3 reasons why Ares expects to outperform

Fundraising from CAPZA, Atalaya, MidOcean, Northwall, Accession, Harlan and RW Capital

👋 Hey, Nick here. A special welcome to all the new subscribers at Golub. Golub is now the leading subscriber of The Credit Crunch 🥳 For all non-Golub subscribers, share this with your colleagues to knock Golub off the top spot.

If you’re new, this is the 66th edition of my weekly newsletter. Each week I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here. Scroll to the bottom, if you’re here for the fundraising news.

📚 Reads of the week

PGIM is looking to grow its private-market assets by more than 50% to $500 billion in the next five years. Link

BDC’s are borrowing… Link

Atalaya: Sizing Asset-Based Finance Market Link

Matt Levine: Banks Transfer Risk to Themselves Link

Email me if you don’t subscribe to Matt Levine and I can forward you the above article.

📈 3 reasons why Ares expects to outperform

Ares Capital Corporation (ARCC) hosted its Investor Day a few weeks ago (Link). Below are a few of my highlights. You can expect to see more analysis at a later date.

3 Reasons Why Ares Expects To Outperform.

1. Ares is Big

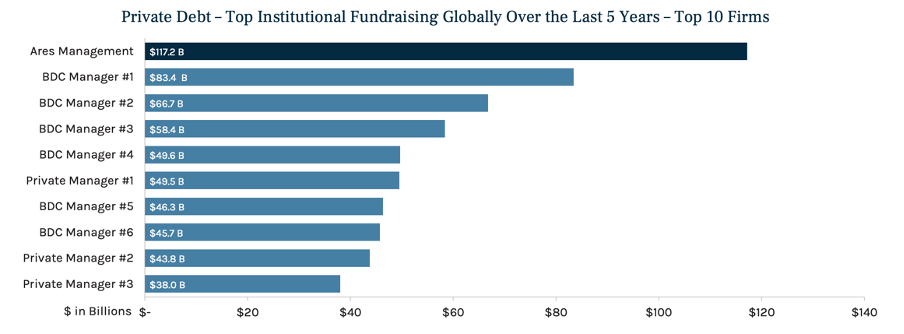

ARCC has raised more capital over the last five years than any other BDC manager.

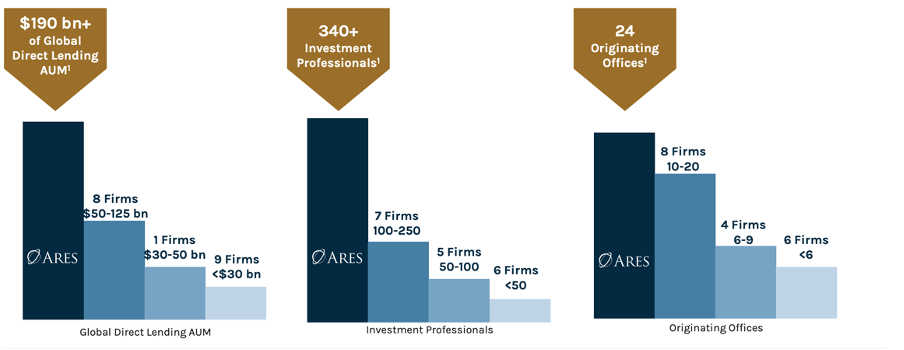

Ares Direct Lending strategies have raised nearly $200 billion over the last 5 years.

This scale has enabled Ares to hire more investment professionals and establish more offices than any of its peers.

This scale also allows Ares to invest across more markets, more geographies, more industries, and more different-sized companies than its peers.

