👋 Hey, Nick here. A special welcome to the new subscribers at Ares, Stepstone, and Integer Advisors. This is the 88th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

Blackrock’s Fee Machine: Alternatives made up just 3% of BlackRock’s total assets in the third quarter, but generated 11% of total revenue Link

Private Debt funds have outperformed Buyout funds in seven out of the ten quarters since Q1 2022 Link

Bonuses expected to surge at year-end Link

If you spent 20 minutes doing leveraged finance at a bank, now is the time to start your own private credit firm Link

Pitchbook: What will private credit recoveries be when defaults occur? Link

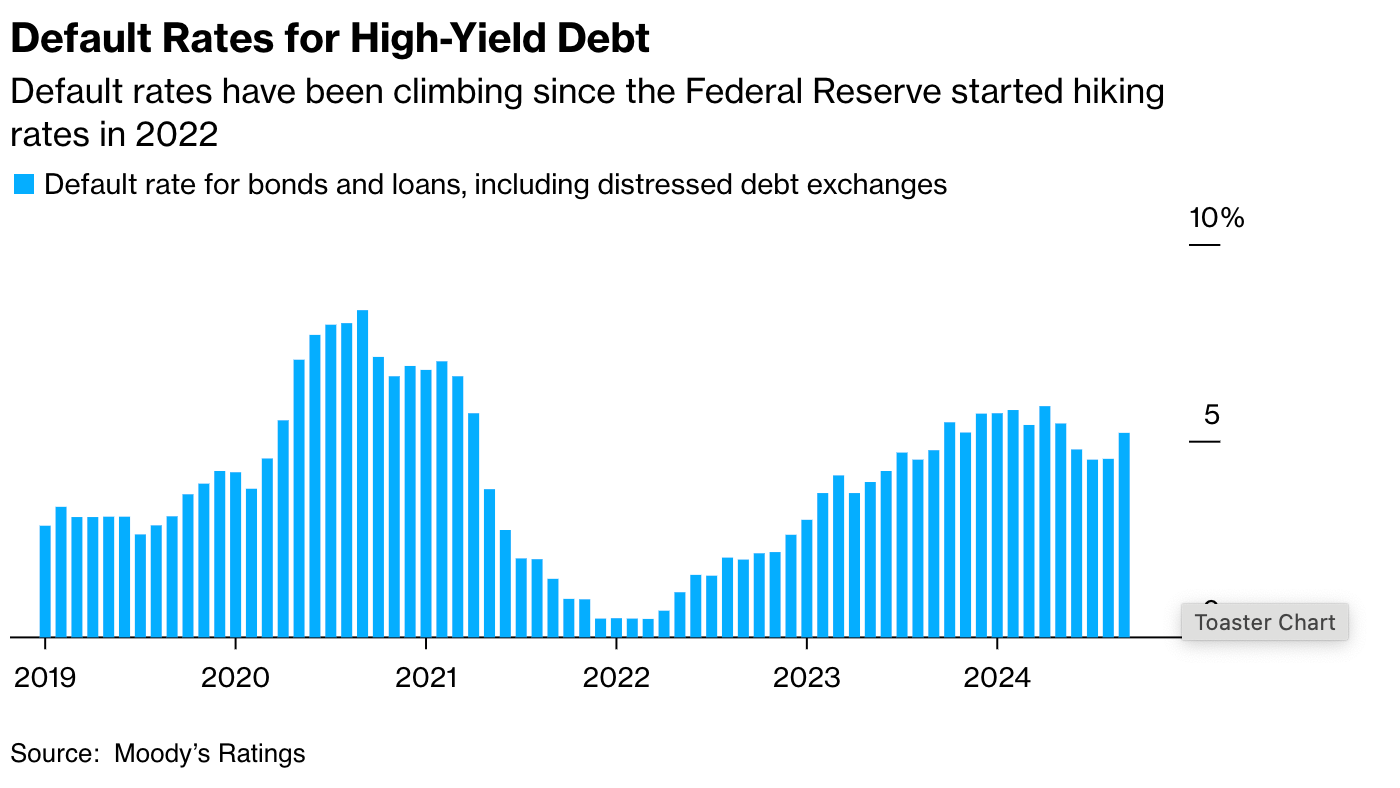

Default rates have been a leading indicator of recessions in three of the last four US recessions. In 2024, according to Bankruptcy.com, the number of corporate bankruptcies increased 39% vs H1 23. This is also a 46% increase compared to the number of H1 filings between 2015–2024; Link

👫 Partnerships & Acquisitions of the week

State Street says it is ‘shopping’ for a private credit manager. Alternatives account for less than 5 percent of AUM at State Street. Given the size of State Street and its clients’ needs, the FT believes that HPS, Sixth Street, and Golub Capital would be the most suitable candidates. Link and Link

BC Partners Credit Announces Combination with Runway Growth Capital Link

Stonepeak agreed to acquire Boundary Street Capital, a private credit firm focusing on digital infrastructure, enterprise software, and technology services in the lower middle market. Link and here

📊 Three reasons why Northern Europe is the sweet spot in direct lending

Federated Hermes, a London-based asset manager, announced a first close for its European Direct Lending III Fund this week. The fund lends senior secured loans to small and mid-sized private companies in Northern Europe. This is why they think the lower mid-market in Northern Europe is the sweet spot.

