Brookfield: We're in the early innings of a multi decade trend

Fundraising from Silver Point Capital, ICG, RoundShield, Muzinich, Eiffel Investment Group and Viola Credit.

👋 Hey, Nick here. A special welcome to the new subscribers at Ares, Morgan Stanley, and Paceline Advisors. This is the 80th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

BlackRock Shakes Up Its Private Credit Division. A direct-lending unit is being set up after increasing demands from investors. This will “help accelerate [Blackrock’s'] ambition to be a leader in direct lending and growth debt globally.” Link

The Big Winners From Private Credit’s Boom Are Becoming Clear Link See last week’s newsletter for further insights on this topic Link

Apollo pushes its investment-grade debt business. “We want to invest in investment-grade companies at scale,” “The traditional markets alone are not large enough to be responsive to these companies.” Link

Where Does KKR’s Credit Business Go From Here? Chris Sheldon Has Ideas Link

Arbour Lane is raising its latest Mid-Market Distressed Debt fund. “The broader markets and economy continue to perform well but problems exist below the surface of the market,” Link

Oaktree: The Changing Face of Private Credit. “Since 2019, the majority of capital structures were put in place with 0% base rates. Most of those capital structures are over-levered because rates have moved 500 basis points”. Link (Transcript).

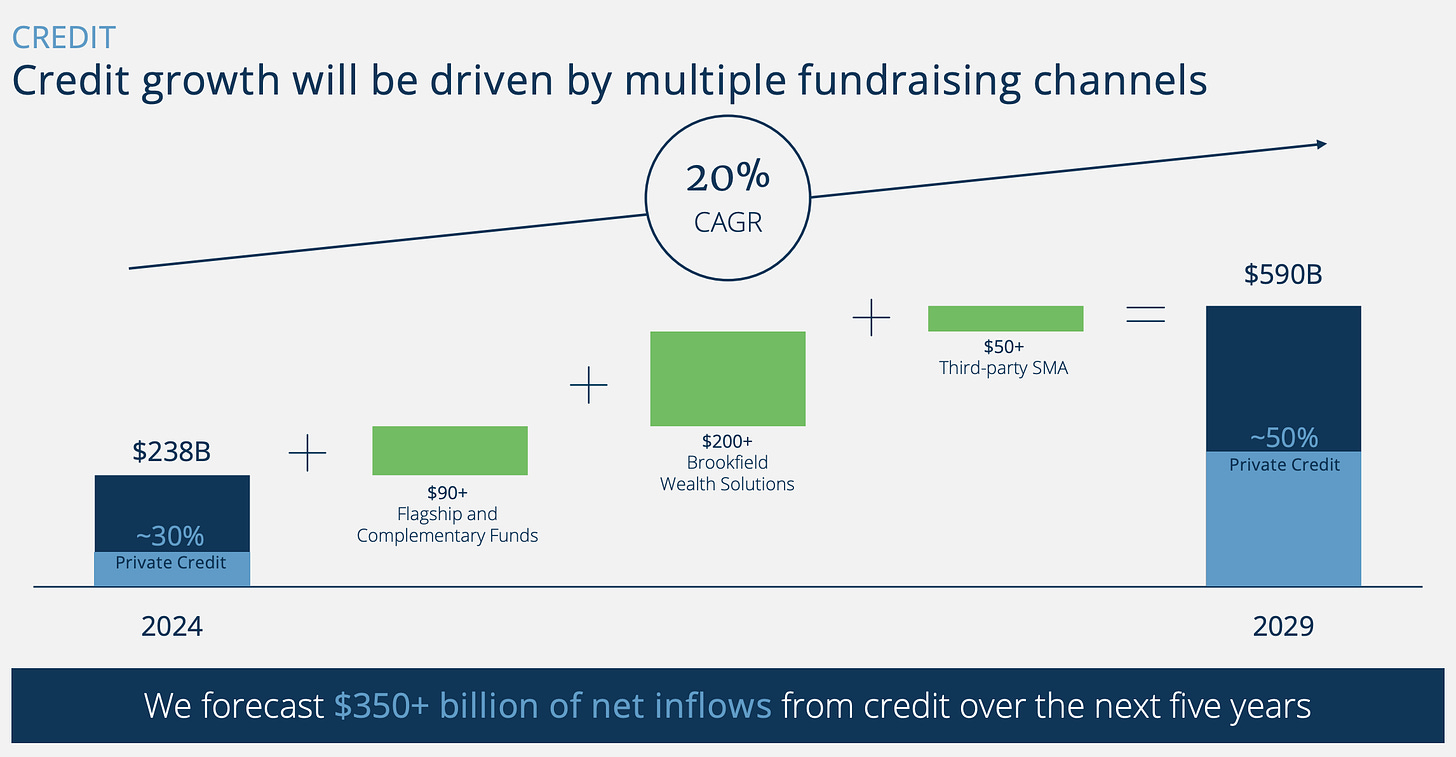

📊 Chart of the Week - Brookfield Investor Day

Watch the Credit Presentation Here Here

We feel like we are the dog who caught the bus, but the bus is moving at 40 miles an hour.

If we are going to ride this wave of quickly scaling, we needed to step into a different league.

We needed a partner who was going to open doors and provide multiple different types of capital.

Isaiah Toback, Partner, Deputy Co-Chief Investment Officer, Castlelake

💰Fundraising News

Silver Point Capital, a Connecticut-based manager, closed its latest $4.6 billion opportunistic credit fund. The Fund will invest in cyclically-driven market dislocations, including traded credit and restructuring investments. It has a global and opportunistic mandate extending across geographies, market capitalizations, capital structures, and industries. More here

ICG, a London-based manager, closed its $1.9 billion North American Credit Partners Fund III. The fund finances sponsored and unsponsored middle-market companies in North America. It typically invests in businesses with $25m to $250m of EBITDA. More here

ICG also announced its mammoth $17 billion Senior Debt fund, last week here

RoundShield, a London-based manager, closed its $1 billion RS Fund. The fund focuses on asset-backed loans primarily in real asset sectors in Western Europe. Sectors include hospitality, student housing, residential, social infrastructure, renewable energy, and other operating-related real estate. The Fund is Article 8 fund. More here

Muzinich, a New York-based manager, announced its $1 billion Infrastructure and Real Assets Private Debt Strategy. The Strategy is a partnership with Hong Kong-based Orion3 Group. It will lend to middle-market infrastructure and real asset companies. Energy transition will be a key theme for the strategy. The strategy will focus on opportunities in Australia, Singapore, South Korea, Japan, Hong Kong, UK and Canada. More here

Eiffel Investment Group, a Paris-based asset manager, closed its ~$870 million Impact Debt fund II. Impact Debt II provides senior loans of between €10 million and €100 million, targeting sponsorless businesses in Europe with EBITDA above $15 million. Loans are priced at approximately EURIBOR + 500, generating a net yield of ~9 percent. €420 million (nearly 60 percent) has already been deployed via 21 investments. More here

Viola Credit, a New York-based manager, announced a $500 million asset-based lending platform in partnership with Cadma Capital Partners, an Apollo affiliate. The platform will provide asset-backed loans to high-growth technology companies as well as their VC / PE sponsors. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.