duration payment facilities originated online and in stores over 2.5 years. BNP Paribas and Santander CIB will provide senior financing as part of the agreement. More here

Blue Owl is continuing its push into asset-based finance by purchasing $2 billion of consumer loans from fintech lender Upstart. The forward flow agreement will unfold over the next 18 months. Apollo’s Atlas SP Partners will provide the debt financing. More here

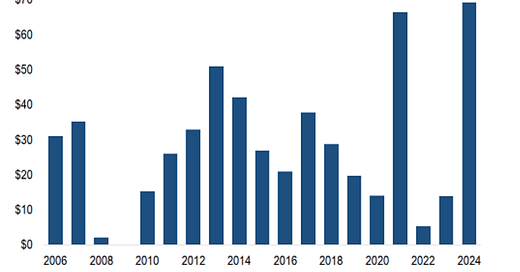

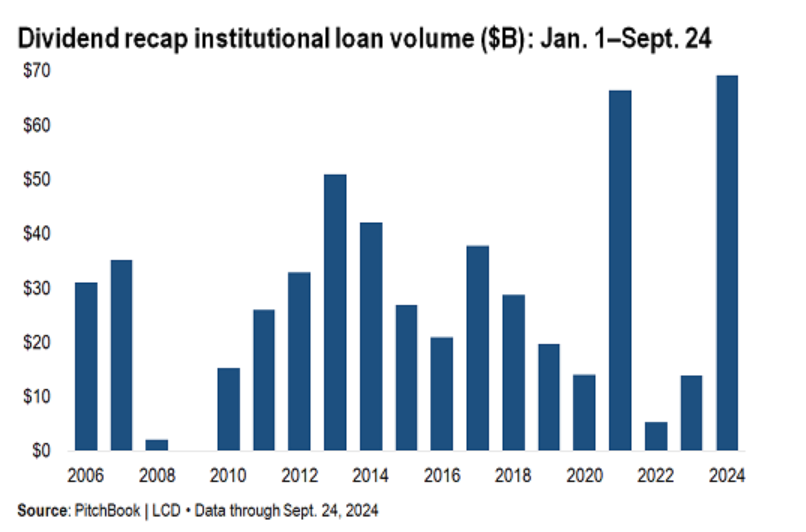

📊 Chart of the Week

Dividend recap volume is setting a record pace and closing in on 2021’s all-time annual high of $76 billion. Link

💰Fundraising News

Ares is raising at least $7 billion for its Special Opportunities Fund III. The fund will target North American companies facing complex situations. Situations may include the transition to a new management team, out-of-favor industries, debt-burdened balance sheets, or industry downturns. The fund can buy distressed public debt. The second fund achieved a Net IRR of 10.4 % as of the end of March. More here

BNP Paribas Asset Management held a first close of ~$300 million for its European Junior Infrastructure Debt Fund II. The fund will finance projects in continental Europe focusing on energy transition, green mobility, and digital infrastructure. The first vintage invested €300 million in several European infrastructure projects to date. BNP is targeting a fund size of ~$800 million. More here

Forum Investment Group, a Denver-based real estate investment manager, announced a final close of $226 million for its private credit strategy. The fund lends to sponsors supporting their ground-up developments, value-add repositioning, and acquisitions of multifamily properties. It focuses on high-growth markets across the United States. More here

Root Capital, a Brazil-based credit manager, launched its Special Situations Fund IV. The distressed debt fund aims to raise ~$100 million from domestic Brazilian investors, followed by an additional $100 million from international investors. It will focus on acquiring distressed corporate debt and legal claims from companies, as well as claims against governments. Brazil has entered a new monetary-tightening cycle, pushing interest rates up to 10.5%. This is exacerbating financial strain on Brazilian companies, leading to a record 72% increase in bankruptcy protection filings. More here

Susi Partners, a Switzerland-based manager, announced a close of its Energy Efficiency & Transition Credit Fund. The fund finances projects that increase the energy efficiency of existing infrastructure, real estate, and industrial facilities. These include LED streetlighting, smart metering, waste-heat recovery systems, and industrial machinery retrofits. Susi has invested ~€700 million into energy transition projects since 2014. More here and here

Old Orchard Private Credit, a New York-based manager, launched its credit master fund. The fund will finance social infrastructure with an initial focus on loans for affordable housing. More here

Russell Investments, a Washington-based manager, launched its new evergreen, multi-manager Global Private Credit Fund. The fund will provide exposure across North American and European private credit markets. It has already made investments in seven portfolios and targets an annualized net return of 8%. The fund will be available to professional investors in the UK, France, Luxembourg, Belgium, Netherlands, Italy, Germany, and Austria. More here

Canyon Partners, a California-based hedge fund, launched its Evergreen Private Credit Fund. The new fund is reportedly targeting performing, income-oriented strategies across corporate, real estate, and asset-backed credit. It will build a diversified multistrategy private credit portfolio that can shift to the best areas of opportunity. Canyon manages more than $24 billion. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.