👋 Hey, Nick here. A special welcome to the new subscribers at The Private Market Forum, Rothschild & Co, and CalSTRS. It’s great to have you. Reach out and say hi. This is the 108th edition of my weekly newsletter. Each week, I write about private credit insights and fundraising announcements. You can read my previous articles here and subscribe here.

📊 2025 Fundraising Recap

With Q1 behind us, here are my top insights for the quarter. This recap isn’t exhaustive, and with a bit of luck, it’s enough to keep you ahead of 99% of your peers.

Key Q1 stats 📈

Number of fundraising announcements covered: 67 (Up 70% YoY)

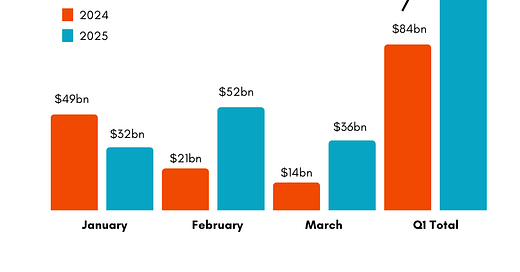

Amount raised: $119 billion (Up 42% YoY)

Number of fund managers covered: 56 (Up 37% YoY)

Number of Countries where funds were based: 14 (Up 27% YoY)

Private Credit Raised Nearly 50% More YoY

Turns out, LPs like their cash back.

Global capital, American fees 🌎

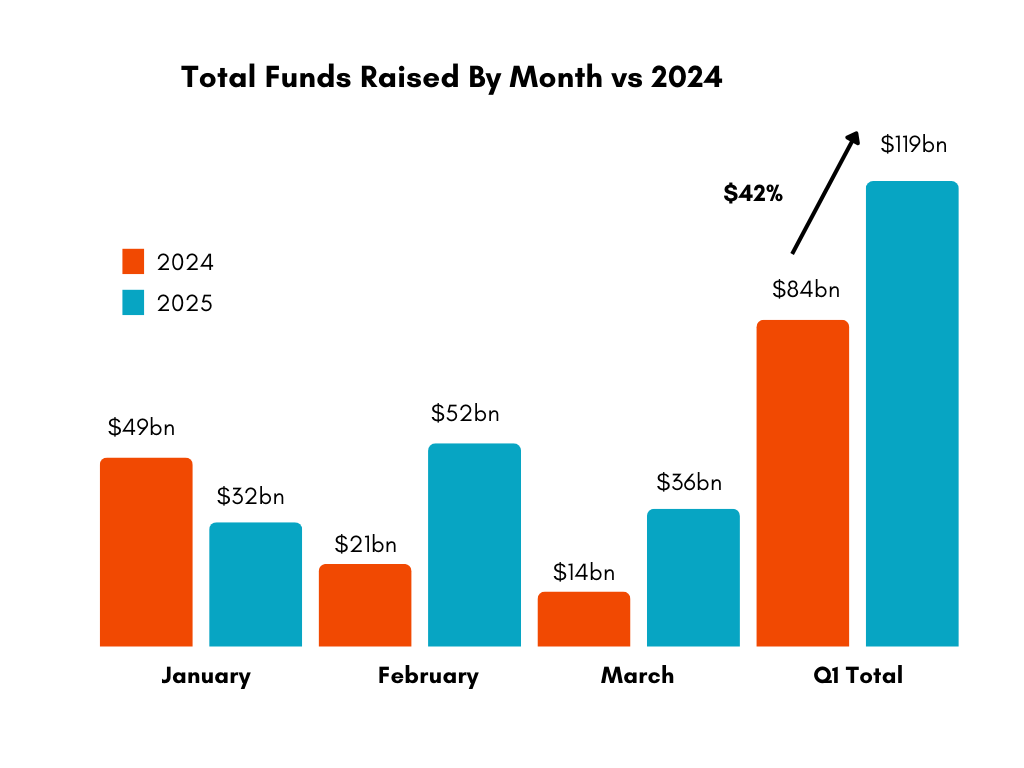

🇺🇸 US private credit funds continue to raise the most capital, with 33 funds raising $83 billion in Q1.

