Asset-Based Finance is One of PIMCO’s Highest-Conviction Investment Themes

Fundraisings from Carlyle, Sixth Street, Canyon Partners, Pantheon and January Capital

👋 Hey, Nick here. A special welcome to the 134 new subscribers! It’s great to have you. Please reach out to say hi. This is the 93rd edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕 Reads of the week

📹 Ares 2024 Reflections and 2025 Market Outlook Link

Matt Levine: Private Credit Wants to be the Bank Link

What’s Oaktree Reading? 2024 Year-End Book Recommendations Link

Schroders is shutting down its Australian Private Credit Business Link

Nomura’s Guide to Asset-Based Lending Link

Pitchbook 2025 US Private Credit Outlook: More M&A, larger lenders, bigger market Link

👫 Partnerships of the week

Blue Owl co-founder Michael Rees is working on a plan to merge several firms to create a diversified business similar to Blackstone and KKR Link

AB CarVal and Farsight Partners announced a $1 billion investment partnership Link

Mubadala announced a strategic partnership with Silver Rock Financial. Mubadala will acquire a 42 percent stake in Silver Rock with an option to increase it to 50 percent over time. As part of the partnership, Mubadala also intends to commit over $1 billion to Silver Rock funds Link

🎄 Holiday Video Recaps

The cringe holiday videos are back.

Blackstone has gone All In. Link

Apollo is “Making Meme-ories” 🤦♂️ Link

🚜 Asset-based finance is one of PIMCO’s highest-conviction investment themes

PIMCO published a deep dive into asset-based finance. Below is a summary of its highest conviction investment areas but you should also read the full report here

Asset-based finance is an attractive and less crowded asset class bolstered by favorable trends in the evolving banking landscape.

PIMCO estimates the asset-based finance market (excluding commercial real estate lending) to be valued at ~$20 trillion.

PIMCO’s highest-conviction investment areas within asset-based finance are:

Residential Mortgage Lending

US Consumer Lending

Aviation Finance

Data Infrastructure

🏡 Residential mortgage lending:

The residential mortgage market is the largest component of the asset-based investment opportunity set, supported by several compelling trends, including leverage in the U.S. and U.K. housing markets that is lower than historical norms.

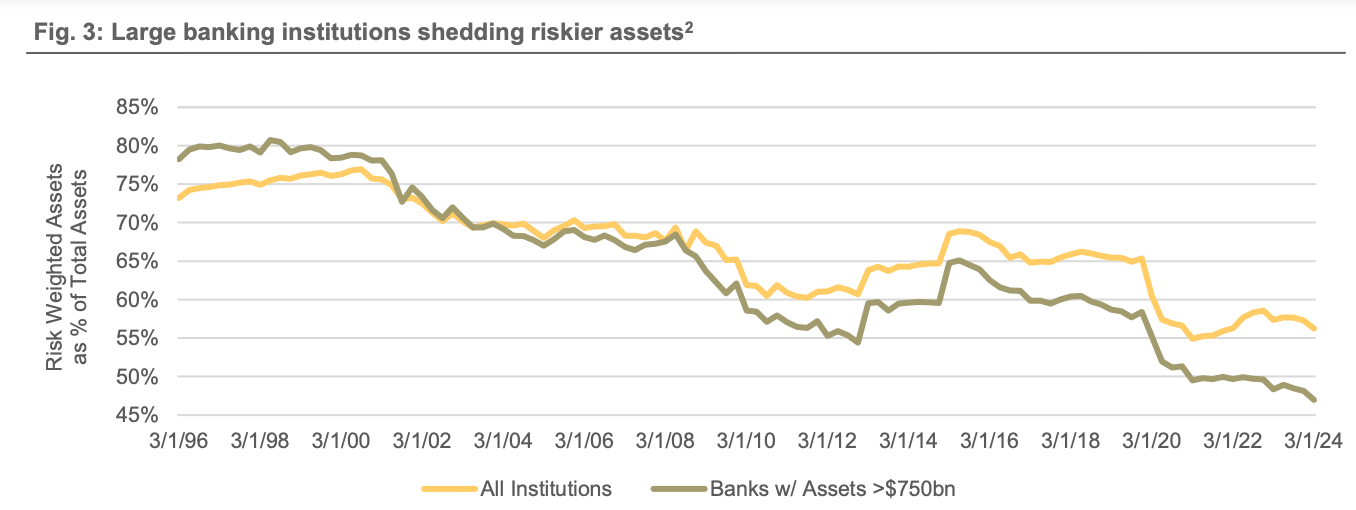

Due to stricter post-GFC regulations, non-qualified mortgage (non-QM) loans – aimed at borrowers who may not meet the requirements of standard loan programs, such as self-employed individuals, property investors, or non-residents – represent a growing segment of the U.S. housing market.