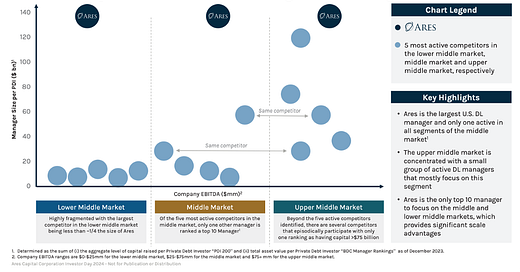

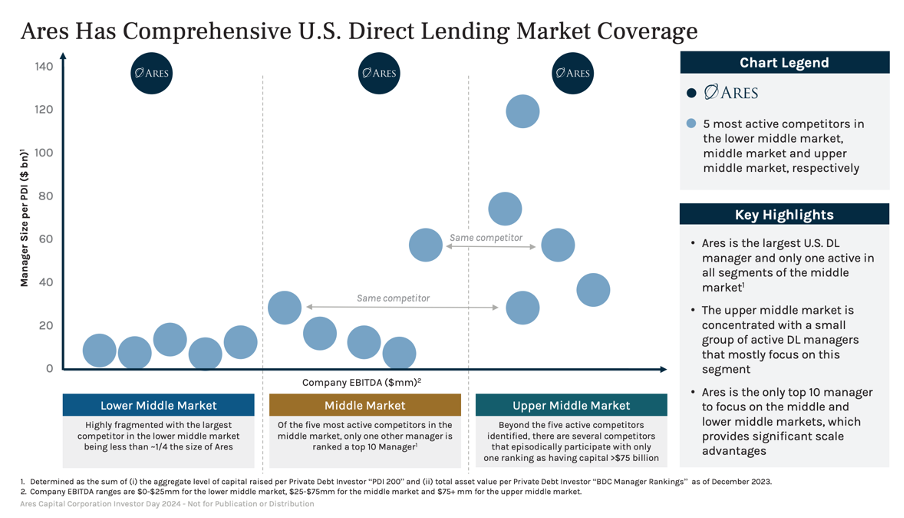

Ares believes it is the only credit manager with full middle-market coverage.

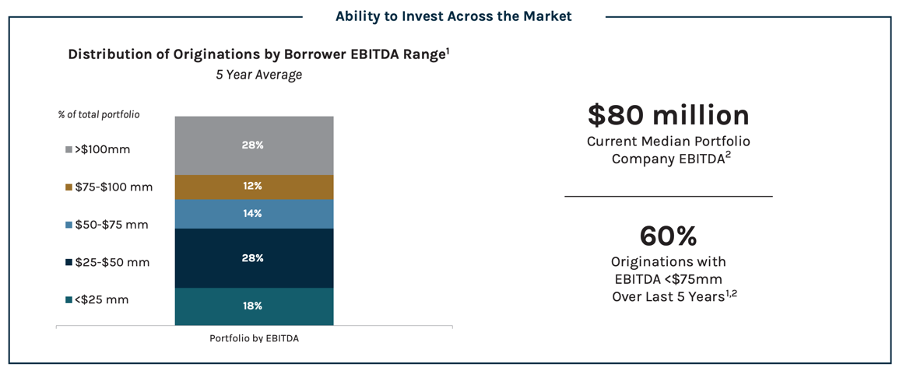

This full market coverage is highlighted by two points

Nearly half of ARCC’s investments have been in companies with less than $50 million of EBITDA.

ARCC’s median investment has an EBITDA of $80 million. Whereas its average investment is ~$162 million. (I.e. there are a lot of smaller loans)

ARCC has seen 37,000 opportunities and completed over 2,000 deals with over 500 portfolio companies.

