Ares & The Asset-Liability Arbitrage

Fundraising from LGT Capital Partner, Primary Wave, FCMB Asset Management and Texas Capital

👋 Hey, Nick here. A special welcome to the new subscribers at Carlyle. This is the 74th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📕Reads of the week

Janus Henderson acquires Victory Park Link

Alameda County increases its private credit allocation to 6.8% Link

Not all BDCs are equal. Prospect’s investments generated cash flows that were $200 million less than the amount the fund distributed last year. Prospect charges some of the highest management fees in the industry and one-fifth of the fund’s assets are concentrated in a real-estate investment trust, that it fully controls. But it’s the jump in PIK loans and a series of circular financing arrangements between the fund and the REIT that have attracted the most scrutiny. Link

NYSTRS plans to commit between $800 million to $1 billion per year to Private Debt. Its $4.3 billion portfolio has generated a net IRR of 10.5%, since inception. It will continue to focus on North America and will consider tactical opportunities including asset-backed debt and opportunistic loans. (See page 40 Link)

Goldman Sachs helps Chanel raise €700 million in Private debt. Link

📝 Ares & The Asset-Liability Arbitrage

Ares published its Alternative Credit Summer Newsletter. This edition is almost exclusively dedicated to Asset-Based credit and is one of the most comprehensive articles I have found to date. I would highly recommend printing it off and leaving a copy on everyone of your colleagues’ desks. Below are my highlights. Link

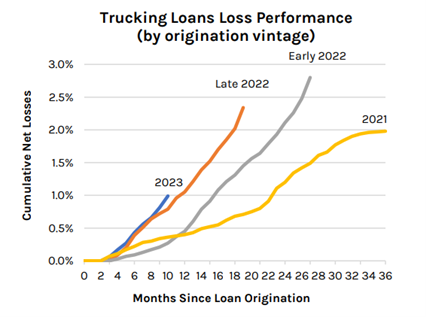

Money makes the world go around; credit makes money go around: All assets-from cars to companies- are valued not by the equity markets but by the availability of credit. The arb between assets and liabilities (Credit) is economics’ version of gravity, and gravity always wins in the long-term. It is why default cycles and economic recessions are just a story of credit expanding and contracting.

A healthy asset-liability arbitrage condition allows for risk and value to be appropriately, and dare we say fairly, distributed across the capital structure of a transaction. A weak or broken arbitrage creates a situation where risk and value can shift or concentrate in one part of the capital structure at the expense of the other part(s). Mistakes are made when investors are compelled (by mandate or other restriction) to continue investing in the part of the capital structure where risk has shifted without a compensating quantum of value.

Asset yields should always be greater than liability yields; that differential, or arb, is what drives excess returns If the asset-liability arbitrage is weak or non-existent, you should own the liability, not the Asset

How does this apply to the current asset-based lending environment?

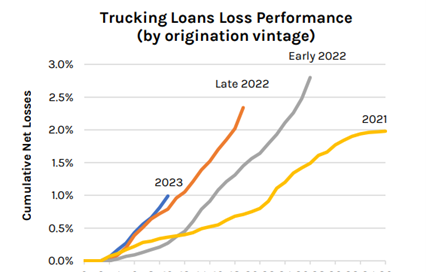

🚚 Trucking

During the pandemic, households shifted consumption from services to goods. The result was a sharp increase in demand for over the-road trucking, and a commensurate spike in both spot and contract rates.

The prospect of excess profits attracted more than 40,000 new trucking firms into the sector.

40,000 new entrants not only created far greater capacity to move boxes around the country but also rendered the industry significantly more fragmented: by the end of 2023.

Both spot and contract rates fell precipitously, largely because of excess capacity that was slow to leave the system.

As we speak, capacity is being forced out of the industry with lenders compelled to “literally” take the keys. This situation will certainly sort itself out over time, and supply-demand will regain its balance.

✈️ Aviation

Debt service is absorbing the vast majority of asset yields.Such a condition shifts most of the investment risk into the residual value of planes.

To achieve acceptable returns, plane values must hold up or even outperform expectations.

In our view, a better relative value approach would be to maintain high-quality assets and lessee targets, acquire planes only opportunistically to achieve higher asset yields, and/or wait until more efficient leverage is achievable.

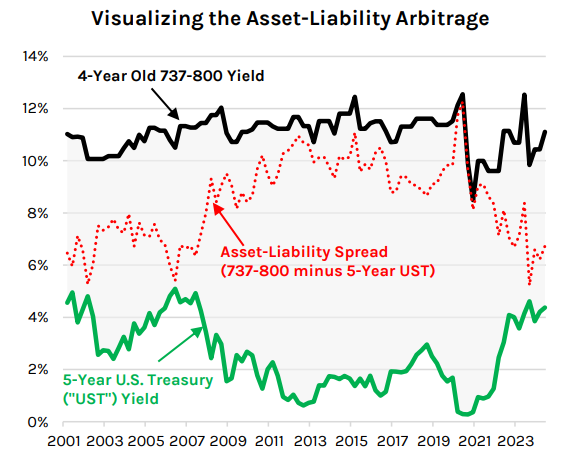

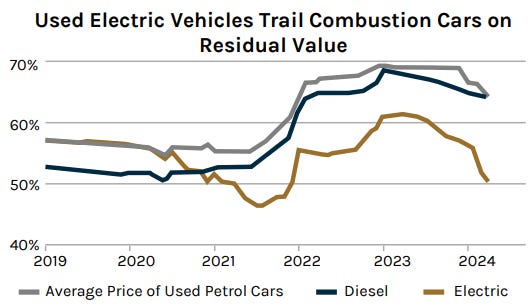

🚗 Cars

The crux of the issue is the falling vehicle values at a time of increasing auto loan credit deterioration

Credit performance in autos has already started deteriorating, especially for second and third vehicles, while loan amortization has not kept pace with the faster rate of depreciation. More owners are deeply “underwater” on their cars, resulting in higher rates of delinquencies and defaults.

Once again, I’d highly recommend you read the full article here

Time is your most precious resource. Finding balance in your schedule is the key to finding balance as an investor. You need time to read, whiteboard, vet investments, talk to the market, etc. The hardest transition for investors as you get more senior is that you have more to do with less time. Failing to prioritize your time is like failing to diversify: it will end badly.

💰Fundraising news

LGT Capital Partner, a Switzerland-based alternative investment manager, raised $2 billion for its semi-liquid open-ended investment vehicles. The private credit strategy invests in yield-oriented and opportunistic credit, through both corporate and asset-backed strategies. More here

Primary Wave, a music publisher, is raising funds for its Music IP Fund 4. Primary Wave acquires and licences song copyrights, especially for older, legacy artists. Brookfield bought a significant minority interest in Primary Wave in 2022, in a deal valued in excess of $2 billion. More here, here and here

FCMB Asset Management, a Nigeria-based manager, is raising ~$60 million for Nigeria’s first private credit fund. The fund will support companies in Nigeria with revenue of least $6 million. FCMB is targeting 25% net returns. More here

Texas Capital, a Texas-based Bank, launched its Direct Lending platform. The platform will provide non-bank private capital to Texas-based middle market companies. It will have a primarily target companies with between $10 million and $30 million in EBITDA. It will also focus on senior secured floating rate loans. More here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.