These loans benefit from a robust equity cushion given relatively low-loan-to-value ratios, tighter underwriting standards, and home price tailwinds amid strong demand from millennials and a housing undersupply.

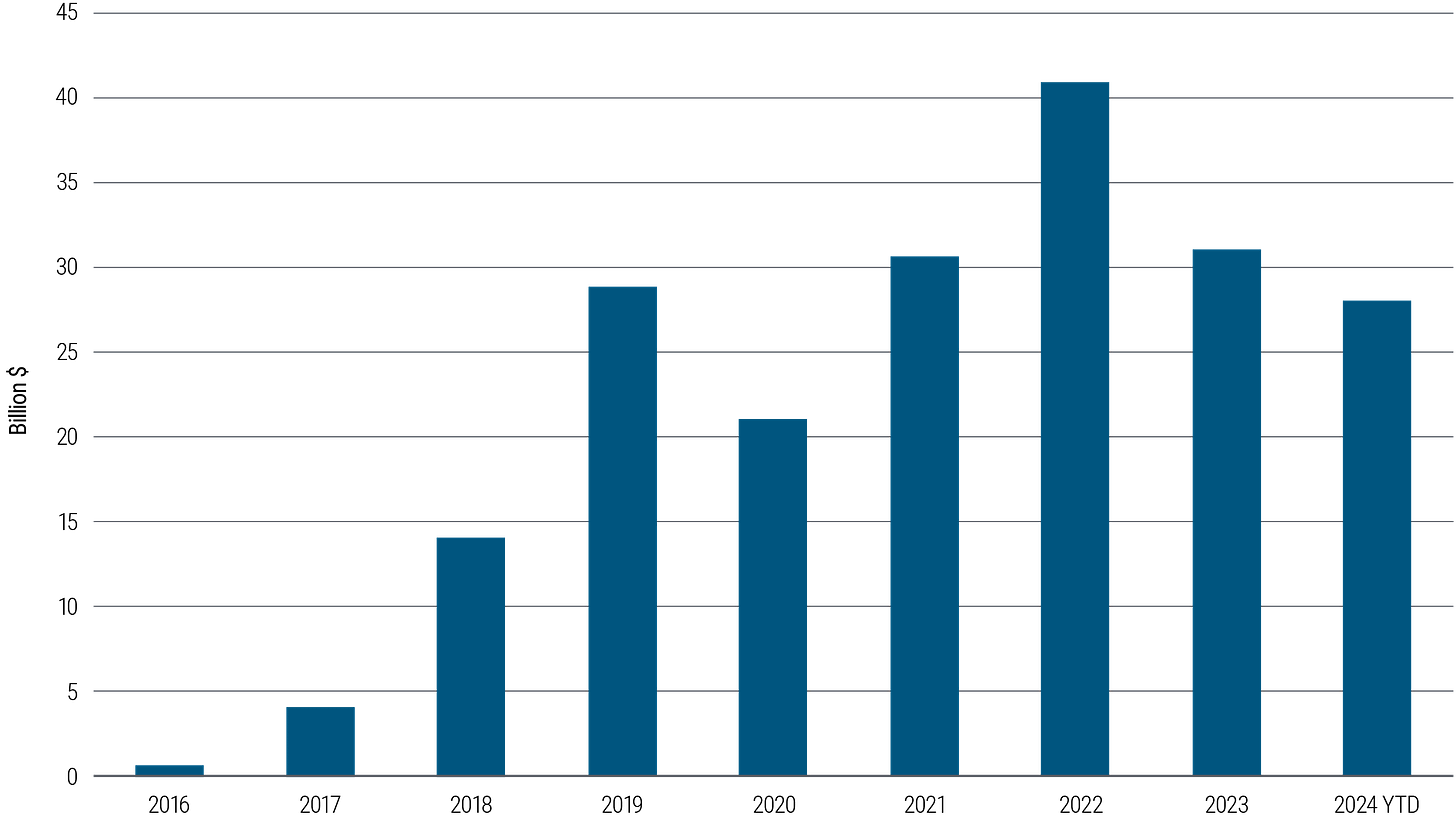