2. Ares has developed strong networks

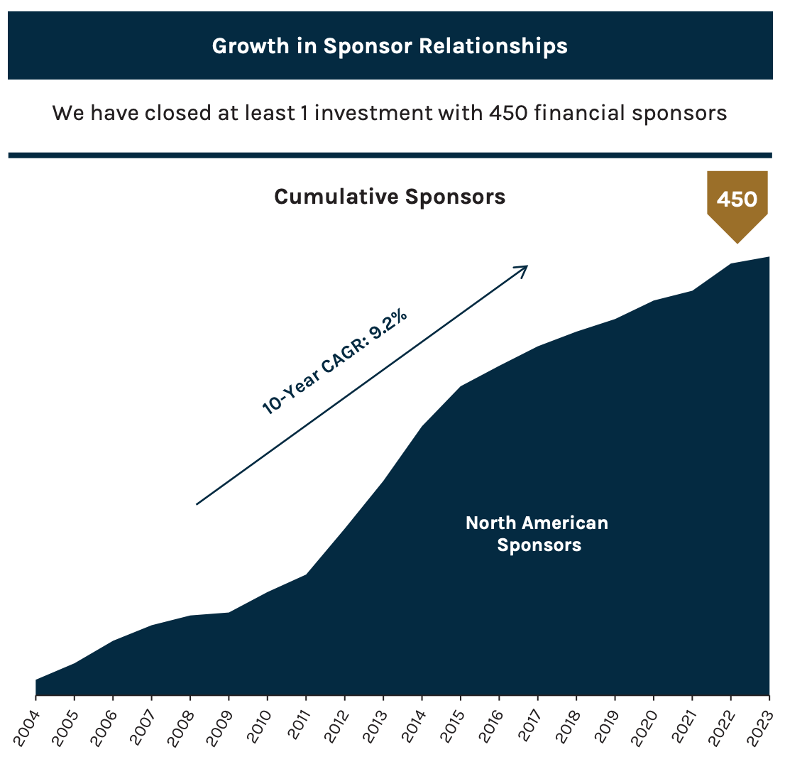

Ares covers 620 sponsors and has transacted with more than 450 sponsors.

This network provides deal flow and makes them less reliant on any individual sponsor.

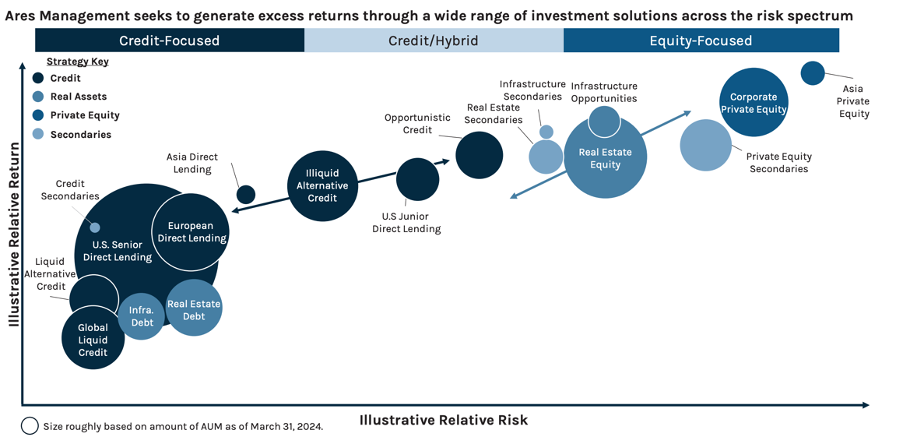

Additionally, Ares Credit Platform does not exist in a vacuum. Ares has large strategies across the risk and return spectrum.

This platform allows Ares to provide multiple solutions. It could be a senior loan, It could be a minority equity investment, or all things in between.

.