The total amount raised in the US was three times greater than in any other country.

$21 billion of the European-focused funds was raised by Blackstone and Ares.

Nothing says ‘European strategy’ like a Delaware LP and a Palm Beach IC.

📕Nick’s Top Articles of the Quarter

Your cheat sheet for sounding informed without reading the full deck.

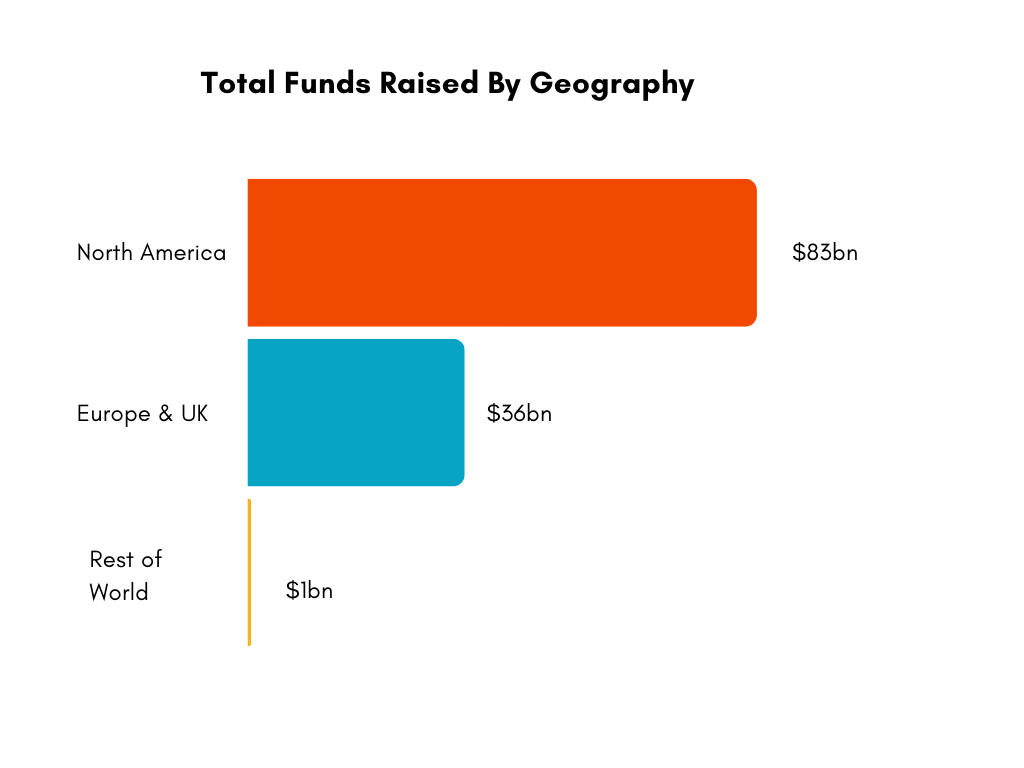

2025 is the year everyone rebranded as “opportunistic.”

Even the mid-market guys.

Opportunity funds raised $29 billion, more than double Q1 last year.

Oaktree’s $16 billion fund was the clear outlier.

There’s been a lot of talk about the mid-market’s saturation. Mid-market funds raised 40% less this quarter compared to last year. Draw your own conclusions.

The five largest funds raised over half the capital…

Everyone else split what was left.