Non-QM loans have grown rapidly since 2016

💳 U.S. Consumer Lending

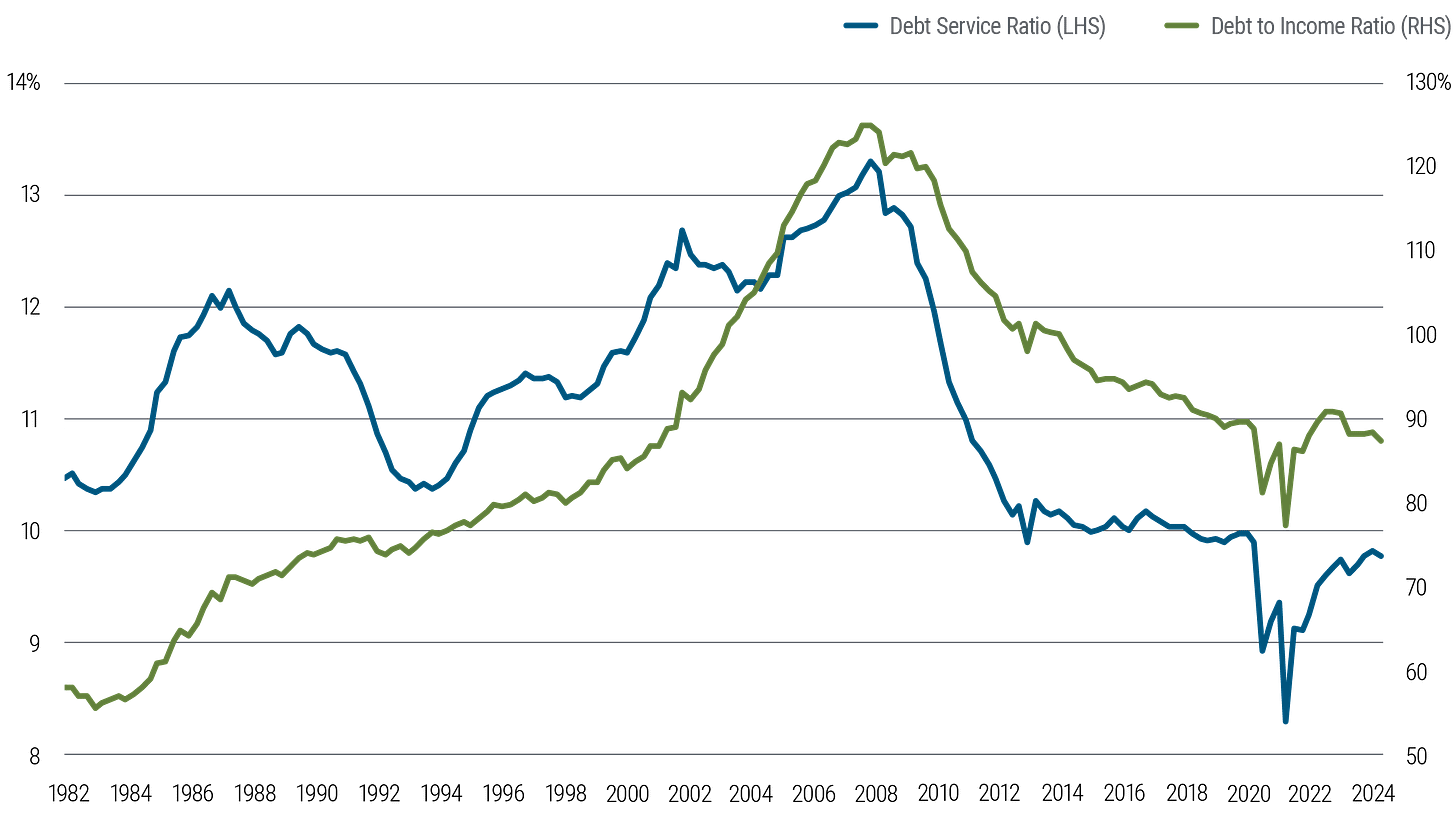

Despite higher interest rates, household balance sheets remain strong, with debt-to-income ratios declining in recent years and net worth near all-time highs.