3. Ares has strong incumbency

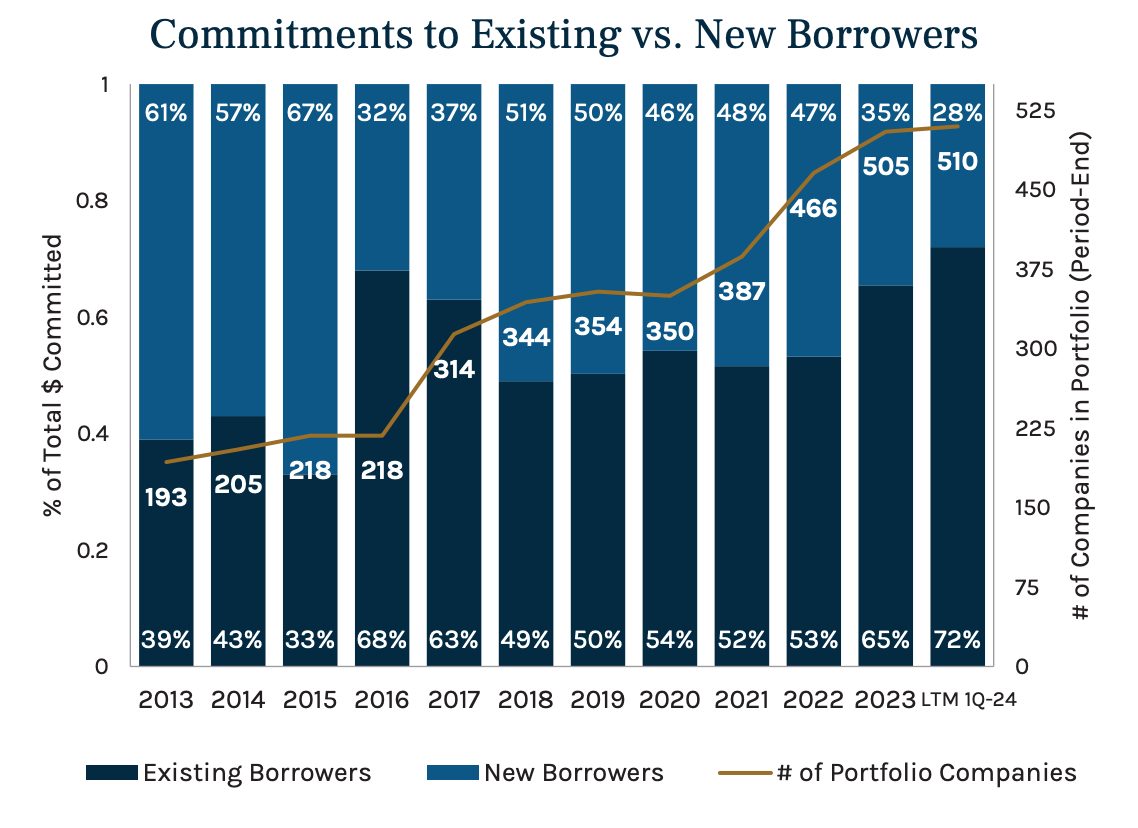

ARCC has over 500 portfolio companies. These companies have grown EBITDA by an average of 14.1% per year over the last 10 years.

This incumbency provides Ares with an information edge and generally a First Look on follow-on financings.

The benefits of this can be seen over time.

ARCC’s existing borrowers account for 72% of committed facilities. This is nearly two times higher than 10 years ago.

💰Fundraising news

CAPZA, a Paris-based investment manager, closed its $2.7 billion Fund VI. The fund lends to middle-market companies in France, Germany, Benelux, Spain, and Italy. It sources deals using its regional offices in these locations. CAPZA focuses on resilient and non-cyclical sectors such as healthcare, tech, and B2B services. The fund has committed ~60% of its capital to 24 transactions. More here

Atalaya Capital Management, a New York-based investment manager, has raised ~$1 billion for its Special Opportunities Fund IX. Atalaya invests between $30 to $50 million in North American specialty finance assets. These include consumer credit card receivables and auto loans. The latest fund, for example, will continue buying loans made by peer-to-peer lender LendingClub. More here and here

MidOcean Partners, a New York-based asset manager, closed its $765 million Tactical Credit Fund III. The strategy targets off-the-run, stressed, distressed, and dislocated investments. The fund has deployed ~60% of its capital to date. More here

NorthWall Capital, a London-based credit investment manager, closed its ~$700 million European Opportunities Fund II. The fund predominantly lends senior secured loans to both sponsored and unsponsored companies in Western Europe. Northwall targets mid-teens and above returns. The fund has committed ~60% of its capital to 14 transactions across five countries in Western Europe. More here and here

Accession Capital Partners, a Poland-based credit manager, raised ~$360 million for its fifth flagship fund. The fund provides structured growth capital to mid-market businesses in Central Europe. It invests €10-35 million per transaction using a combination of debt and minority equity. More here

Harlan Capital Partners, a Florida-based investment manager, closed its $130 million Special Opportunities Fund V. Harlan targets niche sectors and asset types that are complex, inefficient, and often hard to access. Some notable investments include a fiber-to-the-home network, A video game aggregator, and a specialty finance platform offering structured credit to soccer teams. More here

RW Capital, an Australia-based investment manager, launched its $400 million Real Estate Credit Fund II. The fund targets real estate in Australia and New Zealand. It invests across all commercial real estate asset classes and stages in the development cycle. The fund targets net IRRs of greater than 12%. More here and here

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.