Attractive Yields

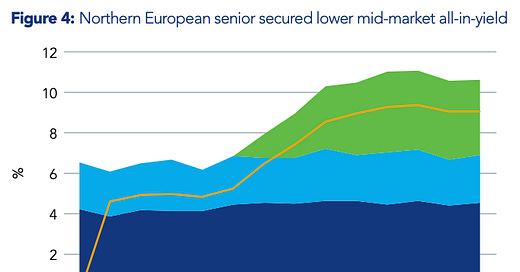

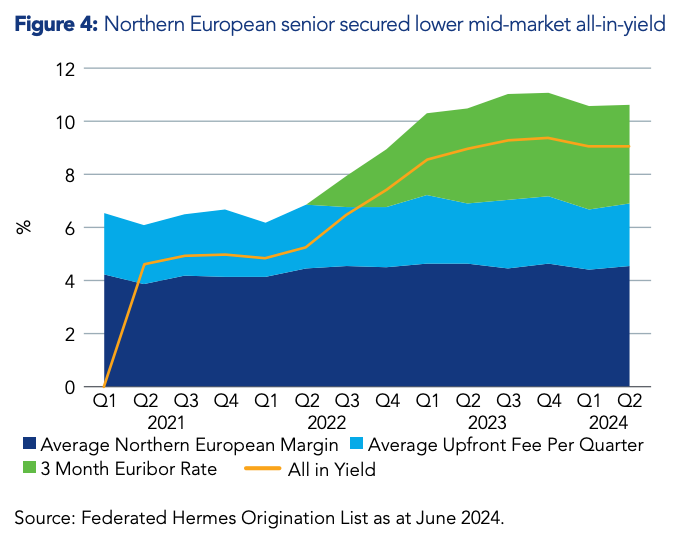

Federated Hermes believes the lower mid-market in Northern Europe is an area where investors can reasonably anticipate an all-in yield of approximately 903bps, for senior secured debt.

Lower Competition

The larger first-mover direct lenders have migrated out of the middle market and into the large-cap domain. Concurrently, turbulence in the banking sector has seen several banks shutter their lending businesses.

This migration has presented an opportunity for those who remain. One example of this reduced competition is the return of a second covenant, with interest coverage partnering with a leverage covenant in most instances.

Stronger Downside Protection

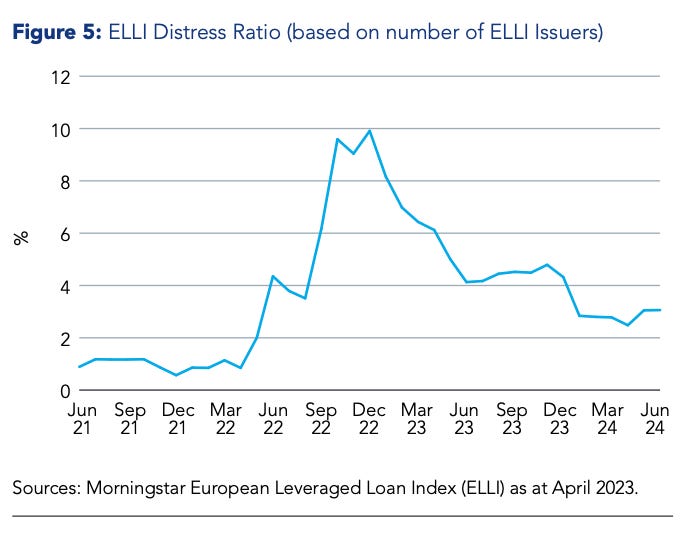

Federated Hermes believes the number of restructurings and borrower requests for lender support will likely remain elevated in the short-to-medium term.

By allocating to a strategy focused on northern Europe (as opposed to pan-European) investors are lending into the most creditor-friendly jurisdictions. These are geographies where lenders have tried and tested the legal systems regarding insolvencies. The swift nature of the courts means that insolvency processes are faster, reducing value leakage from a borrower at a time when cash and asset preservation is paramount.

Read more about Federated Hermes’ latest fund here and its investment strategy here

💰Fundraising News

D.E. Shaw, a New York-based manager, raised $1 billion for its Alkali Fund VI. The fund will pursue a multi-strategy approach focusing on corporate debt, structured credit, and synthetic securitizations. The fund can invest in stressed and distressed assets. The latest fundraise brings the total commitments across the Alkali series, which launched in 2012, to about $3.9 billion. More here

AshGrove Capital, a London-based specialty lender, closed its ~$685 million Fund II. AshGrove lends to small and medium-sized European companies in B2B software and services. It typically invests €10 to €50 million of senior secured debt to businesses with robust business models and a high proportion of recurring revenues. Fund II has already committed ~20% of its capital across five investments. This fund is more than 2x larger than AshGrove’s €300m first fund. More here

Pearlmark, a Chicago-based real estate manager, announced a second closing of $300 million for its high-yield credit investment fund, Mezzanine Realty Partners VI. The fund lends subordinated debt in the top 30 metropolitan areas of the United States. It primarily invests in multifamily and other adjacent sectors, including student housing, active seniors, and build-for-rent communities. Loan sizes are expected to range from a minimum of $5 to $50 million. Pearlmark has originated over $2.1 billion across 162 investments over 23 years. More here

ILX, an Amsterdam-based emerging market private debt specialist, announced the first close of its second fund. ILX finances private sector companies in emerging markets. It does this by investing in syndicated loans alongside Development Finance Institutions such as the World Bank (through the IFC) and the Asian Development Bank. ILX’s first fund has invested $800 million in 40 projects across 18 countries. This close brings the total commitments across both funds to nearly $1.7 billion with a $3 billion target. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.