BlackRock Bets on Private Credit’s Staying Power

Fundraisings from AlbaCore, BC Partners Credit, Macquarie, L&G and AXA IM

👋 Hey, Nick here. A special welcome to the new subscribers from Prosek, Orix, and Goldman Sachs. It’s great to have you. Reach out and say hi. This is the 107th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here

📕 Reads of the Week

“If people are not watching closely, the largest asset manager, the traditional asset manager in our industry, has delivered a wakeup call to their entire peer set that private is going to be an important part of client solutions going forward.” Marc Rowan Link

Marc Rowan called it earlier in the year; BlackRock is serious about private markets. This week, BlackRock launched “a first-of-its-kind customizable public-private model portfolio”. This product lets financial advisors invest across public and private markets in one managed portfolio. BlackRock already manages close to 10% of today’s $5 trillion managed model portfolio market, and they expect this market will double over the next four years. As Marc pointed out, BlackRock is making a deliberate bet that integrating private markets will position it to capture an outsized share of this $10 trillion opportunity.

Learn more about BlackRock’s model portfolio here. Scroll down for BlackRock’s latest thoughts on private credit.

Other Notable Reads of the Week:

Direct lenders are positioning themselves as the solution to US college sports’ cash flow needs. Link

Asia’s annual data center revenue growth surpasses the US, and two major Asian data center operators have recently secured their biggest-ever loans. Link

Apollo’s Jim Zelter, Private credit “is not a bubble, but it’s certainly been long in the tooth in the cycle… Bubble means there’s very much irrational actions, and while I think there are folks that are probably taking [a] more aggressive portfolio construction than I would take, I don’t think it’s a bubble where you’re going to find the massive losses that you saw in other bubbles since I’ve been around” Link

Architect Capital is lending up to five times annual recurring REVENUE. 🤒… Link

Deutsche is gauging interest in a $200 million loan to support Blackstone's bid for seaplane operator Trans Maldivian Airways. Link

Lazard and Arini Enter Cooperation and Sourcing Agreement for EMEA Private Credit Link

Pitchbook: Europe’s private credit providers voice concerns:

“You'd be surprised how many well-known software names are seeking subordinated capital just to gain further access to liquidity” Link

📊Charts of the Week:

Pitchbook’s Global Private Debt Report. Link

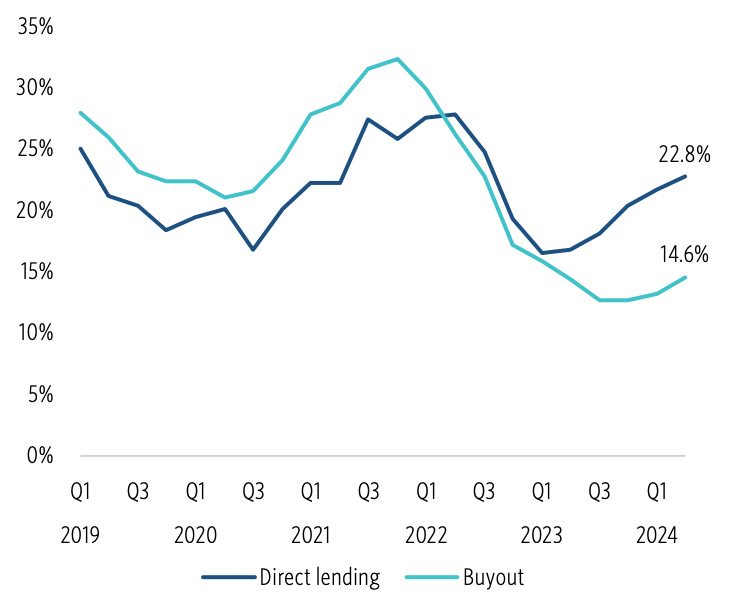

Direct lending funds distribution rates are nearly double buyout funds

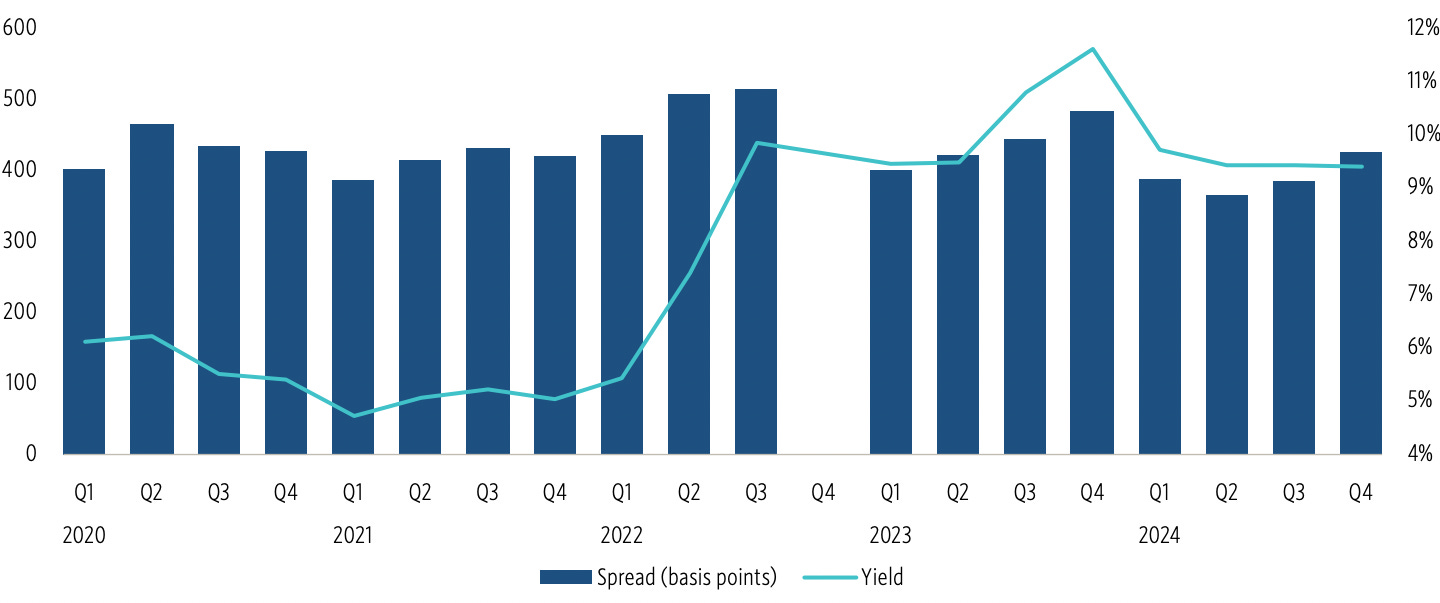

New-issue spread and yield to maturity of LBO loans

Borrowing costs for LBOs funded in the BSL eased to 9.4% in Q424 from 11.6% in Q423

Read the full report here

💰 Private Credit’s Staying Power

"In the confrontation between the stream and the rock, the stream always wins, not through strength but by perseverance and staying power."

— H. Jackson Brown, Jr

BlackRock recently published some great content on why private credit is no longer a niche financing solution. If you're short on time, here are my top highlights. You can read the full report here. Link

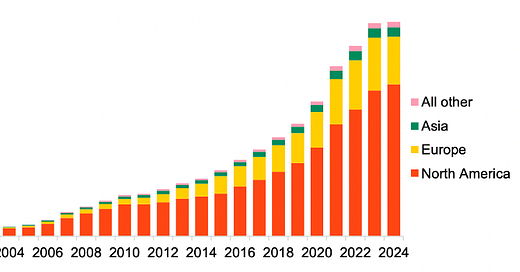

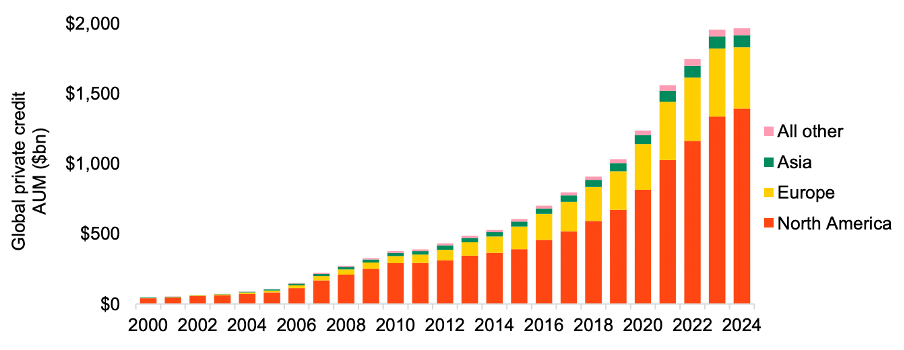

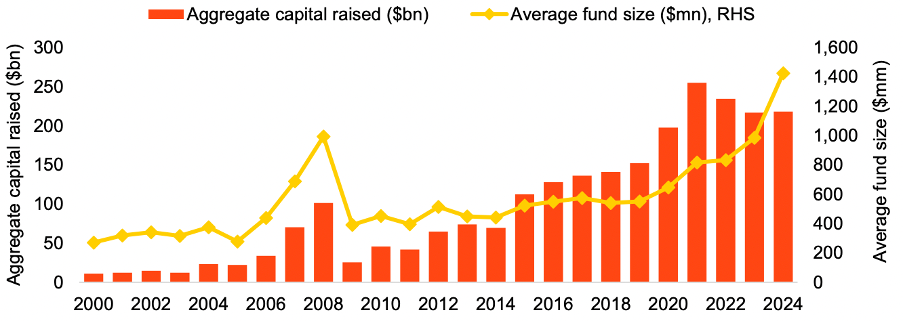

Private credit has grown to a sizable, scalable, stand-alone asset class

Private credit fund sizes have also grown

Larger fund sizes have allowed private credit lenders to finance larger borrowers and compete with syndicated markets.

Larger fund sizes have also led the growth of “jumbo” private credit loans.