Debt servicing costs remain low by historical standards, largely because about 95% of American mortgages are fixed rate.

While higher delinquencies are often seen as signs of U.S. consumer weakness, not all U.S. consumers have similar credit profiles. Delinquencies have risen significantly in the subprime segment; but those in the prime and near-prime categories have normalized to pre-COVID levels. Additionally, many lower-credit consumers experienced a temporary and artificial boost to their FICO scores due to pandemic-era student loan forbearance and fiscal stimulus, which has since led to increased delinquencies.

Household balance sheets remain strong with relatively low debt servicing costs

🛫 Aviation Finance

Capital needs continue to grow in this sector. Barriers to sourcing and servicing the underlying collateral remain high, while the collateral itself exhibits strong fundamentals.

The aviation industry has faced substantial disruption from the pandemic and the Russia-Ukraine conflict. However, after taking on $250 billion in incremental debt, airlines returned to profitability in 2023 by focusing on cost-cutting and increasing fleet capacity to meet increasing travel demand, with revenue passenger kilometers (RPKs) surpassing pre-COVID levels.

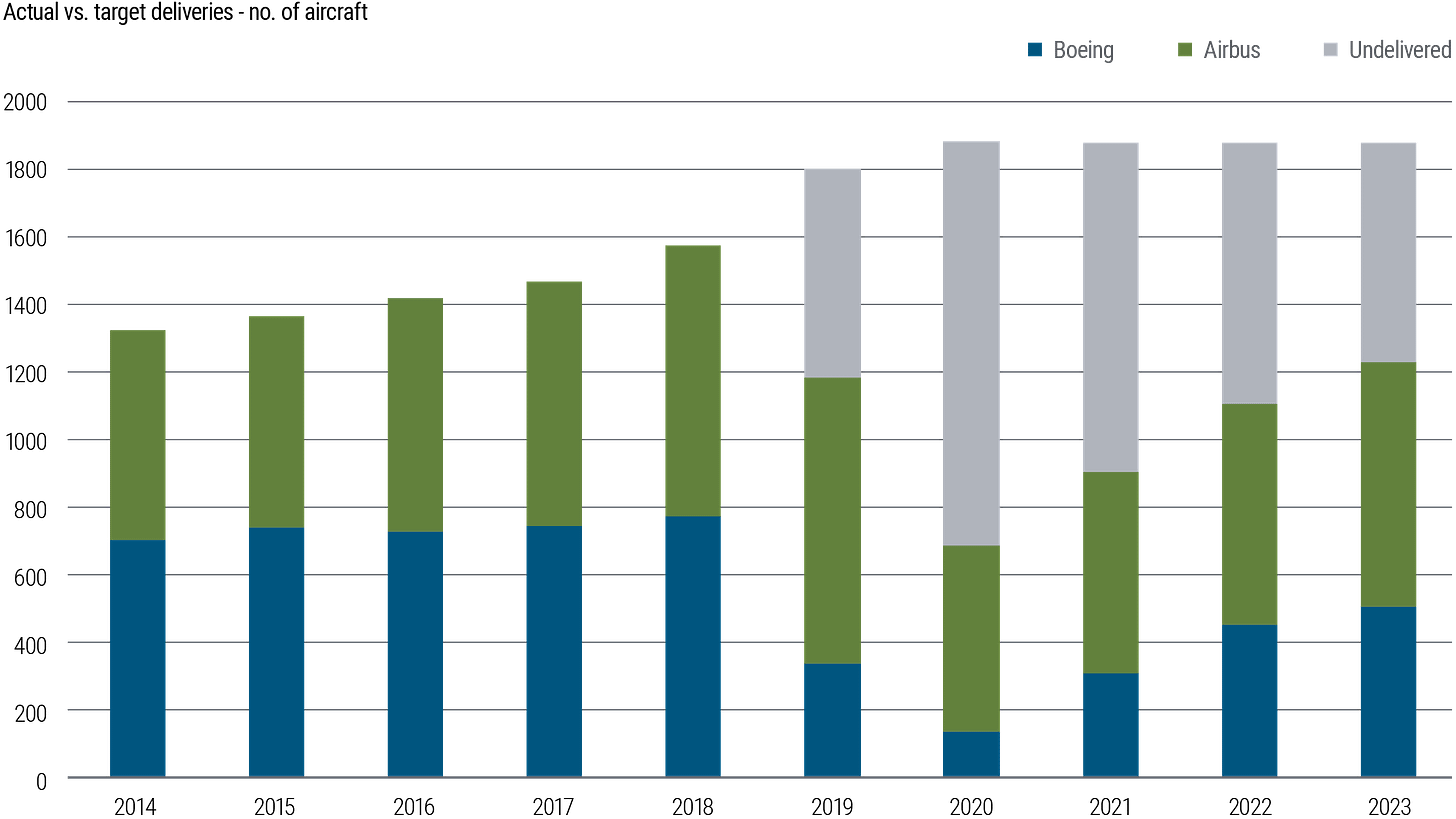

Production issues and a persistent backlog in aircraft manufacturing have limited the availability of new planes, with original equipment manufacturers delivering 35% fewer aircraft (4,200 planes) than ordered from 2019 to 2023. With this supply/demand imbalance growing, PIMCO believes lease rates on new and mid-life aircraft offer attractive yield and income potential.

Airbus and Boeing have underdelivered vs targets from 2019 onwards

🖥️ Data Infrastructure

Demand for data centers has been surging – driven by increased connectivity, cloud computing adoption, large language models, and the rapid evolution of generative AI technologies– and the supply of capital is not keeping up.

Companies need robust infrastructure, including both data centers and high-computational GPU chips, which require significant capital.

Banks have had a very limited footprint in these markets, specifically in lending to companies looking to buy new chips. PIMCO sees numerous opportunities to develop bespoke financing solutions that can benefit from underlying collateral, including chips, network infrastructure, or contractual future cash flows derived from customer contracts.