Sub-scale funds are still raising…

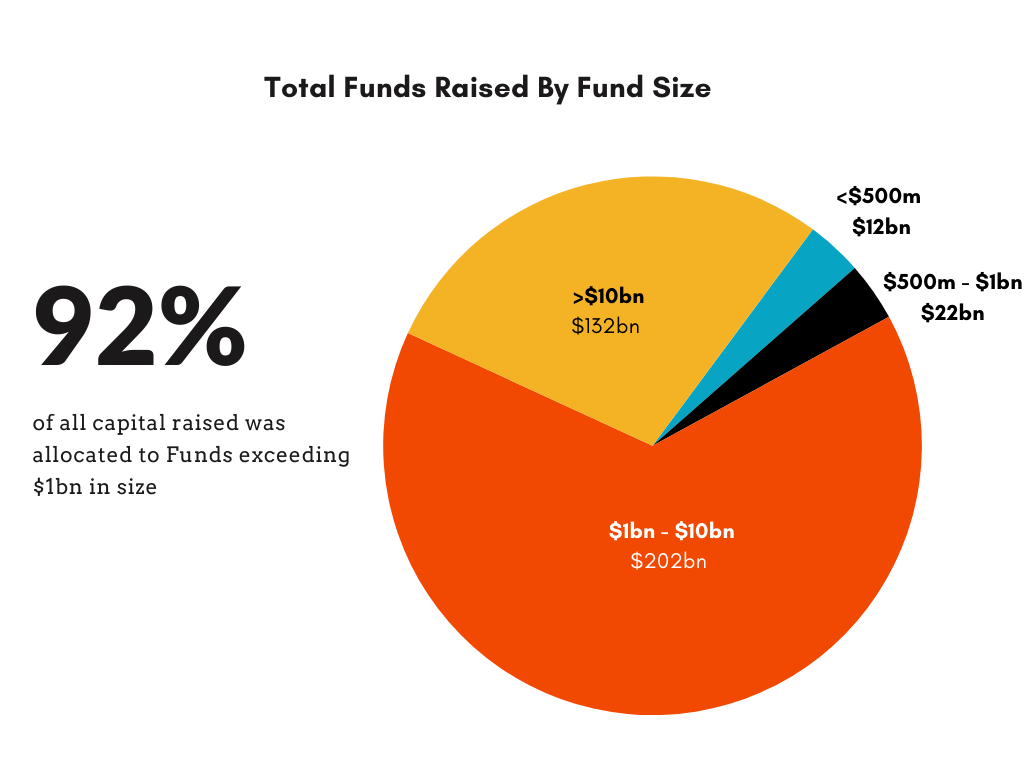

The majority of capital went to funds with over $1 billion of AUM, with 33 funds raising $110 billion. These funds had an average size of $3.3 billion.

The remaining funds accounted for less than 10% of the total capital raised. These funds had an average size of $383 million (10x less than funds with over $1 billion of AUM).

🏆 Nick’s Funds of the Quarter

Proof that private credit is more than senior and “special sits.”

🌱 Goldman Sachs AM West Street Climate Credit Fund

ESG may be out of fashion, but Goldman Sachs is raising $3 billion for its West Street Climate Credit Fund. The fund aims to generate unlevered net returns of 8% to 10% and around 13% on a levered basis.

📱Francisco Partners Credit Partners III Fund

Francisco Partners closed its $3.3 billion Credit Partners III Fund. The fund finances technology-driven businesses and works alongside FP’s Flagship Private Equity fund, which closed its $13.5 billion Fund VII in 2022.

Read more about this strategy in this Harvard Business case study. Link

👩⚖️ Fortress Legal Assets Fund II.

Fortress is raising $1 billion for its latest litigation finance fund. The fund targets ~16% net returns and would be more than double the size of the prior fund that closed in 2021. Fortress is already a leader in the sector with $6.8 billion in commitments. It has backed law firms behind some of history’s biggest mass tort suits, such as the Roundup cases against Bayer AG and talcum powder litigation against Johnson & Johnson. More here

Read CovenantLite’s Introduction to Litigation Finance. Link

This newsletter is for education or entertainment purposes only. It should not be taken as investment advice.