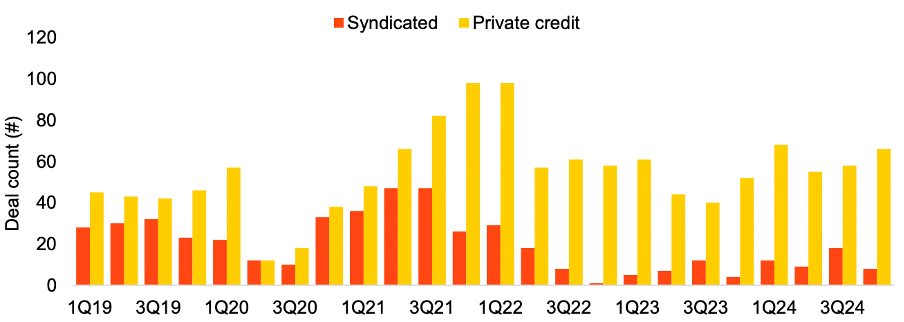

The majority of LBOs sought funding in the private credit market

Borrowers increasingly use private credit markets when capital is less available in public markets.

BlackRock believes considerations such as flexibility, customization, and desiring a long-term financing partner also play a role.

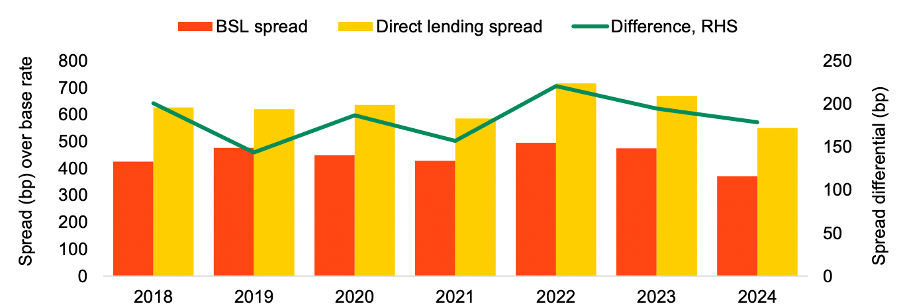

Direct lending spreads remain elevated vs. the BSL market

While tighter vs. 2022, it remained meaningful at 178bp, on average, for 2024.

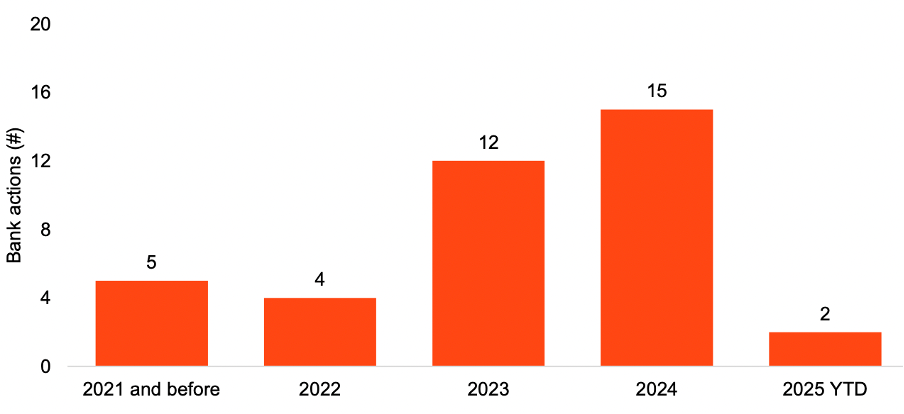

Bank participation in private credit is increasing

Banks realize the importance of incorporating private credit into their client service ‘tool kit.’

Read the full report here

💰Fundraising News

AlbaCore, a London-based credit manager, announced a first close of $1.8 billion for its Senior Direct Lending Strategy. The fund will primarily lend senior loans to upper-mid to large-cap businesses in Europe. The fund was anchored by the Abu Dhabi Investment Authority and MUFG. AlbaCore managed $9.0 billion as of December 31, 2024. More here

BC Partners Credit, the credit arm of BC Partners, is targeting $1.4 billion for its third Special Opportunities Fund. The fund provides capital to entrepreneurs and businesses primarily across North America. The strategy has already executed several high-profile investments, including a $400 million investment in football helmet maker Riddell in 2023 and an investment in GSE Worldwide, a sports talent management and marketing firm. More here

Macquarie, the Australian bank, has launched a European direct lending platform. The platform provides investors with access to European middle-market credit. Macquarie expects to launch a similar platform in the United States by mid-2025. More here

Legal & General, the UK-based insurance and pension provider, announced a $235 million Nature and Social Outcomes Strategy. The strategy finances projects in emerging markets that target positive nature and social outcomes. Indicative projects include conservation, education, healthcare, and access to clean water. More here

AXA IM Alts, the investment arm of the French insurer AXA, announced the launch of a diversified evergreen private credit strategy. The strategy will invest across the entire private credit spectrum, from direct lending to asset-backed finance. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.