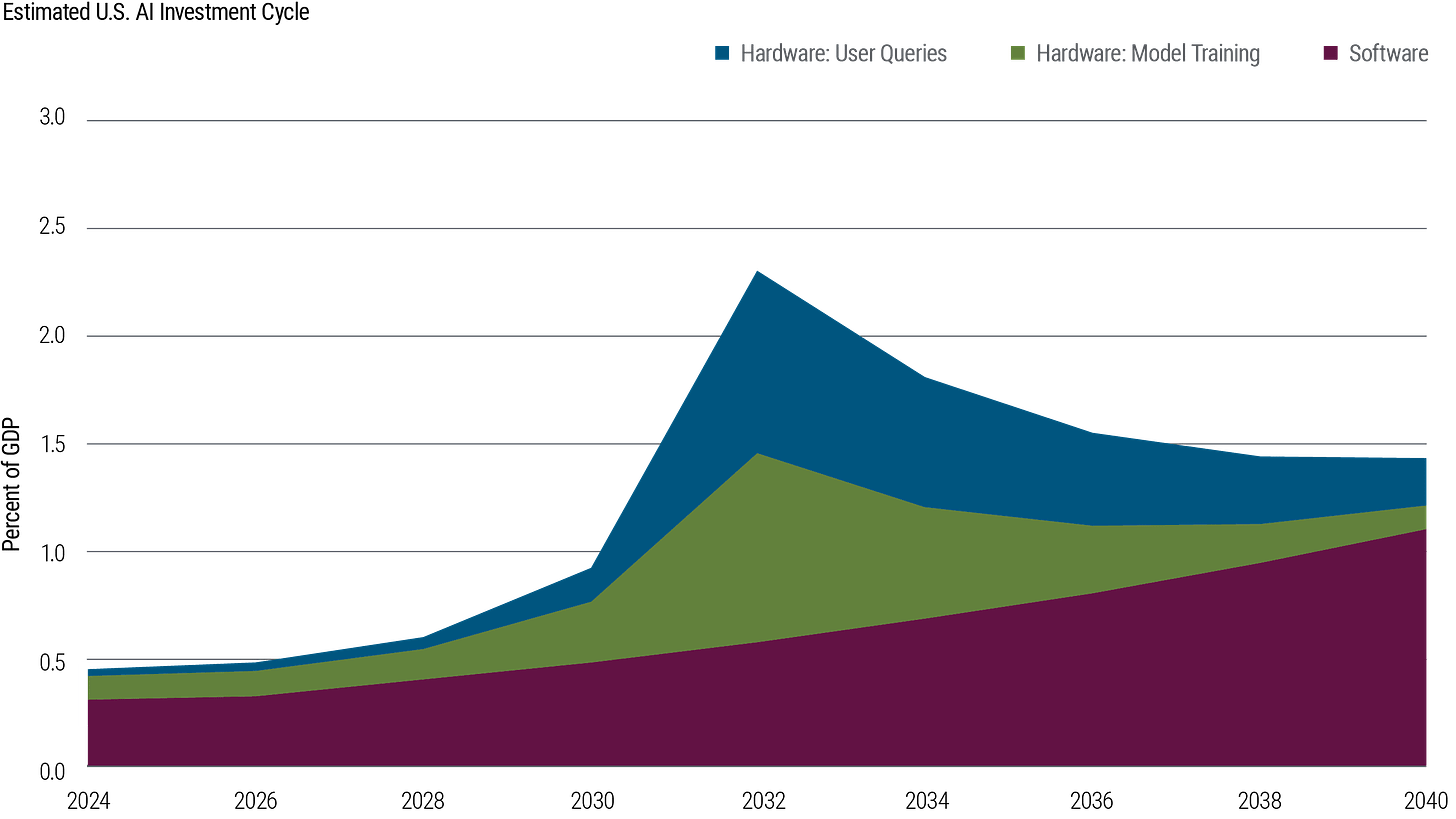

AI could drive a sizable investment cycle, which requires data infrastructure

Click the link if you’d like to see which sectors PIMCO is most cautious about.

💰Fundraising News

Carlyle closed its $7.1 billion Credit Opportunities Fund III. The fund lends across the capital structure and has invested or committed more than $2.4 billion in 25 investments. Since 2017, Carlyle’s Credit Opportunities strategy has deployed nearly $22 billion across sports, media, and entertainment; residential real estate and services; software and technology; and financial and business services. More here and Check Out its Announcement Video here

Carlyle’s Global Credit platform has been Carlyle’s fastest-growing business segment over the past five years. With $194 billion in AUM as of September 30, 2024.

Sixth Street Partners is raising at least $4 billion for its Sixth Street Opportunities Partners VI. The strategy focuses on three key “hunting grounds” - control-oriented investments, asset opportunities and corporate dislocations, according to a 2021 presentation and More here.

Canyon Partners, a Dallas-based alternative asset manager, closed its $1.2 billion US Real Estate Debt Fund III. The fund is Canyon's largest US real estate debt Fund to date, nearly doubling its $650 million predecessor fund. It invests opportunistically across property types with a focus on multifamily and other defensive asset classes. More here

Pantheon is targeting $750 million for its Pantheon Credit Opportunities III. The fund will invest with more than 10 different GPs with over 1,000 underlying loans. It expects 80-100 percent of its capital to be in secondaries, with up to 20 percent in co-investments. Fund III is targeting an 8 percent preferred return, charging 1.25 percent on invested capital and 10 percent carry. More here

January Capital, a Singapore-based manager, raised $85 million for its Growth Credit Fund. The fund lends to private equity-backed technology companies in Asia Pacific. It typically lends $5 million to $20 million per transaction and charges interest rates between 12% and 16% plus upfront fees. The loans also include warrants. January Capital hopes to have a final close of ~$150 million in 2025. More here

MA Financial, a listed Australia-based alternative asset manager, launched its first North American investment vehicle, MA Specialty Credit Income Fund. The fund invests in a portfolio of US private credit assets, spanning asset-based lending, specialty finance, and co-lending opportunities. It is structured as a continuously offered, closed-end interval fund. The fund has about $85 million in assets with plans to raise more funds early next year. More here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.